The concept of 'retail' in the crypto world is as multifaceted as it is elusive. As the ecosystem matures, pinpointing the arrival of retail investors becomes obscured by a broadening horizon of behaviors and values. The days when crypto could be seen as a monolithic 'we', united by a singular vision, are gone. The growth in adoption has led to a splintering of ideals, with some championing crypto as a vessel for digital freedom, advocating for products that uphold civil liberties like free speech and financial privacy, while others ride the wave of gamification: seeing parallels in how TikTok revolutionized media consumption and predicting that crypto will similarly transform our relationship with money. And the list goes on. These differing perspectives not only complicate our understanding of retail's role but also challenge us to redefine who the retail investor is in an ever-evolving crypto landscape.

The retail landscape of past cycles was marked by a clear archetype: the 'degen' gambler, eager to stake their claim in the latest token frenzy. These consumers, often the quintessential Robinhood users, signaled a surge in retail interest as they poured into the crypto space.

Further complicating the matter, a staggering 70% of crypto owners are now under 34: a generational shift towards digital asset adoption. Memecoins have historically presented themselves as barometers for retail presence, but the narrative has evolved. Today's market participants are well aware of the speculative nature of these assets. They recognize the crypto casino for what it is, and memecoins have become the chips of choice. As we stand on the cusp of a new era where PVE dynamics take center stage over PVP participants, it's clear that the new adopters won't be the same retail degens of the past. Instead, we could also see a more discerning crowd, one that's ready to navigate the complexities of an expanding ecosystem.

On the flip side, ETFs represent a peculiar breed of retail investors in the crypto space. They bring a wave of capital that's somewhat detached from the 24/7, fast paced, onchain ecosystem. These investors are typically more mature and aren’t necessarily looking to digest the amount of risk that comes from memecoins or smaller projects. It makes sense then that Deutsche Bank's chart shows 'retail' owning a hefty 85% of Bitcoin ETFs. This statistic, however, masks a nuanced reality. Typically, these investors remain on the periphery of onchain dynamics with their funds flowing into crypto indirectly through traditional financial products. Bitcoin, and soon Ethereum, have amassed this type of capital, attracting inflows from IRAs and those averse to direct crypto exchange engagement. But, for a select few ETF investors, the allure of rapidly growing technology and products is too great to be sidelined, leaving us to ponder the next steps of these somewhat cautious entrants. While the majority may see ETFs as their investment apex, a curious minority peeks beyond, potentially eyeing undervalued non-meme assets. Their journey into deeper crypto waters could signal a new chapter for retail involvement.

Another thing to note is the lack of groundbreaking tech so far in this cycle. The continual rise of prices without the fanfare of innovation presents an interesting paradox. It’s true that this cycle has introduced incredible advancements in the seamless exchange of money, similar to the rapid flow of information, with the help of Ethereum and its L2 counterparts. Rollups like Base are leading this charge, integrating finance into consumer apps with a smoothness that captures eyeballs and wallets alike. In fact, it’s now ‘cheaper to send money on Base than over Venmo’. This trend is luring another subset of retail investors; rather affluent individuals from older generations looking to venture beyond the safety of ETFs. This new breed of retail investor seeks utility tied to genuine innovation, unmoved by viral trends. Take Blackbird for instance, a consumer app that lets diners earn rewards at participating eateries without the hassle of crypto onboarding or gas fees. The “future of restaurant loyalty” as they put it. Products in this vein may be less sexy than memecoins and NFTs, but they may hold real appeal for those who see crypto as more than just a vehicle for gambling. They’ll begin to represent the long tail of retail investors, potentially even driving innovation in crypto sectors some might call 'boring'. The key question now is what else lies beyond ETFs that could captivate these participants.

In some ways, the concept of 'waiting for retail' in crypto has played out. Even after bullish macro conditions such as FIT21 and the ETH ETF approval, skepticism about this cycle is at an all time high. The recent memecoin surge, along with news from within investment funds about memecoins becoming a new investable asset class, might point to retail's return but the scene is far from clear.

