The cryptocurrency market is a relatively free market compared to stock market, Defi provides liquidity for cryptocurrencies, and mainstream NFTs rely on platforms such as Opensea, MagicEden, etc. to achieve a certain degree of liquidity. But there are many things that are poorly or not liquid in the crypto world, such as LP tokens and long-tail assets. How to make these assets liquid or increase their capital efficiency is a big problem, and Pawnfi has come up with its own solution to this dilemma.

Introduction

Non-Standard Assets

With the development of the blockchain industry, more and more types of assets different from traditional tokens are created. As one of them, NFT is deeply loved by crypto fans. The Pawnfi protocol proposed the concept of Non-Standard Assets (NSA), the most representative of which include:

1. Non-Fungible Tokens (NFT), such as tokenized gaming assets, artworks, collectibles, hashrate, etc.

2. Liquidity Provider Tokens (LP tokens)

3. Fungible tokens with relatively small liquidity, such as Altcoins

4. Alternatives, such as tokenized insurance, bonds, bills, derivatives, etc.

5. Other long-tail assets, such as tokenized physical assets

At present, the market size of NSA is much larger than that of NFT, and with the development of the market, the market size of NSA will also be much larger than that of standardized tokens.

The First Lending & Leasing Marketplace for NSA

Pawnfi is the first one-stop pawn (collateralized loan), lease and resale marketplace for non-standard assets, providing appraisal, liquidity and use case for NSA.

In traditional financial markets, asset ownership, use rights, and earning rights are often differentiated into one product. For example, in real estate, the owner of the house has asset ownership, the tenant has use rights, and the earning rights belong to the real estate agent. In the blockchain industry, trading protocols or lending protocols can provide liquidity and increase capital efficiency, but it is difficult to divide these rights. However, Pawnfi can implement these functions of traditional financial markets on the blockchain. It means that based on Pawnfi asset holders can simultaneously acquire cash flow such as loan fund (via Pawn), rental income (via Lease), mining rewards (via Sync Mining) without losing the asset ownership.

For non-standard assets (NSA), its characteristics determine that the transactions of NSA are less frequent than standard assets, so the best way to increase capital efficiency is collateral lending. However, Peer-to-Peer collateral lending do not greatly promote the release of the value of non-standard assets for the difficulty to match and high interest rates in the market. Pawnfi proposes three different approaches for collateralized loan in Pawnfi based on target groups, market size, and risk levels:

1. Crowd-Lending approach for assets with comparatively lower turnover rates;

2. Automatic Pool-Lending approach for assets with high turnover rates;

3. Fast Loan approach to balance between the needs for efficiency and risks of the accommodation of all types of assets.

How it works

One of its most fundamental functions is similar to the lending protocol, when the borrower (asset holder) can initiate a collateral loan in Pawnfi, lock the NFT in the protocol, obtain the money from the above three methods and will pay interest for the loan.

Apart from that, the borrower can choose to lease his assets when he initiates a collateral loan contract, so that he can obtain benefits by transferring the use rights while retaining ownership of the assets. People who borrow assets in the market are the lessee. They may be reluctant to buy some assets because of concerns about liquidity or the risk of price fluctuations, but they need these assets to realize some utility or earn the money. Therefore they can pay a deposit (the target selling price plus haircut) in Pawnfi, and then lend out the assets they need and pay the interest.

Pawnfi also supports selling, when an asset holder initiates a pawn (collateralized loan) contract, they can simultaneously choose whether enable the asset available for sale as well. For some NSAs, the asset holders prefer to sell the assets to obtain greater cash flow than pawning or leasing, which are less-than-ideal alternative method for them. Therefore, sale of collateral assets is not only the way of realizing gains in Pawnfi, but also an innovative approach to do asset settlement .

This is why we call pawnfi the one-stop pawn (collateralized loan), lease and resale marketplace for non-standard assets. By integrating the pawn module, lease module and resale module into one dapp, asset holders, the lessee and buyer can enjoy a complete ecosystem experience with promoted liquidity of NSA.

The Independent Appraisal Module

Pawnfi's Appraisal is an independent module that indicates the collateral value for rare NFT types or long-tail assets. The Pawnfi appraisal module will provide the collateral value of the asset, which is usually the "floor price" rather than the "reasonable selling price". And under lease and resale module mentioned above, the price of the asset is usually the "ceiling price".

By integrating the functions of pawning, leasing and selling on one platform, Pawnfi can limit the price of assets to the fair value of NSA as collateral and the lease price of NSA (out of resale target price), which is the true range of NSA.

The Independent Appraisal Module requires appraisers to participate. According to Pawnfi protocol, the anti-cheating mechanism will be updated, and this module is still under constant development and improvement.

Risk control and Liquidation.

The gap between collateral value and lease price forms a natural buffer zone that ensures funds security. The design of the Pawnfi mechanism makes the lessee have a huge default cost, thus prompting both parties to abide by the terms.

For the the borrower (asset holder):

1. Low sunk cost compared to asset value (because the collateral asset are relatively undervalued by appraisers/ lenders to form an over-collateralization).

2. After default, the collateral asset will first be liquidated via auction among appraisers/ lenders of this Pawn contract. Appraisers/ lenders would have the first priority to get the asset at a decent price to get excess returns.

3. If none of the appraisers/ lenders purchase the collateral assets, the assets will be sold on Pawnfi and other partner platforms at the same time. The selling proceeds will be distributed to appraisers/ lenders and borrower proportionally.

