Adam is a B2C cross-border e-commerce entrepreneur specializing in Japanese and Korean personal care products. His customers span Southeast Asia, North America, and the Middle East. Like many “new wave” global merchants, Adam long struggled with one core challenge: settlement delays and poor capital liquidity.

Many of his clients, channel partners, and marketing affiliates prefer to pay with crypto assets—a trend rapidly growing in emerging markets. But this comes with risks: blocked platforms, difficulties converting to fiat, and unclear compliance routes.

That changed when Adam discovered the AP U-Card. His business finally “took off.”

One Card to Unblock Global Cash Flow

The AP U-Card enables crypto assets to be compliantly converted to USD through a licensed financial channel and loaded directly onto a physical or virtual card linked to the global Visa/MasterCard network. This bridges on-chain value with real-world spending and settlement needs.

Here’s how Adam uses it:

-

Supplier Payments: After confirming orders with Korean suppliers, he pays in USD directly from his card—no more complicated wire transfers.

-

Customer Refunds & Incentives: Loads funds to customer U3 accounts as credit or promotions, boosting repeat purchases and word-of-mouth.

-

Cross-Border Advertising: The card is compatible with ad platforms like Facebook Ads and Google Ads—recharge and spend in real time.

-

Payroll & Affiliate Payments: Manages global KOLs and ambassadors using multi-card systems, separating commissions and streamlining operations.

-

Travel & Operations: Partners use the card for travel expenses, lodging, equipment, and more—everything traceable and unified for easy accounting.

For a business owner who doesn’t want to open overseas entities, but needs flexible international operations, this card became a reliable and long-term financial exit channel.

Compliance-Driven Security at the Core

Unlike informal "exchange platforms," Adam values safety and legitimacy. The AP U-Card is operated by licensed institutions and guarantees asset security through:

-

API Payment Services authorized by the UK’s FCA, compliant with US and EU payment regulations.

-

Licensed fiat-crypto channels managed by U3, with funds safeguarded by international banks.

-

Built-in risk control across the platform, aligned with KYC/AML standards—yet seamless for users.

-

Independent audits conducted regularly, with all transactions fully traceable and verifiable.

Adam’s finance team can now generate monthly statements with ease, track every transaction, and simplify corporate tax filing and regulatory reporting.

More Than a Card — A Financial Tool for the Digital Age

Adam’s story isn’t unique. More and more SMEs, freelancers, and cross-border professionals are unleashing the real-world value of their crypto assets through the AP U-Card.

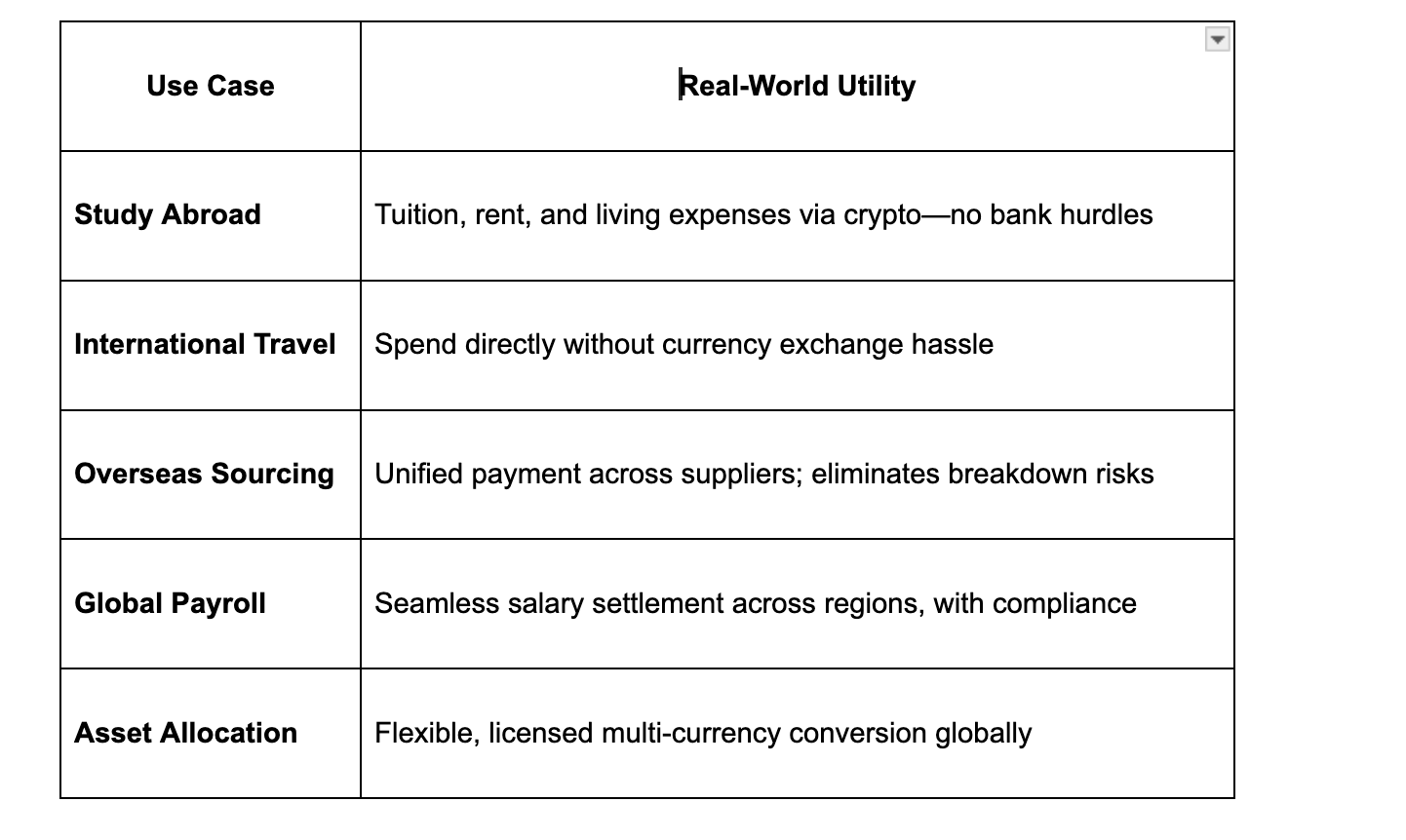

The U-Card offers practical utility across diverse use cases:

Financial Freedom for Every Business Begins with One Card

As Adam puts it:“I don’t use crypto just for the sake of it—my clients and ecosystem already do. If I don’t adapt, I fall behind. The AP U-Card lets me not just keep up, but lead.”

In a world where digital economies are going global, every business leader should ask:

“Can I connect my value to global markets safely, efficiently, and on my terms?”

The answer might just be in your wallet.

AP U-Card — the real-world key to on-chain value. Empowering businesses for a global era.