Author: @CryptoScott_ETH , @RealResearchDAO

Foreword

In traditional finance, the construction of valuation models is one of the most important steps in investment and financing decisions, providing a basis for the rationality of the target price. In the crypto context, tokens are similar to the publicly issued shares of the protocols. It has certain governance rights over the protocol, and has the opportunity to receive dividends from the protocols’ income. Therefore, when people make investment and financing decisions on tokens, they can also build a valuation model to judge the reasonableness of the token prices. This article first introduces the construction of traditional financial valuation models, draws out the problems that valuation models can solve, and finally discusses how to apply traditional financial valuation model construction methods to token valuation.

1. Construction based on traditional financial valuation models

1.1 Dividing revenue performance

The first step in the valuation model is to divide the company’s revenue performance. The company’s revenue is generally driven by multiple businesses. For the main business, further price-volume divisions are required. For the other businesses, it’s simply needed to take a loot at the performance growth rate. Performance divisions can be done in either bottom-up or top-down approaches.

① Bottom-Up: For companies with limited production capacity, that is, all products produced can be sold, and the company's future revenue is driven by production capacity. Such companies use a bottom-up model to estimate future revenue by estimating the company's future capacity. For example, a power plant company can sell all the electricity it generates, and its future performance and income are determined by its production capacity.

② Top-Down: Most companies use the top-down valuation method, which predicts the company's future revenue by predicting the macro environment - industry growth rate - penetration rate - company market share. First, determine the impact of the macro environment and policies on the development of the industry to give an assumption of industry growth. If a new paradigm appears in the industry, we need to make a penetration rate assumption. Based on the company's share and competition barriers, we can make an assumption of the future market share, and finally calculate the company's future revenue. For example, valuing new energy vehicle companies, predicting the future growth of the auto industry based on the macro environment, predicting the penetration rate of new energy vehicles in the future based on policy objectives and historical data to obtain the market share of new energy vehicles, and predicting the company's future market share to estimate the company's future revenue.

1.2 Construct Income Statement, Balance Sheet, Cash Flow Statement

After the revenue is determined, other items in the income statement are forecasted according to the ratio of history to revenue. After the income statement is obtained, the changes in the future balance sheet and cash flow statement can be predicted according to the relationship between the financial statements.

1.3 Valuation

After filling the three tables, balance the balance sheet. The next step is to value the company based on the predicted financial statements. The valuation includes two methods: Absolute Valuation and Relative Valuation.

①Absolute Valuation

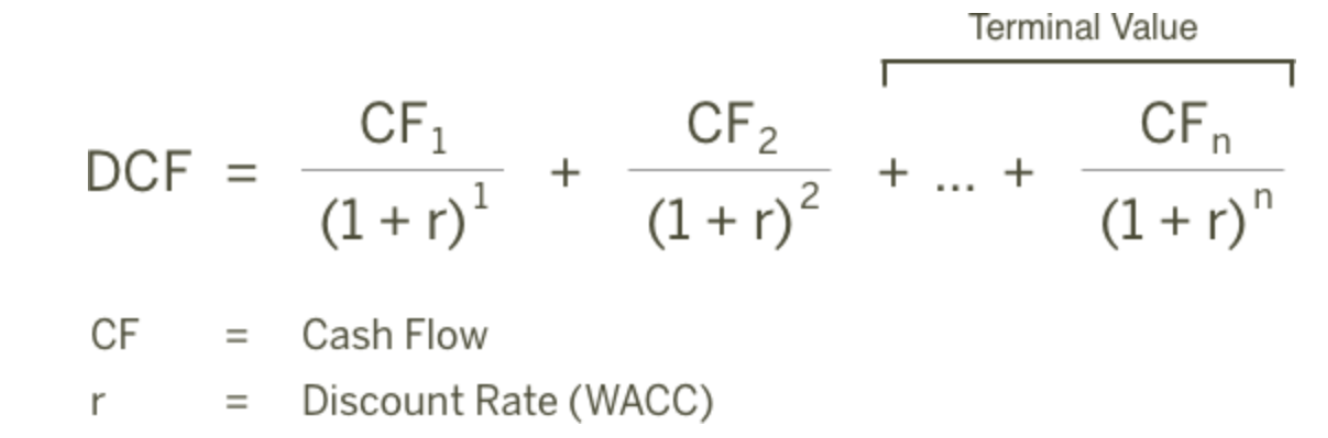

- The Absolute Valuation method estimates the value of the target at the current point in time by predicting the future cash flow and cash discount rate. Two common cash flows are dividends and free cash flow.

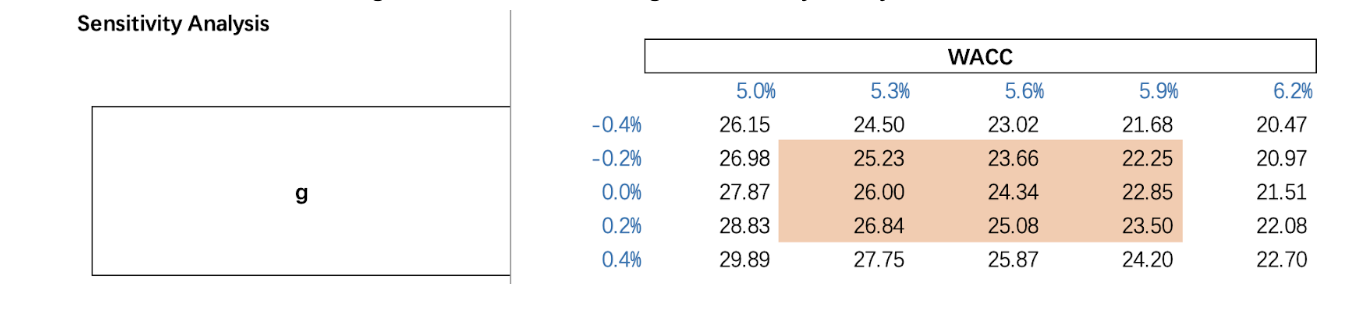

- Sensitivity analysis of key factors: For example, in the discounted cash flow model, the final valuation is more sensitive to the discount rate/WACC and the growth rate of cash flow, so a valuation range is calculated through sensitivity analysis.

② Relative Valuation

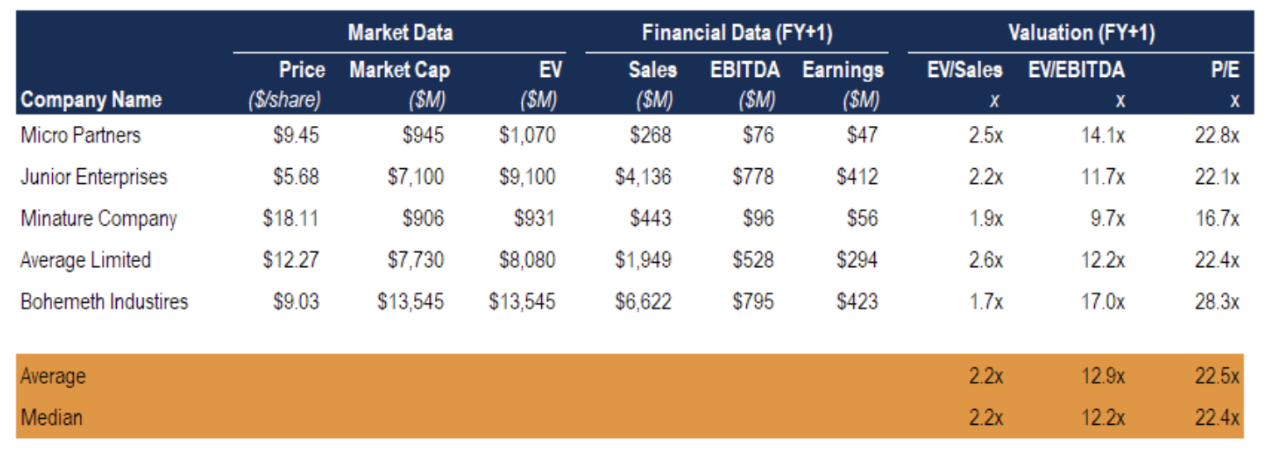

Find companies that operate the same business, compare these companies' valuation multiples, such as P/E, and find the median or average of comparable companies' price multipliers.

The valuation range is derived by adjusting the target's price multiplier based on the median.

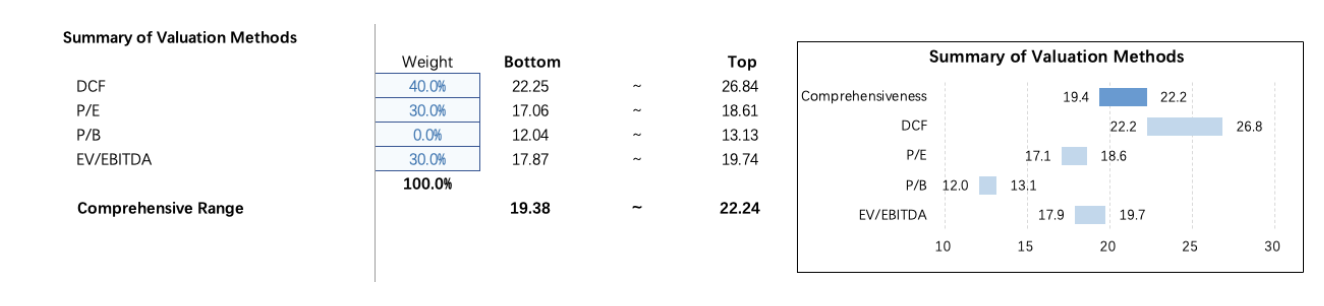

③ Comprehensive Valuation

Determine the weight of each valuation method to deliver the final valuation

2. Why do we build a valuation model?

2.1 Investments

① Price transmission mechanism: From fundamental analysis to technical analysis, professional institutions find Alpha by analyzing fundamentals, the process of opening a position drives changes in the underlying price and volume, and technical analysis dispatches to capture the changes in price and volume to open a position. At present, the currency circle is mainly dominated by the retail market, resulting in low information efficiency. With the improvement of the investor structure, the price discovery mechanism will be more efficient.

