Introduction

The question I initially set out to answer was…

- How do you value the on-chain treasury/DAO of a DeFi project?

And that lead to a second question…

- For a DeFi project, is an on-chain treasury managed by direct-democracy the best way to allocate funds?

Over the past year it has become conventional wisdom that a large governance treasury translates into a valuable token. ‘Valueless governance tokens’ are far from valueless as tokens like $UNI boast deca-billion dollar market caps. At some level, the thinking goes that if you have some voting power in how $9,000,000,000 will be spent, your governance tokens are worth some amount of value (also, “wen fees”). But conventional does not always mean correct.

What Makes Governance Tokens Valuable?

Anthony Sassano had some good points in a recent article ($ paywalled):

“If we take a step back and take a first-principles view of governance tokens we can see that they are essentially social coordination tools”

Agreed!

The fact that thousands or millions of people all own an asset that can go up or down in value is a strong social coordination tool. But I felt that Anthony’s article was missing its punchline. It laid out a bunch of argument for novel features of governance tokens (also broadly true for any “tokens” in my view)

- Yes, governance tokens are good for social coordination,

- Yes, governance tokens should incentivize people to think about protocol’s success

- Yes, governance tokens give users more say in the protocol development

But how do these points translate into long-term token value?

To understand this a bit more, let’s talk about DAOs

What is a DAO?

If tokens are “social coordination tools” then a DAO is a “social coordination structure”.

“The LLC of the internet”

Greg Di Prisco, previously head of business development at MakerDAO (perhaps the only well-established DAO) had an exceptionally philosophical and practical post recently titled “What is a DAO anyway?” It’s a long post, but the TLDR definition is:

DAOs are coordination mechanisms for actors seeking to operate permissionless public goods & maximize censorship resistance. DAOs use tokens to align incentives & measure power. DAOs are comparatively inefficient operating structures built to avoid tyranny, not be hyper efficient

Few DAOs today hit this level of permission-less-ness, censorship resistance, or tyranny avoidance (nor do many of them even need to).

Mostly DAO today are ways for people to pool money and then collectively make decisions in the pursuit of growing an ecosystem or making investments.

Different Types of DAOs

To oversimplify, it seems as if most DAOs falls into three categories:

- Social Clubs (e.g., FWB)

- Investment Collectives (e.g., pleasrDAO, Metacartel)

- Governance Treasuries (e.g., Uniswap, Compound)

For the purpose of today’s post, we’re strictly speaking about Governance Treasuries / Project DAOs. [1]

Is Governance Financially Valuable?

We can look at traditional markets.

Of the companies who have $1T+ market capitalization (Apple, Microsoft, Amazon, Alphabet, Facebook), Alphabet and Facebook have dual-class share structures which make voting pretty moot for most shareholders.

Apple does not have dual class shares, but does have relatively stringent requirements to make proposals.

In an effort to “increase shareholder rights”, Apple as of 2015 allows any investor holding 3%+ of AAPL to nominate new board members. At the time only 3 firms held that much stock.

As of 2021, Apple receives little dissent from shareholders. From AppleInsider:

“Apple's stock holders have voted in the annual shareholder meeting at Apple Park, with the company getting everything it recommended in every vote presented at the gathering of investors.”

It’s good that these measures exist for public companies and crypto companies, but ultimately it does not seem ‘governance’ is why most people hold Apple or Amazon stock even though similar (albeit, more difficult to access) voting mechanisms exist.

Is there actually wisdom in the crowds?

It depends on who is in the crowd!

I had a Twitter thread the other day outlining one potential downside of community governance as compared to traditional private VC investments. The crux is that traditional VCs have much longer time horizons than most random token holders.

- VCs are paid to be patient (7-10 year fund lives) and are okay with companies not generating revenue (and definitely not profit) for years.

- VCs recognize that years of FAST growth without revenue/profit is (often) more valuable than years of profitable, but slower growth.

On the other hand, the average token holder is not paid to be patient and in many cases doesn't actually care about the long-term success of a project, they just care about a positive return on capital (often in the shortest amount of time possible).

