Welcome to the fifth edition of Fluff and Air, a recurring publication by 0xcarnation and ct_zpy. Today we’re looking at what happened to liquidity across all our chains when people committed wire-fraud (allegedly) from the Bahamas.

Just a heads up: This post is just for education, and this post is not financial nor criminological advice. We may hold tokens of some of the projects mentioned here.

After a certain effective altruist tested the solvency of several major CEXes and on-chain ecosystems, we have decided to do (yet another) a follow up and assess the damage to the ecosystems of our favourite digital currencies.

Methodology

We followed the same methods as our last article. Market caps were pulled from CoinGecko. TVL was pulled from DefiLlama. The DEXes used to determine slippage were DEX aggregators where possible (like 1inch, Kyberswap, and Jup.ag), or the largest DEX on a chain when aggregators were not present. All numbers were pulled on Dec 18, 2022.

We checked the slippage when selling tokens that fit into the categories of: primary gas token (gas token of the chain), secondary gas token (gas token of the underlying L1), and governance token of the chain. We examined a total of 17 chains and 24 chain-token combinations.

We attempt to sell the token in question for the most liquid stablecoin on the same chain.

Using the data, we asked the following Qs:

-

What happens when you try to dump 1% of the Market Cap on chain

-

What happens when you try to dump 1% of the TVL on chain

-

How much dumping will bring slippage up to 50% (we’re calling this metric “Exit Liquidity”)

-

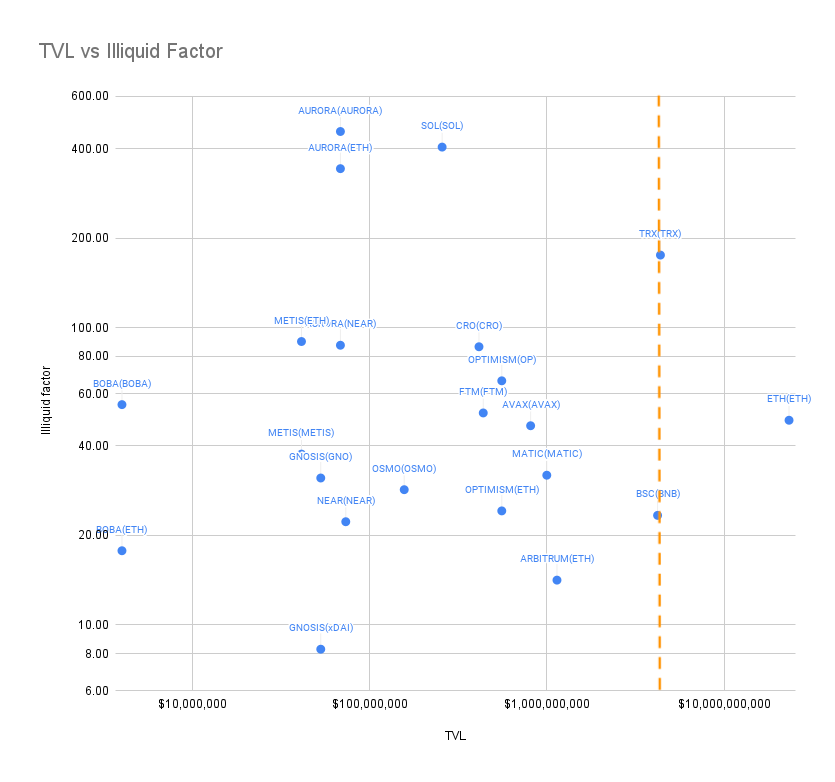

Chains were then assigned an “illiquid factor”, which was calculated by dividing TVL by the amount of money required to reach 50% slippage. A really high illiquid factor means that even if a tiny fraction of TVL decided to exit, they would cause terrible slippage and also take away a large fraction of stablecoin liquidity. The naïve interpretation is that high illiquidity factors are bad.

What we are essentially asking is: Of all the liquidity actively participating in DeFi, how much of them can exit back into stables below a 50% slippage?

