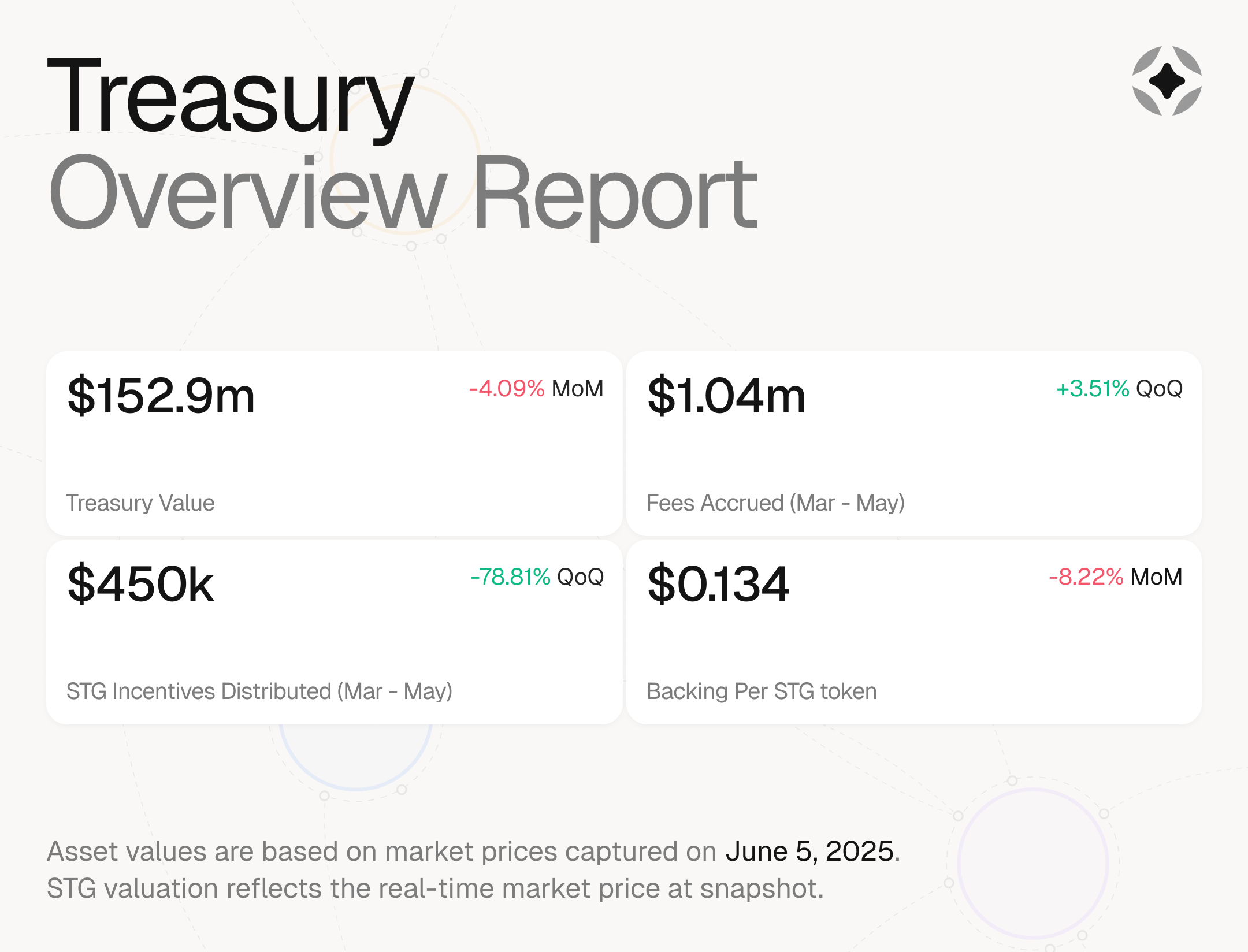

Monthly Key Performance Indicators

-

Treasury Value: $152,901,096.63

-

Fees accrued (protocol fees only) (Mar - May inclusive): $1.04m

-

STG incentives distributed (Mar - May inclusive): $450k

-

Backing Per STG token: $0.134

Asset values are based on market prices as of 16:06 UTC+1, June 5, 2025. STG valuation reflects the real-time market price at the time of snapshot.