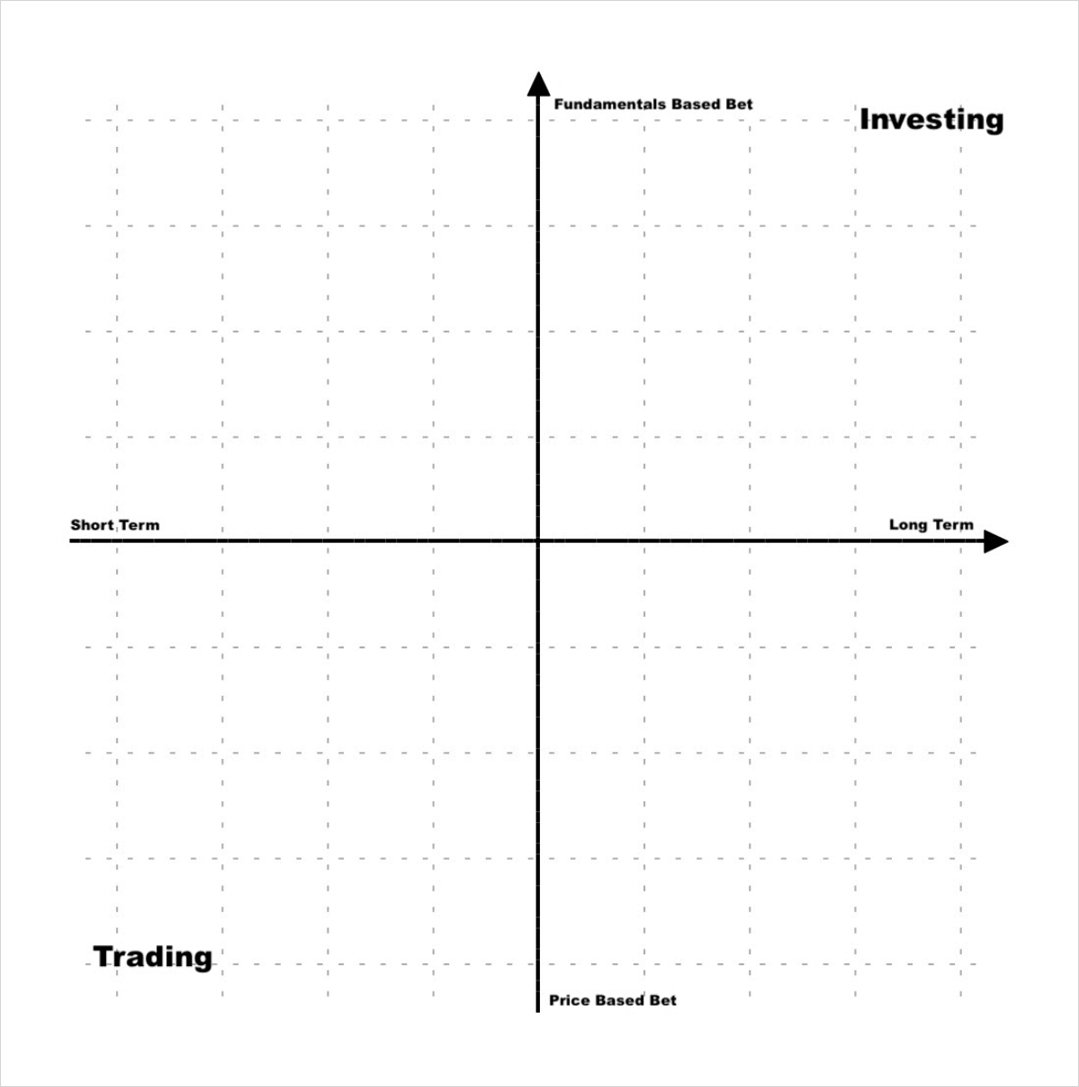

@AviFelman sums up this distinction in his recent Deribit post with this image.

Most token holders are short-term price-based traders. But what young projects should want more of are long-term fundamentals-based investors.

What is the JOB of a project/governance DAO?

In Uniswap’s blog post announcing $UNI, they said,

A community-managed treasury opens up a world of infinite possibilities. We hope to see a variety of experimentation, including ecosystem grants and public goods funding, both of which can foster additional Uniswap ecosystem growth.

I see the high-level job-to-be-done of a project DAO as providing continued funding for growth and development of the protocol and its associated ecosystem. A secondary function could be broader ecosystem (“public goods”) funding.

So back to my question at the start of this essay,

- For a DeFi project, is an on-chain treasury managed by direct-democracy the best way to allocate funds?

If the job-to-be-done is providing continued funding for growth and development of the protocol and its ecosystem, how’re existing project DAOs doing? Is “wisdom of the crowd” or “tragedy of the commons” winning?

On Capital Allocation:

I don’t want to pick too much on existing project DAOs, because it is genuinely still early days! But in general, I think most of Crypto Land thinks that Uniswap DAO funding $20mm to DeFi Education Fund was a bit silly and was not actually that transparent.

- Hypothetical: If Uniswap Labs was in charge of a multi-billion dollar balance sheet, do you think the exec team would have made a one-time lump sum grant for $20mm to fund a barely existent organization without specific deliverables? No.

- Even better, if a subset of people elected by the Uniswap DAO was in charge of allocating those funds, do you think they would have made a one-time lump sum grant for $20mm to fund a barely existent organization without specific deliverables? No.

If you look to many of the best performing stocks in history, the one thing many have in common is that they have a world-class capital allocator leading the organization. Will Thorndike chronicles this in his classic book, The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success.

In the description for the book:

What makes a successful CEO? Most people call to mind a familiar definition: “a seasoned manager with deep industry expertise.” Others might point to the qualities of today’s so-called celebrity CEOs—charisma, virtuoso communication skills, and a confident management style. But what really matters when you run an organization? What is the hallmark of exceptional CEO performance? Quite simply, it is the returns for the shareholders of that company over the long term.

As Warren Buffett expands in his review of the book,

“An outstanding book about CEOs who excelled at capital allocation.”

So one question to ask when considering getting involved with a project with a large DAO is who’re the influential voices? Do they have a demonstrated track record as capital allocators?

Is there a spectrum of DAO Governance?

As Jimmy Ragosa of Kleros points out in a recent presentation (h/t Tally Newsletter):

To date, most DAOs have been designed similarly to a direct democracy. Each protocol change is put up to a vote, open to participation of all token holders. While this is preferred due to a focus on decentralization, in some ways this direct voting framework can be counterproductive.

Jimmy goes on to propose a system with different branches of elected officials (executive, legislative, judicial -- like the USA has). I believe this adds a headache-inducing amount of overhead, but I like the direction he’s going in terms of electing representatives.

Jimmy goes on further to say,

Existing direct democratic systems are similar to a parliament without an executive government or constitution; there is no overarching direction and few guardrails against malicious action. Introducing executive powers, subject to approval from voters (the legislative branch of governance), allows for much faster decisions and more strategic focus.

I agree with many of his points and find the vision from Element Finance to be even more compelling:

The first new component is a governance council, made up of a small group of delegates with the highest voting support. This allows for permissionless entry and exit, based only on vote holders’ decision of delegate rather than political elections. Without fixed terms, council members are subject to continual accountability to voters. The council will have some limited on chain powers, including being able to submit proposals regardless of proposal threshold. But their primary purpose will be handling off chain protocol management and operations.

This seems to be loosely aligned with Synthetix Council. Going back to Synthetix Council’s November 2020 launch post,

The fundamental danger with these on-chain voting schemes is there is no check on power if votes go wrong. I strongly believe we are too early to implement direct token voting, but we need a legitimate way for token holders to govern protocols while maintaining speed of governance decisions under uncertain conditions.

Synthetix ultimately landed on,

After reviewing the requirements for Synthetix governance, I believe a representative democracy controlled via delegation is potentially a viable solution.

From my reading of Synthetix Council, it seems like elections are held every 3 months. I could envision an even more liquid version of that (along the lines of what Element laid out) where the 5-10 addresses with the most tokens delegated towards them take on the roles of “council members” and are granted authority to act on behalf of the best interest of the DAO (reviewing funding proposals, pursuing new initiatives, hiring people, etc.). This helps to eliminate some of the “tragedy of the commons” issues where token holders are somewhat careless in what they vote for since they don’t really have any responsibility if something goes wrong.

After reading a fuckton (too much honestly) on this topic, I am pretty confident that this system of “representative democracy” is the “best” solution for most projects seeking to decentralize.

This falls in line with a tweet thread I had in June based off of similar insights from @bantg

It is important that token holders ultimately retain veto rights, but it seems to not be in most stakeholders best interest for every decision to require a vote and micromanagement.

- One example I look to were the conversation in MakerDAOs forums were everyones compensation needed to be laid out in the open. Radical transparency with the whole internet is a bit too much.

Conclusion

Please excuse my roundabout way of getting to a conclusion.

Back to our original two questions:

- How do you value the on-chain treasury/DAO of a DeFi project? With limited track record of capital allocation, it is tough to make judgements. Most value seems to come from optimism about future investment prospects or dividends/buybacks.

- For a DeFi project, is an on-chain treasury managed by direct-democracy governance the best way to allocate funds? No

Much like how a company can trade below book value if shareholders are bearish on the future outlook of the companies, it would be possible for a DeFi project to also trade below its treasury value if token holders did not believe in future prospects or the ability of the project to properly invest into its future. Most of these massive treasuries (e.g,. Uniswap) are comprised of the native token rather than other assets (ETH, stablecoins) so it would be unlikely we see more Digix-like events where DAOs are dissolved and funds returned to token holders, but this is also something to keep in mind.

I believe the way to best apply a premium to the value of a DeFi project treasury would be if governance of the treasury uses some system of liquid democracy/council where the members involved have a history of effective capital allocation. At least in the way I think of DeFi treasuries, investing into positive ROI opportunities is the best possible use of funds.

As mentioned above, we really are in the early days of decentralized governance. Much like in the early days of any governance system, there are kinks being worked out as we go and we will continue to see new projects improve on models of the pioneers in the space.

I’m cautiously optimistic of where this space can go, but also aware of the fact that the end state might be system that look a lot like traditional systems where there is an elected ‘board’ and ‘buybacks’ or ‘dividends’ to tokenholders on a regular basis when the project runs out of things to fund.

[1] In some ways, explaining the value of (1) Social club DAOs and (2) Investment Collective DAOs are much easier.

-

Social Club DAOs: You’re a part of a social club. People have been paying to join social clubs since the beginning of time (e.g,. fraternities in college, SoHo House which just went public at ~$3bn, and The Battery)

-

Investment Collective DAOs: You’re buying a share in a fluid investment partnerships where you can somewhat come and go as you please.