The Problem

In a multichain world, assets would also be multichain (duh!). That means assets will have to be bridged around. When a bridge mints you a receipt token on your destination chain, that’s in fact just a receipt, the real token is still sitting locked (and idle) inside the bridge contract of the origin chain.

This is all fine and dandy, until one realizes…

“Wait, why are the assets just sitting in the bridge, when they could be put to use somewhere to earn some yields!”

Indeed, Proof of Stake assets such as ETH could be earning the staking rewards, and RWA-related assets like DAI could be earning from the DAI Savings Rate (DSR).

Just a heads up: This article is for educational purposes only, and does not constitute financial or traveling advice. I am a contributor to various DeFi projects, including Redacted DAO mentioned at the bottom.

The Idea

Okok hear me out.

Wot if we took the assets from the bridge, and like, put them to work?

What’s the opportunity size?

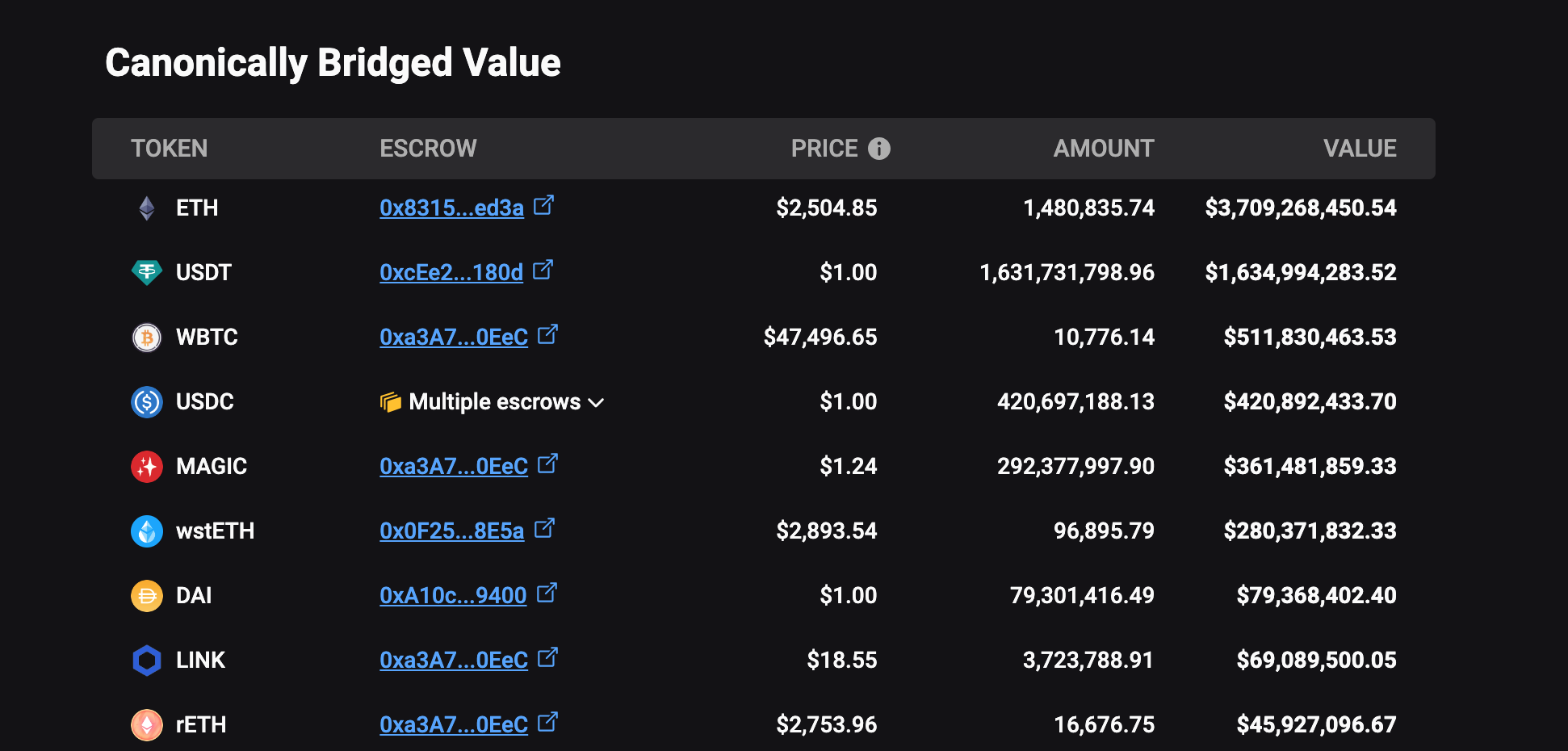

Arbitrum is the leading L2 solution on Ethereum in terms of TVL, and there’s a lot of assets that have been bridged to Arbitrum. Below we can see a breakdown of assets locked into just the native Arbitrum bridge. There’s 3.7B USD of ETH and close to 80M of DAI just sitting there.

Suppose ETH staking is 3% APR, that’s 3.7B x 3% = 111M USD of potential annual yield. Suppose DSR yield is 5% APR, that’s 80M x 5% = 4M USD of potential annual yield.

