For anyone supporting Aave over the past week, including: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Risk 🔎 | Governance ⚖️ | Events 📆 | Hey Anon 👻

// Spotlight: Clutch 🔦

Clutch is your web3 Homepage - allowing users to discover, navigate and participate in the crypto ecosystem by aggregating social, news, and assets into one view. Clutch has been educating users and building for the past 7 months, and with support from Aave Grants, they're developing new features to continue exposing the masses to web3. Try out Clutch today!

// Protocol 📰

-

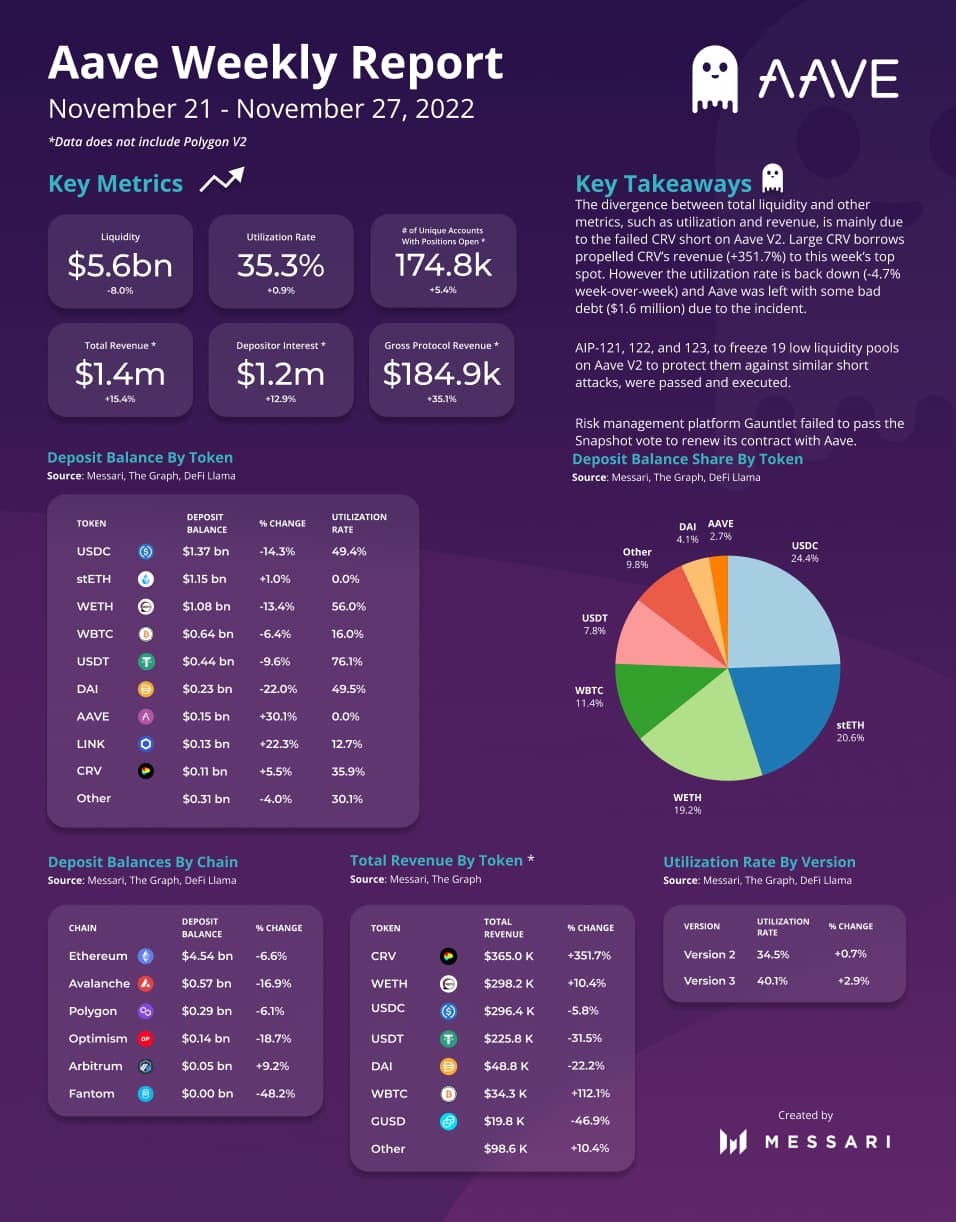

The Aave community continued to take action following last week’s event that left the protocol with bad debt. See a full recap of the forum activity in Governance ⚖️ and the latest updates in Risk 🔎. One notable conversation that emerged is around establishing a Risk Council for v3.

-

Voting is live to deploy and activate the Aave <> StarkNet aTokens Bridge. Read more details in their governance post on the Aave <> StakNet Phase I release. If this vote is approved, the aTokens Bridge will go live.

// Ecosystem 🧉

-

Goldfinch shared a post explaining "Why RWAs Are Important to DeFi".

