Stay Gold

In the past year, Hakka Finance had a bumpy ride. It wasn’t just about the token price. But rather about lost faith in our community. At this moment, I appreciate every supporter who keeps standing with us. We couldn’t have gone this far without your support. I believe that we’re at the start of DeFi’s golden age. While the market cap of DeFi is growing over $120B, it’s just a drop in the ocean compared to the traditional banking industry. However, many players get lost in the forest full of Ponzi and speculation in DeFi. To avoid that, I would like to share Hakka Finance’s future roadmap to reunite us with the same vision. I have to admit that It’s impossible to predict the future, and there’ll be many things happening out of the scope of this roadmap. It doesn’t mean that the roadmap is worthless. Instead, it represents our vision and what’s essential for us. Besides, it shows that we’re not ignorant children roaming around in the dark forest without a compass. I hope you will go alongside us and enjoy the gorgeous scenery of financial innovation together.

First, I want to rephrase the Hakka spirit and the holy grail of Hakka Finance.

Hakka is an ethnic subgroup of Han Chinese. To escape famine and civil unrest, Hakka people have experienced a long series of relocations, from central China to southern China, and from China to Southeast Asia. When immigrating to other regions, the Hakka as newcomers were forced into the less-fertile outer fringes of plains. Hence, Hakka became tough, diligent, and frugal to accommodate severe environments. That’s the spirit we want to bring to Hakka Finance, the Hakka people’s spirit of endurance, diligence, and bravery in exploring new lands.

Hakka Finance will be the brave and diligent one who cultivates the virgin soil of decentralized finance.

Our ultimate goal is to become one of the wisest DeFi DAO, discovering unmet needs and fulfilling them with the most efficient derivative DeFi products to the public. Looking back at the history of finance, the opportunity we see is that complex derivative financial products are blooming in Defi. Finance is born from central banks issuing money with gold guarantees, then commercial banks offering deposits, loans, and foreign exchange to the general public. Next, investment banks design derivative financial products to meet the needs of risk management and arbitrage. History is surprisingly similar, and we can see the same path in DeFi.

That also indicates, unlike other protocols, that we do not only focus on one specific financial service but also try to build a series of products under Hakka Finance. The reason is that we want to give a more long-term commitment to align our incentive to the community.

From the examples of other protocols that faded away, if your token is highly tied to one service, the team will leave the community behind after the end of its product life cycle. In addition, the community will lose their faith when they expect the team will abandon the project having no further exponential growth opportunity. There is vital reflexivity between team and community that they will get stuck in the death spiral if they don’t have a long-term consensus. By becoming a DeFi Studio, our staunch believers will benefit from every product’s profits and take less risk than other one-shot protocols.

We look forward to gathering crypto sages who believe in our vision, love to experiment, play, and craft innovative DeFi products, and are willing to stand with us. In our future vision, Hakka Finance is a robust and fully decentralized organization. Community members would discuss the uncovered design of DeFi and build products like open-source projects, which our governance treasury sponsors. Hakka Finance will grow and thrive with the contribution of our community, and anyone who contributes to Hakka Finance will be richly rewarded.

Regain Momentum

Now, it’s a critical time for us to get back on track and renew the community’s faith in us. So we’re going to sprint, explore, and craft our moat relentlessly to win our community back. Next, I’ll go through our products and what we’re developing to elaborate our strategy.