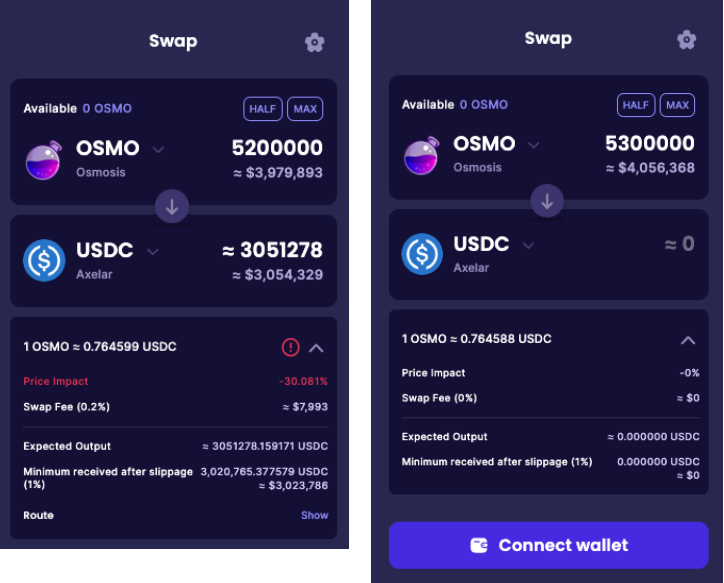

Changes from the previous article: inclusion of the OP token on Optimistic L2, using USDC(axelar) as the most liquid stablecoin on Osmosis, inclusion of Firebird dex aggregator.

For full data, see link to GSheets here.

Observations

Instead of going over the entire spreadsheet, we will highlight a few curiosities that caught our attention.

Dex aggregators

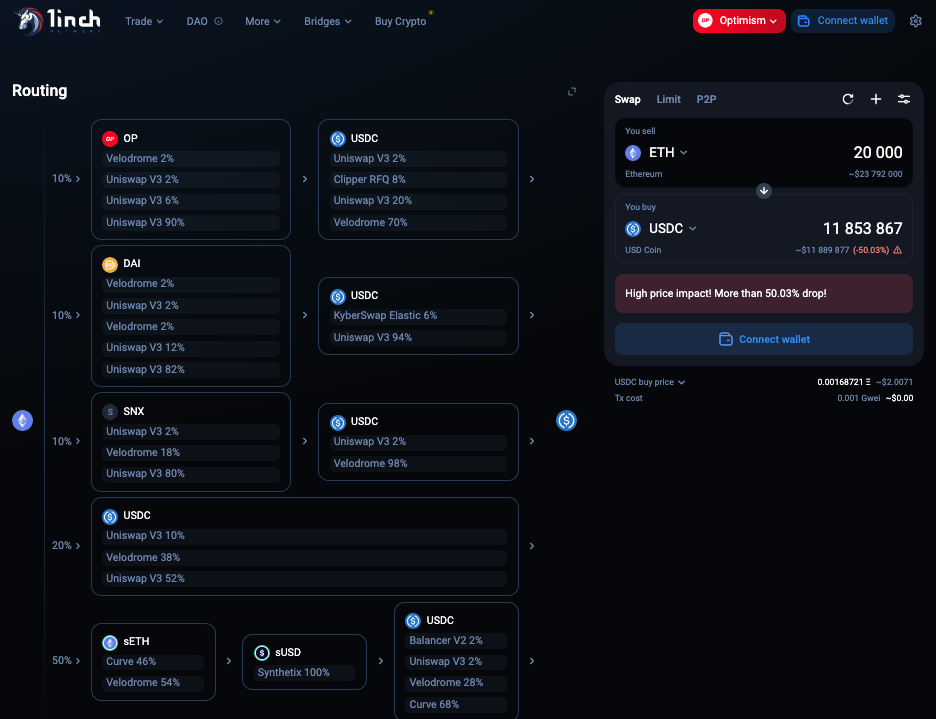

Initially, we wanted to take a closer look at the two leading L2’s for Ethereum, Arbitrum vs Optimism. In the first version of the draft, we found that the max size we could route for 50% slippage (“Exit liquidity”) on both Arbitrum and Optimism was 20,000 ETH using 1inch.

Intuition says that Arbitrum should have a lot more liquidity than Optimism, so what happened? Let’s dig deeper.

We saw that Optimism routing is more complex, mostly routing through the Synthetix ecosystem.