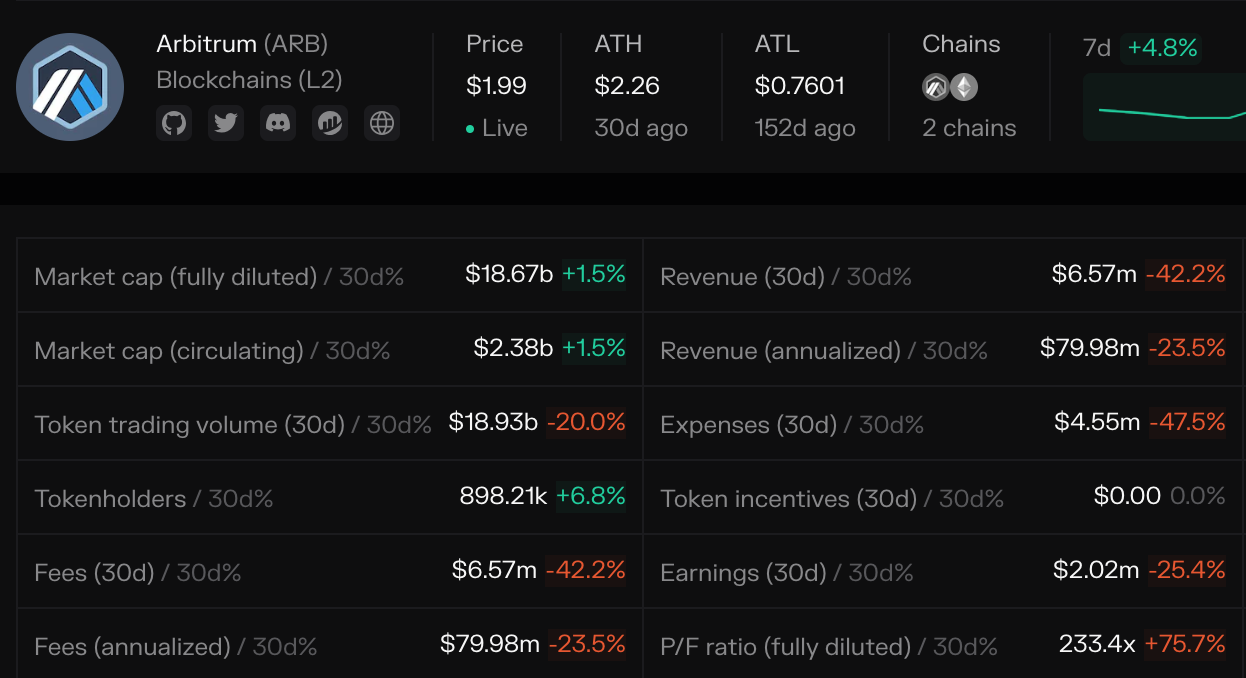

If we look at the Arbitrum sequencer revenue below, it annualizes to about 80M USD.

So if Arbitrum staked all the ETH inside the native bridge today for some yield, the annualized revenue of the chain would more than double(!!)

Now that size is size.

The Rise of Native Yield Chain

Welcome to NYC (Native Yield Chain, not the city)!

Some prominent examples of NYCs are Blast L2 and Berachain, where major assets bridged into the chain are generating revenue towards the chain. We can define “Native Yield” to describe the yield being produced natively by some asset and then imported into a chain.

Chains that adopt Native Yield can have an unprecedented amount of room for experimentation.

Native yields can be redirected to key infrastructure operators.

Some infra operators had traditionally not been not compensated/incentivized to operate, such as the Relayer in Ethereum block building, IBC relays in Cosmos, wallet providers, etc. While other infra providers traditionally charge a hefty cost to the blockchain to provide their services, such as DA layer, block explorers, RaaS providers, oracles, etc.

Point being, with Native Yield, if the rollup/appchain pulls in enough TVL, there will be enough yield to cover all these costs associated with the key infra.

Eliminating pay-per-transaction fee model.

One thing about current blockchain UX that I think we’ve been accustomed to, but is actually really annoying when you think about it, is having your wallet confirmation pop-up on every txn and you have to double check the gas fee to pay.

Suppose the Native Yield is high enough to cover the costs of the rollup (see the key infra operators in section above), then technically the rollup is free to charge for its blockspace however it wishes and still turn a profit.

Some under-explored transaction fee models could be:

-

making gas completely free (but this invites annoying MEV spam)

-

offering subscription packages to use the chain Netflix style (i.e. pay $10 a month and you can use it all you want)

-

wholesale blockspace credits with tiered discounts (the more gas you buy all at once, the more discounts you receive), or

-

tiered freemium txns where everyone gets a few free txns but you need to hold the governance token to unlock more free txns, etc.

These are just some alternative fee systems that would offer a better UX and abstract away some of the annoyances of interacting with blockchains, like deciding on how much gas to put or worrying about running out of gas to pay.

Almost an infinite design space we can play with here, but the Native Yield is crucial to ensure the costs of the rollup will actually be covered no matter what.

