What is Retention?

User retention refers to the ongoing utilization of a product or feature. To assess overall retention, it is crucial to establish clear criteria for what constitutes user engagement, such as logging in, accessing a specific page, or performing essential actions. When measuring the retention of a particular feature, it is helpful to consider individuals who have used it at least once. The metrics used in this analysis aim to determine if the feature successfully retains these users. User retention is a reliable and unbiased measure of user behavior, making it a trustworthy and valid indicator.

Introduction

Cohort analysis is a powerful tool for measuring user retention by categorizing data into groups with shared characteristics before conducting analysis. It helps organizations isolate, analyze, and identify patterns in the user lifecycle, ultimately improving user retention and gaining a deeper understanding of user behavior within specific cohorts.

To better illustrate how cohort analysis works, let's consider an example from Bill Su:

Imagine you have a customer named Bob who discovered your online store four months ago when you offered a 50% discount. Bob browsed through your products and purchased a small trial set of avocado cosmetics [1].

As a business owner, you naturally wonder if customers like Bob return to your store as a result of their initial trial set purchase. To answer this question, you instruct your store attendant (named "Cookie") to track the behavior of customers similar to Bob and monitor whether they come back and make subsequent purchases, as well as the frequency of their returns.

In this scenario, the group of customers attracted by the 50% discount, including Bob, forms a cohort. The objective is to analyze whether these customers continue to revisit the store on a monthly basis.

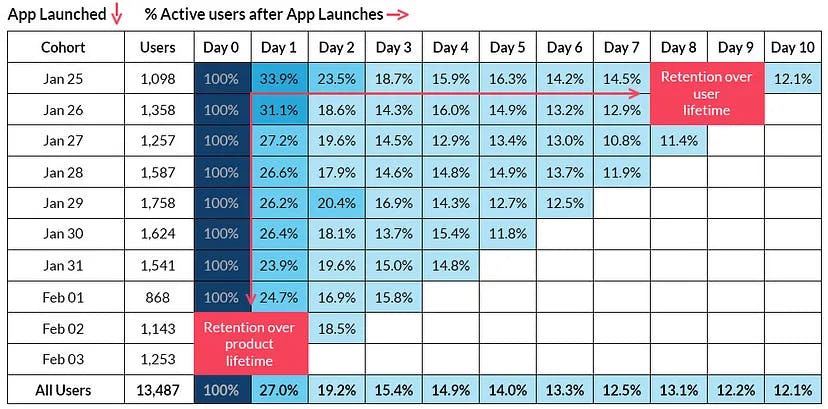

Here's a real-world example of how cohort analysis can be used: Suppose you have an app, and you want to measure the number of users who initially launch the app and then revisit it within the next 10 days. By employing cohort analysis, you can track and analyze this specific behavior to gain insights into user retention and engagement patterns.

Cohort analysis enables businesses to assess the effectiveness of various acquisition strategies, evaluate the impact of specific events or promotions on user behavior, and make data-driven decisions to optimize user retention efforts.

From the above retention table — Triangular chart, we can infer the following

-

1358 users launched an app on Jan 26. Day 1 retention was 31.1%, day 7 retention was 12.9%, and day 9 retention was 11.3%. So on the 7th day after using the app, 1 in 8 users who launched an app on Jan 26 were still active users on the app.

-

Out of all of the new users during this time range (13,487 users), 27% users are retained on day 1, 12.5% on day 7, and 12.1% on day 10.

Cohort Analysis in Blockchains

The blockchain industry boasts an abundance of blockchains and decentralized applications (dApps). Nowadays, with the prevalence of EVM compatible Layer 1 (L1) blockchains, one can observe the widespread deployment of similar dApps across multiple platforms. Consequently, the growth of an L1 blockchain is contingent not only upon attracting users but also on their sustained retention month after month. To achieve continuous expansion and success, L1 blockchains must prioritize strategies that focus on retaining users throughout extended periods.