Executive Summary

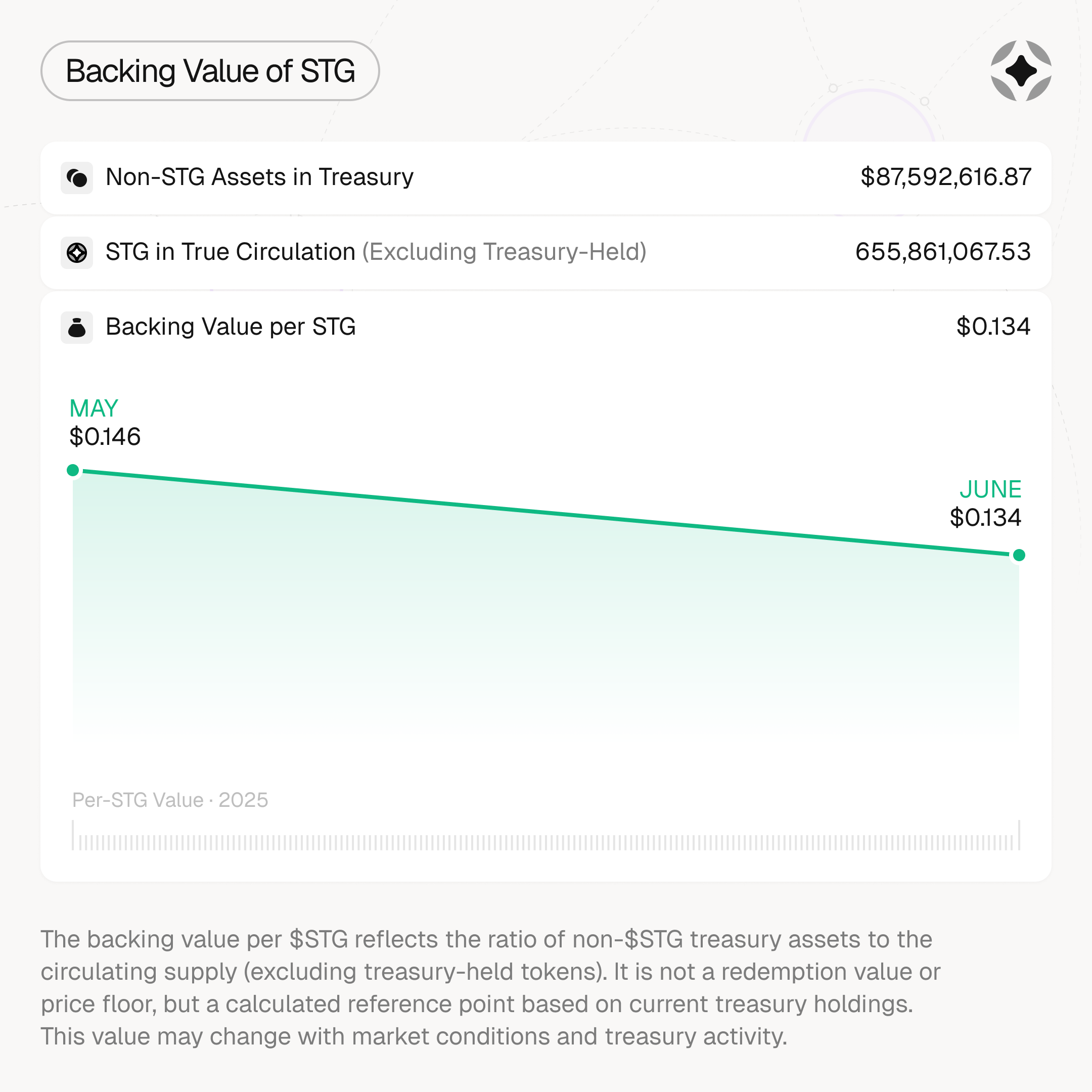

Stargate closes the second quarter of 2025 with a Net Asset Value (NAV) of US$152.9 million, underpinned by disciplined liquidity deployment and fee income resilience—US$272 thousand in protocol fees were accrued during May alone. Non‑STG treasury assets of US$87.6 million support an intrinsic backing of US$0.134 per circulating STG token. Approximately 26 % of total assets are productively deployed across seven chains, maintaining the protocol’s cross‑chain liquidity while preserving strategic reserves.

Purpose of this Report

This report presents a comprehensive assessment of Stargate’s treasury—covering asset composition, deployed liquidity, revenue streams, and expenditures—together with an overview of recent DAO-driven initiatives. It is designed to enhance transparency, furnish the DAO with actionable insights, and provide a consistent, data-driven gauge of how treasury resources are managed in pursuit of Stargate’s long-term strategic objectives.