Scaling past transaction fees as a revenue source

Blockchains usually make profits from selling blockspace. But between more chains opting to go down the “lower fees = better” route and more scaling solutions coming online, txn fees will drop by orders of magnitude. Another problem is a lot of useful apps do not require high frequency interactions, for example, if you use Aave as a passive savings account to earn some interest, you do not need to manage it more than a few times a year.

Native Yield allows the chain to monetize on its sticky liquidity rather than its usage, similar to charging an AUM fee from tradfi funds. One interesting note is that both txn fees and Native Yields will scale from the increased adoption of the chain, but the important part here is that Native Yield is orthogonal to txn fees and Native Yields aren’t limited by physics in how far they could scale.

Almost like magic!

Only Possible On NYC

Continuing on some of the ideas above, what would be some really cool apps that are Only Possible On NYC?

CSR and public goods

Suppose we run a NYC, and we create a unique Contract Secured Revenue (CSR) program. CSR was popularized by Canto to reward apps that drove a lot of gas consumption on their chain.

Suppose our version of CSR tracked both the gas usage and the amount of TVL contributing to Native Yield, and allocates rewards to protocols according to their contribution to both these metrics.

Then, we have solved monetization for the vast majority of apps out there:

-

High txn count but low TVL protocols might be an NFT minting platform or a DEX aggregator

-

Low txn count but high TVL protocols might be lending protocols or yield vaults.

-

High txn count and high TVL protocols might be spot DEXes.

To remain competitive, many of these apps have been reducing fees or keeping fees at zero, which is a bad thing if the team still wants to put food on the table or drive value accrual to their tokens. If deploying on a NYC helps them monetize even if protocol fees are at zero, then it’s a no-brainer for them to at least try deploying on these chains.

(I can’t think of a low txn count and low TVL that’s useful but lemme know if you think of one lmeow)

Positive-sum Derivatives

Suppose we’re operating a derivatives DEX, having Native Yield means that between me and my counterparty, the pot of monies we’re fighting over is constantly growing larger, so we’re not playing a zero-sum (or negative-sum) game anymore. Also, the DEX might even consider using Native Yield to charge zero (or even negative) maker fees and taker fees. That’ll make trading on here more attractive and competitive than CEXes.

Perpetual and Autonomous Games

Suppose we’re building a Metaverse game, we can use Native Yield to first pay for the costs of the chain, and move away from the pay per txn model. Then, excess yields can be used to do cool things like prizes for tournaments, allowing the game to acquire PoL for its own assets, etc. Most games involving tokenized resources also find it difficult to maintain a floor value on them due to heavy inflation, Native Yields could serve as the source of buying pressure to counteract death spiral tendencies. We could also emit Native Yields to power autonomous agents, NPCs, or even enemies(!), as a way for the game world to evolve and improve over time.

Food 4 Thot

In general, having more value brought into a chain means there’s more monies to play around with. And more monies means you can cover costs, spend on incentives, and even bring value accrual back to your own token and ecosystem.

Here are a few analogies that may or may not help:

-

Native Yield is like subscriptions, it’s generated consistently with time.

-

Native Yield is like AUM fees, it scales with the value brought into the system.

-

Native Yield is like taxes, it taxes the productivity of the underlying asset.

For those trying to maximize Native Yield, I think this formula will present a bit of clarity:

Native Yield = Time x TVL x APR

Does Native Yield have to exist on a rollup or appchain?

Not at all! Ethereum L1 is a NYC as well! One just has to capture that yield with LSTs and a few more tricks. We can see Balancer is tapping into Native Yields as a way to build a spot DEX that moves away from relying on swap fees for revenue into one that diversifies into using Native Yield as revenue:

Don’t the Native Yields Come With Risks?

Of course! We’re not quite there with a “Risk Free Rate” of DeFi yet, although ETH staking and battle tested bluechips like Maker’s DSR come close.

There will always be a space for chains that take the most conservative and risk-averse routes to setting up their chain, and perhaps integrating Native Yield directly into the bridge is not a risk they would want to take. However, it’s still possible to bridge Native Yield assets like ETH LSTs and sDAI to your chain, but in those cases, the yields accrue directly to the users and there is no way for the chain to capture that for its own usage.

Furthermore, I am of the opinion that as a general purpose rollup, you cannot convince builders to come build on your chain just because you’ve got the best tech. Yes, builders will still deploy to your rollup if you have a potential token airdrop. But no, the long-term builder’s decision will be whether they can make a successful and profitable product on your chain.

Additionally, here’s a thread from Knower on chains competing on the hyper-financialization front rather than competing on the ETH-alignment front:

Yields are dead. Long Live Native Yields

What’s Next?

A lil’ birdie told me that ████ia and ██st will be launching this year with some exciting Native Yield mechanisms.

If you’re building an app that could benefit from deploying on a Native Yield Chain, hit me up because I have some recommendations for you.

If you’re building an appchain/rollup/RaaS, Redacted’s Pirex ETH is the highest yielding ETH LST on the market and is ready to power your chain.

Keep your eyes on this space, NYC has a lot to offer <3