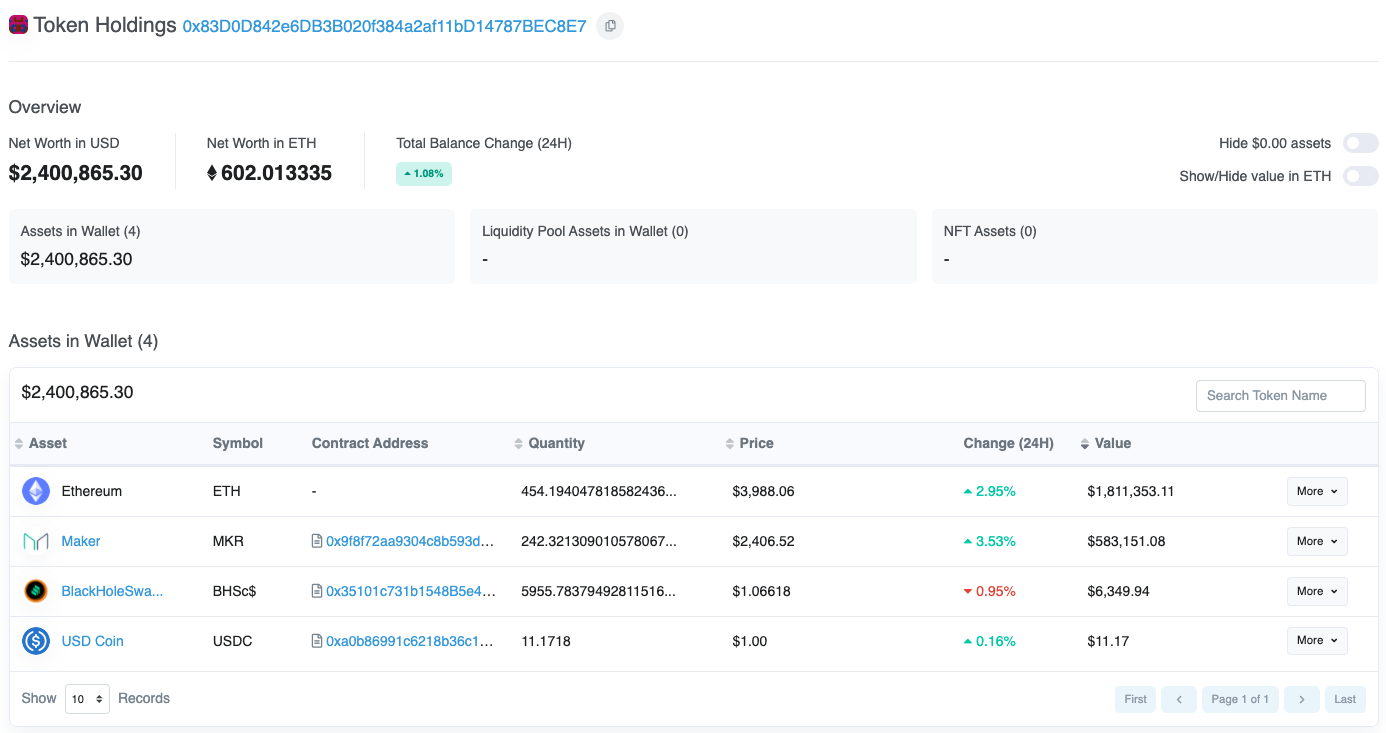

First, back in 2020, we had launched two products, Blackholeswap, and 3F Mutual, which attracted lots of attention when Hakka Finance went on stage. They are our courageous veterans, which earned around $2.4M profits and were saved in our guild bank, but faded away in the dynamic changing DeFi world. Blackholeswap is an exquisitely designed product that leverages the concept of mortgage loans to give tremendous liquidy for the stablecoin swap. It hit a critical demand when DAI fluctuated widely, creating $100M transactions in the first month of BSH online. However, MakerDAO onboarded more centralized assets as collateral, including USDT, USDC, and WBTC, and introduced PSM to stabilize its price further. As a result, a more significant price gap was not seen on DAI ever again, and the ideal scenario of Blackholdeswap was gone; stepping off the stage of the stablecoin swap was inevitable.

On the other hand, 3F Mutual was another trial on building fair, self-operated insurance by a fully-decentralized mechanism. Because we use a rainy day fund pattern, which means that compensation comes from the insurance premium, it was suitable for incidents with a low chance of occurring but that would cause a significant impact. Finally, we chose the collapse of MakerDAO as our subject. Then, we got $1.3M transactions in the first two weeks, and it’s still working normally with a few transactions now. However, it’s not a popular product when Defi users seem not very interested in buying insurance for accidents that have a minimal chance of occurring in Defi. Thus, these two products are now under maintenance, that it still works but we won’t develop more features.

Next, there are products we are keeping on developing and preparing. We hope that they can become the shining stars of our Hakka universe.

Hakka Intelligence, a decentralized prediction market

Unlike traditional prediction markets, they create the games by wrapping subjects of the prediction into contracts. In most cases, players need to buy/sell a contract to bet their forecast, which requires enough liquidity in the market. To reduce the capital needed to create the market, we have designed a score-based model specialized for blockchain, Hakka Intelligence. Some people may think this is just a tiny toy for us, but it’s actually a testing ground to help us design a better DeFi financial product.