Mandate of the Treasury

Stargate’s treasury exists to safeguard the protocol’s resilience while enabling strategic responsiveness to an evolving onchain economy. Its role is to ensure long-term sustainability and omnichain growth alignment. Treasury activities are guided by the following objectives:

-

Sustaining Core Infrastructure: Maintain liquidity across Stargate-supported networks to enable seamless and trustless cross-chain transfers.

-

Strengthening the Hydra Ecosystem: Deploy resources to support Hydra Chain integrations, reinforcing the protocol’s role as foundational infrastructure.

-

Catalyzing Ecosystem Growth: Engage in strategic investments including early-stage team incubation, token swaps, and partnerships that strengthen the Stargate ecosystem.

-

Maintaining Long-Term Reserves: Preserve financial flexibility through prudent capital management.

-

Backing Protocol Expansion: Provide targeted support for new product development and DAO-sanctioned initiatives aligned with Stargate’s innovation roadmap.

Reporting Cadence & Scope

-

Monthly Snapshot – A single‑page dashboard delivering headline NAV, fee accrual and key liquidity metrics.

-

Quarterly Report (this document) – An extended review providing deeper insight into Treasury positioning, performance drivers and DAO‑backed initiatives.

-

Annual Budget Report – A comprehensive account of broader protocol expenditures and budgetary forecasts, published separately.

The scope of this report is limited to Treasury activities; all protocol‑level budget items are addressed in the Annual Budget Report.

