To scale in DeFi today, protocols must move beyond single-chain constraints. Growth depends on composability, connectivity, and unified liquidity. EtherFi has built to position itself to scale in such a manner.

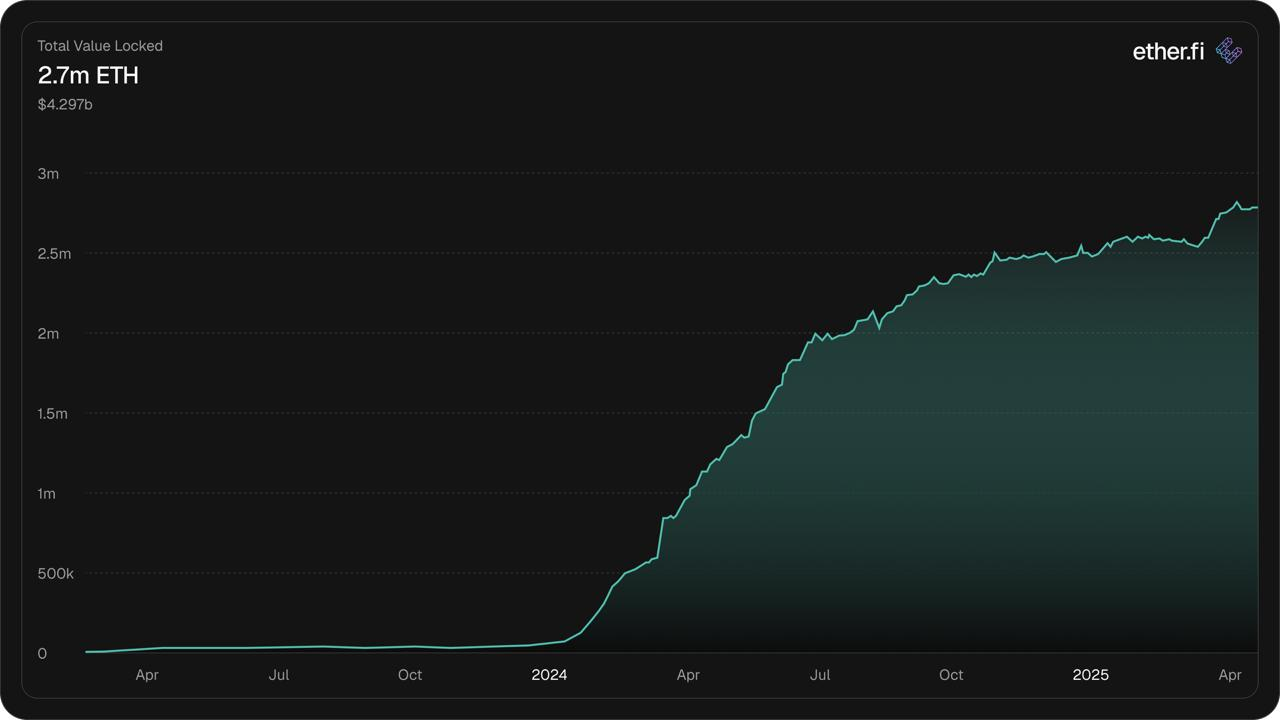

By integrating Stargate and building on top of LayerZero’s OFT standard, EtherFi has gone from a novel ETH staking protocol to one of the most composable, omnichain liquidity protocols in DeFi, now securing $4B+ TVL and 2.7M ETH.

Introduction to EtherFi

EtherFi is a restaking protocol that allows users to stake ETH while retaining control of their keys. Stakers receive eETH, which can be restaked into weETH through native EigenLayer integration. Initially popularized by weETH, EtherFi has since expanded into restaking for USD and BTC assets, liquid yield vaults, and EtherFi Cash, a crypto-native credit card leveraging omnichain architecture.

EtherFi’s weETH LRT

weETH is one of the most widely adopted restaked LRTs, currently securing over $4bn in ETH and powering a TVL >$4B. It is minted via EigenLayer restaking and uses the OFT (Omnichain Fungible Token) standard built on LayerZero to enhance its interoperability and enable seamless 1:1 transfers.

weETH is available as collateral and can be minted on six chains including Base, Linea, Berachain, Blast and Scroll, as well as Ethereum Mainnet. This is where Stargate steps in, enabling the issuance of weETH across chains via its unified liquidity network to power a seamless omnichain staking solution.