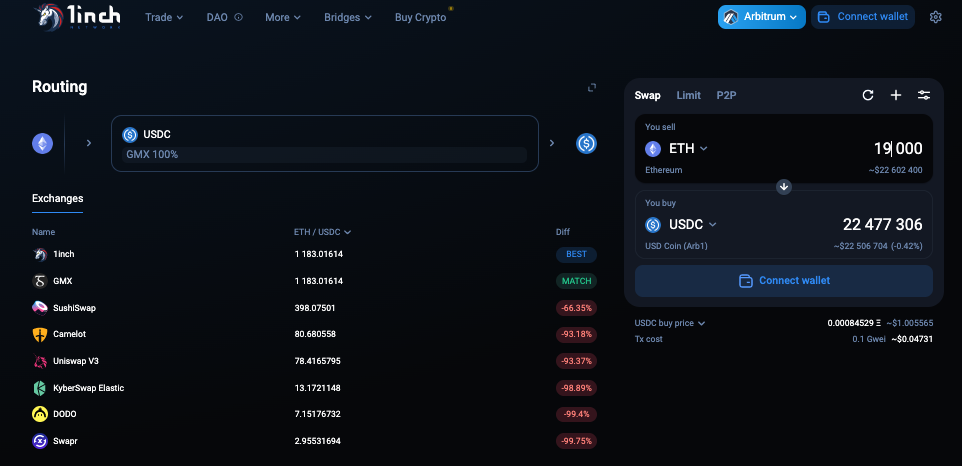

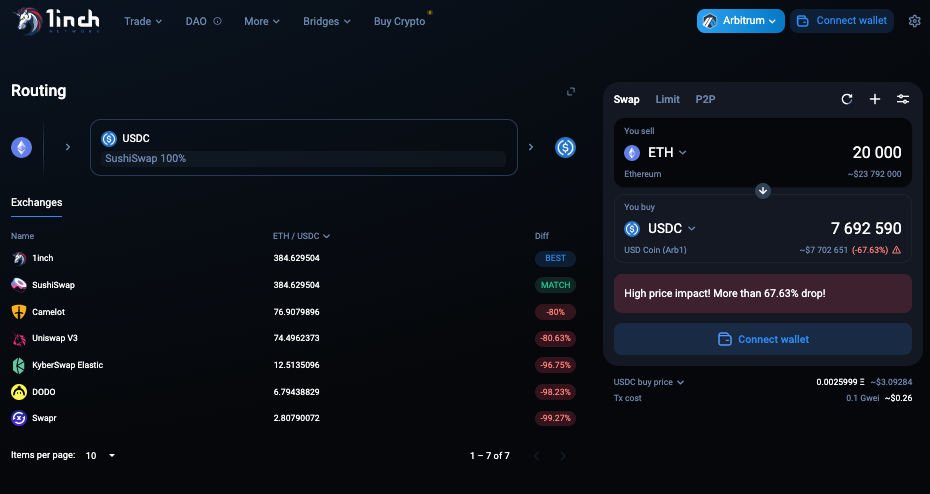

On Arbitrum, the main liquidity source for large swap remains to be GMX, however, as soon as we ask for a quote larger than what GMX supports, 1inch defaults to a single source. The slippage is extremely low when under the GMX max limit, but suddenly spikes when above that limit.

We can see that 1inch is not routing optimally for the 20,000 ETH quote on Arbitrum, since you could first fill whatever the GMX max limit is, then fill the remaining using other dexes.

We decided to test a few more dex aggregators.