Treasury Breakdown

-

Breakdown of assets

-

Activity of assets

-

Backing value of STG

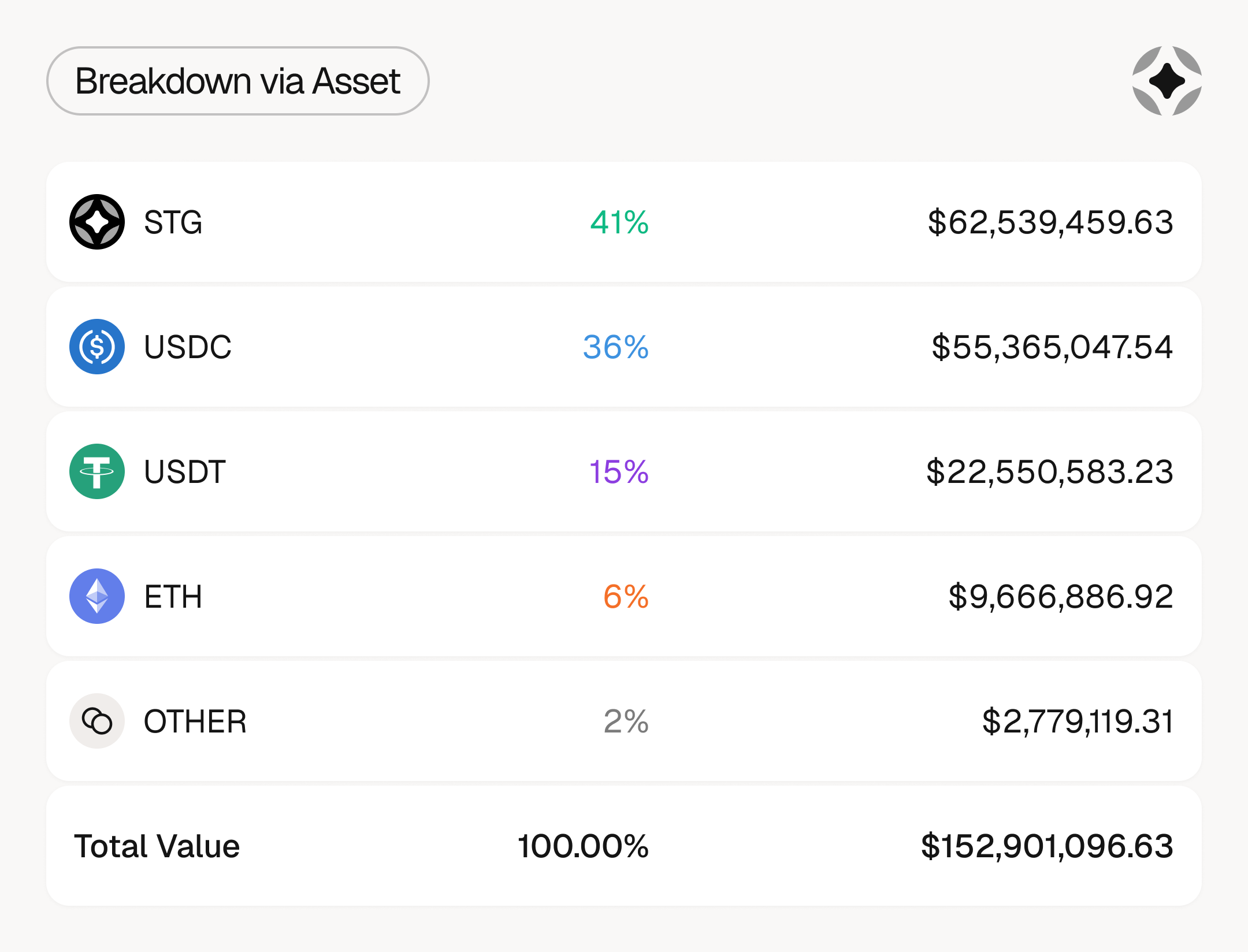

Breakdown via Asset

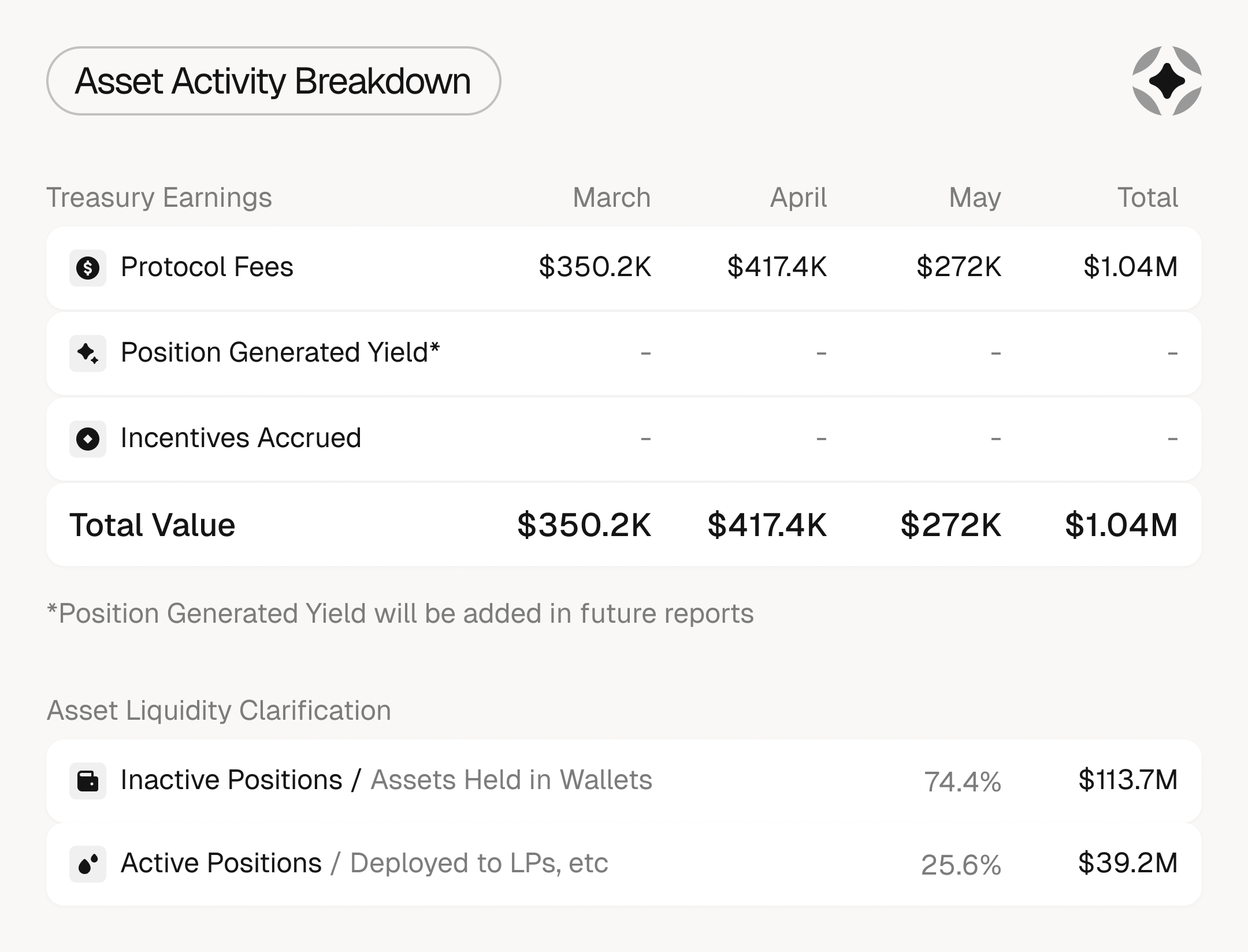

Asset Activity Breakdown

Backing Value of STG

DAO-Backed Protocol Initiatives

Hydra Expansion Programme (HEP-1)

To date, 10,494,750 STG has been distributed as part of the Hydra Expansion Programme (HEP-1) to incentivize sticky USDC.e and WETH liquidity within the Berachain ecosystem via the designated Boyco vaults.

STG/HONEY vault approved for Berachain’s PoL

As mandated by HEP-1, the DAO will participate in PoL by allocating $100,000 per week in STG bribes over a 12-week period. These bribes will be executed through the STG/HONEY vault, which was approved by the DAO in a proposal submitted by the Kodiak team.

The bribes are conditional: they will only be deployed if the combined value of received Bera Governance Token (BGT) emissions and vault bribes exceeds the STG being distributed. During this timeframe, Stargate also anticipates receiving BGT from validator delegations, enabling further compounding via additional vault participation.

Stargate to offer EURC bridging

Following DAO approval, Stargate will now support Circle’s EURC, marking the first non-USDC fiat-backed stablecoin in the ecosystem. Stargate expects to deploy EURC pools across Ethereum, Base, and Avalanche, with an initial target of €2 million TVL per chain.

EURC is planned to be fully integrated as a Hydra-enabled asset, expanding its reach across existing and future ecosystems via Stargate’s standard interop stack. This will enable fast, low-cost, and secure movement of EURC across chains — a key step in unlocking omnichain Euro liquidity.

DAO Backed Strategic Initiatives

Glue X Stargate SuperApp

A strategic partnership with Glue has been approved to co-develop a flagship cross-chain mobile application. The app is intended to facilitate seamless any-to-any token swaps for retail users, leveraging Stargate as its exclusive backend liquidity infrastructure.

The DAO has committed:

-

$1M in USDC for app development and security audits

-

$500K in STG for performance marketing and user acquisition

-

$500K in STG for user incentives

-

A $500K STG–GLUE token swap, subject to a 3-year staking lock to align long-term incentives

All swaps executed within the app will exclusively route through Stargate, generating protocol revenue. Of this revenue, 35% will be allocated to STG buybacks, with 10% distributed to veSTG holders.

Swell Chain deployment

The proposal to deploy an ETH pool onto Swell L2 was passed in april enabling the Stargate DAO to deploy $5m in ETH onto Swell in exchange for 5% yield ($250k). This yield earned will be distributed to stakers once the incentives are received and calculated under ‘incentives received’ from the ‘Treasury Earnings’ section.

Summary

This is the first edition of the Stargate Treasury Report. Feedback is encouraged to help shape future iterations can be shared in the Stargate Discord or on the Discourse forum.

Important Information & Disclaimers

This document has been prepared by the Stargate Foundation Treasury & Finance Team (the “Team”) and is provided solely for informational purposes. It does not constitute investment, legal, accounting, tax or other professional advice, nor should it be relied upon in making any investment or other decision. Nothing herein constitutes an offer to sell or the solicitation of an offer to purchase any security, token or other financial instrument, nor should anything herein be construed as a recommendation to engage in any investment strategy.

All data—including, but not limited to, Net Asset Value (NAV), asset valuations, revenue accruals and performance metrics—are unaudited and derived from internal records and/or third‑party sources believed to be reliable. The Team makes no representation or warranty, express or implied, as to the accuracy, completeness or timeliness of such information. Figures are stated in United States dollars unless otherwise noted and are based on spot market prices prevailing at the valuation timestamp indicated; values and percentages are subject to change without notice.

Forward‑looking statements—identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “seek,” “will,” “should” and similar expressions—are inherently subject to risks, uncertainties and assumptions. Actual outcomes may differ materially from those expressed or implied. Past performance is not indicative of future results.

Digital assets are highly volatile and involve a high degree of risk; an investor could lose all or a substantial portion of their investment. No representation is made that any investment or strategy described herein will, or is likely to, achieve profits or losses similar to those shown or that significant losses will be avoided.

The Treasury mandate, strategic pillars and allocations set out in this report remain subject to Stargate DAO governance and may be modified, suspended or terminated without notice. Neither the DAO, the Team nor any of their respective affiliates or contributors accepts any liability whatsoever for any direct, indirect or consequential loss arising from the use of, reliance on, or any decision made based on, the information contained in this document.

Distribution of this report may be restricted by law in certain jurisdictions. Persons into whose possession this document comes should inform themselves about and observe any such restrictions. By accepting this document, you acknowledge and agree to be bound by the foregoing limitations and disclaimers.

First Edition — June 2025 Prepared by the Stargate Foundation Treasury & Finance Team.