Methodology

What is a cohort? — In this analysis, I’m considering the users who joined in a particular month (i.e. the month in which the first transaction was done) as part of the same cohort. Then, I calculate how many of these users are transacting again in the next months.

What does the cohort size show? — The cohort size for each month shows how many new users joined that L1 in that month.

How to read the tables? — To read the tables, start with the month name in the “Cohort” column and then add the month number in the “Month 1, 2, 3 …” columns. E.g. Cohort of April ‘22 will have June ’22 as Month 2.

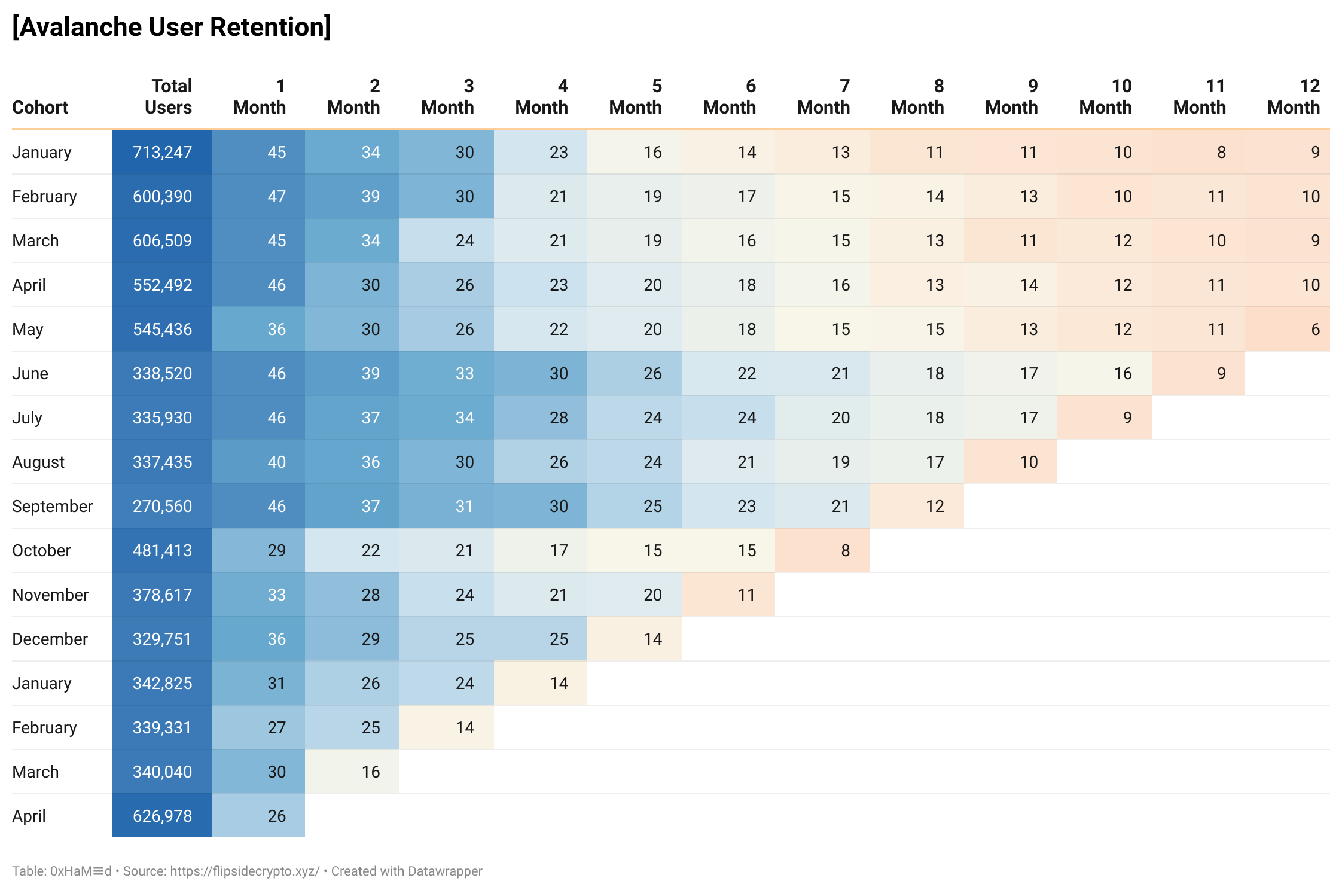

Avalanche

Let's dive into the data for Avalanche, specifically focusing on the period starting from January 2022, as captured in Flipside's tables.

-

In January, an analysis reveals that 45% of the users from that cohort continued to use Avalanche in February. However, as we progress beyond February, the retention rate experiences a decline, dropping to 34%. This downward trend persists, and by the end of 12 months, only 9% of the initial users from January remain actively engaged with the platform.

-

Shifting our attention to the February cohort, we observe a similar pattern. Only 47% of the users from this cohort were retained in the subsequent month, with the retention rate dwindling to a mere 10% after 12 months.

These findings highlight a significant decrease in user retention for both cohorts as time progresses.