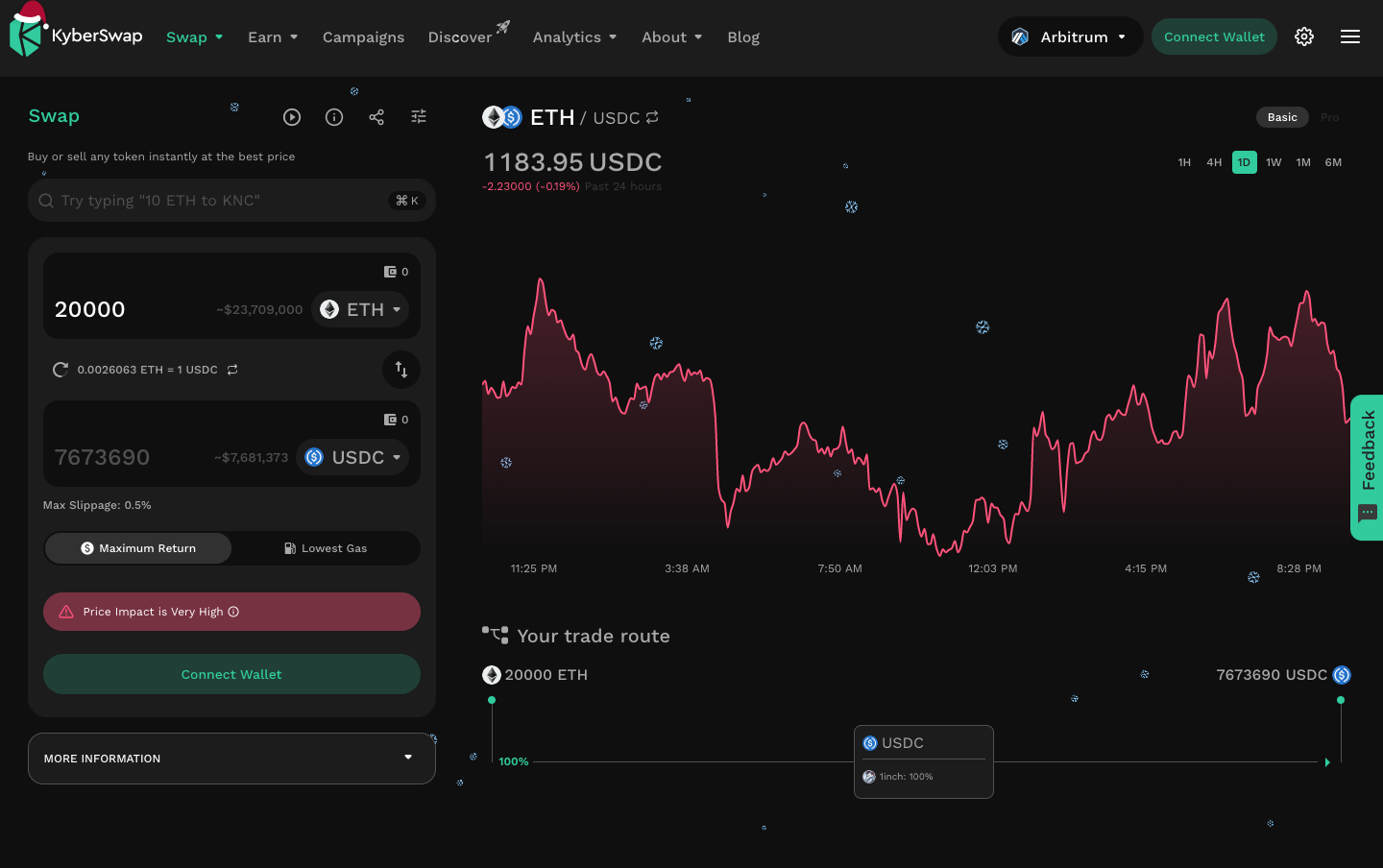

For large swaps, Kyber is just defaulting to whatever 1inch returns. Honestly, that’s kinda smart/lazy. Well played.

Funnily enough, the aggregator that got it right is a little-known one called Firebird:

FIrebird was able to figure out if you hit the max on GMX, it can use other dexes.

