Cross-Chain Revenue Aggregation Made Easy

As DeFi protocols expand to chains, one challenge becomes inevitable: consolidation. Yield, fees, rewards and revenue become isolated to individual ecosystems, creating operational overhead and limiting long-term scalability. New chain deployments expand user access, but also multiply complexity. Without interoperability, growth becomes friction.

Bancor and Beefy Finance show what alternative approaches look like. Both have expanded to multiple chains and integrated use of Stargate’s unified liquidity layer to consolidate protocol revenue, helping them streamline operations as they scale. With Omnichain solutions built into the core of their operation, Bancor and Beefy can scale freely.

______________

Beefy Finance: Vaults at Scale

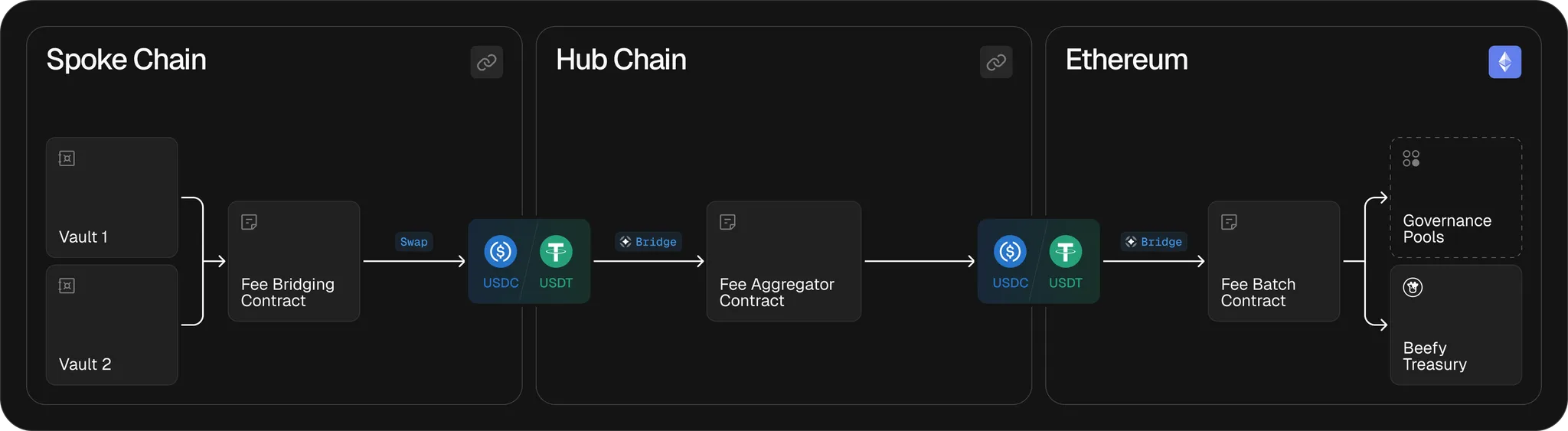

Beefy Finance is a multichain yield optimizer that deploys automated yield strategies through vaults across 35+ chains. These Vaults compound rewards and maximize APYs using a variety of DeFi primitives. However, each Vault generates fees locally, requiring a cross-chain solution to route this value back to Beefy’s mainnet treasury. Stargate enables seamless aggregation of this revenue, streamlining Beefy's cross-chain operations by unlocking true protocol scalability via the Omnichain.

Bancor: Omnichain Arbitrage and Strategy Execution

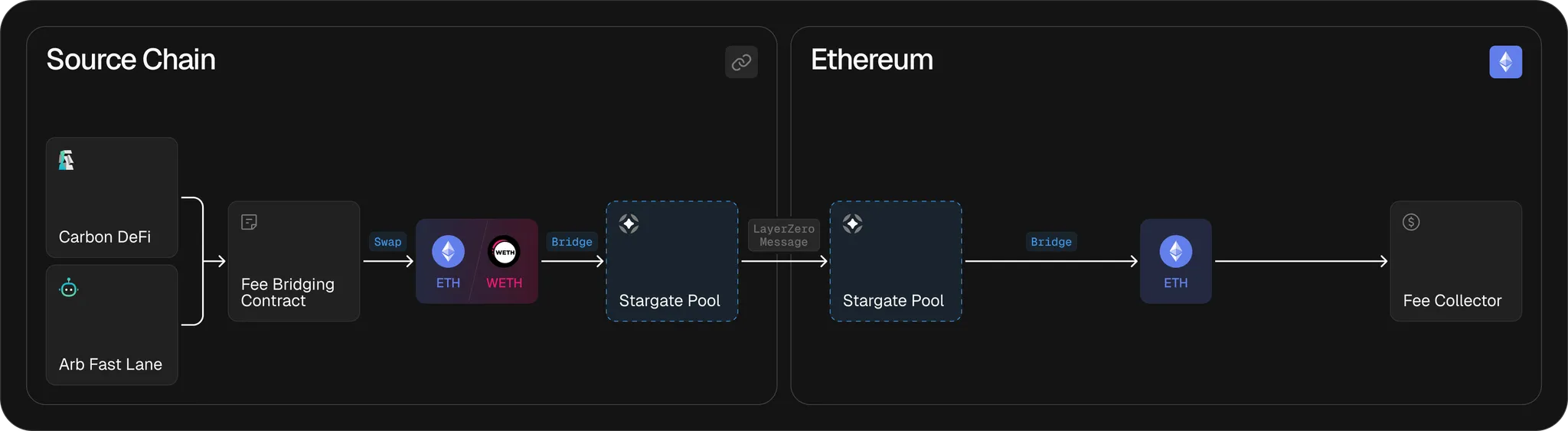

Bancor, a pioneer in DeFi, has expanded its product suite with Carbon DeFi and the Arb Fast Lane. These protocols not only advance onchain trading but also unlock new revenue streams for Bancor. With these new funds, they were in need of efficient cross-chain value routing. By integrating with Stargate, Bancor enables real-time revenue consolidation and state synchronization across its multichain footprint, spanning 10+ blockchains and over 90 protocol integrations.

______________

Scale Without Fragmentation

Ecosystem expansion brings reach, but without infrastructure to unify that growth, value becomes trapped. Protocols generate fees, rewards, and revenue in dozens of environments, yet lack the tools to route it home for core stakeholders, be it DAO members, treasury or team. This results in operational complexity, akin to diseconomies of scale.

Bancor and Beefy Finance show what it looks like to break through the scalability-ceiling. With Stargate, they’ve embedded automated value routing into the core of their multichain strategies.

-

For Beefy, Stargate connects vault revenue over 35+ chains to a central treasury, enabling consolidation at scale.

-

For Bancor, Stargate powers automated fee consolidation across 10+ chains, ensuring generated revenue returns to Ethereum- the home of Bancor’s fee collector..

How Stargate makes this possible

A Stargate Revenue Aggregation Transaction

-

Protocols generate fees locally on their deployed chains (e.g., Beefy vaults, Bancor strategies).

-

These fees are swapped into preferred tokens for each protocol:

-

Beefy: USDC / USDT

-

Bancor: ETH / WETH

-

-

Once a defined threshold is reached, a Stargate transfer is triggered, the assets are locked or burned on the source chain.

-

On mainnet, Stargate unlocks the equivalent amount from its liquidity pool.

-

The received assets are then deposited directly into the protocol’s main treasury vault/fee collector.

For Builders: Why This Matters

Multichain growth without the right infrastructure leads to friction. Manual consolidation breaks down at scale. Stargate turns cross-chain overhead into automated, Omnichain execution. Beefy and Bancor aren’t just using Stargate to streamline current operations, they’re building systems using Stargate that let them scale without future fragmentation.

Contact us

To learn more about how you can leverage Stargate for your dApp or to deploy as a HydraChain, get in touch with Stargate’s DeFi Lead or visit our docs.