-

DAOLens updated the community on how they’re simplifying the Aave interface - take a look at their post and share any feedback.

-

If you registered for IncrementHQ’s Battle Royale, the competition has officially begun. Start trading now for your chance at over $1000 in prizes and speciality NFTs.

// Risk 🔎 - written by Gauntlet

Interest Rate Curve Recommendations:

Details can be found here

Gauntlet has provided a framework to the DAO for modifying interest rate curves and proposed changes to USDT and TUSD. This would be the first implementation of Gauntlet’s ongoing research of this feature within its risk management solution. The analysis includes an investigation into borrower and supplier elasticity by asset. The goals of IR curve optimizations are 1) to mitigate the risk of 100% utilization in a pool and 2) to build reserves to cover insolvencies or other expenses in the future.

Risk Mitigation Proposals:

Details can be found here

Proposals have been passed, including de-risking V2 ETH, de-risking Aave Polygon markets, freezing REN, freezing CVX, and freezing BAL.

In addition, Gauntlet has proposed borrow caps changes on V3 AVAX, which has been passed.

// Governance ⚖️ - written by Boardroom

An especially turbulent week for Aave, but one which reveals the strength of DeFi and the advantages of DAOs. There is one forum thread in particular that captures a wide range of strategies, approaches, and attitudes among those participating in the DAO — and it spawned a host of governance proposals (see below).

Follow along in the Governance Weekly Recap governance thread.

/ Proposals

👻 Aave Improvement Proposals:

-

Risk Parameter Updates for Aave v2 Polygon (126). Llama and Chaos Labs jointly propose to make parameter changes to the Aave V2 Polygon Liquidity Pool, “[i]n response to recent market events and the resulting discussion on the Aave governance forum.”

-

Risk Parameter Updates for Aave v2 Ethereum Liquidty Pool (125). As above, Llama and Chaos Labs propose parameter changes “in response to recent market events.” It is presented as an alternative to AIP-121 (see below), and also results from discussions in the forum.

-

Risk Parameter Updates for Aave V2 Polygon (124). This proposal passed with 100% voting “YAE” and is queued for execution.

-

Pause UNI Borrowing (123). This proposal passed with 100% voting “YAE” and was executed on November 27.

-

Pause LINK Borrowing (122). This proposal passed with 100% voting “YAE” and was executed on November 27.

-

Risk Parameter Updates for Aave V2 ETH Market (2022-11-22) (121). This proposal passed with 100% voting “YAE” and was executed on November 27.

-

Risk Parameter Updates for Aave V2 (2022-11-17) (120). This proposal passed with 100% voting “YAE” and was executed on November 26.

⚡️ Now on Snapshot:

-

Activation of a ParaSwap fee claimer contract. BGD Labs proposes “to deploy a smart contract to automate fee collection from the Aave <> ParaSwap features.”

-

Risk Parameter Updates for Aave V3 AVAX 2022-11-23. This proposal “to set borrow caps on FRAX, MAI, and LINK on Aave V3 AVAX” passed on November 25 with 100% voting “YAE.”

-

[ARC] V3 Supply Cap Recommendations for Uncapped Assets (Fast-track). This fast-track proposal recommends supply caps for currently uncapped V3 assets. It passed on November 25 with nearly 100% voting “YAE.”

🗣 Provide your feedback on these active Aave Requests for Comment (ARCs):

-

[ARFC] Aave DAO Policy Change: Halt Listings on all Aave v1 & v2 Non Permissioned Deployments. A request “to adopt a policy of halting listings.”

-

[ARC] Repay excess debt in CRV market for Aave V2 ETH. Llama and Gauntlet propose to cover the bad debt from the recent exploit with Gauntlet’s insolvency refund and the DAO treasury.

-

ARC: Onboard Gamma Strategies’ USDC/GHO Uni v3 Collateral to Mint GHO. This proposal is to use “Gamma Strategies’ GHO-USDC LP position on Uniswap v3 as collateral, utilizing Gamma’s infrastructure.”

-

[ARC] Uniswap V3 NFT as Collateral for minting GHO. Discussion continues.

/ In the Forums

Reducing long tail asset risk. A discussion initiated by @monet-supply.

Delegate platforms. Updates from @Kene_StableNode and @lbsblockchain.

Pricing mechanisms. BGD Labs provides some “visibility” about the pricing mechanisms of assets (like WBTC) in Aave.

Support for cbETH. Certora provides formal verification of the token’s code.

Improve permissions management. @bgdlabs opens a discussion about the “idea of having faster levers…to change non-invasive risk configurations, in order to react swiftly under urgent circumstances.”

Quick Gov Links: Governance FAQ | Governance Docs | Discord Governance Channel | Snapshot | AIPs | Aave on Boardroom

// Events 📆

If you could only go to one event in 2023, which event would it be? DM us on Twitter or Lens 🌿

// Hey Anon 👻

Have you seen the usage on Aave increasing?