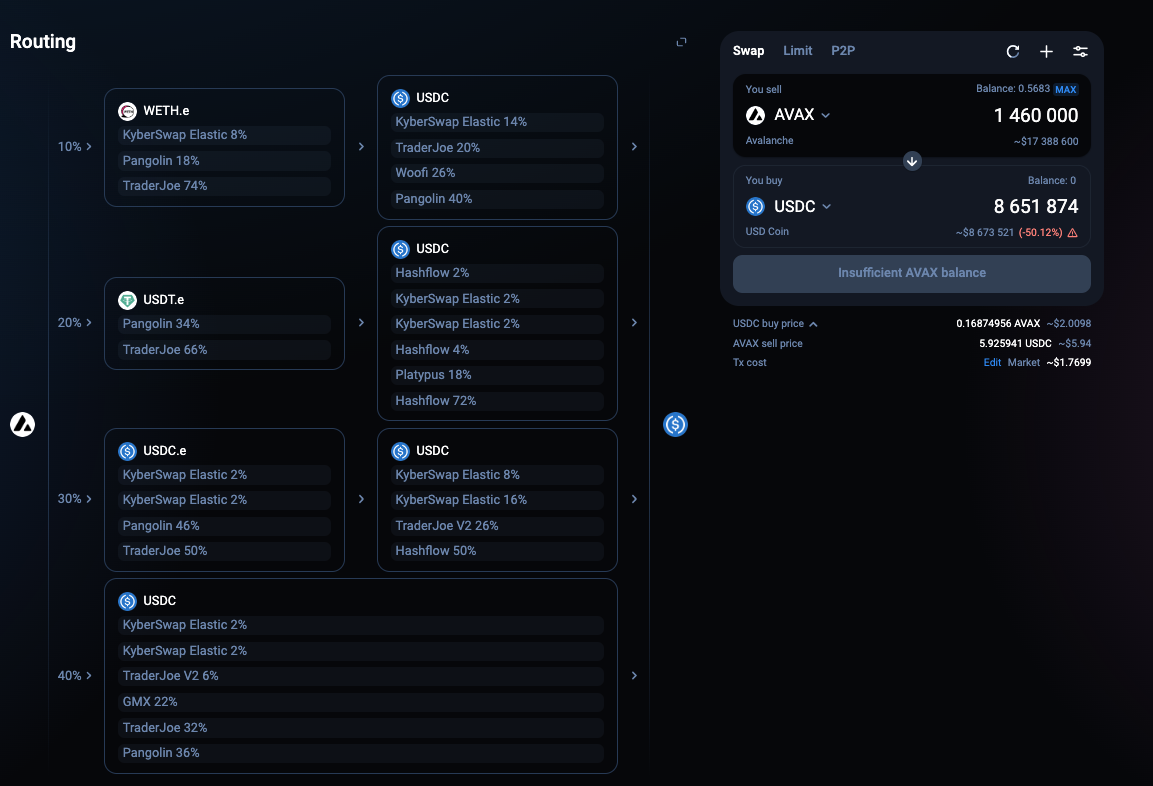

Digging further, we got comparable quotes from Firebird and 1inch on Avalanche, but the two use quite different routing.

However, Firebird does not get better results on Optimism, where 1inch routed 20K ETH for 50% slippage but firebird had 85% slippage on the same quote.

Due to this incidental finding, in this published version, we updated our article and spreadsheet to use firebird results on Arbitrum and Avalanche.

A note for any highly profitable traders, it’s dangerous to assume that by using a dex aggregator you are getting the best routes! Be aware that aggregators might have chain-specific strengths and limitations when swapping in size.

Tron vs BSC

At publication time, BSC and Tron have very similar TVL levels, which makes a comparison of their illiquid factor even more interesting. BSC’s got a much lower illiquid factor than Tron. After drinking two spiked eggnogs, our interpretation of this is that people are more willing to buy shidcoins on BSC than shidcoins on Tron.

Osmosis

Axelar’s bridged USDC is now the dominant stablecoin TVL, replacing UST. Side note, Osmosis’s quote system breaks when the slippage approaches 30-40%.

Stablecoins

On the vast majority of chains, USDC gets the lowest slippage when swapping in size. Exceptions are BUSD on BSC, USDT on Tron, xDAI on GnosisChain.

This indicates a strong trend that USDC is the dominating stablecoin for liquidity on-chain.

Ohh if only we could get our paws on some of that sweet, sweet, Circle equity.

GMX and Synthetix

GMX could be said to be the main force in enabling large ETH trades with minimal slippage on Arbitrum, while Synthetix is doing the same on Optimism.

Questions have been raised regarding the long-term viability of allowing zero (or near zero) slippage spot trades (see GMX price manipulation attack). But to large spot traders, both GMX and Synthetix are a blessing.

We ask ourselves why GMX on Avalanche has not drastically improved the exit liquidity, perhaps, it is because the max swap limit of GMX for AVAX tokens has been capped due to potential price manipulation attacks. We speculate that if GMX continues to grow on Avalanche, it would lead to similar spot liquidity improvements as seen on Arbitrum.

Perhaps smaller chains/ecos would look at this and quickly conclude they must launch their own GMX/SNX fork. We’ve seen numerous forks of GMX and SNX attempted, with none gaining significant traction close to the OGs.

Arbitrum and Optimism

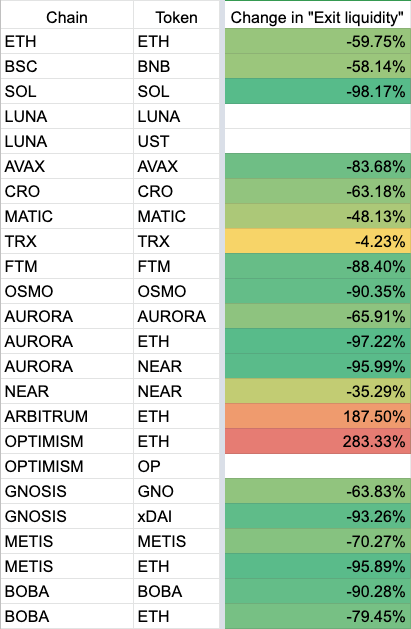

On the topic of GMX and SNX, we can see that Arbitrum and Optimism are the only two chains that had an increase in Exit liquidity while all the other chains had decreases. **

**

While far from decisive, we’re gonna take this as a strong hint that the “L2 thesis” is the centipede while the “Alt-L1 thesis” is more of a worm.