Many DeFi products currently use governance to resolve part of factors in their products, such as rate, threshold, leverage, etc. Nevertheless, it’s no confidence that the community can decide suitable parameters well. The protocol designers just delegate all parameters they have no idea how to address to the community. That’s not a responsible act that assigns the duty of tuning factors to the community without figuring out their capability. Hakka Intelligence is a salutary probe exploring how the crowd perceives the value changing in various financial indexes, aka the ability to determine suitable parameters.

By putting derivative indexes into our prediction game, such as impermanent loss, interest rate…, rather than token price, we can know how much users care about these indexes and what will happen if we utilize community government to determine key parameters of a derivative DeFi product. That’s a precious data source to help us build better DeFi products. Hence, we still polish Hakka Intelligence and launch more financial indexes target games.

iGain, a decentralized derivative options markets

iGain is an option-based derivative financial product, which provides an efficient synthetic asset market that allows users to trade any financial index. The first iteration of iGain is “iGain — Impermanent Gain”, which launched this November. It provides a market for trading impermanent loss first. The research from Topaz Blue and Bancor Protocol shows that impermanent losses have become a critical issue for liquidity providers on Uniswap v3. They indicated that around 50% of UNI V3 LPs are losing money compared to simply holding their assets. Furthermore, the fees they earn don’t make up for it. The research team analyzed pools, which contained over $10M TVL, between May 5 and Sept. 20, 2021. These pools got over $100B of trading volume, earning LPs around $200M in fees. However, LPs lost more than $260M to impermanent loss over the same period, resulting in a net loss of over $60M. That’s quite a vast and severe issue, so we select impermanent losses as our first underlying assets of iGain to provide an IL hedge platform.

Nevertheless, some users seem to misunderstand iGain’s value. They think that iGain appears to be just an options platform to hedge IL risk when liquidity mining, but in fact, iGain is essentially a DeFi product that allows various financial targets to be marketed through options, which can trade a derivative and unmarketable financial concept. For instance, “iGain — Impermanent Gain” is one form of iGain that marketizes the risk of providing liquidity in AMM, so that the risk can be traded and transferred. By doing that, we meet the needs of different participants in the financial market, such as those who want to hedge, arbitrage, find alpha, speculate, and discover the price, etc. This is also the goal of Hakka Finance, to provide a “more efficient” and “lower friction” flow of assets through “decentralized” “derivative” financial products so that capital flows to the right place.