② Judging the overvaluation and undervaluation of the target, and making investment decisions.

③ Immediate valuation adjustments based on actual changes compared to assumptions or expectations. If the actual situation is better than the consensus expectation of the market, it is bullish; if it is lower than the consensus expectation, it is bearish.

2.2 Financing

① Debating valuation reasonableness with investors and adjusting valuation assumptions to arrive at final valuation.

② Bet on the performances with investors, and if the performance required by the valuation assumption is achieved in the future, you can get more money.

3. Applying token valuation by using traditional financial valuation models

3.1 Availability

- The traditional financial information is unbalanced. Generally, investors need to wait for the financial report disclosure date to update the model. Insiders know the company's revenue in advance through the blending of industry chains.

- Openness and transparency is a major advantage of the blockchain. Without waiting for the financial report disclosure date, the real operation of the project can be known in real time, which greatly reduces the situation of information asymmetry.

- Token has certain equity, equity can generate cash flow, and cash flow can guide valuation.

3.2 Public data

- Traditional finance: prospectus, financial report

- Web 3 : White papers/official website documents, blockchain browsers

3.3 Performance splits

① DEX

- Profit model: Trading volume drives fee income

- Volume: Adopting the Top-Down analysis method to estimate the total trading volume, DEX trading volume penetration rate, and project market share

- Price: fee ratio, as competition intensifies, the fee ratio usually declines

② Lending

- Profit model: TVL-driven spread income

- Volume: Adopting the Top-Down analysis method, the future growth of TVL is estimated from the proportion of TVL in the market value of blue-chip tokens, the total borrowing demand is obtained by estimating the capital utilization rate according to historical data, and the future revenue of the project party is estimated according to the market share.

- Price: loan fees

3.4 Market Cap or FDV (Fully Diluted Value)?

- Traditional financial valuation uses the number of circulating shares, that is, the market cap, because there will be no frequent new circulation.

- In the token economic model, it is necessary to pay attention to the token inflation rate. Those with a low annualized inflation rate should pay attention to the market cap, and those with a high inflation rate should pay attention to FDV.

- When comparing with peers, try to maintain consistency. When using FDV for valuation, it is necessary to exclude some shares that are unlikely to be circulated, such as the tokens in the Treasury.

- When using the market cap for valuation, it is necessary to measure the number of tokens in circulation, especially for private placement, and the date of the team's release. Adding tokens dilutes holders' equity, so growth rates and inflation rates need to be compared.

3.5 Making Sure Token Equity

There are differences in the utility of tokens and value capture capabilities of different economic models. Therefore, the same set of models cannot be used to compare valuations. It is necessary to determine the rights and interests of each token. The more rights and interests, the higher the valuation. For example, the initial tokenomics of BNB used 20% of the profit for buying back and burning tokens, while OKB and HT used 20% of the fee income for buying back and burning tokens, and there was a profit margin between the profit and the fee income. In addition to dividends, there are also IEO value, fee reduction value, and public chain value.

3.6 Absolute Valuation or Relative Valuation?

At present, the market is in the early stage, and there is no consensus on the confirmation of the discount rate. It is not easy to use DCF for valuation, so the Relative Valuation method is often used.

During financing negotiation, the Absolute Valuation method can be used, and the selection of r is based on the investor's necessary rate of return.

4. Visions

4.1 Market Efficiency

- In the traditional financial market, there are many sellers and buyers looking for Alpha, the market is more efficient, and opportunities are fleeting

- The retail market is dominated by the currency circle, and the efficiency of digesting information is low, so there is sufficient time to discover Alpha. With the change of investor structure, the market will become more and more effective.

4.2 Build consistent expectations

- Price is the embodiment of expectations. In the traditional financial market, many analysts and fund managers build market consensus expectations. When the actual situation does not match the consensus expectations, investment opportunities will arise.

- The crypto market lacks platforms like Bloomberg and Wind that demonstrate the consistent expectations of all institutions. Expect such a platform to appear in the future.

4.3 Financial audit on-chain

- At present, there is only contract auditing business in the crypto market. Financial auditing in traditional finance plays an important role in investment decision-making.

- On-chain financial auditing companies may have great demand in the future to visualize the financial data of the project parties based on the blockchain parties.

Join Us Here:

About Us:

Twitter: @RealResearchDAO

Medium: https://medium.com/@RealResearchDAO

Discord: discord.gg/ZSdgM7x6pc