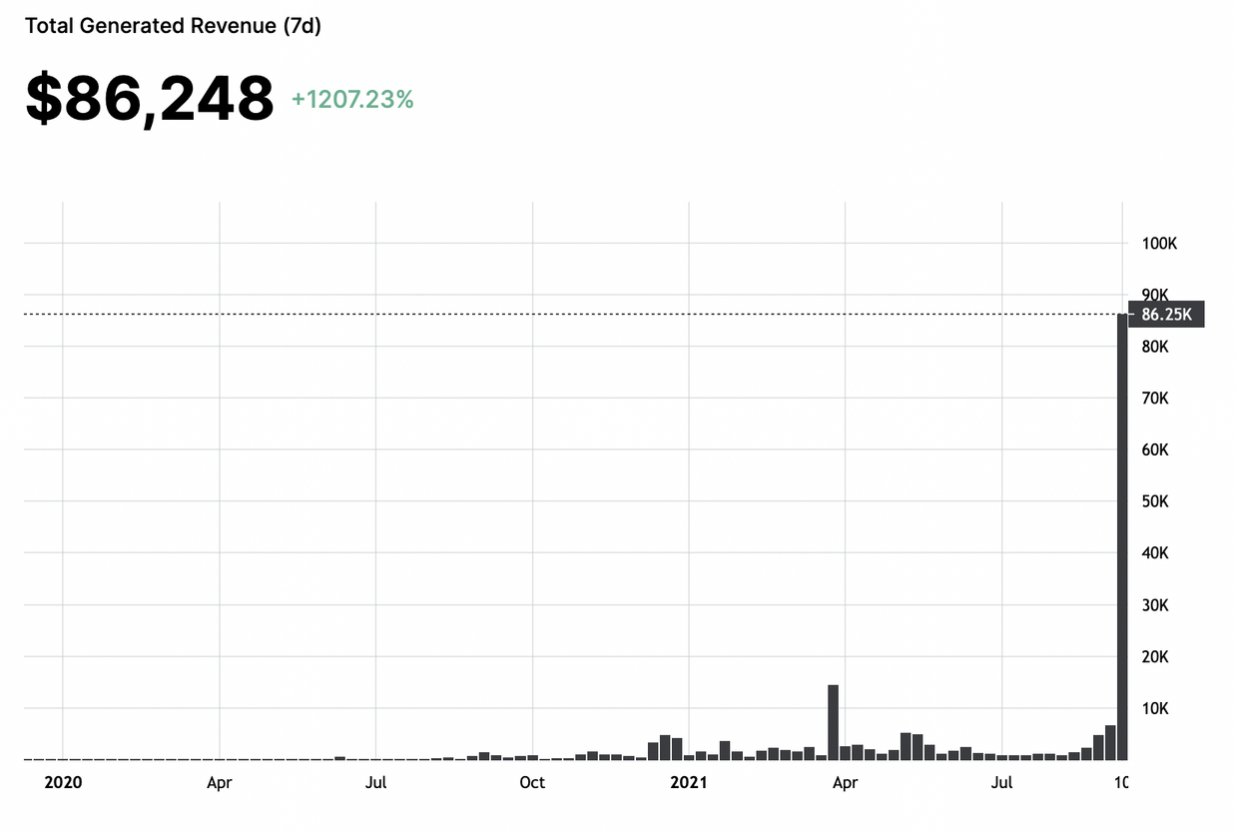

Before the AR's huge price pump in early Nov, the protocol's revenue saw a 1200%+ increase since the first week of Sep which was mainly contributed by the surging demand of minting NFTs on the Solana blockchain.

