Author: 0xoct, @RealResearchDAO

Special thanks to @@0xzhujun、@BeeGeeETH、@0xDavii and @JaneLinkun who contributed help to this article.

Editor's Note: Whether it is leasing or lending, these derivatives are gradually coming to the fore in the industry today as NFT is booming. How to understand the kernel of them and grasp their general laws requires our wisdom. This article provides an in-depth analysis of the logic of NFT leasing from the common case of economics of housing leasing in real society. At the same time, for the current problems that still exist, also put forward their own thinking, worth reading.

In economics, the act of leasing, or Economic rent, first referred to the income obtained from land, and was later expanded to all income obtained because of monopoly power. And the emergence of leasing behavior also leads to the prosperity of rent-seeking behavior.

Consumables leasing, truck leasing, house leasing, and even lending we can also be regarded as a special kind of capital leasing behavior.

The emergence and prosperity of leasing behavior is the inevitable product of a developed market economy and the intensification of the Matthew effect.

And under the premise that NFT and GameFi market is booming, NFT leasing behavior, too, is bound to prosper, and the red and black behind it is worth exploring ......

NFT=House?

Before we can understand NFT leasing, we need to have an intuitive understanding of real-world leasing behavior.

Let's take the most common real-world housing rental as an example.

Microeconomically speaking, the price of a good is determined by the supply and demand for that good, and rent is no exception. But supply and demand are not the only factors that affect the rental market; it is also influenced by the price of housing. When housing is a consumer good, the price of housing affects the demand in the rental market, i.e., prices are high and people cannot afford to buy a home, so they naturally run to rent.

More than two hundred years ago, Britain, the birthplace of the industrial revolution, was the first to face the housing problem while completing urbanization - a large number of peasants flocked to the city, and urban housing was in short supply. As a result, the act of renting was gradually marketed.

Along with the act of renting, many homeowners came to see renting as a way to invest and make money.

Since it is an investment, we have to consider the return, and in the process of the evolution of housing leasing behavior, leasers gradually began to calculate the investment cost and return cycle in a way that is more in line with the laws of the market. This has led to the gradual transformation of real estate leasing from a spontaneous act of individuals to a derivative transaction of real estate.

Similar to real estate leasing, there are also acts such as truck leasing, instrument leasing and musical instrument leasing. To date, the act of leasing has encompassed almost all aspects of society and has evolved into a specialized economic behavior while promoting the liquidity of assets in various fields.

The same principle applies to the development of the NFT leasing business.

NFT bottleneck: scarce liquidity and difficulty in expressing complex economic relationships

In the tide of the era when all people are moving towards the meta-universe, people have given the blockchain and cryptocurrency concepts a whole new meaning.

If DeFi will be the economic system of the future meta-universe, then NFT is given both asset expression and application expression inside the framework of the meta-universe.

PFP, playing gold, asset recognition ......NFT itself as a commodity has both rich application scenarios, while its own value flow also brings monetary properties.

But the root of the problem is that, in a large-scale, complex interaction of the huge virtual world, NFT itself a variety of functional limitations lead to, its no cash flow asset attributes, such as the law like BTC, ETH rapid circulation, and therefore can not be effective expression of the complex economic relations of a complex world.

It is true that the emergence of smart contracts provides a practical solution for the development of human society, but at the same time, the current low flexibility of smart contracts is also to a certain extent unable to effectively respond to industry trends such as large-scale user growth and large capital entry.

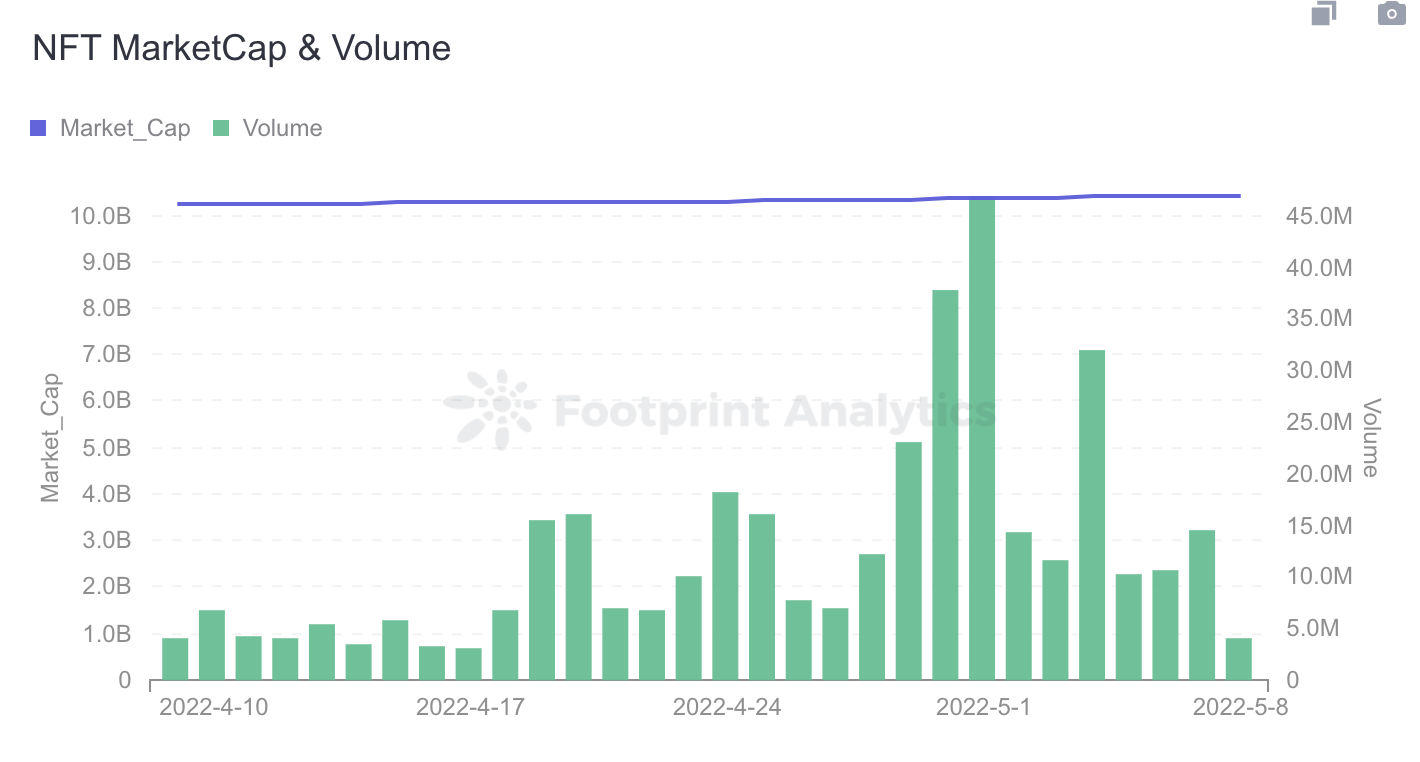

The 24-hour trading volume is the most intuitive indicator of the poor liquidity of the NFT market. According to Footprint data, the 24-hour trading volume in the past 30 days was about $4 million. This is insignificant compared to the $98.8 billion trading volume of the entire cryptocurrency market.

Unlike homogenized tokens such as Bitcoin, non-homogenized tokens (NFTs) are inherently unique and distinct, indivisible, and not freely exchangeable among themselves, which together make NFTs severely illiquid, and this is an almost insurmountable problem.

The inability to split it also adds a significant barrier to its circulation in the market, especially for high-value NFT works.

The end result is that the industry, for its own development, has spontaneously explored liquidity solutions such as: NFT fragmentation, NFT lending or NFT leasing with more financial attributes.

NFT's "means of production" attributes drive leasing businesses' boom

With the rapid development of GameFi, NFTFi and other fields, NFT is gradually shifting from being dominated by the PFP factor to being dominated by the "means of production" factor.

The so-called means of production are the resources or tools that workers need to use when they produce.

With each new GameFi or Metaverse project, it is increasingly clear that NFT represents more than just speculative artifacts. Whether it is the land on which buildings are built in Decentraland or playable Axie pets in Axie Infinity, it is clear that the true potential of NFTs lies in their ability to represent assets with utility - much like cars and houses have utility in our economic lives in our economic lives.

The bottom line is that as GameFi's overall development progresses, the number of games will grow and their gameplay and financial aspects will become more and more balanced. The NFT as a proof of participation will also be increasingly valued by all players in the industry.

Ordinary players will further increase their demand for NFT for gaming experience and gold playing return, while large VCs, institutions, Guild and other giant whales will use their supremacy in the game and capital volume to increase their NFT hoarding and rent them out for more benefits. Objectively, this has caused a boom in the NFT leasing market.

It is worth noting that this kind of leasing behavior and GameFi early, YGG and other guilds compared to the leasing behavior despite the same form of expression, but the underlying thinking is very different.

In the early days of YGG or Axie official launch of the leasing service, the purpose is more in the capture of private domain traffic, more users in their hands.

The current and future NFT leasing market, on the other hand, implies the birth of a new industry whose purpose is to provide services for more public domain traffic and get returns from it.

Current mainstream centralized NFT leasing programs:

GameFi and the development of the NFTFi concept has brought more value to the use of NFT. For example, NFT in games can be "used" to play, virtual land can be "used" to build scenes, and music NFT can be "used" while listening. In some cases, the owner and the user may not have the same account. Someone may buy an NFT that has utility, but they may not have the time or ability to use it, so it makes sense to separate "use" rights from ownership.

In fact, separating ownership is not only the cornerstone of NFT leasing, it is also a prerequisite for giving NFT an expression of complex economic relationships. At present, more than 90% of NFT transactions are almost all one-time title buyouts. This simple and straightforward form of transaction will become increasingly anachronistic in a future where the metaverse is booming.

It is conceivable that with the further expansion of NFT applications, the problem of access management will become more common, and NFT leasing, as the best expression of property rights separation, will naturally have more room for development.

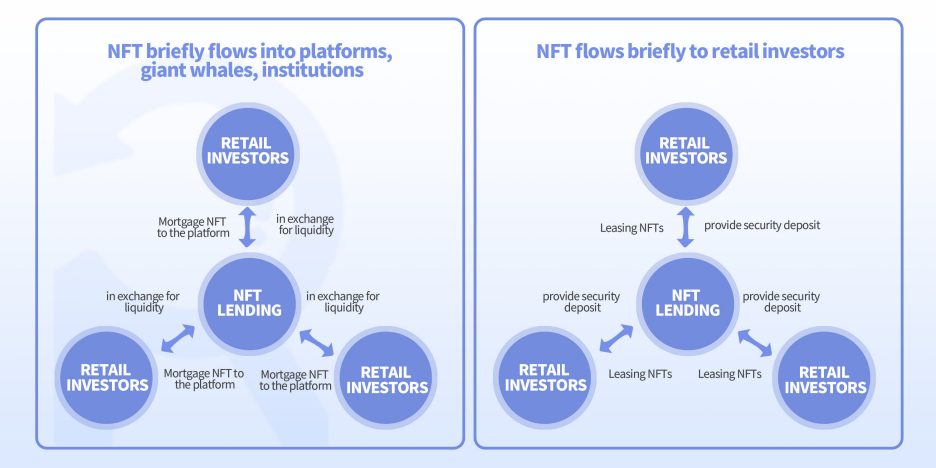

Today, there are two main types of NFT derivatives: NFT lending programs and NFT leasing programs.

The first type allows users to pledge their NFTs to borrow cryptocurrencies, such as Benddao, while the second type allows users to rent their NFTs to others, for example, if the borrower wants to temporarily gain access to a token gated community.

Compared to NFT lending, which concentrates NFTs in the hands of giant whales, NFT leasing, a B-to-C or C-to-C approach, is more likely to facilitate the flow of NFTs themselves.

In the field of NFT leasing, there are two main types of leasing models:

- Product-based leasing

- Project comes with leasing function: Axie Infinity, Starsharks

- Third-party leasing platforms: ReNFT, YGG

- These leasing products, by managing the accounts of leasers and lessees, accomplish the separation of NFT ownership and usage rights and ensure contract enforcement through centralized coordination services, or multi-signature wallets.

- Protocol-based leasing

- ERC-4907: An NFT casting protocol focused on making NFT more mobile.

- The ERC-4907 protocol is an extended protocol based on the functionality of the ERC-721 protocol, so ERC-4907 is fully backward compatible with the ERC-721 standard. Based on the ERC-4907 protocol, users can briefly gain access to the corresponding NFT, but will not be granted user transfer, change the state of the NFT privileges.

The boom of NFT leasing business can further stimulate the development of various fields related to NFT.

- GameFi: A Win-Win for High Net Worth Gamers and Regular Gold Players

- With NFT rental, gamers who are borrowers can rent NFTs they can't afford or have upgraded and use them to access restricted areas or as a tool to earn higher in-game rewards. NFT owners who rent assets will receive a share of any cryptocurrency borrowers receive while playing the game through a revenue share model.

- Meta-Universe Land Hype: Further Activating the Use of Meta-Universe Land

- As more and more Web 2 giants such as Meta, Prada and Adidas enter the metaverse, the land parcels in Sandbox and Decentraland, which are big blue chips in the metaverse, are gradually favored by big capital. And the corresponding leasing business will also promote these plots to have more application scenarios. (For example, renting plots in Decentraland for art exhibitions)

- Art and equity NFT: get more revenue and user traffic

- Artists can rent out the use of their art NFTs to others to get additional income in addition to royalties.

- The rental of equity NFTs allows more lessees to get credentials to join various project communities at a lower cost. (For example: Moonbirds' Pass Card)

NFT's lease-to-sales ROI is difficult to calculate

As a new financial product born in a new field, NFT leasing business will also encounter some potential problems in the process of development.

Current phenomena of NFT leasing:

- The value of collateral + rent is set too high, even the rental cost is higher than the NFT floor price

- The rental time is too short, the shortest is 1 day, generally concentrated in about 10 days

- The ratio between rent and selling cost is confusing.

In the NFT rental market, we are not yet able to calculate a reasonable ROI, the reason is that it is still in the early stages of development, the laws of the market have not yet spread to this area, the NFT rental price depends more on the players' self-pricing.

Besides, there is another very important reason, which lies in the drastic price fluctuations of the cost of NFT itself.

We can take real estate as an example, after the UK took the lead in the market economy to try this behavior of housing rental, because the UK promotes the free market economy, the government does not intervene in the real estate industry, which resulted in more than 90% of the houses at that time were controlled by the capitalists, greatly raising the rent to exploit the workers, and the rent deviated too much from the income level of the tenants, also to a certain extent, led to the atrophy of the supposed housing rental market.

On the other hand, the rental market is also closely related to the urbanization of the population. The most prominent contradiction in the process of urbanization in the world is that the urbanization of population is slower than the urbanization of land, i.e., a large number of mobile population and new citizens are unable to obtain normal housing and living security in cities. These phenomena can, to some extent, lead to the departure of rental housing users and the decline of rental housing demand, which can have an impact on urbanization.

The current international rental to sales ratio, which is used to measure the good performance of a regional property, is between 1:300 and 200, which means that it takes 200 to 300 months to recover the cost. Translated into "annual rental yield" is between 4% and 6%, which represents the percentage of the cost recovered by renting out the house in a year.

Real estate leasing with 200 years of time, proved a truth: high housing prices is by no means a sign of a prosperous rental market, and the stability of the rental market is the cornerstone of prosperity.

In NFT leasing in, for NFT holders and hoarders, in the case of NFT rents remain unchanged, the higher cost of NFT purchases means lower returns on NFT leases, which will force these to raise rents, while NFT lessees will reduce their desire to lease because of higher NFT rents, thus causing damage to the NFT leasing market and further hindering the development of the NFT industry.

The self-regulating ability of the market economy, on the other hand, will fail with it within the scope of NFT leasing, i.e., a decrease in NFT leasing desire will not affect the decrease in rent.

In the NFT market, the key factors determining the decline in NFT rents are the decline in NFT primary market sale prices and the extension of lessors' calculations of payback cycles.

Thus, we can conclude that:

- The elevated attributes of the means of production have forced the NFT rental market to mature.

- A prosperous NFT leasing market, on the one hand, relies on price stability in the primary NFT market.

- On the other hand, it requires that this economic logic of leasing be more widely accepted and observed during the development of the industry.

Join Us Here:

About Us:

Twitter: @RealResearchDAO

Medium: https://medium.com/@RealResearchDAO

Discord: discord.gg/ZSdgM7x6pc