Intrinsic Research Company gives investors / patrons the ability to define market structure and pays contributors for in-depth research, feedback, and questions. Investors and research contributors receive monthly stakeholder dividends on net income of IRC.

The Problem: Digital media does not fit into the conventional financial model of fundamental valuation.

The dot com era companies had flawed business model assumptions, lacking fundamental value. But even the successful digital media companies show deep market failures: monopoly concentration, censorship problems, privacy issues, fragmentation and polarization of society, mental and physical health issues. The lack of fundamental valuation for digital media causes severe problems for the market and for society. This presents an opportunity for economic and social gain.

Let us look at the conventional finance fundamental valuation model. The Benjamin Graham-Warren Buffet model of fundamental valuation, is essentially:

Low price / high cashflows = good fundamental value investmentwhere,asset price = aggregation of publicly available information (efficient market hypothesis)cashflows = revenues / operating expenses (or demand / cost of supply)

A fundamental value investor looks at the stock price, looks at the financials of the company he is investing in, and does research on how well the business functions. He then invests if there is a low price relative to future cashflows. This concept of fundamental value was a basic principle of American investment for many years.

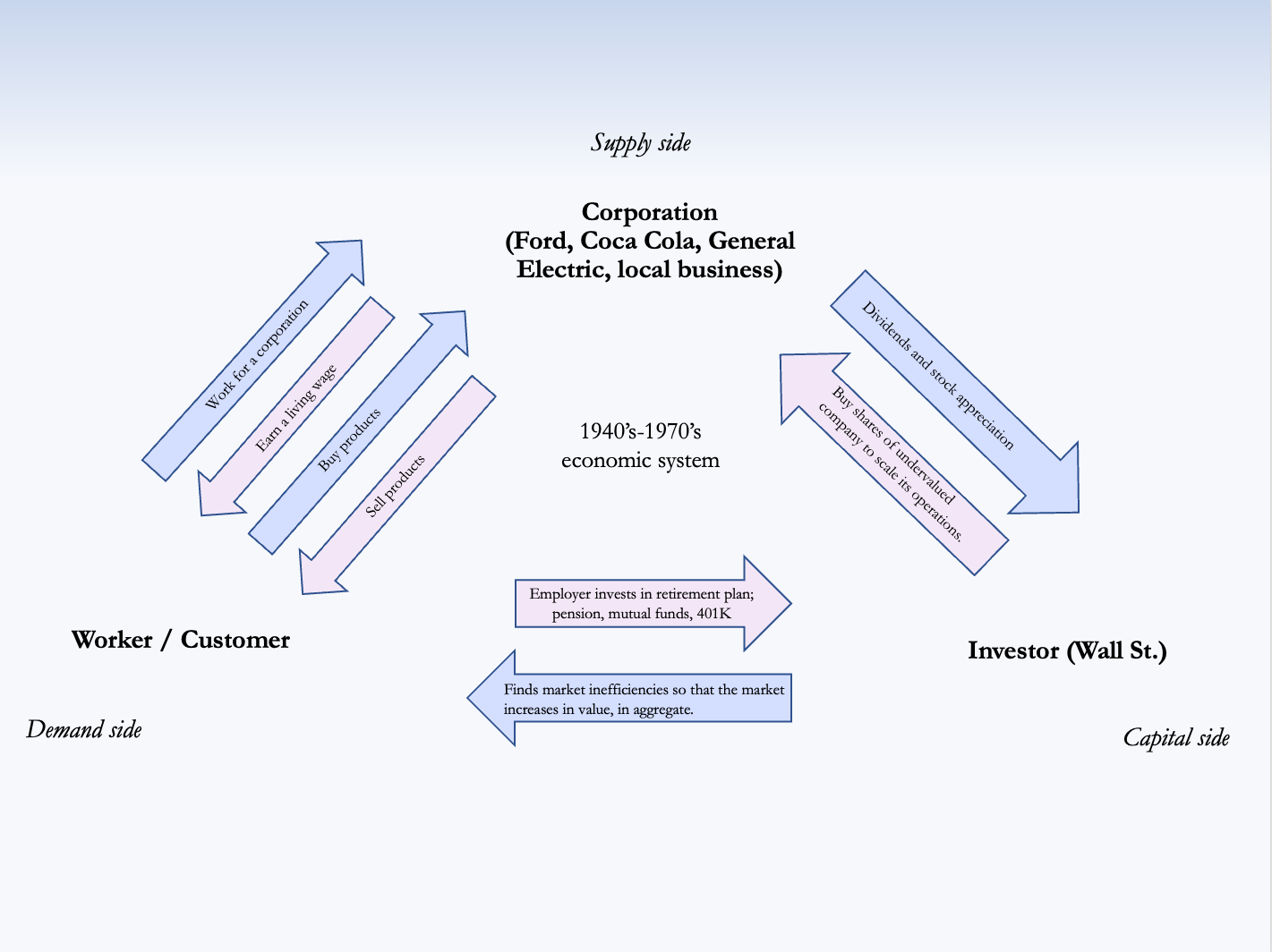

Idealized value production economy, a system of mutual benefits:

Why doesn’t digital media fit into the fundamental valuation model? The product that digital media produces is content. Content is not limited in supply, only valuable content is limited in supply. Yet there is no consensus definition of what valuable content is or how it is limited in supply. Therefore, the implicit economic consensus is that valuable content is defined by whatever its market price is. However, price is only a small subset of valuable content, and can’t say how content is limited. Therefore, valuable content cannot be a limited good and price cannot be an accurate signal of the value of content. But fundamental valuation requires that price be an accurate signal of value. And this means that fundamental valuation for Google, Facebook, Twitter is inherently problematic.

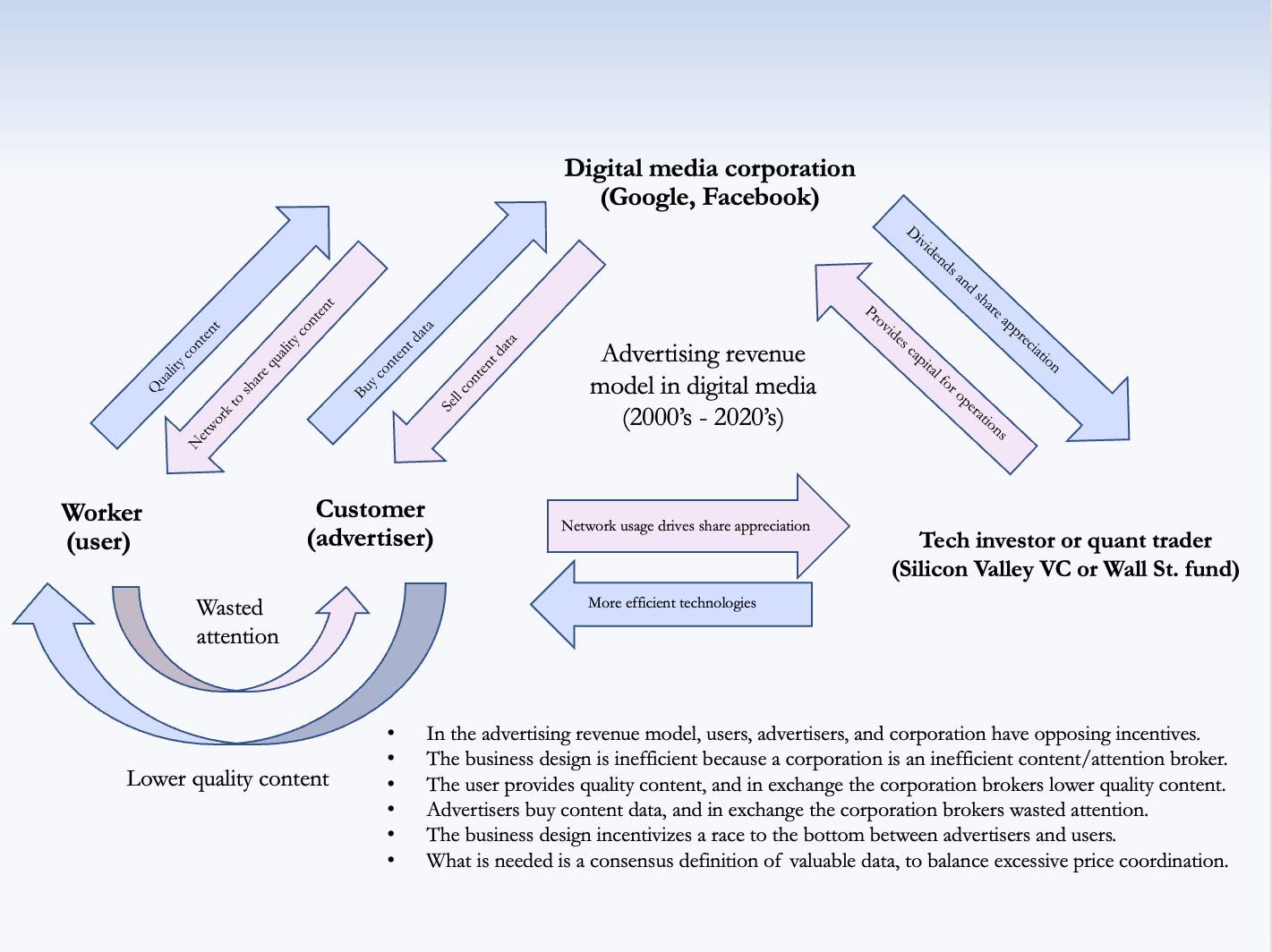

Why can’t price be an accurate signal of value production in advertising revenue model? The advertising revenue model (Google, Facebook, Twitter) has to assume that price can accurately measure the value of content. The problem with this assumption is that both users and advertisers have different notions of why content is valuable, yet they are both on the same demand side. Advertisers care more about price / ROI of content, not as much about quality. Users care more about quality of content, not as much about price. Price has a consensus economic definition, but content does not. This means that users get the losing end of the deal, economically. They do real economic labor to produce valuable content, and yet they are uncompensated.