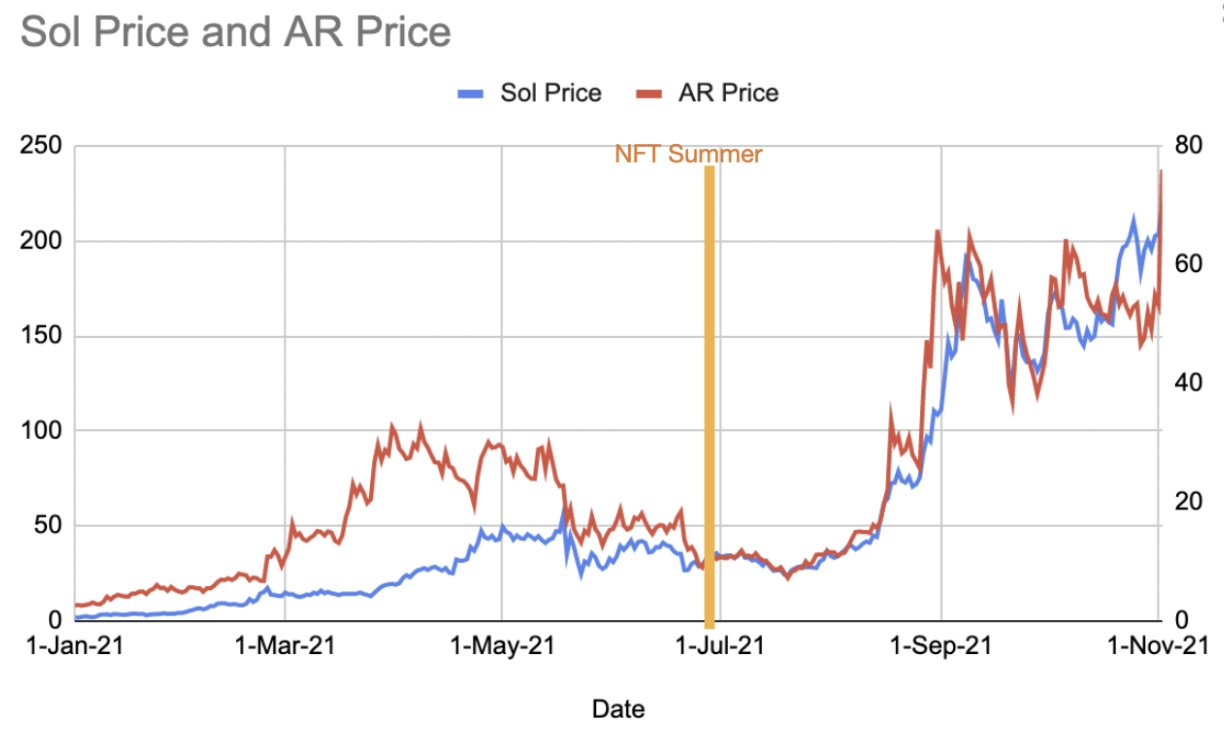

It is worth strengthening that with the SOLAR Bridge built last December, Solana‘s blockchain data would be stored on the Arweave seamlessly instead of relying on replicators. From the graph, we can also clearly see the correlation between the price of Sol and AR also increased.

Moreover, Metaplex, a tool launched in June to facilitate the NFT issuance with Arweave as the default storage layer, scooped up AR in the NFT summer, tightening the price correlation as a result.