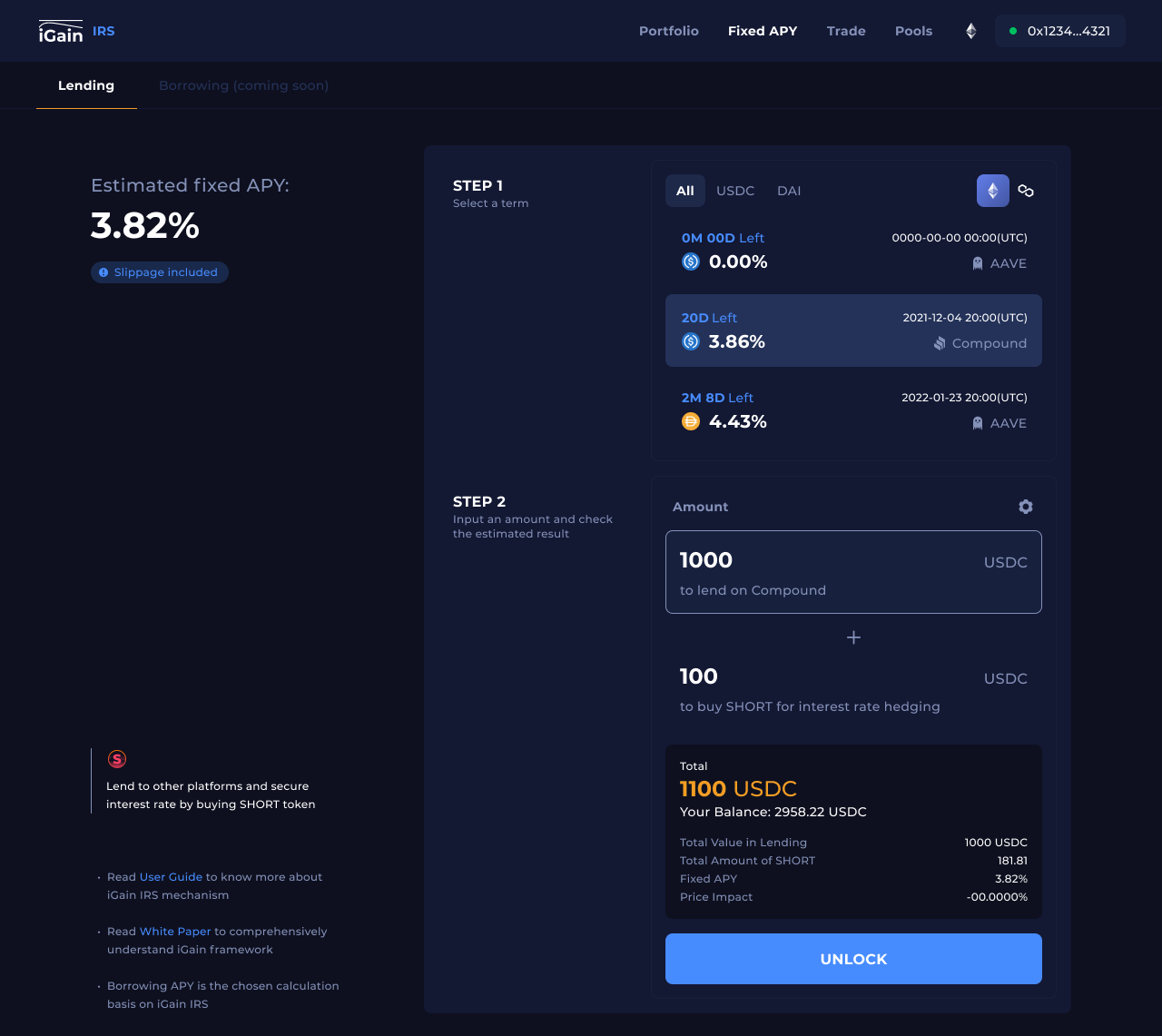

Next, we’re going to launch “iGain — Interest Rate Synth (IRS)” to provide the interest rate trading market on AAVE, Compound, and Yearn, which uses the exact mechanism of “iGain — Impermanent Gain” but with a different underlying asset. What we want to solve is the absence of the interest rate market in DeFi, and the inability to hedge against the borrowing/lending interest rate fluctuation. Even though many solutions are trying to solve float rate issues, there isn’t a perfect solution that could give fixed interest to borrowers and lenders with capital efficiency. Our solution, “iGain — IRS,” provides a two-sided option-based interest rate market, where users can trade interest to hedge risk. For instance, if you lend assets on AAVE, you could get a fixed interest rate by shorting the interest rate on our platform. That means that if the interest rate is going down, your float interest rate deposits will earn less money, but you’ll earn it back from the short position of interest rate. On the other hand, you can get a fixed interest borrowing rate by longing interest rate. Furthermore, by enabling leverage and only settlement interest without principal, we could help users hedge their interest of deposits and borrows with a slight premium.

We’re confident that we can make an extraordinary impact on the fixed interest rate market. Besides, one can see the great potential of iGain; by changing the underlying assets, we could get a new options market. We would like to hear more thoughts on which financial index we should develop on iGain. Please share your opinions on our forum and Discord. Let’s complete the missing puzzle of DeFi options together!

CSF, Crypto Structured Fund

Crypto structured fund is a risk diversification DeFi product, which has won the Kyber DeFi Hackathon in 2019. Traditionally, the risks for investment ranging from safe to risky should be cash deposit > bonds > funds > stocks > options. As for DeFi, there are either very low-risk options such as lending or super high-risk crypto investment or even leverage, so there’s a lot of space to fill in the middle. CSF uses asset tranching to simulate medium-risk products like bonds with a slightly higher return than market interest rates. By reallocating the risk premium within investors, we could fill up the chasm of risk diversity financial products. Previously, crypto investors were not interested in buying hedge financial products. Instead, they’re used to adopting the Barbell strategy or even aped in every FOMO project, which loses money most of the time but earns lots back in a lucky shot. However, while more and more formal investors and institutions are jumping into the crypto world, it increases the need for various risk investment targets.

In addition to the products above, Ping and I have lots of DeFi ideas under discussion and cooking. However, even the best grapes need time to make good wine. We discuss and polish these ideas every day and expect to serve up spectacular DeFi ideas to our community.

