Perry Mehrling’s macroeconomic framework is by far the most approachable way to understand the international banking & financial system. Having this approach available is important in being able to have an adequate public dialogue on the economy.

Whereas neo-classical economics is based mostly on game theory and the concepts of general equilibrium and rational preferences, Mehrling’s approach is based in the older tradition of American institutional economics, which is an offspring of classical political economy.

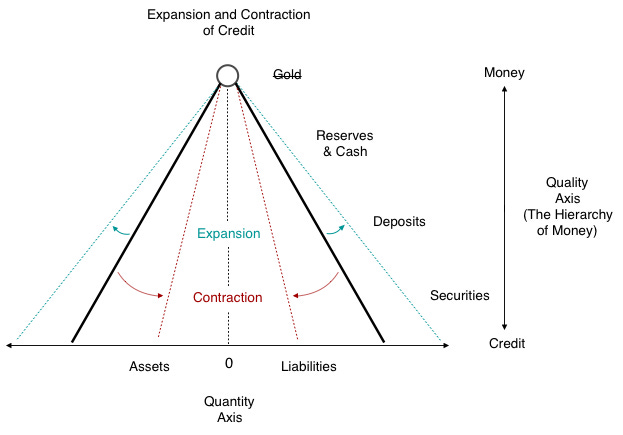

Rather than flattening all economic activity to the forces of supply & demand in general equilibrium, Mehrling’s view is a realist view, which acknowledges institutional hierarchies that exist the circulation of money. Instead of looking at supply and demand curves, we instead look at assets and liabilities of balance sheets at different levels of the financial hierarchy, to determine liquidity and solvency:

Assets correspond to liquidity, liabilities to solvency.

Academic economics is split between the monetarist-Keynesian views which say that the business cycle needs to be regulated through counter-cyclical interventions, policy frameworks, & redistributions of wealth, and free market-libertarian views that say decentralized planning by market participants & small government / deregulation provides the best outcomes for everyone.

Mehrling’s is more general than both of these views, in that it encompasses both; it is agnostic on the issue of top-down versus bottom-up planning, and simply recognizes that hierarchical institutional structures for proffering money exist, ever since central banking came about.

There is a basic acknowledgement that the banking system in the United States, and in most countries is to some extent socialized. Banks are not really independent of the central bank, they are ostensibly quasi-private corporations, but in reality they have a special relationship with the central bank, and thus, with the state. This became much more clear from the response to the 2008 financial crisis and the 2020 pandemic crisis. Rather than debate about whether this should be the case or not, Mehrling simply takes the realist view that it is the case.

These are notes on Perry Mehrling’s course on the Economics of Money & Banking:

The four prices of money:

The four prices of money show that what we think of as money is actually based on four hierarchical categories.

1.) the interest rate — the price of money today in terms of money tomorrow (future). This is central bank money, the central bank sets the benchmark interest rate.

2.) par — price of one money in terms of another money, today (present). This is commercial bank money.

We take the par price of money for granted. If you have a commercial bank deposit of $107, we take it for granted that the bank has assets of $107 — that it is par. But we see in financial crises, sometimes the par price of money is broken. Bank money trades at a different rate than central bank money. US commercial banks hold central bank money as assets. So there is a hybrid system. Par is key to the payment system. If there is not par clearing between different states, for example; if you buy something from California, and you live in New York, they might charge you 5% extra, if there is not par clearing in the states. Par clearing between states had to be established by the banking system, it was not always there.

3.) exchange rate — the price of domestic money in terms of foreign money.

4.) price level — the price of commodities.

The difference between money and credit:

Money is better than credit. Credit is a promise to pay money. Money is money. Money is qualitatively better. Money is the thing that eliminates debts, the thing that debts are cancelled in. Credit is an IOU.

All text books talk about money and credit like that. In order to emphasize the hierarchy, Mehrling emphasizes four categories of money. There is an ultimate money: gold.

Hierarchy of money & credit:

Gold →

National currencies →

Deposits →

Securities

Strictly speaking, only the first is money, the next three are merely promises to pay money (IOU). Now where do we draw the line between money and credit? If you take a banking point of view, deposits & securities are credit, and gold & national currencies are money. What counts as money and what counts as credit depends on the circumstance. In any individual situation, we can ask ourselves, what things are credit, what things are money? In an expansion, more things become money-like, in a contraction, debts have to be settled.

Hierarchy of financial institutions:

Whenever we are talking about institutions, we are talking about balance sheets.

Central bank → issues national currencies

Banking system → takes the national currencies and issue deposits & loans

Private sector → takes deposits & loans and buys securities & goods

Everything is credit besides gold or money. Any form of credit is inside money. Gold is no one’s liability, and so it is outside money. All inside money is an IOU, a kind of promise to someone else to pay at a later date.

Dynamics of the hierarchy:

During an expansion the hierarchy of money & credit becomes more flat — the distinction between money and credit is lost. During a contraction, the hierarchy of money is reasserted. In a contraction, all the things that are credit and, not money, lose value, as repayments in money are demanded and liabilities are settled.

The Scarcity of (Ultimate) Money

There is only so much gold in the world. This is the disciplining feature of the money. But counterposed to this is the elasticity of derivative credit. It is denominated in money, but is not itself money.

In a crisis, the principle of discipline smacks you. In a boom, elasticity makes everything seem like money.

The principle of elasticity is credit — if you and I make an agreement, an IOU, then we can expand credit without any constraint of the monetary system. Ordinary people can simply expand the total “money supply” or really the total credit, simply by making an agreement with one another.

And this is where we see how Mehrling’s theory (called the money view) generalized from both left wing and right wing economists. You can build a theory of money from elasticity of derivatives or the scarcity of ultimate money.

Banking principle: monetarism, Keynesianism, is built on the presupposition of more expansion of credit and more elasticity in the system. The money supply can be expanded to intervene in times of crisis.

Currency principle: metallism, charlatism, is built on the presupposition of more discipline and austerity, and less expansion of credit. The market is a disciplining mechanism and the state should allow for bankruptcies of non-functioning companies.

There is always a debate between these two views of economics. At any moment in time, there is always more discipline or more elasticity. It swings back and forth. This can give the impression that economists are fickle or that they don’t know what they are doing. Both sides are capturing something true about the system, but not the whole system.

Hierarchy of market makers:

Central bank →

Banking system →

Security dealers

Each of the institutions is a market maker.

Securities dealers knit together deposits & securities. This determines price, as interest rate.

The banking system knit together currencies & deposits. This determines the par price.

Central banks knit together nation currencies & international currencies, this determines the exchange rate.

Incentives:

Some actors are focused on profit maximization, the private sector. Others are focused on economic stability, the central banks.

The role of economic stabilization has evolved over time. What do central banks do? One thing that they obviously have to worry about is the exchange rate. They have to defend the exchange rate in the international economy. Sometimes they help banks to maintain par.

Bagehot’s book Lombard Street: A Description of the Money Markets (1873) is about the London money markets. What Bagehot tries to convince the world with this book, is that the Bank of England — a private bank — has been acting as a lender of last resort. It had done this in prior crises. The system had evolved that way without intending to. Bagehot wrote this book to bring this phenomena of “lender of last restort” up to public consciousness, so that people could just accept it.

Bagehot’s solution was, in a financial crisis, we’re going to lend freely, at a high rate against good collateral. It was very controversial when it first came out, but then all central banks embraced it.

But wouldn’t it be better if we never got to the financial crisis? Central banking became about counter-cyclical intervention policy. It comes from the inevitability of hoping you can do something about financial crises to avoid them. Not just counter-cyclical policy, but prudential policy.

The term structure of interest rates

There is the policy rate, set by the central banks. This is the overnight rate, the Fed funds rate in the United States, or simply the interest rate to borrow money from the central bank.

There is also the market rate, which is set by the bond market. This is the rate set by bond traders on instruments such as the 30-year government bond.

Intrinsic Macro is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.