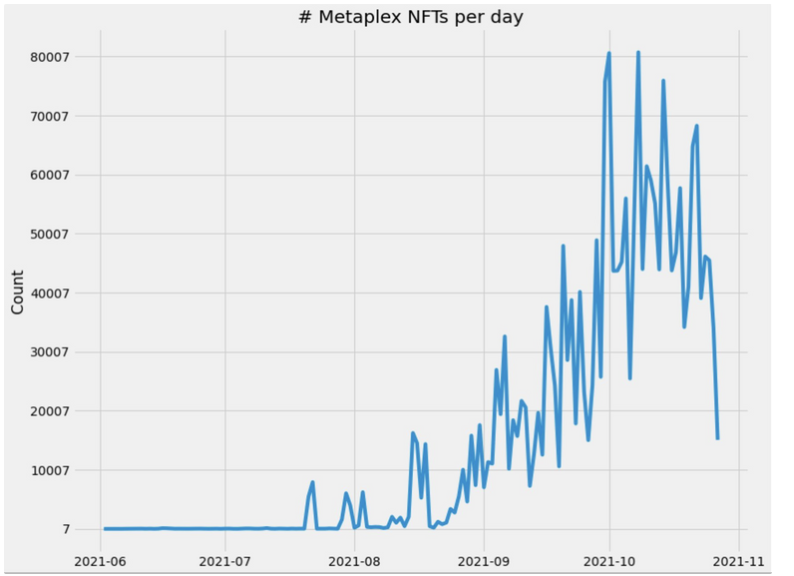

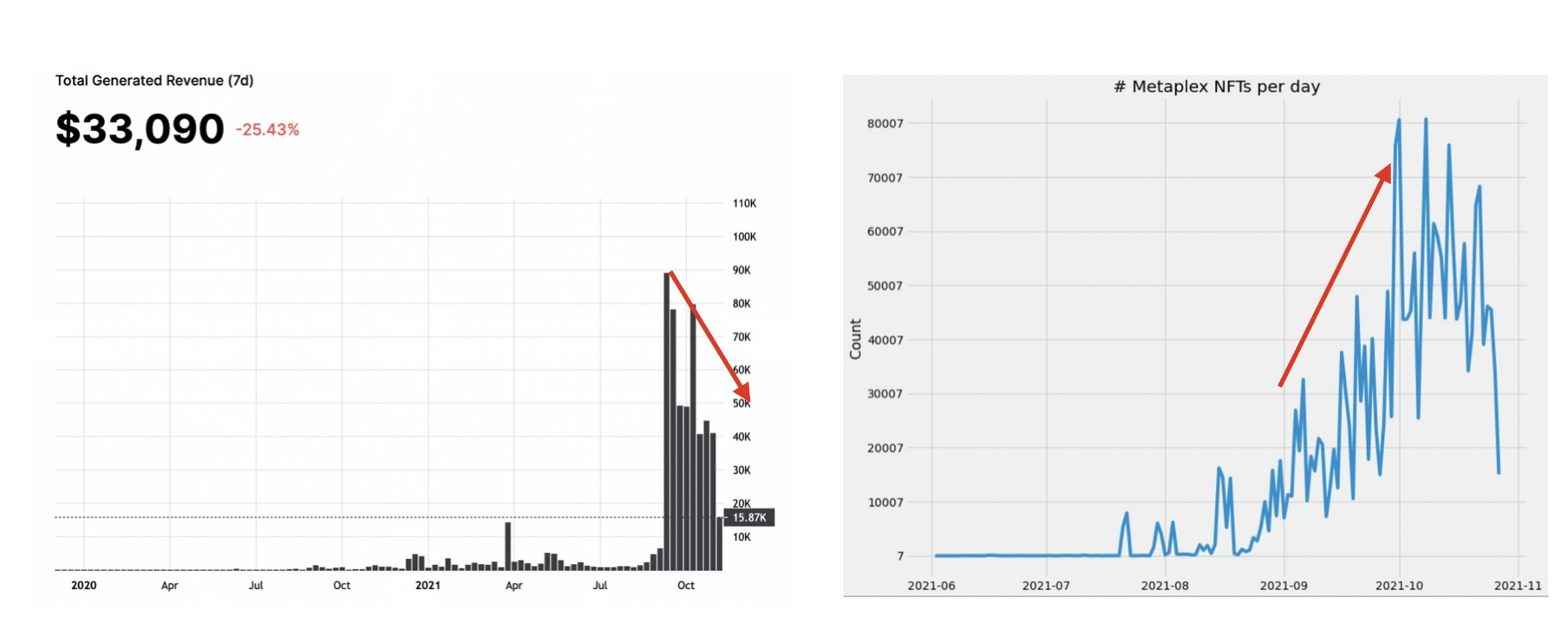

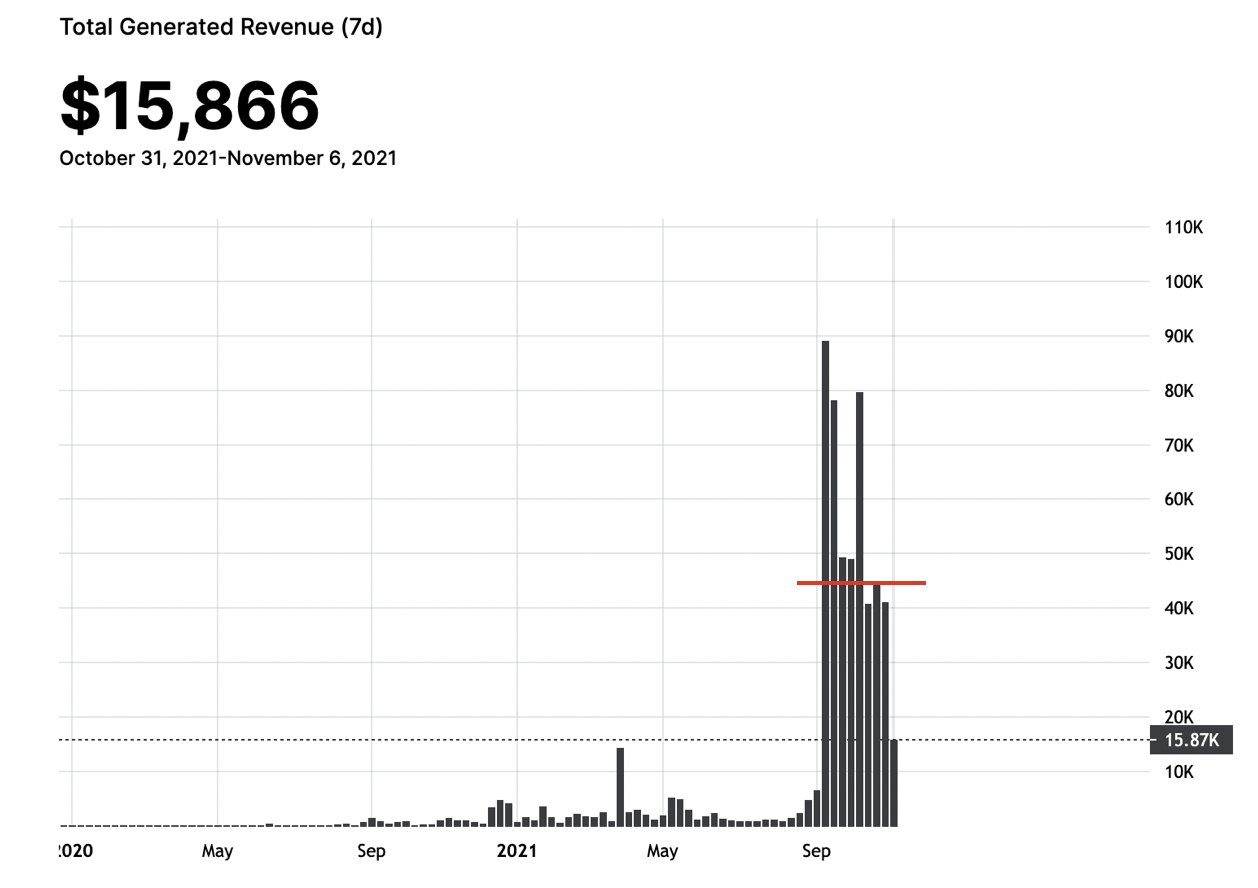

Another dimension to verify the JPEG summer craze's contribution to Arweave's ecosystem is shown in the graphs below. Arweave's total generated revenue is highly related to the number of NFTs minted on Metaplex.