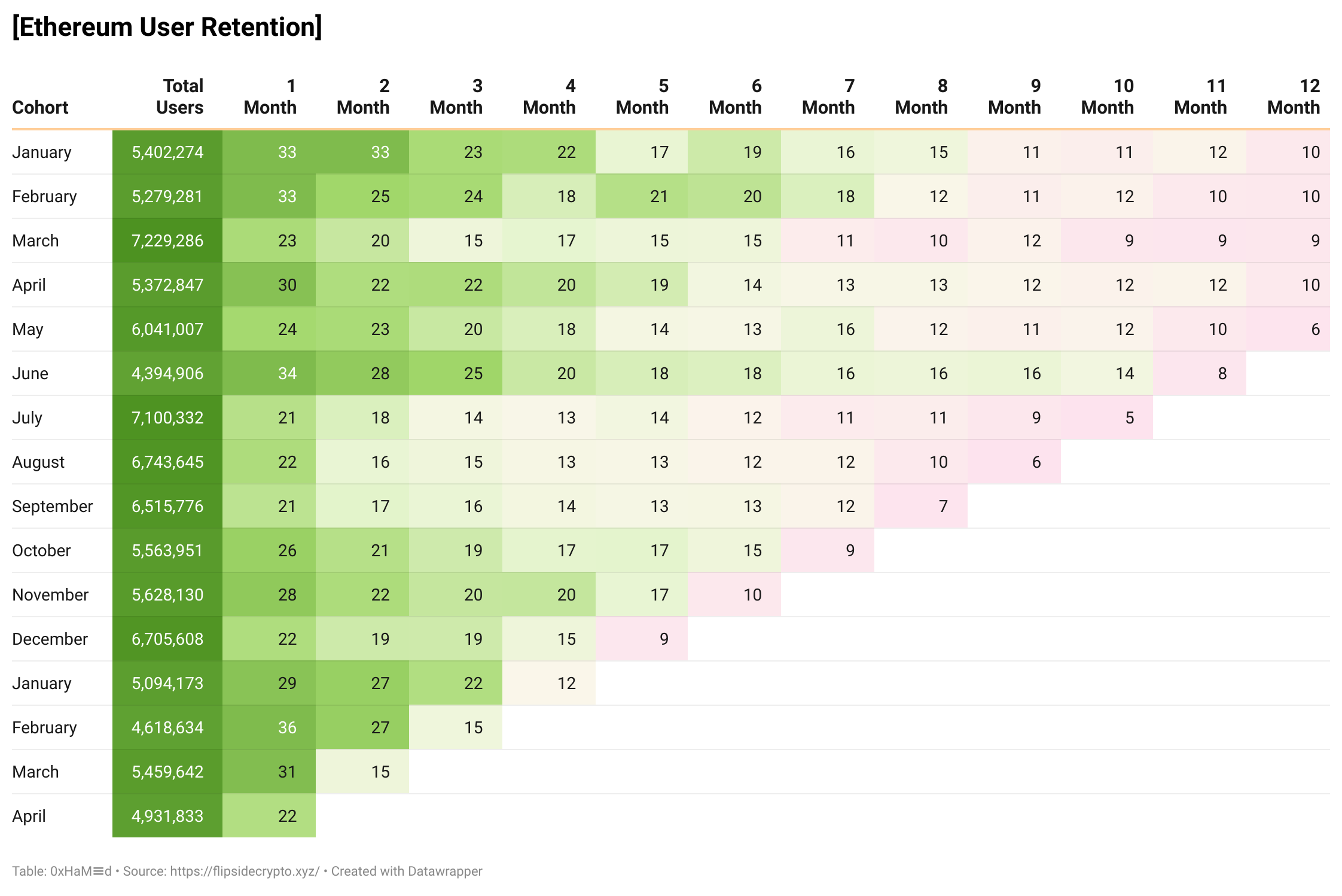

Ethereum

Let's shift our focus to Ethereum and explore a similar time period as we did with Avalanche.

-

The January cohort stands out as the largest, comprising 5.4 million wallets. Over the course of 12 months, the cohort remains relatively stable, with approximately 5.1 million wallets still active from the January cohort.

-

When it comes to retention rates, Ethereum demonstrates a lower level compared to Avalanche. In the first two months, only 33% of the January and February cohorts are retained. By the sixth month, the retention rate drops to nearly 19%, and after 12 months, it reaches 10%.

-

As we examine the March cohort, the retention rate declines further to 12% in the ninth month and eventually settles in the high single digits in the subsequent months.

While Ethereum's initial retention is a little lower compared to Avalanche, the retention levels after 12 months are surprisingly similar. This suggests that Ethereum faces challenges in retaining users over the long term and may need to focus on strategies to improve user engagement and retention beyond the initial months.

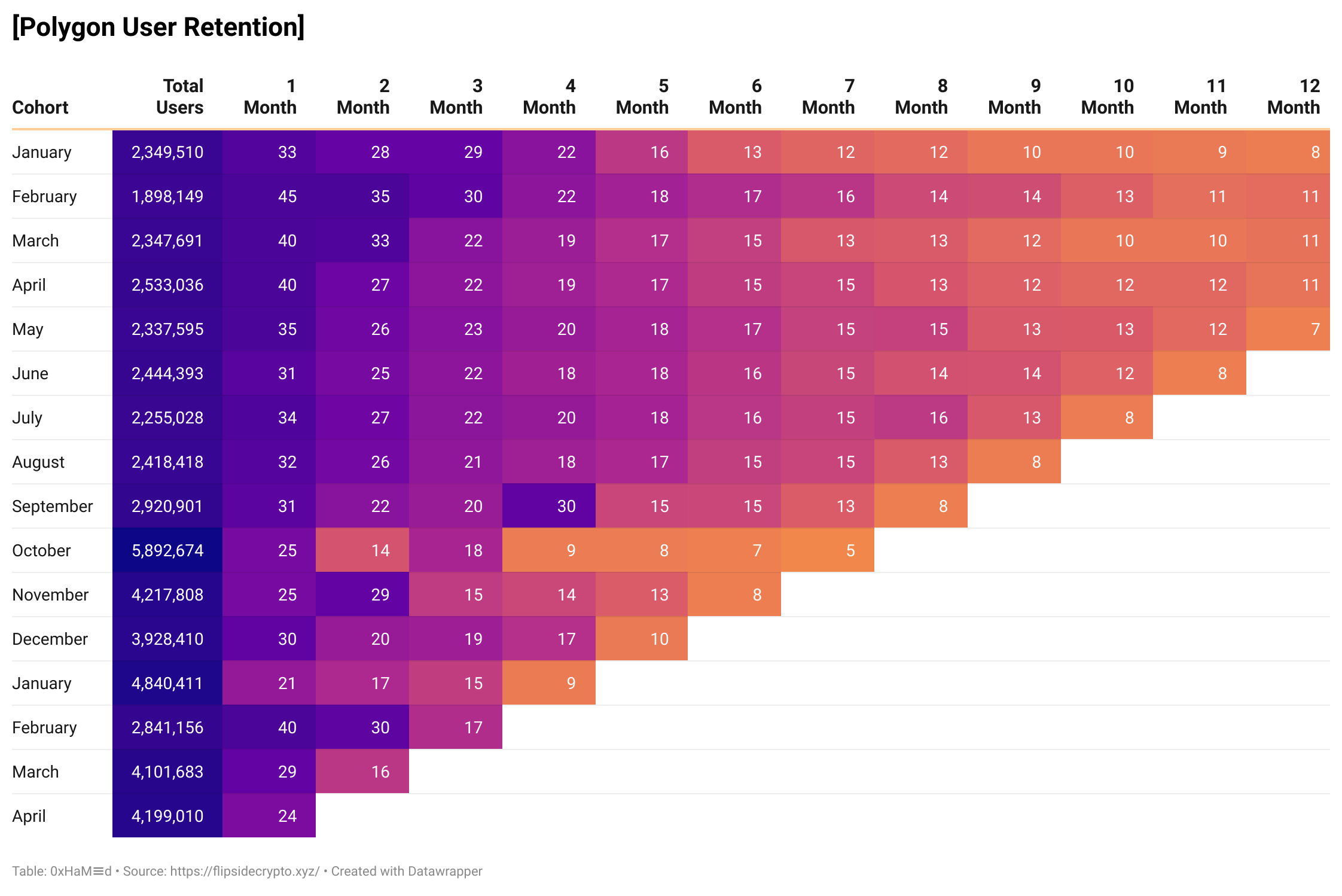

Polygon

Now let's turn our attention to Polygon and examine the same time period starting from 2022. As we analyze the data, several noteworthy observations emerge:

-

In the cohort table's first row, we notice that the monthly cohort sizes for Polygon are considerably smaller compared to Ethereum.

-

However, what stands out is the significantly higher user retention for Polygon in the subsequent months. For instance, in the second month, the retention rate for the February '22 cohort is 45%, surpassing both Avalanche's 47% and Ethereum's 33%. Moreover, the retention rate from February to March is nearly twice as high as Ethereum's and slightly lower than Avalanche's, demonstrating a strong retention trend.

These findings indicate that while the initial cohort sizes for Polygon may be smaller than Ethereum, Polygon exhibits higher user retention rates in the following months. This suggests a potentially more engaged and loyal user base on the Polygon network, which could be attributed to factors such as improved user experience, unique features, or targeted user acquisition strategies.