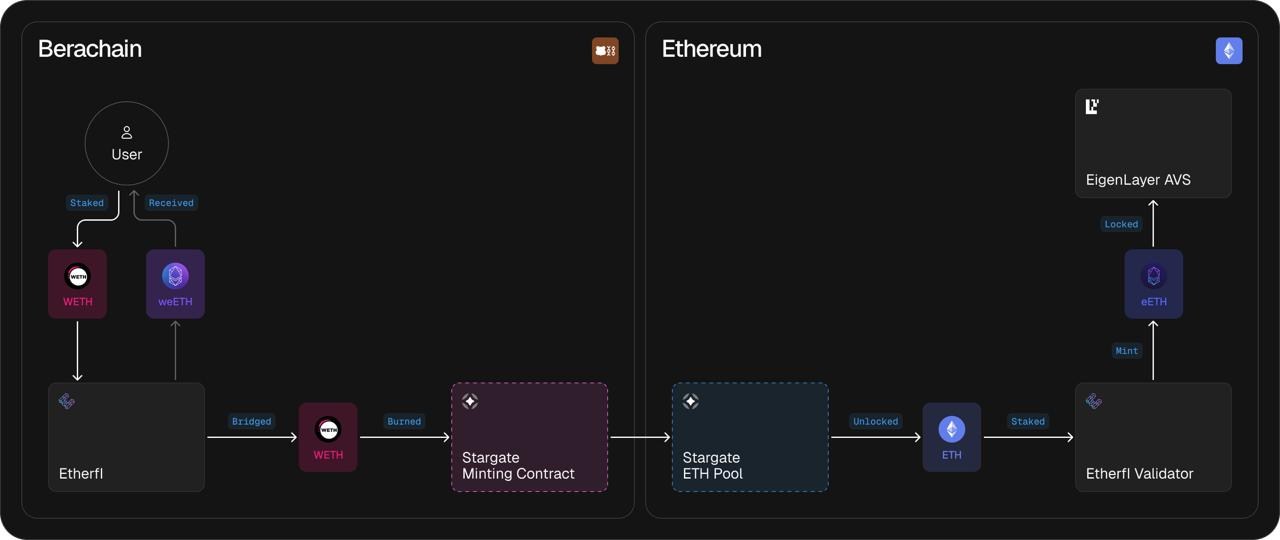

What a Stargate Transaction Looks Like

-

A user initiates a transaction to stake WETH on Berachain.

-

EtherFi mints weETH instantly and sends it to the user.

-

The WETH received on Berachain is set to be bridged to Ethereum mainnet.

-

Using Stargate’s Hydra minting contract, the WETH is burned on Berachain.

-

Corresponding ETH is unlocked on mainnet from Stargate’s ETH pool.

-

That ETH is then staked into EtherFi’s validator infrastructure.

-

EtherFi mints eETH instantly which then gets staked in the EigenLayer AVS

But EtherFi isn’t just using Stargate to scale restaking. It’s also applying the same omnichain design to settle onchain payments that power real-world spending.

EtherFi’s Cash Card

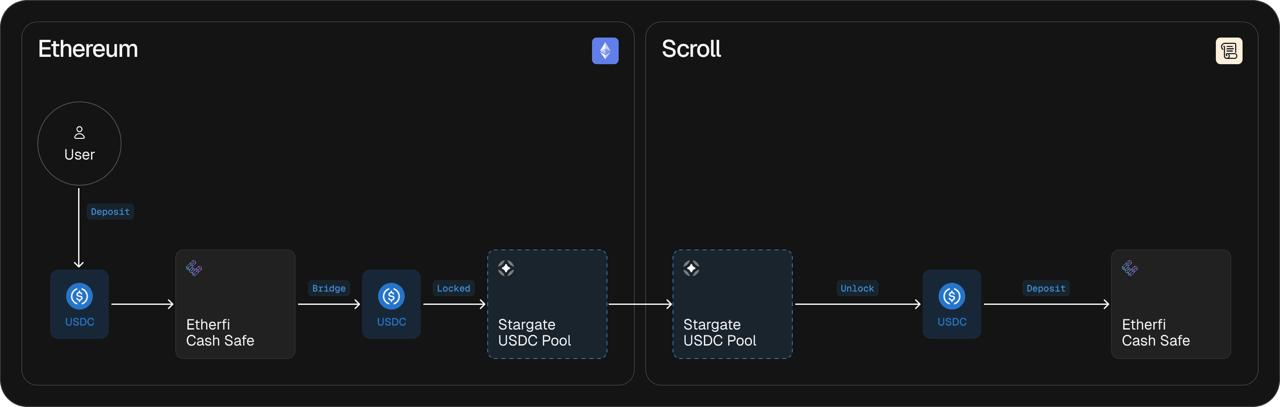

EtherFi's cash card lets users hold crypto in a smart contract wallet, which serves as collateral for purchases in the real world via the card they hold. To hold collateral securely, EtherFi Cash Safes are deployed on Scroll to minimize gas costs, while still supporting deposits on Ethereum mainnet. Once the card Safe wallet on Ethereum reaches > $10k, a Stargate transaction is initiated to deposit those assets into the Safe on Scroll.

This architecture powers real-world payments backed by DeFi-native assets, while abstracting away complexity through smart interoperability and capital-efficient routing.

What a Stargate Transaction Looks Like

-

A user initiates a transaction to deposit USDC on Ethereum.

-

EtherFi Cash Safe bridges the USDC via a Stargate Bus once it reaches >$10k deposits.

-

The USDC is then unlocked from Stargate’s USDC pool on Scroll.

-

Unlocked USDC is deposited into the EtherFi Cash Safe.

How Stargate Powers EtherFi’s Expansion

-

Support ETH staking on chains that are not natively supporting ETH

-

Abstract cross-chain logic and finality from the end user

-

Scale without deploying validator infrastructure to every chain

-

Leverage unified liquidity to enable greater capital efficiency

Summary

Stargate enables EtherFi to scale efficiently as an omnichain-native protocol. By building on Stargate’s unified liquidity, EtherFi abstracts the complexity of bridging and enhances capital efficiency of its protocol, powering EtherFi to scale further and faster.

Contact us

To learn more about how you can leverage Stargate for your dApp or to deploy as a HydraChain, get in touch with Stargate’s DeFi lead.