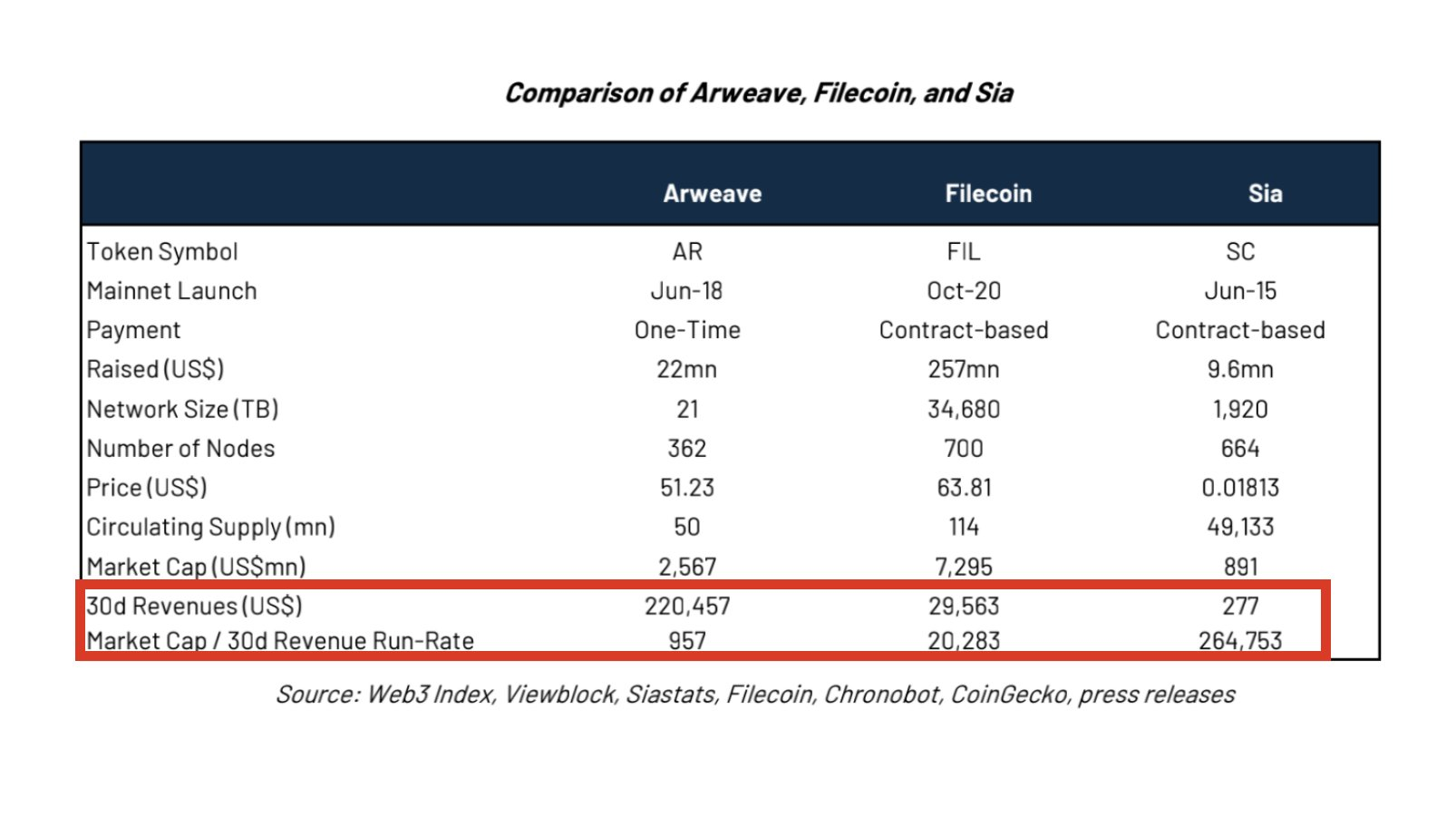

Arweave's value proposition: From above, we can conclude the narrative of Arweave as Web3 infrastructure for NFT storage, or as someone puts it "the public chain" for NFTs.

Not only this, Amber Group's report shows Arweave possesses far more profitability than other storage protocols.

The validation of Arweave's narrative can explain why and how its value gets recognized, but there are two questions remaining unclear. - Why the revenue of Arweave in early Sep is significantly higher than early Oct while the stats of NFT minted showed a different trend?

Why Arweave's token price did not get pumped until November instead of at the time of its climax of revenue in Sep?

In the previous analysis, we deliberately neglected other use cases apart from NFT to validate the narrative. And also we have overlooked one important update of the AR tech system in early Sep - Bundles.

With Bundles implemented, Arwearve's scalability increased over 10 times. That helps to explain the discrepancy mentioned above: the 1st week of September digested a lot of accumulated storage demands on AR which were limited by the bottleneck of scalability.

The explosion of NFT minted in Oct coincides with the revenue of Arweave as the demand from NFT occupied mainstream.

The second question would be more interesting. If the lagging of price appreciation is rooted in the inefficiency of the market, the valuation of Arweave should reflect its fundamental change since Sep.

Since then, Arwearve's weekly revenue has increased 400% to 1300%, while price only increased 35%. So what's next?

Reference: Threads and deep analysis of AR by Amber Group.