For the lessee:

1. Low sunk cost compared to asset value (because the requested deposit is embedded with target selling price and perceived haircut ).

2. When default happens, it is in analogous to asset holder selling the asset to lessee at a price higher than target selling price, which mitigates the risks of other participants.

3. Lessee’s deposit will be settled among lessor and lenders (if lessor at the same time initiated a Pawn contract for unreturned asset).

Investors and Partners

In October 2021, Pawnfi was included in CoinList Seed 2021 batch, a virtual demo day for crypto founders to connect with the qualified investors on CoinList. CoinList Seed focuses on early-stage crypto startups that are looking to raise their first rounds of funding. Joining CoinList Seed represents this project has attracted market attention at its initial stage and brings Pawnfi the opportunity to cooperate with multiple elite investment institutions.

In November 2021, Pawnfi announced the completion of a $3M strategic financing. This strategic round was led by Digital Currency Group (DCG) and followed by Animoca Brands, Dapper Labs, Polygon, DeFi Alliance, Hashkey Capital, Everest Venture Group, SNZ and 6Block.

Pawnfi is a multi-chain pawning, selling and leasing platform. There are many versions of Pawnfi, of which the EVM version supports ETH, BSC, Polygon, Arbitrum, and Moonbeam chains, and the project will also be integrated on the Flow chain and other chains. Pawnfi will bring huge changes to the NSA ecosystem on these chains.

In December 2021, Pawnfi announced the partnership with Biconomy for providing a seamless multi-chain transaction experience and injecting more possibilities into non-standard assets (NSAs).

Biconomy is a multi-chain relay protocol that simplifies end-user on-chain transactions. It provides a quick and easy way for dApps to rescue users from complex processes. Its core products include Mexa, Forward, and Hyphen, which are easily accessible through APIs and SDKs. Mexa brings users gasless transactions, Forward enables users to pay transactions fees using ERC-20 tokens, while Hyphen is for instant cross-chain transfers.

It's a win-win cooperation for both Pawnfi and Biconomy. Pawnfi’s optimal business module and the edge in the scale of assets will entitle Hyphen to more volume on NFT & DeFi assets with a wider range of users from the Pawnfi community. And Pawnfi users make seamless cross-chain transactions with reduced gas fees due to the intergration with Biconomy.

Community Activities

Public Beta Testing

The first test version of Pawnfi was launched in 2020 and Pawnfi has run the closed Beta Testing to many investors, GameFi partners and NFT KOLs. In September 2021, Pawnfi launched Public Beta Testing, which is will be finalizing soon.

Anyone wants to participate in the public beta can fill out the application form and meet its conditions for a chance to become PawnCrafters. While for NFT KOLs, veteran players and crypto influencers, they can email pr@pawnfi.com directly to receive the qualifications to become PawnCrafters.

Join in the beta and become one of the first batch of PawnCrafters will be rewarded with exclusive Pawnfi NFT and valuable Airdrops!

Link: https://forms.gle/UPBd3UgPJ8FBehJz7

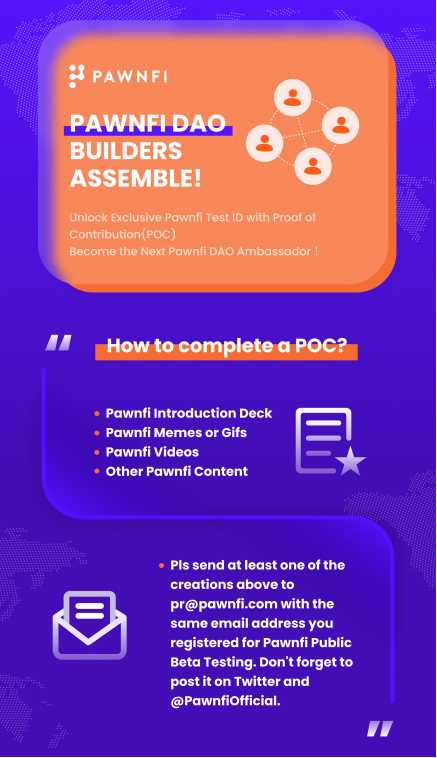

Pawnfi DAO Ambassadors

Pawnfi recently hosted an Pawnfi DAO Ambassadors activity where community members can get the Test ID through Proof of Contribution (POC). Different types of contributions all have access to the Test ID, including:

1. Pawnfi Introduction Deck

2. Pawnfi Memes or Gifs

3. Pawnfi Videos

4. Other Original Content about #Pawnfi

After finishing the work, you need to email the content to pr@pawnfi.com with the same email address registered for Pawnfi Public Beta Testing, and then post it on Twitter and @PawnfiOfficial.

Contact Details

Up to now, Pawnfi has 27,000 followers on Twitter, 15000 fans on Telegram and 8,000 community members on Discord. Follow Pawnfi's Twitter and join the Telegram and Discord for the latest announcement and communicating with community members.

Reference:

Introducing Pawnfi.com, a Ready-to-launch Lending and Leasing Marketplace for Non-standard Assets

Pawnfi.com is in favor with CoinList Seed 2021 batch

Pawnfi.com Raises $3M to Launch the First Liquidity Protocol for Non-Standard Assets

Pawnfi.com Partners with Biconomy to Advance the Liquidity of Non-Standard Assets