Therefore, in a true digital economy, the economic definition of price requires a consensus economic definition of valuable content. And this is what becomes possible with the NFT market.

Digital media economy with advertising revenue model; a race to the bottom:

What is the economic definition of valuable content? With digital assets, the economic definition of valuable content becomes more clear. In digital assets the distinction between user, advertiser, and company, collapses. Thus, the motives of those who produce valuable content versus its opposite, is more clear. Thus, it is more clear that content determines the price of digital assets, rather than price determining content, as in the advertising revenue model. And this applies in the economy more generally. The quality of a good determines its price, the price ought not determine its quality. Valuable content is therefore defined more by how high its quality is, than by how much is paid for it. Then how is valuable content produced, if not by price coordination? Valuable content is produced by internal coordination in small collaborative groups. Internal coordination produces content fundamentals such as engineering, incentives, and design. These are the fundamentals that also determine price in digital media more generally. Therefore, the economic definition of valuable content is: a limited good produced by internal coordination in small group communications.

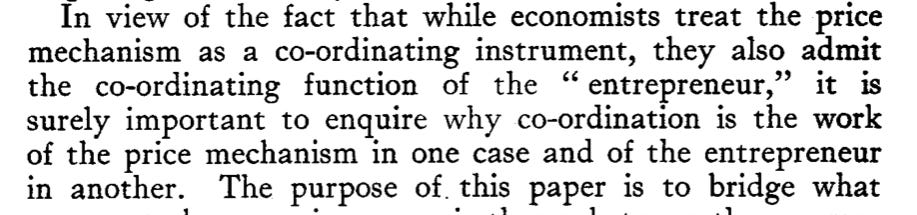

This economic definition can be derived from Ronald Coase’s “The Nature of the Firm” (1937). Coase shows that internal coordination is **mutually opposed **to price coordination:\

There is a cost to coordination by price mechanism:

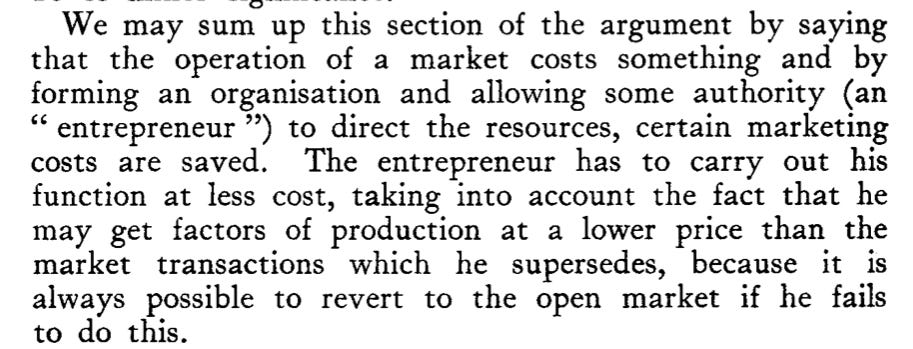

The cost of using the price mechanism is less internal coordination (within the firm):

and,

There is an equilibrium dynamic between price coordination and internal coordination:

Coase’s “Nature of the Firm” has a new significance in the context of distributed networks and digital assets. The firm is now small groups of digital collaboration. With Coase in mind, let us return to the original fundamental valuation model:

Low price / high cashflows = good fundamental value investment, where

asset price= aggregation of publicly available information (efficient market hypothesis)

cashflows= revenues / operating expenses (demand / supply)

Now, we can take the next step:

aggregation of publicly available information =

internal coordination / price coordination

Internal coordination could be measured by network size, but network size is only a proxy for price, which does not account for the qualitative aspect that is necessary for true internal coordination.

Conclusion: Revenues and operating expenses (or demand and supply) in conventional finance are analogous to internal coordination and price coordination in digital media. This changes our notion of incentives. In this analogy, revenue is collaboration, and price is an expense burden. The digital economy produces valuable content through internal coordination primarily, and price coordination secondarily, only after the fact. This is what we see in the NFT market. What the conventional economy produces- cars, tables, etc.- is now largely influenced by the valuable content that the digital economy produces. Valuable content is also a limited supply good, but in an altogether different sense than a material good. Valuable content is *limited* because internal coordination is extremely difficult.

Part II introduces the application of this thesis: the Learn to Earn business model.

This piece is available for investors and feedback. Investors and contributors receive monthly dividends on sales and re-sales.