Preface: The Mission and Value of USDA in the New Era

As global financial digitalization accelerates, blockchain technology is increasingly integrated with traditional finance. Stablecoins, as the bridge between on‑chain assets and the real economy, are experiencing unprecedented growth opportunities.

USDA emerges in this context, carrying the mission of driving global digital asset circulation and building a trusted payment network. It is not just a USD‑pegged stablecoin, but a strategic asset featuring regulatory compliance, cross‑chain compatibility, and high transparency.

USDA is designed to:

-

Serve as a reliable, efficient, and open global payment intermediary

-

Establish an on‑chain and off‑chain financial service loop for real‑world utility

-

Enable users and institutions to participate in the decentralized economy safely and compliantly

By combining multi‑bank FDIC‑insured distributed reserves with on‑chain transparent auditing, USDA greatly enhances its resilience against banking risks and ensures secure and real‑time redemption. Leveraging the AP Web3 ecosystem, it forms a seamless connection across payments, lending, asset clearing, and cross‑border settlements.

I. Core Features of USDA

-

FDIC Multi‑Bank Distributed Reserves

Swarm Network distributes funds across 20+ U.S. regulated banks

Up to $5 million FDIC coverage per account via $250,000 layered insurance per bank

Smart allocation and second‑level fund rebalancing to ensure safety and liquidity

-

Full On‑Chain Auditing and Transparent Reserves

Daily reserve disclosures via CeFFU and partner custodians

Users can verify 1:1 USD backing anytime for trust and transparency

-

Native Cross‑Chain Architecture

Initially launched on BSC, with native deployment on AP Web3 Chain in Sept 2025

Supports LayerZero / Wormhole for multi‑chain liquidity and interoperability

-

Deep Integration with AP Web3 Ecosystem

Serves as the financial backbone for payments, lending, GameFi, and RWA issuance

Powers user accounts, merchant settlements, and institutional adoption

-

Compliance‑First & Multi‑Stakeholder Adaptation

Robust KYC/AML processes with multi‑sig and DAO governance

Designed for seamless integration for users, merchants, and institutions

II. Project Overview: USDA – A Compliant Stablecoin for Global Circulation

The stablecoin market is entering a new era of institutionalization beyond its early experimental phase.USDA, as a next‑generation compliant USD stablecoin, is positioned to be:

-

Compliant: Globally regulatory‑ready with transparent reserves and KYC accounts

-

Usable: Extending from DeFi to payments, commerce, and settlement

-

Secure: FDIC‑insured custody plus on‑chain transparency

-

Open: Multi‑chain issuance with native cross‑chain capabilities

Unlike stablecoins limited to DeFi, USDA is designed for comprehensive real‑world applications, including retail payments, cross‑border settlements, institutional clearing, and Web3 finance.

