Stablecoins are one of the pillars of DeFi. They are present in liquidity pools, treasuries, wallets, and so on. They provide a certain level of stability in a highly volatile environment.

However, most of the major stablecoins in our ecosystem are fully centralized or backed by centralized assets. Some have become centralized over time, while others were centralized from the beginning.

A few brave projects have attempted to offer alternatives to this situation but have not yet succeeded in changing the paradigm.

f(x) Protocol comes to propose an additional option by creating two assets derived from ETH. One of these assets has reduced volatility to resemble a stablecoin, while the other inherits this volatility by offering variable leverage on ETH.

Current state of stablecoins

This part is well known to everyone, so I won't dwell on it. There are mainly three types of stablecoins:

-

Fiat-backed stablecoins (USDC, USDT)

-

Stablecoins partially backed by other fiat-backed stablecoins (DAI, FRAX)

-

Fully decentralized stablecoins (LUSD)

The first type of stablecoin, fully centralized, has achieved great success in DeFi. With their real-world reserve model, they have been able to benefit from high capital efficiency (1:1), thus ensuring relative stability of their peg over time. This has led to significant usage, exponential growth, and deep liquidity.

However, while improving the user experience of DeFi, these stablecoins have brought with them an insidious risk, often perceived as a "strength": centralization.

Today, they dominate the market and even serve as support for many other stablecoins. Whether along the way (DAI) or from the inception of projects (agEUR), the introduction, even partial, of these stablecoins brings the same type of risk (special mention to the USDC crisis).

It is therefore illogical to continue down this path considering the ideals of DeFi.

Fortunately, a few indomitable Gauls have not given up and have continued the fight.

The main alternative, the most decentralized and viable model to date, is the Collateral Debt Position (CDP) model that only accepts uncensorable and decentralized assets (Liquity).

Unlike other models, the growth of stablecoins adopting this approach is more gradual, slower.

This opens the door to the exploration of new models, which is ultimately a good thing because diversity means resilience.

So let's embark on the discovery of an approach that aims to be a little different, by proposing not a stablecoin but something that resembles it.

The Operation of the f(x) Protocol

The protocol accepts ETH as collateral and issues tokens backed by this collateral with either low or high volatility.

You can create fETH and/or xETH by using ETH, in quantities based on the price of ETH and the current price of each token.

Similarly, you can exchange fETH or xETH for their equivalent value in ETH.

Two Assets

The system relies on two assets derived from ETH:

-

fETH (Fractional ETH) - A token with reduced volatility, approximately 10 times lower than that of ETH.

-

xETH (leveraged ETH) - A token equivalent to exposure to ETH with variable leverage.

The role of fETH is to track the price of ETH with movements 10 times less significant.

Thus, if the price of ETH increases/decreases by 10%, the price of fETH will increase/decrease by 1%, which is equivalent to a leverage of x0.1 on ETH.

This provides a certain stability against price fluctuations while protecting against the depreciation of USD compared to ETH. The fETH can be considered as a first iteration of a pseudo-stablecoin anchored in the Ethereum economy.

The role of xETH is to capture the 90% of volatility not captured by fETH. Therefore, it exhibits greater price variations than ETH itself.

The Invariant

The system adjusts the prices of xETH and fETH based on the price of ETH to maintain the total value of all xETH plus the total value of all fETH equal to the value of the ETH reserve. This is the protocol's invariant.

Thus, each fETH and xETH is backed and can be exchanged for its equivalent value in ETH at any time.

In response to ETH price fluctuations, the protocol adjusts the price of fETH to reflect 10% of the variation in ETH price, while simultaneously adjusting the price of xETH to consistently maintain the protocol's invariant.

fETH: A Stablecoin?

The power of a stablecoin relies on three key factors:

-

Price volatility

-

Intrinsic risks (which should be low)

-

Liquidity (which should be deep)

In the case of fETH, price volatility is relatively low, as explained in the previous sections.

It is also important to note that the issuance of fETH does not affect its price.

Risks of centralization are avoided; the main risks would be related to smart contracts and the oracle.

The depth of liquidity could theoretically be high because the maximum quantity of fETH that could be issued at any given time is only limited by the fETH:xETH supply ratio.

In other words, is the supply of xETH sufficient to absorb the volatility of fETH supply?

The system was designed to make the leverage of xETH variable, thus allowing a relatively small amount of xETH to support a relatively large amount of fETH.

Therefore, the growth of fETH supply could theoretically be quite rapid and allow for significant liquidity depth.

fETH possesses the characteristics of a powerful stablecoin. However, can we classify it as a stablecoin?

In my opinion, it is still too early to consider this type of asset as a stablecoin. In the collective consciousness, something with a price that can fluctuate even slightly cannot be considered a stablecoin.

The term "pseudo-stablecoin" or "low-volatility asset" would be more appropriate.

xETH: A Perpetual Contract with No Funding Cost

As you've understood, xETH is the centerpiece of the system. It allows fETH to maintain low volatility and thus brings value to the ecosystem.

It is the equivalent of a variable leverage on ETH. It aims to be composable, with low liquidation risks and no funding costs. We will come back to this, but in certain cases, you may be incentivized to mint (create) it.

Its precise effective leverage varies over time based on the xETH:fETH supply ratio due to mints and redeems.

Simply put, if the supply of xETH is greater than that of fETH, the leverage effect will be low. The volatility captured by xETH is distributed over a larger number of tokens.

Conversely, a larger supply of fETH, concentrating volatility on a reduced number of xETH tokens, results in a higher effective leverage.

The question here is: How can we ensure sustained long-term demand for xETH regardless of market conditions?

The designers assume that the demand for long positions on ETH never disappears.

As illustrated in Figures 1 and 2: "The funding rate of ETH is practically never negative, and even when it does happen, the open interest is still so significant that there is evidently always demand for longs, even if they are not dominant (even briefly). Given this consistently demonstrated level of demand for longs, as well as the highly desirable characteristics of DeFi such as decentralization and composability, xETH will provide a powerful new tool in the trader's toolbox."

System Stability

Now that you understand how the system works and the specifics of its main assets, let's delve into how the system maintains stability.

Let's consider the entire system as a large CDP (Collateralized Debt Position):

-

Total CDP collateral = Total ETH reserve

-

Borrowed amount = Total fETH supply

-

Difference between total collateral and borrowed amount = Total xETH supply

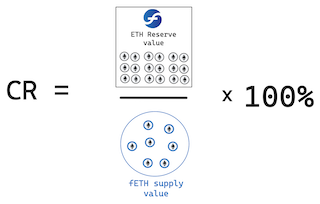

We can measure the health of the system using a Collateralization Ratio (CR).

Just like any CDP, it is necessary to maintain a CR above 100%, which means ensuring a sufficient supply of xETH.

The CR is calculated as the value of the ETH reserve divided by the value of the fETH supply, multiplied by 100%.

Changes in the supply, fETH price, and xETH price will impact the CR.

A CR of 100% would imply a price of xETH at 0 (equivalent to liquidation). This would result in the inability to maintain fETH's low volatility. At that point, fETH would experience 100% of ETH's volatility.

A CR of 100% is not a desirable state for the system, so a risk management module exists to prevent it.

Risk Management

The risk management module consists of four modes, each more powerful than the previous one.

Each mode is activated at a certain CR level, with increasingly smaller gaps between modes. Their purpose is to incentivize users to adopt specific behaviors to readjust the CR.

Each mode remains active until the CR has risen above its trigger level.

Level 1 - Stability Mode

When the CR is below 130%, the system enters Stability Mode:

-

Minting of fETH is disabled.

-

Redeem fees for fETH are set to 0%.

-

Redeem fees for xETH increase.

-

xETH minters receive stability fees paid by fETH holders.

Stability fees involve reallocating a portion of fETH collateral to the beneficiaries of these fees, resulting in a decrease in the price of fETH.

Level 2 - User Rebalancing Mode

When the CR is below 120%, the system enters User Rebalancing Mode:

- Users are incentivized to redeem fETH for ETH. The incentives are paid by fETH holders through stability fees. Redeemers receive slightly more than the value of their fETH during the exchange.

The design of this mode creates a barrier that is unlikely to be crossed. Arbitrageurs can execute the purchase of fETH and redeem for a greater value in ETH in a single block.

Level 3 - Protocol Rebalancing Mode

Below a CR of 114%, the system enters Protocol Rebalancing Mode:

-

Similar to Level 2, but in this case, the protocol rebalances itself using the reserve. It uses ETH from the reserve to buy fETH on the market, and then redeems it for a greater quantity of ETH. Stability fees are collected by the protocol.

Level 4 - Recapitalization

In the most extreme case, the protocol has the ability to issue governance tokens to raise ETH for recapitalization, either by minting xETH or by buying and redeeming fETH.

ETH Reserve

The reserve is "divided" into two parts, one to support fETH and the other to support xETH. The allocation of ETH from each part fluctuates with the price of ETH while respecting the protocol's invariant.

xETH Leverage

The change in xETH price over a given period will depend on the share of the reserve supporting fETH compared to the share supporting xETH in the previous period.

As you can see, as the share of the reserve allocated to fETH increases, xETH leverage increases as well, until triggering the different modes if an imbalance dangerous to the protocol occurs.

Protocol Fees

The protocol charges fees during fETH/xETH minting and redeeming. These are mint and redeem fees.

As mentioned earlier, when the risk management module is activated, stability fees may be collected directly from the portion of the reserve supporting fETH, which has an impact on its price.

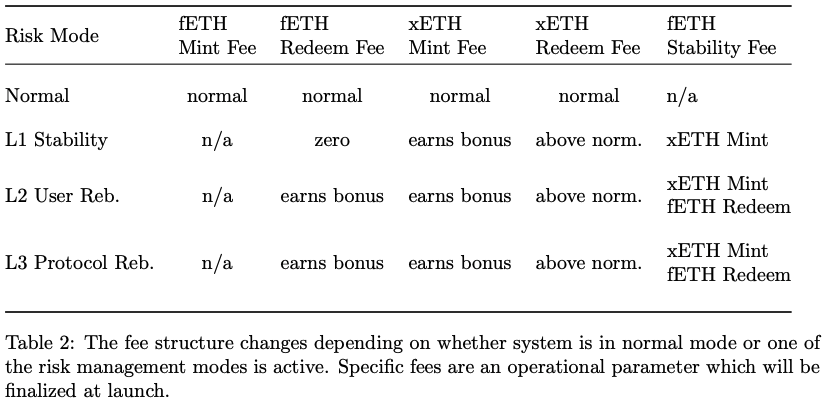

Here's a table summarizing when the fees are in effect:

The $FX Token

Simply put, $FX is the governance token of the protocol. It operates on a veToken model, meaning you can lock it for a variable duration. The longer the lockup period, the more veFX you will receive.

veFX allows you to vote on governance decisions and receive a portion of the protocol's generated revenue.

I suggest reading this article to learn more about it.

Conclusion

AladdinDAO's approach is very interesting. It disrupts the current stablecoin landscape by offering a decentralized model that integrates deeply into the Ethereum ecosystem.

At first glance, it may seem a bit complex, with different risks than those known to users of existing proposals, but it's worth exploring and understanding its mechanisms.

Ultimately, a pseudo-stablecoin pegged to ETH—could that be the new norm for a truly decentralized finance independent of the almighty dollar?

Find all of my achievements here.