TL;DR

-

PT: Fixed APY, no Points

-

YT: Long the yield, earn 5× Points

-

LP: Earn swap fees, up to 4× Points on the YO token side

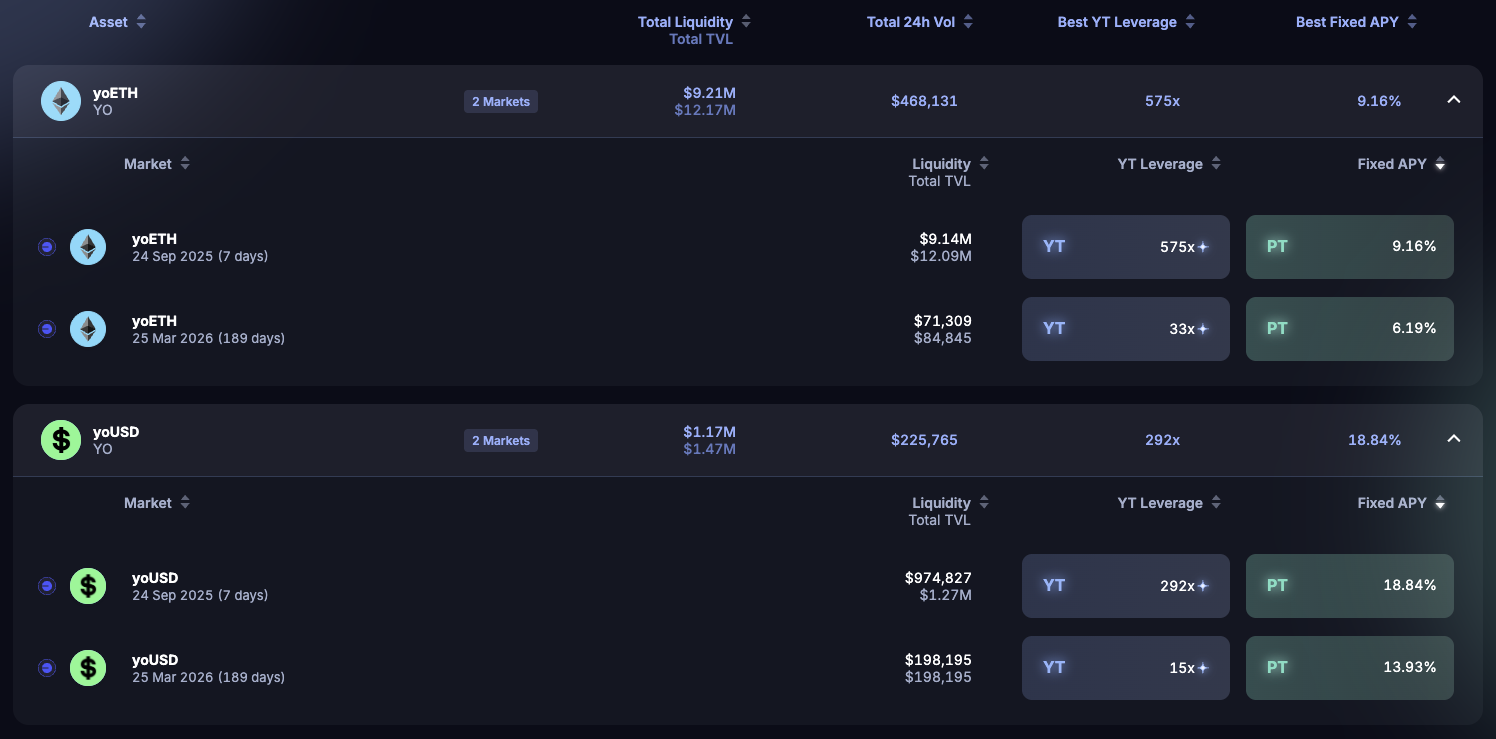

Pendle is one of the most powerful tools in DeFi for yield trading. It lets you separate the underlying yield of a token from its principal and trade them independently. For YO vaults, that means there are markets for yoETH and yoUSD that unlock new strategies to farm yield and stack YO Points.

Let’s break down the three main approaches — PT, YT, and LP — and how they connect to YO Points.

Why Pendle?

Pendle allows you to trade the yield of tokens directly. Instead of just holding a yield-bearing asset, you can decide whether to:

-

Lock in a fixed yield (PT)

-

Speculate on yield going higher (YT)

-

Provide liquidity and earn fees (LP)

This flexibility makes Pendle a natural fit for YO vaults, where capital is already deployed into productive yield.