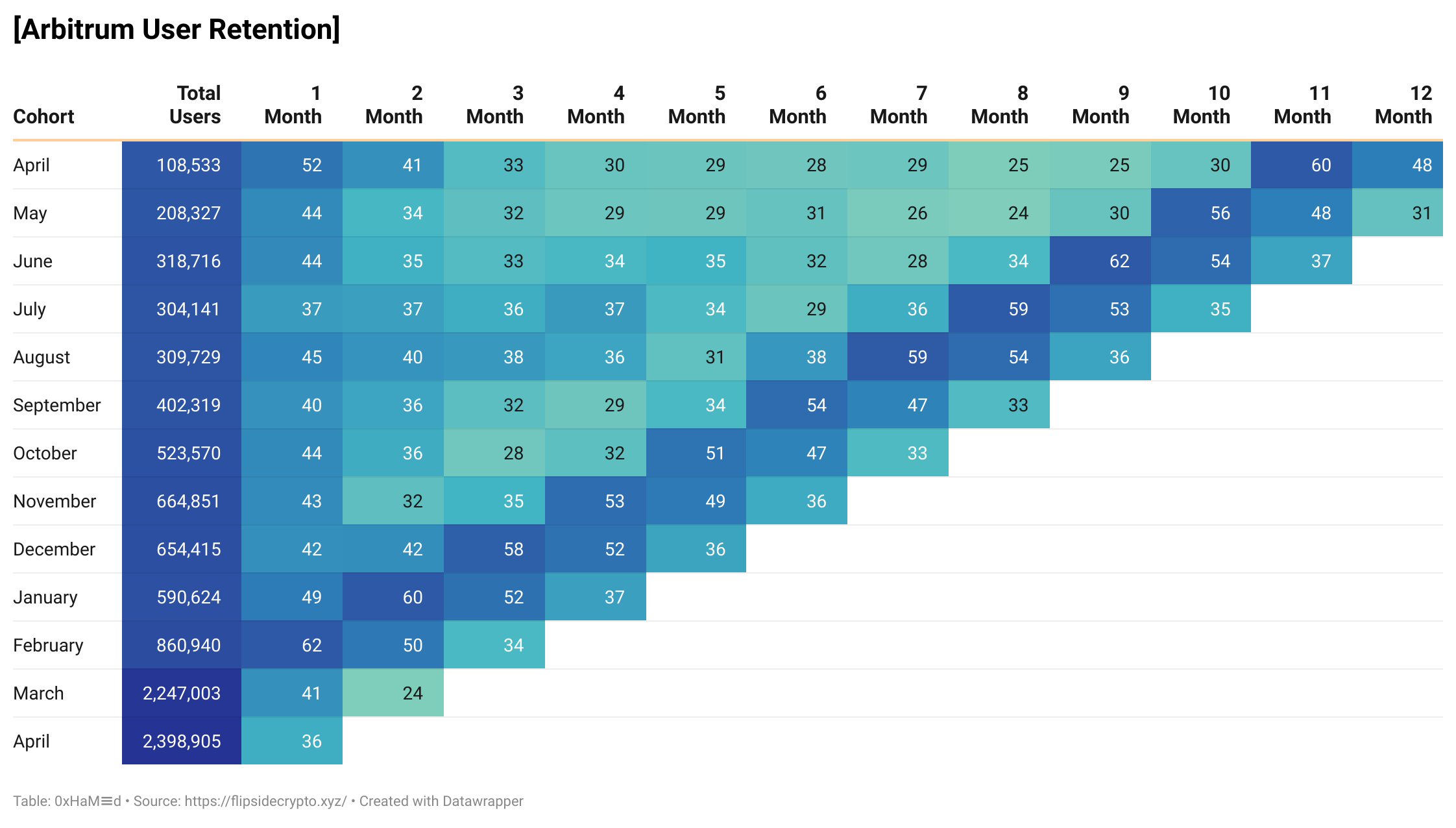

Arbitrum

Arbitrum stands out as another blockchain network that exhibits higher user retention rates compared to Avalanche and the other assessed chains. This elevated retention can be attributed to a few factors, such as lower gas fees and the presence of an airdrop, which likely contribute to the increased user engagement and loyalty.

-

For instance, in the first month, Arbitrum showcases a 52% retention rate for the January '22 cohort, surpassing both Avalanche's 47% and Ethereum's 33%. In the second month, the retention rate from February to March is nearly twice as high as Ethereum's and approximately 1.5 times higher than Avalanche's.

-

While Arbitrum initially shows similar retention rates to Avalanche in the first months, its retention rate after 12 months remains significantly higher at 48% compared to Avalanche's 9%. This highlights Arbitrum's ability to retain a larger portion of its user base over an extended period.

The combination of lower gas fees and the impact of the airdrop likely play a crucial role in attracting and retaining users on the Arbitrum network. These factors contribute to its strong performance in terms of user retention, positioning it as a competitive player in the blockchain landscape.

Retention Rate

Retention rate is the percentage of users who continue to use a product or feature over a given period of time. To calculate the retention rate, two numbers are required: the initial number of users at the beginning of the time frame and the number of users who remain active at the end of that time frame. The retention rate is obtained by dividing the latter by the former. For instance, if you had 100 users on July 1 and by August 1, 94 of them were still using the product or feature, then the retention rate would be 94%. In this example, the churn rate would be 6%, representing the proportion of users who have stopped using the product during that period. It's important to note that any new users who join during the time frame are excluded from the retention rate calculation for that specific period.

The analysis of the presented data suggests that the majority of users across the assessed chains do not exhibit sustained and frequent interaction with the networks over an extended period of time. A notable pattern is that the largest group of users tends to retain their engagement with the chains for only a week, with the number of users retaining for longer durations gradually decreasing.

Several factors could contribute to this trend. It is possible that the chains lack compelling features or incentive programs to actively engage and retain users over a long-term basis. Additionally, it could indicate that the target audience for these networks primarily seeks short-term interactions rather than long-term commitment and utilization of the chains.

To address this issue and improve user retention, further analysis and research are crucial. Understanding user behavior and preferences more comprehensively can help identify specific areas for improvement and opportunities to enhance user engagement on networks such as Avalanche and others. By implementing strategies that cater to the needs and desires of users, the chains can work towards increasing retention and fostering a more active and dedicated user base.

Conclusion

In comparison to the other assessed chains, Avalanche exhibits varying conditions in terms of user retention. When comparing retention rates over the course of several months, Avalanche generally shows lower retention rates than Ethereum and Arbitrum but higher retention rates than Polygon.

Avalanche's retention rates tend to decline over time, with a significant drop observed after 12 months. The retention rate after a year is considerably lower for Avalanche compared to Ethereum and Arbitrum.

However, it is important to note that the specific factors influencing user retention on Avalanche and other chains may vary. For example, Ethereum's lower gas fees and the presence of an airdrop on Arbitrum may contribute to their higher retention rates in comparison.

To improve user retention, Avalanche may benefit from strategies aimed at increasing long-term engagement, such as introducing engaging features, optimizing user experience, or implementing incentive programs. By focusing on enhancing user retention, Avalanche can strive to attract and retain a more dedicated and active user base in the competitive blockchain landscape.

Key Takeaway:

-

User retention rates vary across the assessed blockchain networks, with Avalanche generally showing lower retention compared to Ethereum, Arbitrum, and Polygon. This indicates the need for Avalanche to focus on improving long-term user engagement and retention.

-

Ethereum demonstrates relatively higher user retention compared to other chains, which may be attributed to factors such as lower gas fees and a more established user base. Learning from Ethereum's success can help inform retention strategies for other networks.

-

Arbitrum stands out with higher user retention rates, potentially influenced by lower gas fees and the impact of airdrops. This highlights the importance of incentivizing and rewarding users to encourage sustained engagement.

-

Polygon exhibits significant user retention, positioning it as a success story among the assessed chains. Identifying the factors contributing to Polygon's retention can provide valuable insights for other networks striving to improve user engagement.

-

Understanding cohort analysis is crucial for evaluating user retention over time. Comparing cohort sizes and retention rates among different chains allows for a better understanding of user behavior and can guide decision-making in retention strategies.

-

Continuous analysis and adaptation to user needs are essential for improving user retention in the blockchain space. By understanding user preferences, implementing effective engagement features, and optimizing the user experience, blockchain networks can foster a loyal and active user base, driving sustained growth and success.

Refences:

Header’s Image Source

Fig 1 Source

Fig 2 Source

Fig 3 Source

Fig 4 Source

Fig 5 Source

Fig 6 ~ 9 Source