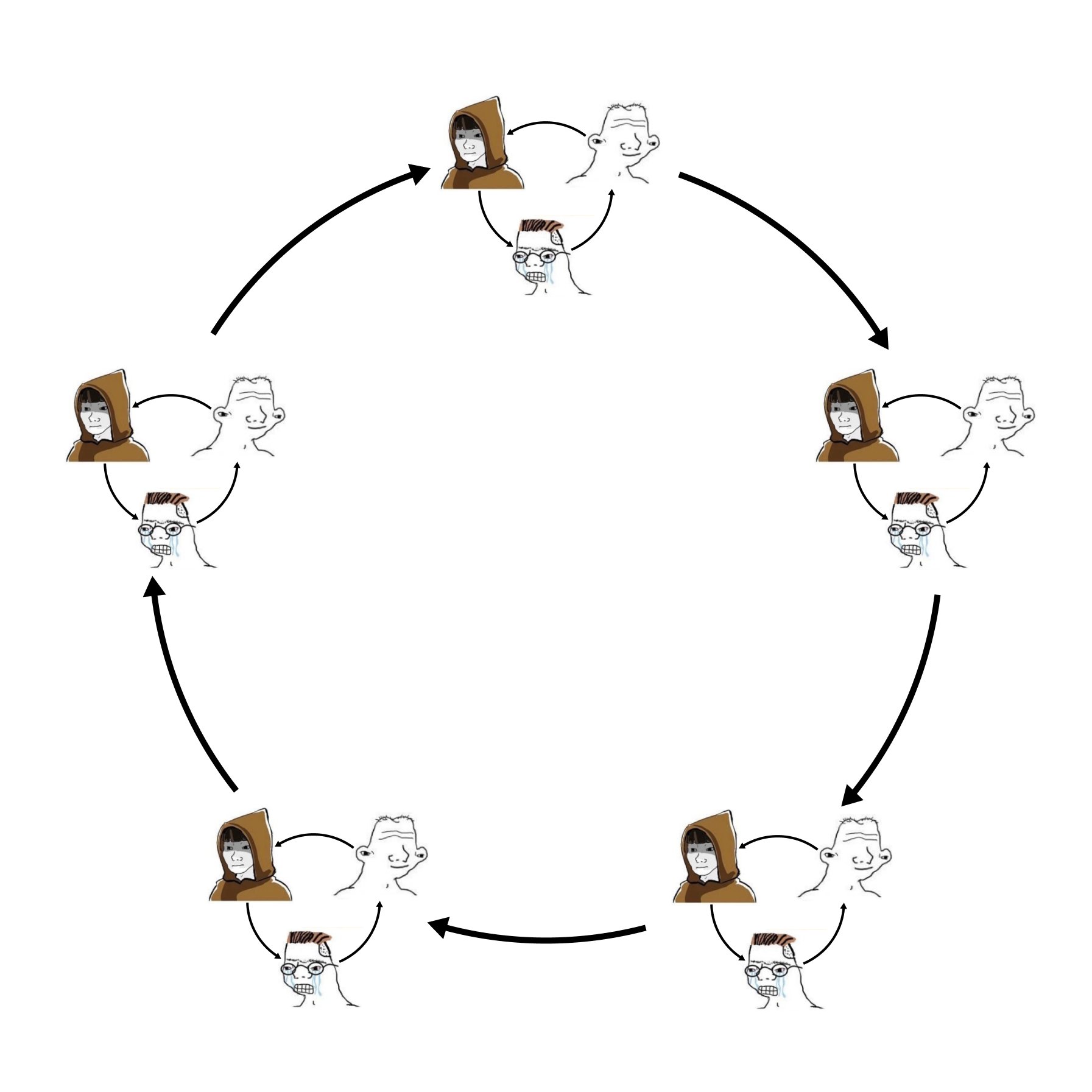

Some fear that the old yield adage, 'if you don't know where retail is, you're retail,' reverberates in the current market, especially in cutthroat arenas like memecoins. Albeit, when the true retail bull market arrives, it will likely ignite a reflexive explosion of new activity. Looking back, Dapper Labs and Flow's NBA Top Shot was a harbinger of the NFT boom, showcasing sports as a potent conduit for tech adoption. Today's broader unbundling trend in hardware, like the Rabbit R1, Humane Pin, and Daylight Computer, mirrors crypto's disentangling of traditional financial structures and consumer loops. Retail investors are on the hunt for fresh, groundbreaking opportunities, and crypto's multifaceted impact continues to redefine the investment landscape. Capital from ETFs will eventually trickle down to the broader market, echoing the idea that rallies can be sparked by a wealth effect, where newfound riches in other areas of crypto lead to innate changes in taste.

Ultimately, 'retail' is becoming a chameleon term, adapting to cultural shifts and the ever expanding reach of crypto. We must adjust our perspectives accordingly, realizing that sometimes, retail isn't just coming - they’re already sneakily reshaping market dynamics.