Sorry, did we lose you on that metaphor? Let’s put it this way, which one’s got more legs?

Solana vs Near

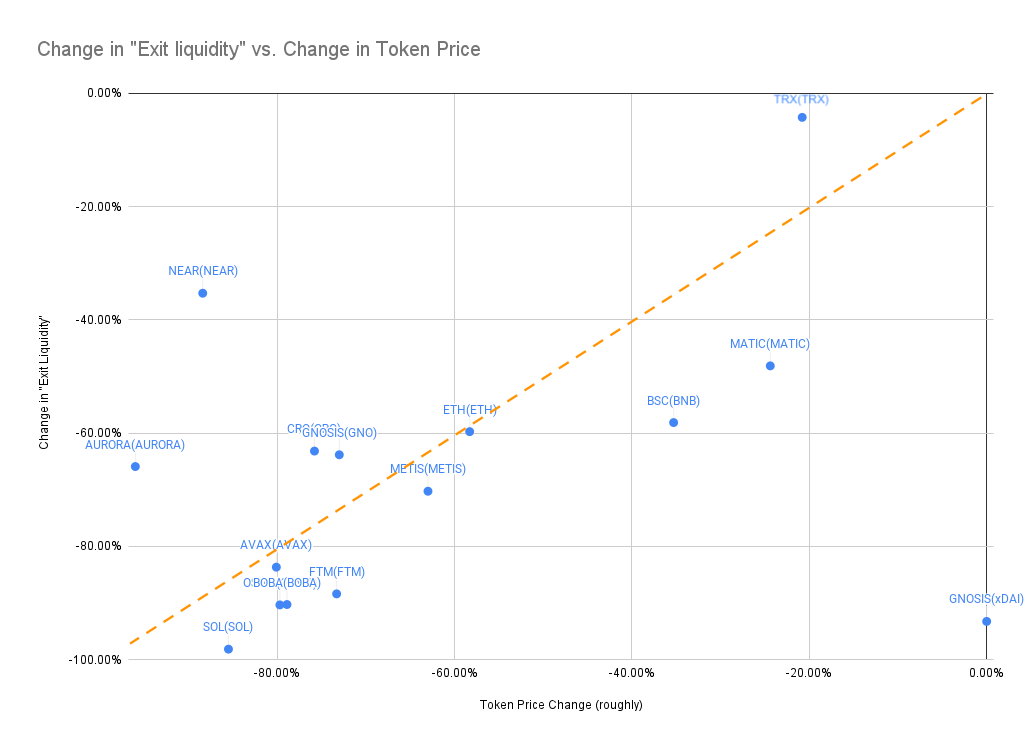

We constructed the graph below, where the dotted orange line indicates a (hypothetical) linear relationship between “price” and “Exit liquidity”.

Despite both SOL and NEAR having >80% price drawdowns since May, NEAR doesn’t have nearly (ha!) as large of a drop in the “Exit liquidity” metric. In fact, NEAR seems to be an outlier for how much Exit liquidity there is! Our interpretation is that big money would be comfy buying Near at current prices or lower (through providing liquidity on dexes).

Solana is absolutely rekt in terms of liquidity. We interpret this as a sign that people pulled their money out of Solana faster than SBF’s dad did to SBF’s mom.

A discovery

Finally, a sm0l discovery as a parting food for thought. There’s a decent linear correlation between TVL and Exit liquidity.

If we squint a bit, the formula for the line is pretty close to 0.023x=y, which means that in the average chain, each $100 of TVL is propped up by only $2.3 of Exit liquidity. More insidiously, we could say that a removal of $2.3 of Exit liquidity shaves off $100 in TVL.

Keeping in mind that when we say Exit liquidity we mean the amount required to cause 50% slippage in a spot trade, and that correlation is not causation.

Conclusion

Empires come and go, even the Ponzi Empires. Thank you for staying with us.

In the next edition of Fluff and Air, we have a new idea about which “types” of liquidity will matter most in DeFi. Please stay tuned <3

To help keep the lights on, we’ve enabled the Collection feature on Mirror!