Schedule

Again, It’s difficult to predict the future, especially in the fast-changing DeFi industry. To accommodate changes in the external environment, we might have to emergency steer our ship. Nonetheless, these are the significant Items that will help Hakka Finance become more antifragile and gather more Defi sages. The following are what we’re going to achieve:

iGain — Interest Rate Synth (IRS)

Timeline: 2022 Q1

We expect “iGain — IRS” to hit a market with great demand. As mentioned above, it’s our next flagship product, allowing people to trade interest rates on DeFi. Furthermore, it brings Hakka Finance into the fixed interest rate market, which is now an emerging market. We will publish more detail in the following week and release “iGain — IRS” v1 in the middle of 2022 January. Please stay tuned to our social media to follow the latest news.

iGain / Tokenized Position

Timeline: 2022 Q1

Composability is a distinguishing feature of DeFi and the key that DeFi could raise in a short time. Tokenization usually is the cornerstone of composable DeFi by allowing users to transfer share/position in a protocol. Now, the position of iGain is not transferable because it’s not a standard ERC20 Token. But we’re going to update it in the next version soon.

iGain / Order book

Timeline: 2022 Q3

Although the AMM model is the most popular trading model on DeFi, Orderbook is an alternative competitive option. The drawback of AMM is the following “large slippage”, “high cost”, and “front running”. Matcha from 0x and Cowswap from Gnosis inspire us how the order book could help decrease trading friction on the blockchain, which fits our Hakka spirit. However, it would take time to do more research and integrate it into our iGain.

iGain — Impermanent Gain Upgrade

Timeline: 2022 Q2

While the impermanent loss is getting served, “iGain — impermanent Gain” shows its importance. We will continue to upgrade it and try to work with AMM platforms, providing integrated services that liquidity providers could add liquidity and provide liquidity in one click.

iGain / Community Government

Timeline: 2022 Q2

Empowering our community to engage in product strategy decisions is necessary to become a DAO. We would like to invite our community to govern iGain step by step. There’re lots of decisions that we could make together, such as what’s options we would like to open and how much bonus reward do we want to put into the LP staking pool. By giving Hakka tokens the right to determine the distribution of reward and sustenance of pools, our tokens will be more valuable and incentivize users to own them.

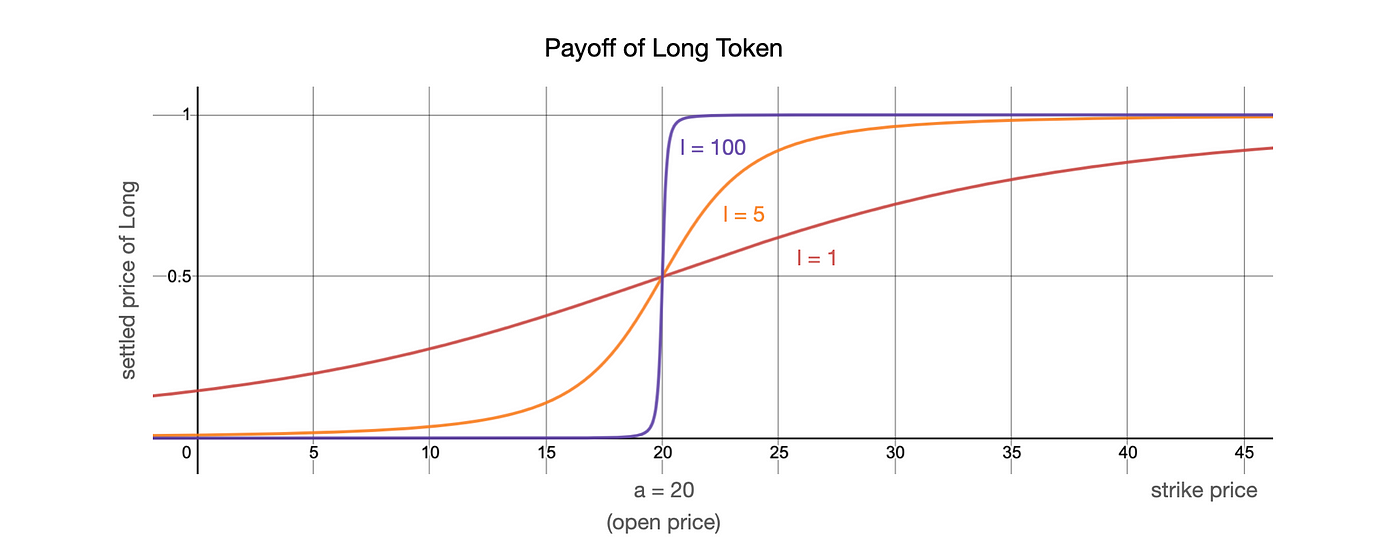

iGain — Slide Binary

Timeline: 2022 Q4

In developing iGain, we got a pretty interesting idea to build an option with a custom-made settled curve. It’s similar to the binary option in crypto price, but the payoff of the Long Token does not comply with all-or-none law. The settled price of Long Token will gradually go up from $0 to $1. As the leverage is larger, the liquidity is becoming more intensive.