III. Issuance Mechanism and Cross‑Chain Integration

Issuance Logic

-

Pegged 1:1 to USD, minted via USDT, USD, or bank deposits

-

KYC‑verified accounts required for minting and redeeming

Initial Deployment and Liquidity

-

BSC as the launch chain with USDT/USDA pair

-

Initial liquidity pool target: $10M

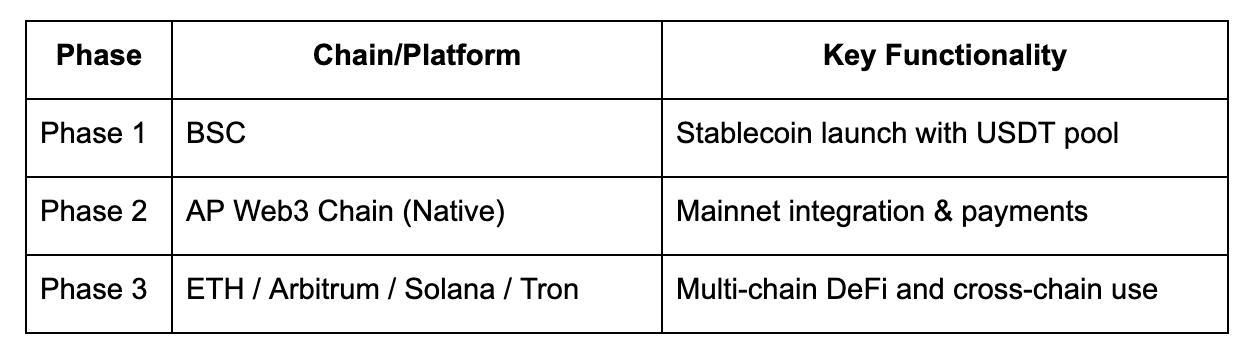

Cross‑Chain Rollout Path

USDA leverages LayerZero/Wormhole plus lightweight node bridging to maintain 1:1 parity and verifiable multi‑chain circulation.

IV. Synergy with the AP Web3 Ecosystem

USDA is the core settlement asset and financial foundation of AP Web3, empowering:

-

AP Pay Global Payment System

-

Usable in 210+ countries for consumer and merchant transactions

-

Integrated with AP Card to bridge on‑chain incentives with fiat spending

-

-

DeFi and On‑Chain Finance

- Lending, staking, liquidity mining, and multi‑chain asset bridging

-

RWA & Virtual Economy Applications

-

Anchor for real‑world asset tokenization and NFT/GameFi ecosystems

-

Supports task rewards, payroll, and credit systems

-

-

Community Governance

-

Used for proposal deposits, voting, and ecosystem rewards

-

Forms a dual‑asset governance model alongside $APD

-

With USDA, AP Web3 enables a full‑stack financial loop from custody and payments to asset flows and DAO governance.

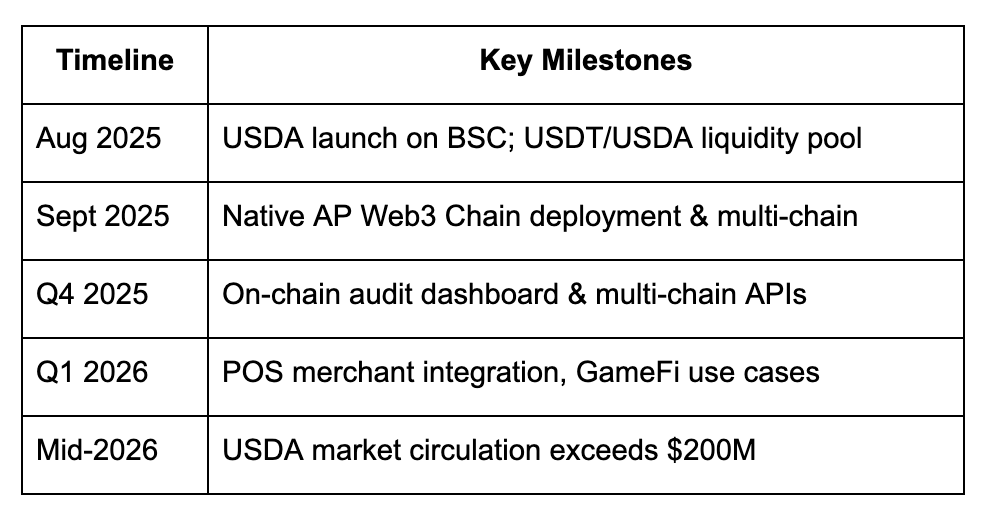

V. Roadmap

VI. Conclusion: Redefining Global Digital Finance

USDA strikes a perfect balance among regulatory compliance, on‑chain transparency, and multi‑chain interoperability.It is not only the financial backbone of AP Web3 but also a trusted infrastructure for global digital finance.

With $5M FDIC‑insured distributed reserves, daily on‑chain transparency, and native cross‑chain architecture, USDA transitions stablecoins from simply storable to truly usable.

Every transaction becomes secure, borderless, and verifiable, enabling billions of users worldwide to enjoy the real benefits of the digital economy.