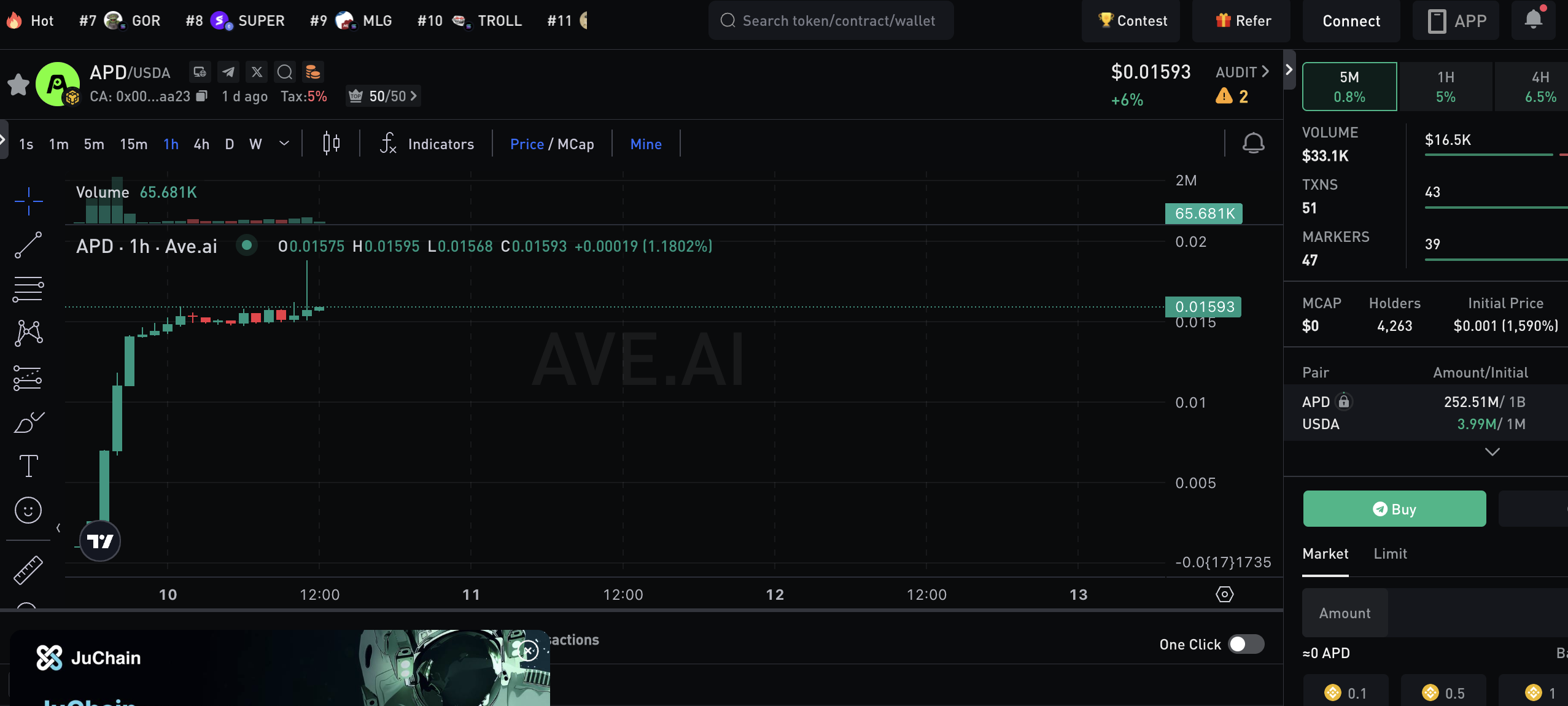

On August 10, 2025, the DeFi world witnessed a seismic move — $APD, the core governance token of the APDAO ecosystem, officially went live on PancakeSwap. Within hours, it was picked up by top market tracking and charting platforms like AVE, with a liquidity pool worth around $8M USDA, and price action exploding past a 15x gain from launch.

Contract: 0x001208f7f53f78db2b32e1c68198d3e8f320aa23

This momentum is powered by USDA, APDAO’s fully compliant, multi-chain stablecoin pegged 1:1 to USDT — already listed on major price trackers and wallet apps. The USDA/USDT swap channel is deep, fast, and frictionless, making it effortless for users to enter or exit $APD positions without liquidity concerns.

$APD: Governance, Incentives, Scarcity – All in One Token

-

Governance Power – $APD holders can propose, vote, and directly shape the APDAO ecosystem’s future.

-

Value Distribution – Ecosystem rewards are distributed in a 10% CP + 90% APD structure, locking long-term alignment between growth and holders.

-

Deflationary Economics – With 20% of withdrawals burned, every transaction tightens supply.

-

On-Chain Transparency – Fully tradable and trackable from day one.

USDA: The Stable Pillar of a Global Ecosystem

-

Fully Compliant Reserve Model – Swarm Network tech spreads reserves across 20+ FDIC-insured U.S. banks, with a $5M per-account protection ceiling.

-

On-Chain Audited – Daily transparent reserve verification, open to all users.

-

Ecosystem-Ready – Powering AP Pay, AP Card, GameFi, RWA issuance, DeFi lending, and more.

-

Cross-Chain by Design – Built for LayerZero / Wormhole compatibility for smooth, multi-chain flow.

Why This Matters: The Demand-Supply Equation is Explosive

The APDAO model creates a two-engine system:

-

USDA fuels stable payments, settlements, and liquidity.

-

$APD captures value through governance and scarcity.

As USDA adoption accelerates globally, the demand for $APD will keep climbing — while the burn mechanism steadily contracts supply. The combination of rising utility + shrinking circulation is a textbook setup for sustained upward price pressure.

At just the initial liquidity stage, $APD has already achieved a 15x surge — but with AP Web3 mainnet, cross-chain rollouts, and global payment integrations all coming in Q3–Q4, this could be the opening chapter of a much larger run.

**The market is liquid. The use case is real. The supply is shrinking.**The next leg up may arrive faster than most expect.Don’t just watch the chart — be part of the story.