CSF

Timeline: 2022 Q3 — Q4

Crypto Structured Fund is a treasure sealed on our shelf for a while. Because of the high-risk preference of DeFi Apes, Crypto Structured Fund has not attracted investors. However, CSF will show its value when the market matures and the settlement of high APY liquidity mining competition. Hence, we are preparing to relaunch CSF in the second half-year of 2022.

Hakka Intelligence — derivate index

Timeline: 2022 Q4

Hakka Intelligence is a nice playground where we could develop DeFi products with our community. Besides token price, we would like to put more derivate financial index to Hakka intelligence, such as interest rate, the growth rate of TVL between DeFi protocols, etc. We’ll design the new competition based on the product we will craft. Then, the prediction behavior will be a significant data source to help us design products.

Support Layer 2

Timeline: 2022 Q3

We’re keeping our eyes on Layer 2 technology development. Each current solution has its own drawback now. It’s pretty challenging to choose which one deserves us to put lots of energy into it. However, lots of protocol is adopting one of the rollup solutions. We’re confident that we could make a decision in the middle of 2022 and take on to layer 2.

Support Polygon

Timeline: 2021 Q1

We’re going to onboard Polygon soon with “iGain — IRS”. We’re eager to make more people adopt our products, so the cost of executing our products is a significant factor in our consideration, which is also one of Hakka Finance’s vision. “iGain — IRS” first will deliver AAVE interest rate options and provide fixed-interest lending on top of AAVE, too. Thanks to AAVE is on Polygon now so that we could give low-cost interest rate trading services on Polygon. Besides, we hope that our integrated fixed-interest lending service could help more users get into the DeFi world.

BSC staking

Timeline: TBD

We heard that our community is eager to stake Hakka on BSC because of the high gas fee on Ethereum. Since we believe Ethereum is our homestead and BSC is merely a short-term solution, we don’t want a staking contract that will be abandoned in the foreseeable future. Besides, our vesting mechanism is continuously locking tokens and releasing tokens for an extended period. Hence, our stacking contract is difficult to migrate to another chain without damaging the stacker’s equities. However, it’s not fair that token holders on BSC don’t have voting power to engage community governance. Thus, we’re putting this demand into our discussion now. You can track the progress in our forum.

Support more chains

Timeline: TBD

It looks like multiple blockchains will coexist and thrive together in the foreseeable future. As a DeFi participant, we’re open to building products on different chains. Even we are ETH believers, to provide inclusive finance to the public, we would love to approach various users by adopting more chains, but only if the DeFi infrastructure of the blockchain is mature enough to build derivate financial products. Hence, we’re keeping our eyes on other chains, such as Avalanche, Phantom… are our watchlist. If you have any insights and ideas about which chain Hakka Finance should onboard, please discuss with us in our Discord and forum.

Final thoughts

We believe it’s best to under-promise and over-deliver, which is why many things are not included on this roadmap. Besides the product mentioned above, we’re cooking more ideas and sharing them with the community when our fantasies are reified. We also want to integrate more DAO tools to empower the community to engage Hakka Finance’s affairs, including governance, development, and promotion. Our priority is adopting a treasury management tool and bounty board system to let our community grow with us. By rewarding one who adds value to Hakka Finance, we could really attract those who know much about DeFi and believe in our vision. It’s a long trip to craft a robust DeFi DAO, but I believe we’re all going to make it. We’ll be publishing more information on the blog about many of these items in the upcoming weeks and months, explaining them in more detail. Stay tuned for more exciting updates, and join the conversation in Discord. With hard work, lots of patience, and mutual respect and understanding, we can make Hakka Finance the success it is destined to be. Let’s make a big noise in DeFi!

Hakka.Finance | Discord | Wiki | Medium | Twitter | Telegram