Convergence

Ethena is on a mission to redefine internet-native money by creating a reward-generating, crypto-native synthetic dollar seamlessly integrated with DeFi and CeFi. In early 2024 the team launched USDe, a synthetic dollar designed to maintain its peg while generating crypto-native returns. Just twelve months later, its market cap surged to $6 billion, marking the fastest growth in DeFi history.

Ethena’s approach is simple but powerful: maintain delta-neutral positions on blue-chip cryptos through classic carry trade strategies, and combine CeFi-grade custody and liquidity with DeFi’s programmatic composability. The result is a synthetic digital dollar that not only delivers strong, uncorrelated returns but also paves the way for DeFi to mature into a globally accessible, institution-ready asset class.

Yet, this is only the beginning. The real challenge - and opportunity - lies in exporting crypto-native yields to TradFi users.

Internet-Native Yield at Scale

Ethena aims to bridge this gap, packaging USDe’s rewards into institutional-grade products, driving the convergence of DeFi, CeFi, and TradFi.

Why does Ethena’s yield stand out?

-

Crypto-native real yield, at scale. It combines perpetual‑funding rates with staking rewards—one of the few “real‑yield” combos that has proven it can handle multi‑billion‑dollar demand.

-

A hedge against TradFi rates. So far, funding rates and staking yields have shown a weak correlation to real world interest rates, giving portfolios a rare diversifier.

-

Custody that TradFi trusts. The collateral is held with reputable custodians, making the structure much easier for traditional desks to underwrite.

Ethena combines the scalability of crypto-native returns with institutional-grade infrastructure, making it a powerful new yield alternative for global allocators.

The Constraint: One-size-fits-all Yield

The one-size-fits-all approach of Ethena with sUSDe, while elegant and simple, is not ideal for many investors in both DeFi and TradFi for a few key reasons:

-

Lack of Risk Segmentation

- sUSDe bundles the yield into a single token but this doesn’t allow investors to separate risk and return preferences as conservative investors might want predictable, principal-protected yield while aggressive ones may want leveraged upside—but sUSDe treats them the same.

-

No Customization for Investment Mandates

- Institutional investors often have strict mandates—around risk limits, expected volatility, drawdown profiles, etc. but a single reward-bearing token doesn't allow them to align with those mandates or price risk independently.

-

TradFi Requires Tranching

- Traditional structured products (like bonds, MBS, CLOs) allow for senior and junior tranches—tailored exposure based on risk appetite but sUSDe, as a flat product, lacks that structured flexibility needed for proper portfolio construction in TradFi.

-

No Tailored Risk-Return Products

- From retail users to asset managers to DAO treasuries—each group has distinct risk-return preferences, and Ethena’s single product structure may not fully address the demand for more tailored, diversified offerings to serve a broader investor base.

The Opportunity: Structured Yield

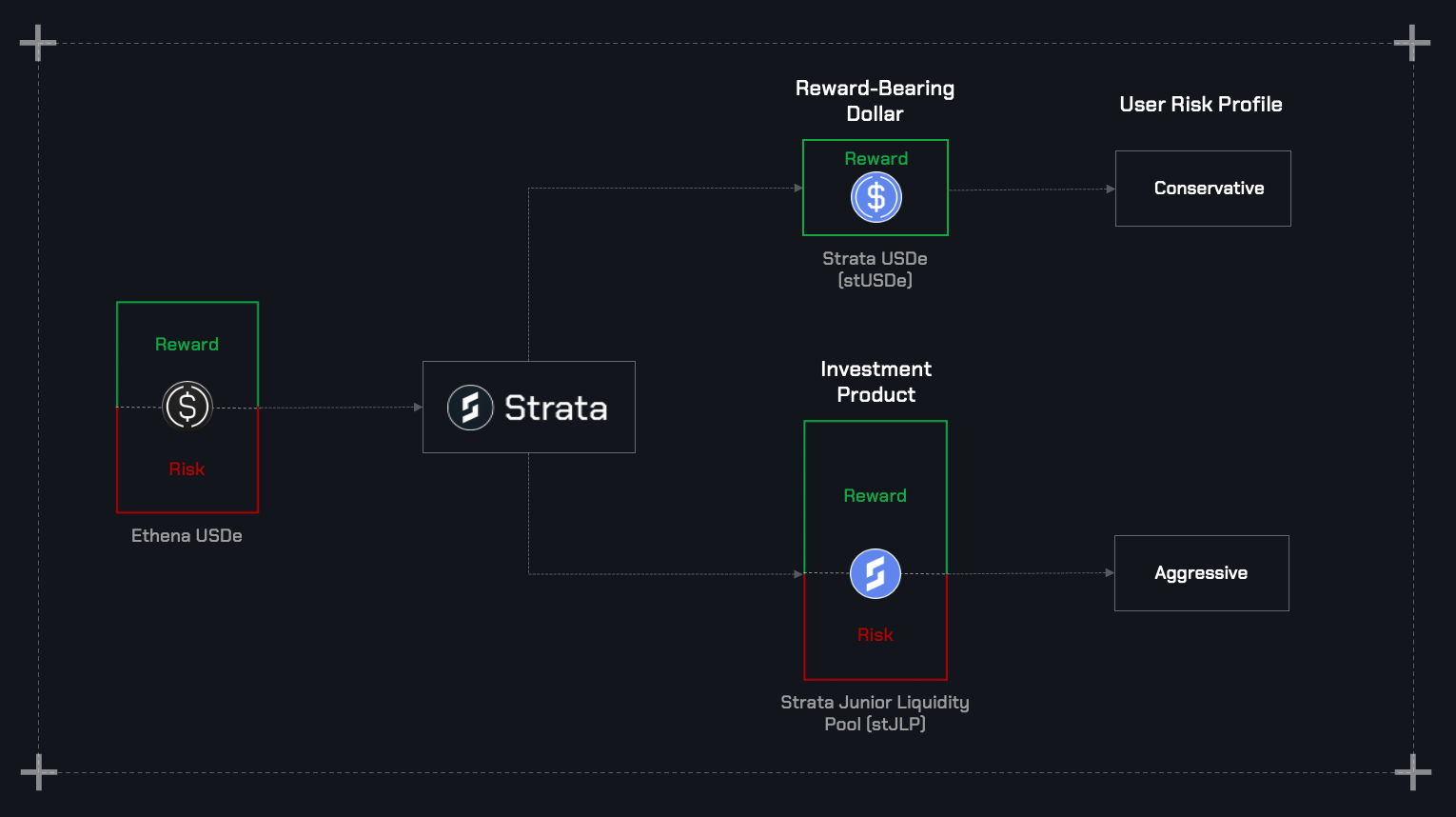

Strata was built to provide structured access to Ethena’s rewards by segmenting risk into distinct tranches, each tailored to match specific investor risk profiles and return expectations. By bringing Strata to Converge, we aim to redefine how internet-native yield is accessed, managed, and scaled across the Ethena ecosystem.

Enter Strata

Strata is a perpetual yield tranching protocol designed to provide structured exposure to USDe rewards and unlock the next phase of Ethena’s growth. By transforming sUSDe into risk-tiered tranches, allowing different types of investors to access yield based on their risk appetite, Strata is redefining how the internet-native yield is accessed, managed, and scaled.

Strata re-packages USDe rewards into two liquid, composable tokens: Strata USDe (stUSDe) and Strata Junior Liquidity Pool (stJLP). This dual-token design introduces a meaningful shift in risk management by splitting yield and risk exposure into distinct senior and junior tranches.

Structured Products: stUSDe and stJLP

Senior Tranche: Strata USDe (stUSDe)

stUSDe is a reward-bearing synthetic dollar fully backed by USDe, representing the Senior Yield Tranche. It offers superior risk-adjusted returns by providing uncapped upside exposure to Ethena's sUSDe APY, while ensuring a guaranteed minimum yield and principal protection for investors seeking low-risk and predictable yields in DeFi.

-

Principal-protected, predictable yield

-

Ideal for institutions, DAOs, and risk-averse investors

Junior Tranche: Strata Junior Liquidity Pool (stJLP)

stJLP represents the moderate-risk, higher-reward Junior Yield Tranche in Strata’s structure. It provides leveraged exposure to Ethena’s yield while simultaneously functioning as a liquid insurance pool for stUSDe. By absorbing excess risk and volatility associated with sUSDe, stJLP earns a risk premium from the senior tranche, delivering potentially higher yields for risk-tolerant investors.

-

Leveraged exposure to sUSDe APY

-

Ideal for DeFi-native power users, funds, and yield farmers seeking higher yields with slightly higher risk tolerance.

Internet-Native Yield, Redefined

-

Tailored Risk Exposure

- Conservative investors prioritize predictable, low‑risk returns, while risk-tolerant users seek higher-yield opportunities with greater upside.

-

Enhanced Risk-Return Pricing

- Splitting USDe rewards into senior and junior tranches enables real-time and transparent market-based pricing of risk and returns.

-

Capital-Efficient Access

- Both tranches are tokenized as fully permissionless and composable assets, enabling seamless integration across DeFi and CeFi. This design offers enhanced capital efficiency, flexibility, and broad accessibility for a wide range of users.

-

Accelerating Ethena’s Growth

- With USDe as the underlying collateral for both tranches, Strata draws liquidity from existing DeFi users while also attracting new capital from TradFi—driving increased demand for Ethena’s products and expanding its user base.

Strata x Ethena: Structured Finance Meets DeFi

Strata introduces programmable structured products to the Ethena and Converge ecosystem. It democratises access to tailored, risk-adjusted returns by unlocking a new class of investment products that were previously accessible only to institutions in TradFi. By merging traditional structured finance with DeFi’s programmability and composability, Strata offers enhanced risk-adjusted yields and capital efficiency, reinforcing USDe’s position as a core asset for scalable, programmable crypto-native returns in DeFi.

Join us as we build the next era of DeFi together with Ethena.