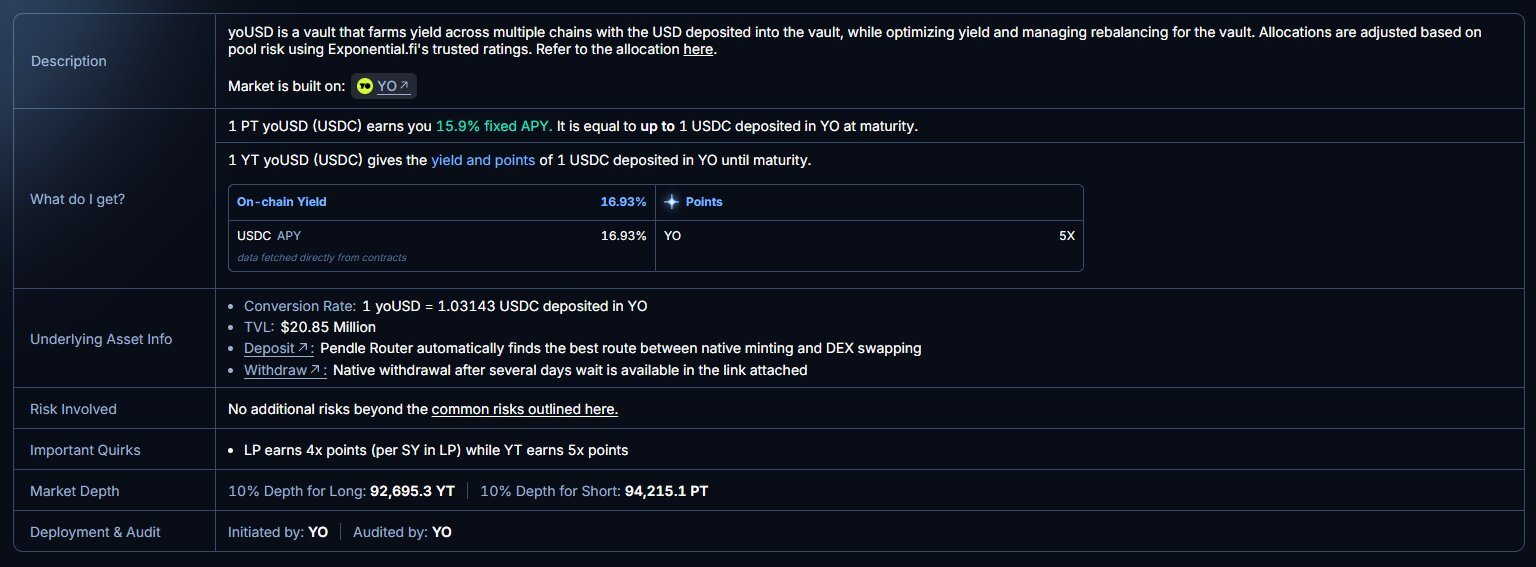

PT: Short the Yield

PT stands for Principal Token, and it represents the fixed yield portion of an asset.

✅ Fixed maturity and fixed yield paid in ETH or USDC

✅ Lets you lock in an implied APY until market expiry (for example, March 25)

❌ No YO Points earned on PT

Think of PT as clipping a safe, fixed coupon. It’s the conservative choice if you want guaranteed returns and don’t care about farming Points.

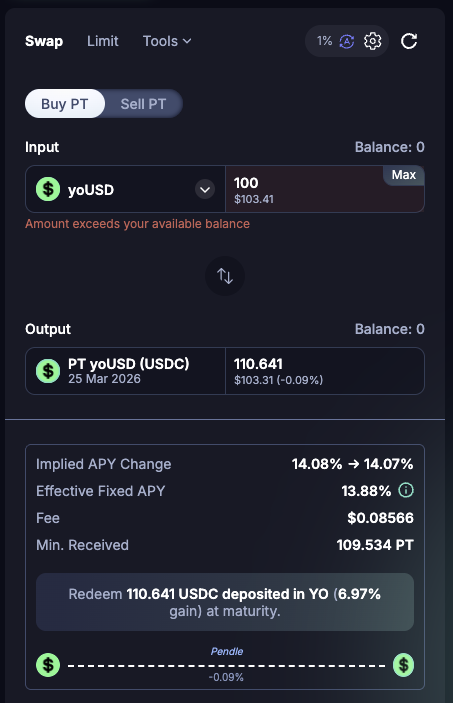

YT: Long the Yield

YT stands for Yield Token, and it’s where things get interesting.

-

If you think yields will rise above the implied APY, you can buy YTs to long the yield.

-

Each YT gives you exposure to the yield of 1 yoToken but costs only a fraction of the price. This creates built-in leverage with no liquidation risk.

💡 Example: Deposit $100 yoUSD → buy ~11,000 YTs

Those YTs give you the same yield exposure as depositing ~$11,000 USDC into yoUSD directly.

That’s ~110× leverage for the duration of the market. Each YT earns 5× YO Points.

In this example, your 11,000 YTs would generate ~55,000 Points per day

⚠️ Keep in mind: YTs go to $0 at maturity. You’re betting on the yield stream, not the principal. Do your own research and manage risk accordingly.

LP: Provide Liquidity

The third option is to act as a liquidity provider (LP) on Pendle.

-

An LP position is made up of yoToken + PT

-

You earn swap fees when traders buy or sell YTs and PTs

-

There is no impermanent loss if you hold until maturity

-

You earn YO Points only on the yoToken portion (PTs do not accrue Points)

-

LPs can get up to 4× YO Points boosts

This approach is ideal if you want to earn steady fees while still collecting boosted Points on your YO tokens.

Explore YO Markets on Pendle

Pendle unlocks advanced strategies on YO vaults. Whether you want a safe fixed APY, leveraged yield exposure, or fee income with Point boosts, there’s a play for you.

Browse the latest YO markets here: