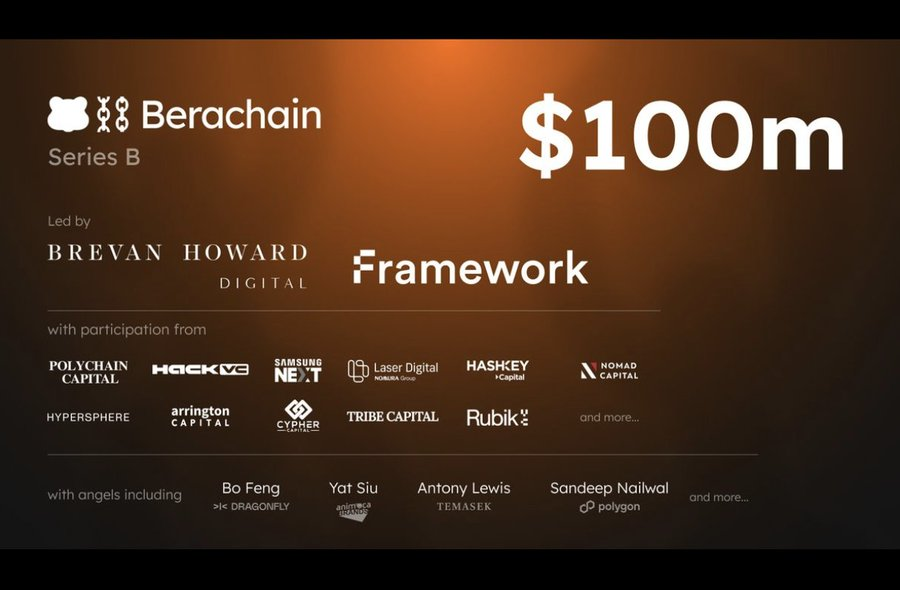

@berachain is a L1 project that has raised up to $142M from major investment funds such as Polychain Capital, Framework Ventures, Brevan Howard Digital, and more.

The special feature of this Layer 1 blockchain, built on the Cosmos SDK and compatible with EVM, is its Proof of Liquidity consensus mechanism — the heart of Berachain.

So, what’s so good about the Proof of Liquidity mechanism that has helped Berachain successfully raise such a large amount of funding?

In this article, I will explain through the following sections:

-

Current issues on blockchain

-

Proof of Liquidity

-

How Berachain operates

-

Advantages of Berachain

1. Current Issues on Blockchain

There are two main unresolved issues with today's blockchains:

🟠 Liquidity limitations

- Currently, most blockchains use the Proof of Stake mechanism, meaning validators must stake a certain amount of tokens to participate in securing the network.

➡️ This means that these tokens are locked and can no longer be used within the ecosystem.

🟠 Imbalance Between Validators and Protocols

-

In a blockchain ecosystem, DeFi protocols play a crucial role in driving activity and growth but are unable to participate in securing the network.

-

On the other hand, validators provide the infrastructure and security for the network but only receive a small portion of transaction fees and gain very little benefit from DeFi protocols.

➡️ This creates an imbalance.

- This is where Berachain comes in to address these issues.

Smokey the Bera, the founder of Berachain, has stated: "Proof of Liquidity will unlock infinite economic games."

2. Proof of Liquidity

-

As the name suggests, Proof of Liquidity (POL) is a consensus mechanism designed to incentivize users to provide liquidity on Berachain and address the shortcomings of Proof of Stake, while still maintaining the system's stability and flexibility.

-

With Proof of Liquidity, Berachain introduces a dual-token system:

$Bera is used for gas fees and network security.

$BGT (Bera Governance Token) is used for governance and as a reward to incentivize on-chain activities. It cannot be transferred or traded.

-

The only way to earn $BGT is by interacting on-chain and participating in Proof of Liquidity.

-

$BGT can be burned to convert into $Bera at a 1:1 ratio.

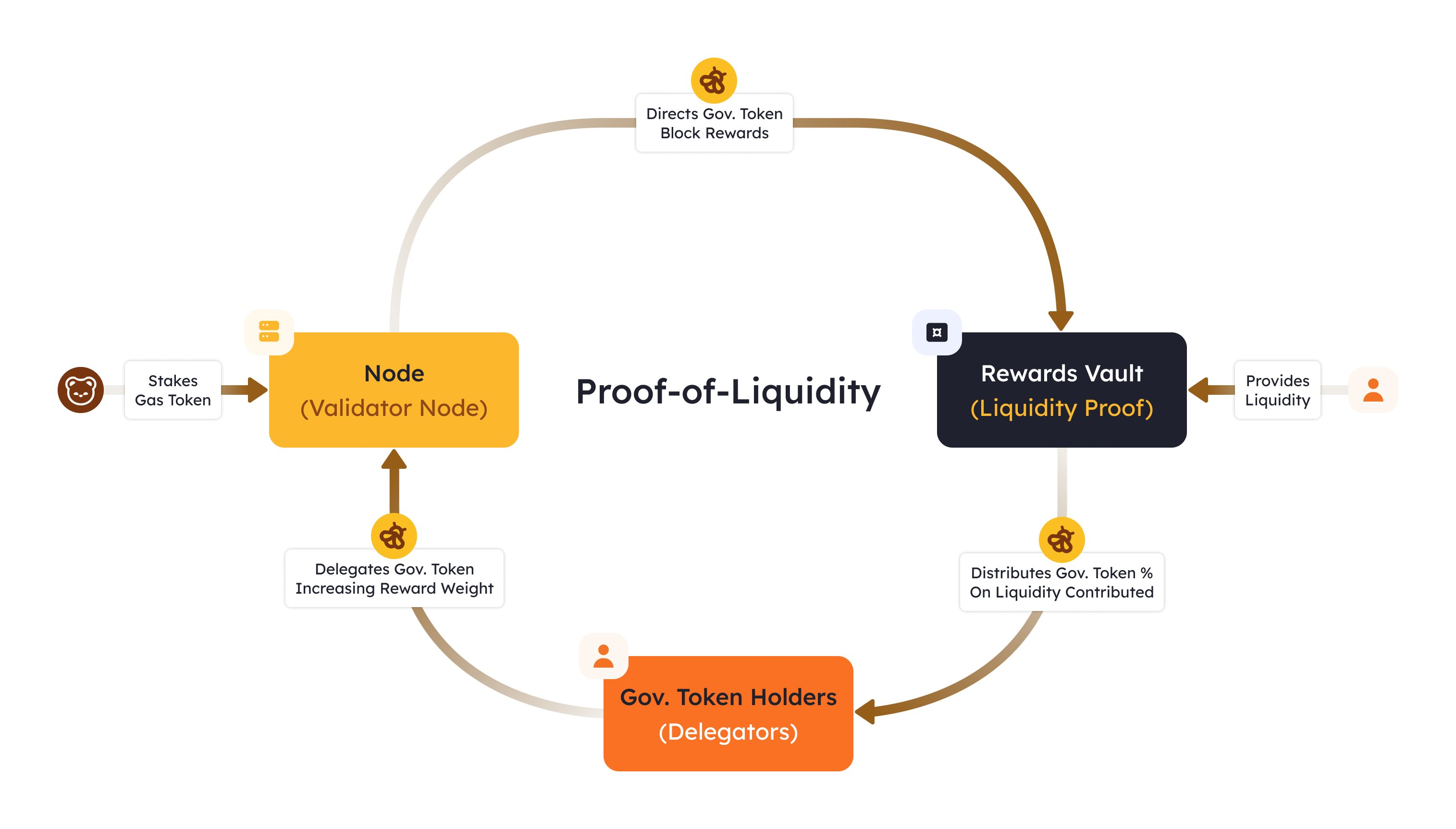

3. How Berachain Works

-

When validators join the network, they need to stake $Bera, which then emits $BGT as a reward.

-

This $BGT is used to create reward pools for users who provide liquidity to DeFi protocols within the ecosystem, like AMMs and lending pools.

-

Users can then take the $BGT they’ve earned and delegate it to validators.

-

The more $BGT a validator receives from delegations, the more $BGT they can emit.

4. Advantages of Berachain

With the above mechanisms, we can see some key benefits of Berachain, such as:

✅ Balancing the relationship between validators and protocols

-

This mechanism encourages validators to secure the network while benefiting from DeFi protocols (since user delegations help validators increase $BGT emissions).

-

Additionally, users who interact with the protocols earn $BGT and delegate it, allowing the protocols to indirectly contribute to network security.

✅ Flexible governance token system

-

Typically, governance tokens are mainly used for voting on protocols, but most users don't know or care about this (they just see them as fee tokens).

-

The fact that regular users can also farm $BGT demonstrates flexibility, attracting more projects and users to the ecosystem.

-

Additionally, users receiving $BGT for adding liquidity solves a common issue for other projects. Often, users add liquidity to receive airdrops and then withdraw their liquidity once the airdrop is over.

5. Conclusion

I've just outlined some of the key potentials of Berachain, and I hope you find it useful.

As you can see, the $BGT token will play a very important role, so if you're participating in the testnet, don't forget to earn as much $BGT as you can.

Who knows, this might be one of the criteria for an airdrop.

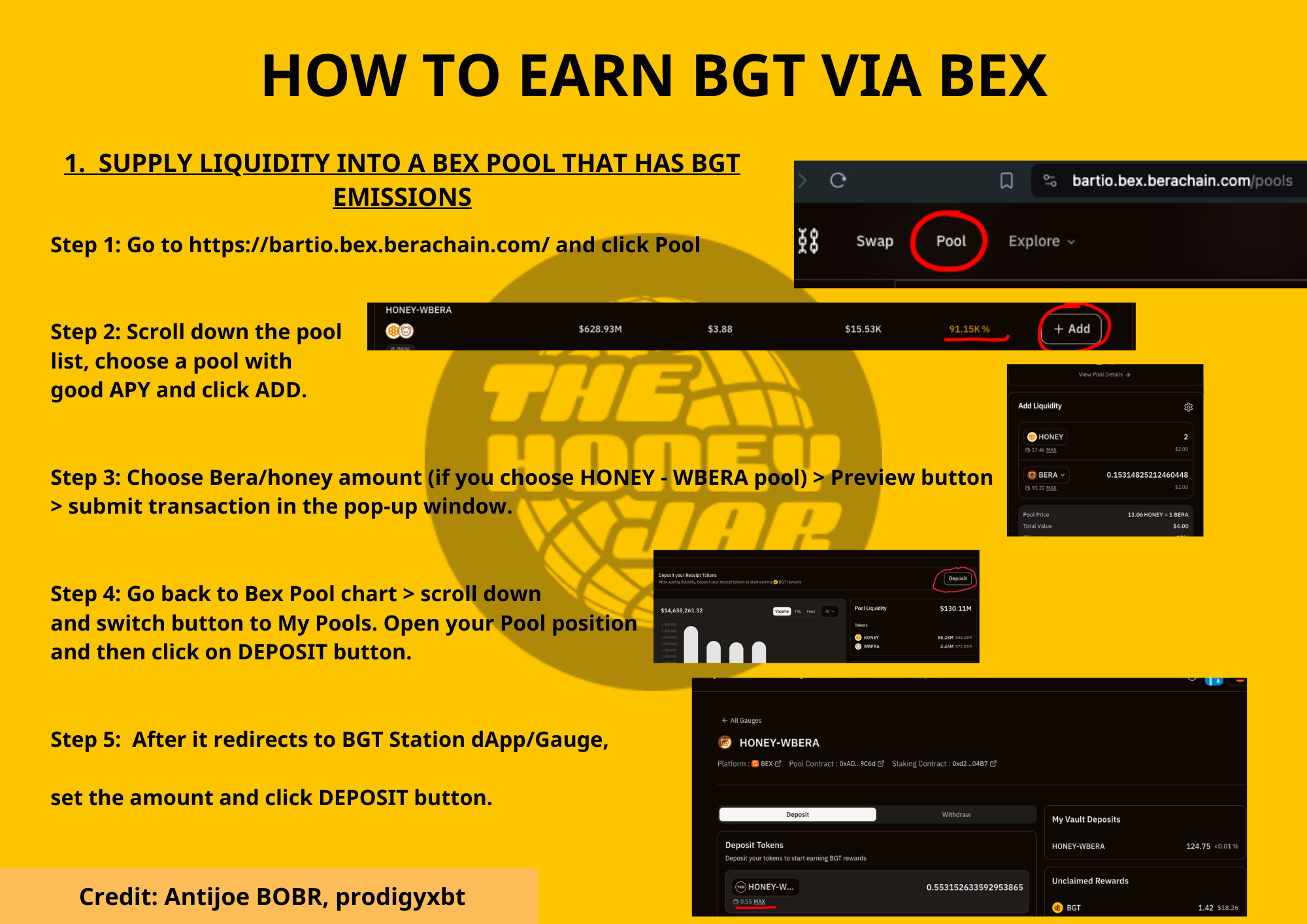

For ways to earn $BGT, you can refer to this guide.

Lastly, to fully benefit from crypto guides, it's essential to stay updated on the latest info and participate in as many as possible. You can do this by following https://twitter.com/prodigyxbt, join The Daily Gem telegram and subscribe to Prodigy’s newsletter.

Many sources influenced this article. In particular, I should note: