Ravioli Ravioli give me the formuoli

Introduction

Let’s cut right to it. The current payment landscape is a mess. Clunky systems, hidden fees, and slow transaction times are just the start of it. Amidst this, a new innovation has emerged that has the potential to change the game. Now, you might be thinking, "Stablecoins!"... however - like money, they are just another tool.

“People who buy and sell chips think about the price of chips, and people who operate data centers think about the cost of operations.”

In this quote from Jensen Huang, he is referring to the competitive moat created by NVIDIA. One in which that is not defined by the price of the product but instead defined by the superior data and software woven into every chip’s performance.

“…so good that even when the competitor's chips are free, it's not cheap enough”

While individual competitors chase marginal gains through price reductions, they fundamentally misunderstand the market's deeper dynamics. The real value isn't in creating the cheapest chip, but in developing the most comprehensive technological ecosystem. NVIDIA has positioned itself not as a mere hardware manufacturer, but as an indispensable solution provider that delivers unprecedented operational efficiency across the entire supply chain.

The broader technology market often falls into a trap of homogenization - a short-sighted race where price becomes the primary differentiator. This approach neglects the intricate layers of value that truly transform technological capabilities. By focusing solely on cost, competitors risk focusing on the minutiae at the expense of the main point, overlooking the sophisticated integration and performance optimization that set market leaders apart. NVDIA demonstrates that true technology leadership isn't about being the cheapest, but the most valuable.

Fundamentals (PFOF & Intents)

TLDR;

Payment for Order Flow (PFOF) is a model where brokers route their clients' trade orders to specific market makers or trading venues in exchange for payment. Instead of executing trades directly on public exchanges, brokers sell their order flow to third parties who then execute the trades. This approach has many benefits but ultimately leads to a conflict of interest between the three parties involved. Marketization of this mechanic, often referred to as open intent & solver protocols in DeFi - is an approach designed to combat the conflicting interest between the three parties involved in a successful transaction while amplifying the benefits derived from a PFOF model.

Overview:

Payment for Order Flow (PFOF) is utilized by companies like Robinhood, routing customer orders to market makers who compensate Robinhood for the business, typically at a fraction of a cent per share. This compensation allows Robinhood to offer zero-commission trading to its users.

Why would market makers do this? Information and money. It provides them with a steady stream of trades, which is crucial for their profitability and ability to act as market makers.

PFOF can lead to conflicts of interest, as brokers may prioritize directing orders to market makers that pay the highest compensation rather than ensuring the best execution prices for their customers.

How do Intents & Solvers help?

Adding an abstraction layer can help mitigate conflicts of interest by allowing users to negotiate with solvers for the best execution, as solvers compete to provide the highest returns within user-defined constraints. Intent-based approaches can lead to a more decentralized and competitive market for order execution.

While PFOF can concentrate order flow in the hands of a few entities, intent protocols aim to onboard more solvers, creating a more liquid and competitive ecosystem where users have more options and better execution outcomes.

The Role of Stablecoins

Stablecoins pegged to non-volatile assets like the US dollar, have gained significant attention as a potential solution to the volatility that often plagues digital assets. They promise to combine the benefits of digital currencies - such as speed and accessibility - with the stability of traditional fiat currencies.

Stablecoins are designed to mitigate the risks associated with price fluctuations, which can deter users from adopting volatile assets for everyday transactions. By providing a stable value, they enable users to transact without the fear of sudden losses. Stability is crucial for businesses that rely on predictable cash flow and pricing strategies. For instance, a company can price its goods in stablecoins, ensuring that the value remains consistent regardless of market volatility. Stablecoins make this possible, acting as a bridge between the traditional financial system and the digital economy. This capability is especially beneficial for small and medium-sized enterprises (SMEs) that may not have the resources to absorb the costs associated with currency fluctuations.

However, it’s crucial to understand that stablecoins themselves are not the end product. Instead, they serve as a tool within the broader payment orchestration framework. Their primary function is to provide stability in a volatile market, enabling faster settlement and more reliable transactions. This is particularly important in a global economy where cross-border payments can be fraught with delays and high fees.

The Broader Impact of Stablecoins

Additionally, stablecoins can play a pivotal role in the DeFi space, where they are often used as collateral or liquidity. These integrations into DeFi platforms further enhances their utility, allowing users to engage in complex financial transactions without relying on traditional banks. While stablecoins are a significant advancement, they are just one piece of the puzzle. To truly harness their potential, we need to look at how they fit into the larger picture.

CBDCs rebranded to Stablecoins?

What do I mean when I say “stablecoins are not the product” or CBDCs rebranded to stablecoins? Aside from the attention grabbing nature of the claim or question, regulation around the globe has started to kick in.

As we see more countries attempt to rely less on the US economy & US dollar for trade, it becomes the ultimate paradox. Stablecoins have enabled a more resilient, harder-to-disrupt form of dollar dominance.

“This is your basic mortgage bond, the originals were simple. They were just thousands of triple A mortgages bundled together guaranteed by the US government, the modern ones are different. They’re private - and they are made up of layers of tranches. The highest level triple As getting paid first, the lowest rated Bs getting paid last taking on the defaults first … and no one is paying attention.”

The Foreseen & Unforeseen

The Silicon Valley Bank (SVB) collapse in 2023 highlighted a critical weakness in stablecoin reserve systems. Circle's disclosure that $3.3 billion of its assets were trapped in the failing institution caused USDC to lose its dollar peg, sparking a frantic liquidation wave. This incident emphasized the inherent vulnerabilities unregulated stablecoin providers face when depending on conventional banking institutions for reserve management.

Money’s centralized & inflationary characteristics are typically viewed as a design flaw, the reality is alternative economic tools also have tradeoffs. Theres a fine line when classifying inherit design characteristics as either a flaw or feature.

Using money as an instrument to facilitate trade & denominate economic activity is the difference between world powers, developing & third world economies. “Over the past 100 years, the U.S. federal debt has increased from $395b in 1924, to 35.46T in 2024” - source

The emphasis here is not that stablecoins & dollars are bad. The emphasis is understanding how to build robust foundations & systems that leverage their unique characteristics. It’s important to remember with stablecoins, they are not the product… you are. In order to understand how we leverage this - it’s time to dive into the nuances of blockchains & AMMs.

Overloading Blockchains

Now that we understand stablecoins should just be tools in larger orchestration frameworks, here we will borrow this section from “Blockchains are bad (for execution)”, written by Josh, one of Aori’s Founders.

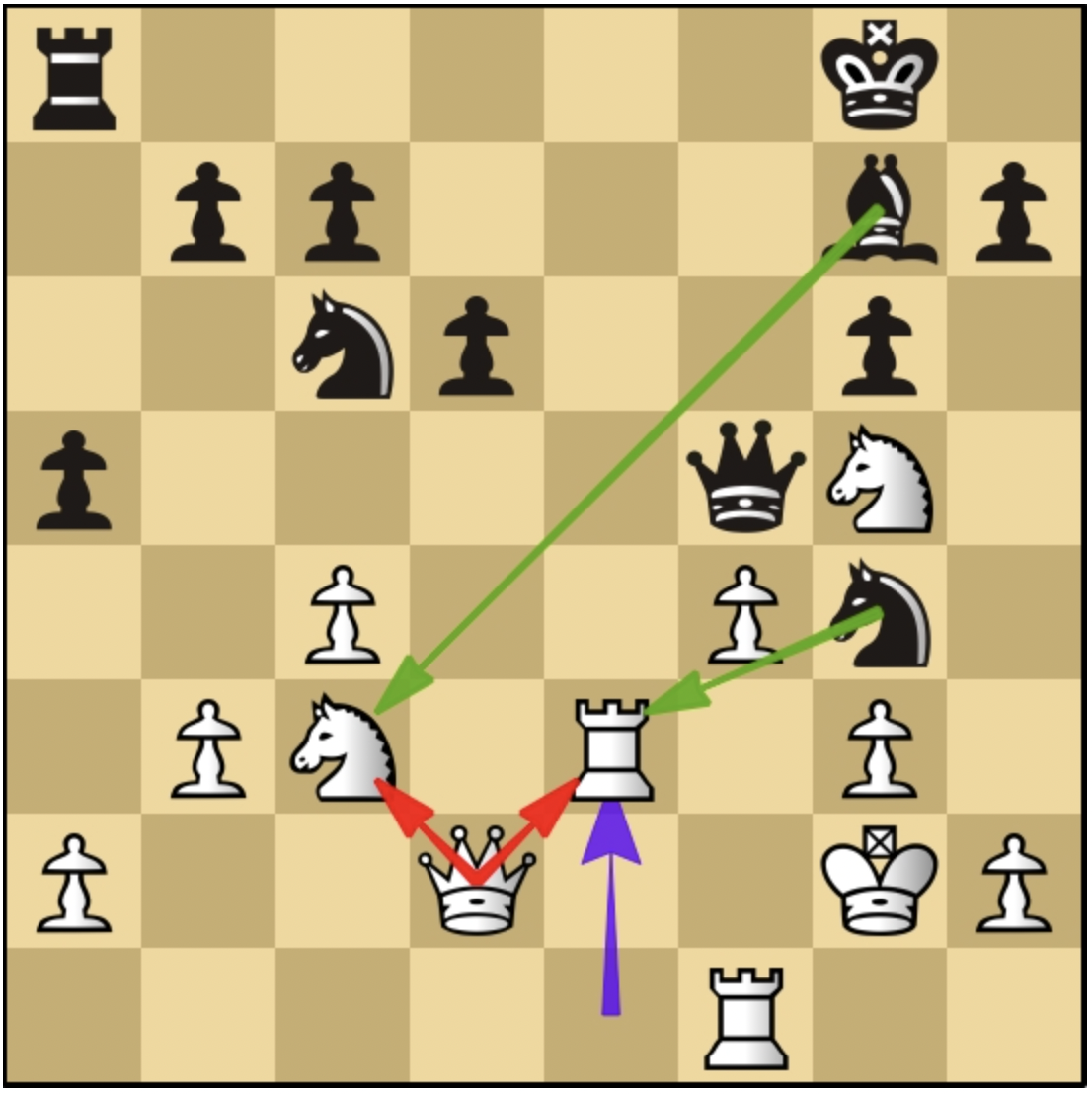

In the above diagram, the queen is both defending the rook, and the knight (highlighted with red arrows). The mistake the white player made was rook to e3 (purple), as that overloads his queen. Now, black can play the brilliancy Queen c2, which allows white to take the queen on c2, followed by white queen taking the black queen on c2, then the fork knight to e3, putting the king in check and winning back the queen on c2. Black wins a rook in this exchange.

This is known as “Overloading” a piece. The queen is trying to do two things at once, and thus cannot do either. Decentralized applications have done the same thing. They have tried over and over to include two components into their smart contracts, which thusly negates both:

-

Logic

-

Storage

Let’s look at an example with relation to AMM’s. Historically when a new asset class is created, sophisticated market makers and liquidity providers of all kinds take sometimes years to inoculate themselves and scale into said emerging markets. The AMM allows for a market to instantly have both a market maker, and guaranteed liquidity at the time of execution. It truly appears to be the solution to the problem of finding and sourcing liquidity all in one innovation!

However, this is not so. When we analyze the historical performance of AMM’s we see clearly that the announcing of the market making strategy (constant function, range bound liquidity, etc. etc), gives all other actors an informational edge to exploit. We then clearly see that the way market makers and LP’s in traditional finance make money is some asymptotic information or strategy, and that if they were to announce their strategy, the same thing that happens to AMM’s would happen to them.

This is a case of overloading, simply because:

-

The AMM appears to solve the problem both of finding a market maker, and being easy to deploy

-

External actors then can attack the pool through various strategies such as sandwiching, LVR, and others.

- end of excerpt

Open to everyone, Open to all.

This is where the concept of intent-based orchestration comes into play - a distinctive approach by implementing a scalable orchestration layer that utilizes an abundance of settlement layers. In harnessing multiple settlement layers, we can overcome the execution limitations often associated with traditional blockchains & payment networks. This orchestration layer not only streamlines the payment process but also facilitates interoperability between diverse networks, ensuring that transactions can be executed swiftly and reliably.

So, what exactly is intent-based orchestration? At its core, it refers to the systematic coordination of various payment origins to create a seamless transaction experience. Think of it as a conductor leading an orchestra, ensuring that every instrument plays in harmony. In the context of payments, this means unifying settlement layers into a single development experience, abstracting away the complexities of infrastructure. This allows developers to easily access users, state, and settlement across both major blockchains and traditional banking networks. When stablecoins are integrated into this orchestrated framework, they enhance the overall transaction capabilities.

One blockchain to rule them all?

No. Intent-based orchestration is about leveraging blockchain as a guardrail for moving money - settlement on blockchains & banking networks alike. Fundamentally, blockchains are a way for us to reduce systemic risk within the current financial markets by decentralizing these systems. If we view blockchain not as a replacement for existing financial infrastructure, but as a complementary layer of transparency and risk mitigation, we can transform how financial transactions are secured and validated.

The goal is not technological dominance, but rather technological collaboration - using blockchain as a strategic layer that adds reliability, transparency, and efficiency to our existing financial infrastructure.

When looking more closely at the excerpt above from “Blockchains are bad (for execution)”, we can examine in analogy the flaws associated with truly decentralized blockchains. Amongst this, we also identify the flaws associated with payments in relation to overloading. Think about payments today:

-

Bank A can't easily send money to Blockchain B

-

Blockchain B can't easily interact with Blockchain C

-

Bank D can't efficiently settle with either

Each payment rail is its own siloed network, with bridges (blockchain bridges, SWIFT, etc ) that are expensive, slow, and often unreliable.

Intent-based orchestration is about not overloading the settlement layer with the execution layer (not overloading the queen with the rook):

Settlement Layer Independence

-

Each network (blockchain or traditional) maintains its own settlement process

-

No need to force interoperability at the base layer

-

Banks keep being banks, blockchains keep being blockchains

Unified Execution Layer

-

One standardized layer for processing transactions

-

Handles routing across ALL networks

-

Universal translator for money movement

Example: When you use a payment app that connects to banks, you don't care how the money moves behind the scenes. You just want it to work. That's what intent-based orchestration does, but across ALL financial networks. The magic happens because:

-

Execution is separated from settlement

-

Each network can use its native settlement mechanisms

-

The orchestration layer handles the complexity of routing

-

Stablecoins serve as efficient bridges when needed

This solves the interoperability problem without forcing networks to change their fundamental nature. Banks don't need to become blockchains. Blockchains don't need to become banks. Each can excel at what they do best. The Result? Fast execution across any network, secure settlement on each native layer, no more island problem, & true financial interoperability.

This is where intents and solvers become crucial to the orchestration story. Instead of introducing yet another blockchain trying to be the "one chain to rule them all" (we've seen how that story ends), protocol layer orchestration leverages intent-based architecture to create a more efficient market for execution. Just as PFOF evolved into open intent protocols in DeFi, payment orchestration evolves ALL payment rails into a solver-based ecosystem.

When you want to send money from your bank to someone's wallet, you don't care about the underlying mechanics. Your intent is simple: "Move X value from A to B." The solver network can then compete to execute this intent in the most efficient way possible, whether that means:

-

Direct settlement on a blockchain w/ or w/o conversion, bridging, etc

-

Bank-to-bank transfer

-

A combination of routes using stablecoins as bridges

-

Or even novel pathways we haven't discovered yet

This approach solves the overloading problem we discussed earlier. Instead of forcing a single system (like a blockchain or an AMM) to handle everything, we're creating a market for execution while letting settlement layers do what they do best. Solvers can specialize, compete, and innovate without compromising the security and reliability of the underlying settlement networks. The result? Payments that are as fast as centralized finance, as secure as decentralized finance, as convenient as G7 finance markets, and more efficient than all three combined.

This isn't about building another blockchain or payment network – it's about building the connectivity that makes all existing financial infrastructure work better together.

What this means for the world

"Take control of their margins by commoditizing their payment order flow with bindpay."

Let's unpack what this actually means:

When businesses process payments today, they typically rely on a broken system that charges absurd fees. These businesses have little negotiating power and no way to create competition for their payment volume.

By commoditizing payment order flow, businesses can:

-

Create competition for their payment volume among multiple solvers

-

Capture more value from each transaction by reducing intermediary fees

-

Access more payment rails without increasing integration complexity

However, this approach does introduce new considerations:

-

Dependency on solver networks for reliable execution

-

Potential customer questions about how their payment data is being used

-

New monitoring requirements to ensure optimal execution

The key difference from traditional PFOF is that businesses maintain control over how their payment flow is monetized, rather than surrendering that value to a single intermediary. This shifts the power dynamic in favor of the business while potentially reducing costs for end users.

Distinguishing PFOF from MEV

It's worth addressing a potential confusion: if PFOF is presented as beneficial, why are similar MEV activities in DeFi often framed as "attacks"?

The key difference lies in transparency, consent, and value distribution:

1. In traditional PFOF, users knowingly trade with better rates in exchange for their order flow being sold — there's an explicit value exchange.

2. In many MEV scenarios, value is extracted without user consent or compensation —users often don't realize they're paying an invisible tax.

Intent-based orchestration aims to bring the benefits of PFOF (efficient execution) while addressing its drawbacks (conflicts of interest) and the problems of MEV (lack of user compensation). By creating an open market for execution where solvers compete, users can capture more of the value that would otherwise be extracted.

This doesn't eliminate all forms of value extraction - solvers still need economic incentives - but it creates a more transparent, competitive market where users have greater agency and receive more value.

Challenges and Limitations of Intent-Based Orchestration

While intent-based orchestration offers significant advantages, as anything - it's not without challenges and potential downsides:

1. Solver Centralization Risk: As with many markets, there's a risk that a few dominant solvers could emerge, potentially recreating the centralization problems we're trying to solve. Without proper incentives for solver diversity, we could end up with an oligopoly that captures most of the value.

2. Complexity Trade-offs: While we aim to abstract complexity away from users, that complexity doesn't disappear - it moves to the solver layer. This creates new technical challenges in ensuring reliable, consistent execution across diverse networks.

3. Regulatory Uncertainty: As intent-based systems blur the lines between traditional finance and DeFi, they may face novel regulatory challenges that could impact their development and adoption.

5. Economic Sustainability: The long-term economic sustainability of solver networks depends on finding the right balance of incentives that rewards efficient execution without extracting excessive value from users.

These challenges don't negate the potential of intent-based orchestration, but they do require thoughtful design and ongoing refinement as these systems evolve.

Concluding Thoughts

Stablecoins, fiat, banking networks, and blockchains are all tools in a larger orchestration framework, each playing a part in a more harmonious system.

It’s important to understand the role of each stakeholder in the systems we design.

For Developers: Intent-based orchestration offers a path to reclaim control over your payment flows and reduce costs without sacrificing reliability. This isn't just about adopting new technology - it's about fundamentally rethinking your relationship with payment infrastructure.

For Businesses & Users: Demand transparency in how your financial data and intents are being used. The systems that serve you should compete for your business, not extract hidden value from your transactions.

I'm actively working with teams building the next generation of payments. If you're:

-

Building payment solutions and looking to reduce costs

-

Developing intent-based systems and facing technical challenges

-

Interested in exploring how these concepts apply to your business

Shoot me a DM on X or LinkedIn or set up a time to chat through our website.

Valued Sources I have learned from along the way

Understanding Basic Solver Economics: Take a dated approach to understanding if not familiar, just some blogs I personally enjoyed reading.

Context: Intents & Solvers = Marketized Payment For Order Flow

Q4: 2023: CoW Swap: Intents MEV & Batch Auctions

Q1 2024: Frontier Tech: CAKE Framework

Q3 2024: LiFi blog: With Intents, It’s Solvers All the Way Down

Q3 2024: Josh from Aori: Blockchains are bad (for execution)

Q4 2024: Josh from Aori: Tinker Tailor Soldier …. Solver

Q1 2025: Off-Chain Labs: Universal Intents Engine