In April, the number of GameFi game projects grew from 1,406 to 1,479, a monthly increase of 5.2%, with growth concentrated in the BSC and Polygon chains. The month ended with 9.22 million active users and $34.37 million in transactions. However, compared to March, active users and transaction volume declined by 24.9 percent and 73.4 percent, respectively.

Despite the decline in users and volume, some GameFi projects continued to perform well. For example, STEPN was the hottest DApp on the crypto market that month, Splinterlands ranked #1 in daily active users with a daily average of over 350,000, and DeFi Kingdoms surpassed Axie Infinity as the most traded GameFi project.

GameFi Market Overview

GameFi project count 5.2% YoY, growth concentrated in BSC and Polygon

According to Footprint Analytics, as of April 30, 38 public chains have participated in the GameFi space, with 1,479 game projects, a 5.2% increase from the previous year.

Ethereum's project count in the GameFi ecosystem is not growing as fast as on the BSC and Polygon chains. The projects on BSC and Polygon have become some of the more popular games in the crypto market today. They include Bomb Crypto and Mobox on BSC; Crazy Defense Heroes and Pegaxy on Polygon.

Developers prefer BSC and Polygon games because of their low gas fees, high throughput, and high security on par with Ethereum. The number of projects on Ethereum is gradually divided by public chains such as BSC, Polygon and WAX, attracting a large number of game users and projects.

Active users down 24.9% YoY, GameFi's transaction volume down

As of April 30, the total number of active users was 9.22 million, of which 780,000 were new users. Compared to March, the number of active users decreased by 24.9%.

Since October, the number of new and active users has declined, despite the increase in the number of games.

But not all public chain games are unpopular; for example, the Polygon game ecosystem saw a 25% increase in new users, led by Crazy Defense Heroes and Pegaxy.

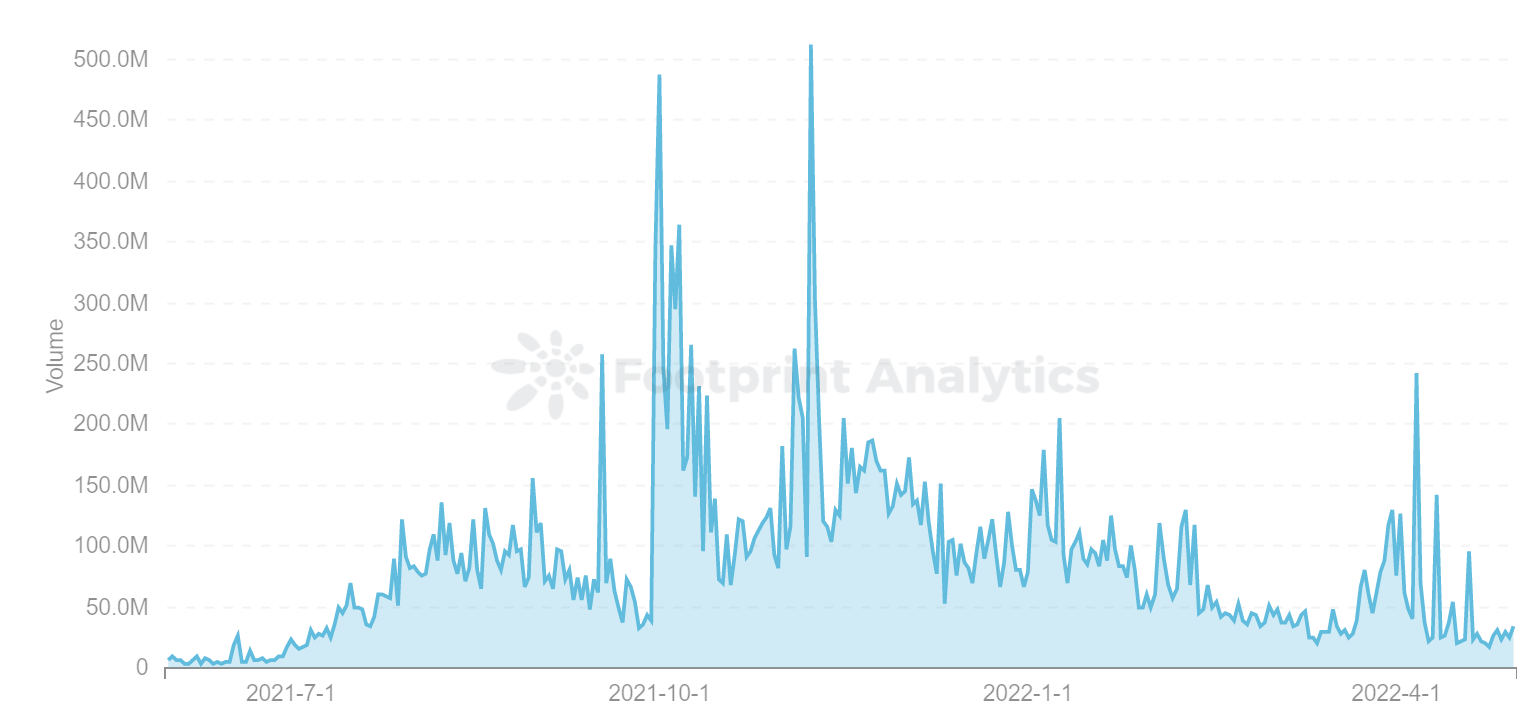

According to Footprint Analytics, trading volumes spiked from October to November, even exceeding $510 million in daily trading volume. However, since January, GameFi trading volume has been in a slump due to the macroeconomic impact. Per capita trading volume has gradually dropped from $105 to $20.

In addition, the Axie Infinity hack in mid-February significantly impacted active users and trading volume, which resulted in the loss of over $615 million in ETH and USDC to users.

Nearly $2.4 billion raised in GameFi, up 381% YoY

The data shows that the overall blockchain space saw the largest amount of funding in April, with investments totaling $6.62 billion. the GameFi space accounted for 36.3% of the total investments, with $2.4 billion invested. Compared to March, GameFi grew by 381%.

Web3 has seen the largest investment in the investment space, with STEPN, a Web3 project that combines elements of GameFi and SocialFi, being the most notable project.

April GameFi data underperformed, but still had great projects

While the macro trend was negative, several projects performed well in April. Splinterlands continued to rank #1 in daily active users for over three months, averaging over 350,000 daily. deFi Kingdoms surpassed Axie Infinity as the most traded GameFi project. And STEPN became the hottest DApp on the crypto market with Move to Earn.

Splinterlands holds the number one spot with 350,000 daily users

Splinterlands, an NFT card game, has become the most popular program in the GameFi space. According to Footprint Analytics, the number of users and transactions is gradually increasing and stabilizing.

Splinterlands has proven to be popular for its simple gameplay and low barrier to entry. And like Axie Infinity and other games, it uses a dual-currency model to stabilize the liquidity of in-game funds and minimize the impact of token price fluctuations in the secondary market on the game.

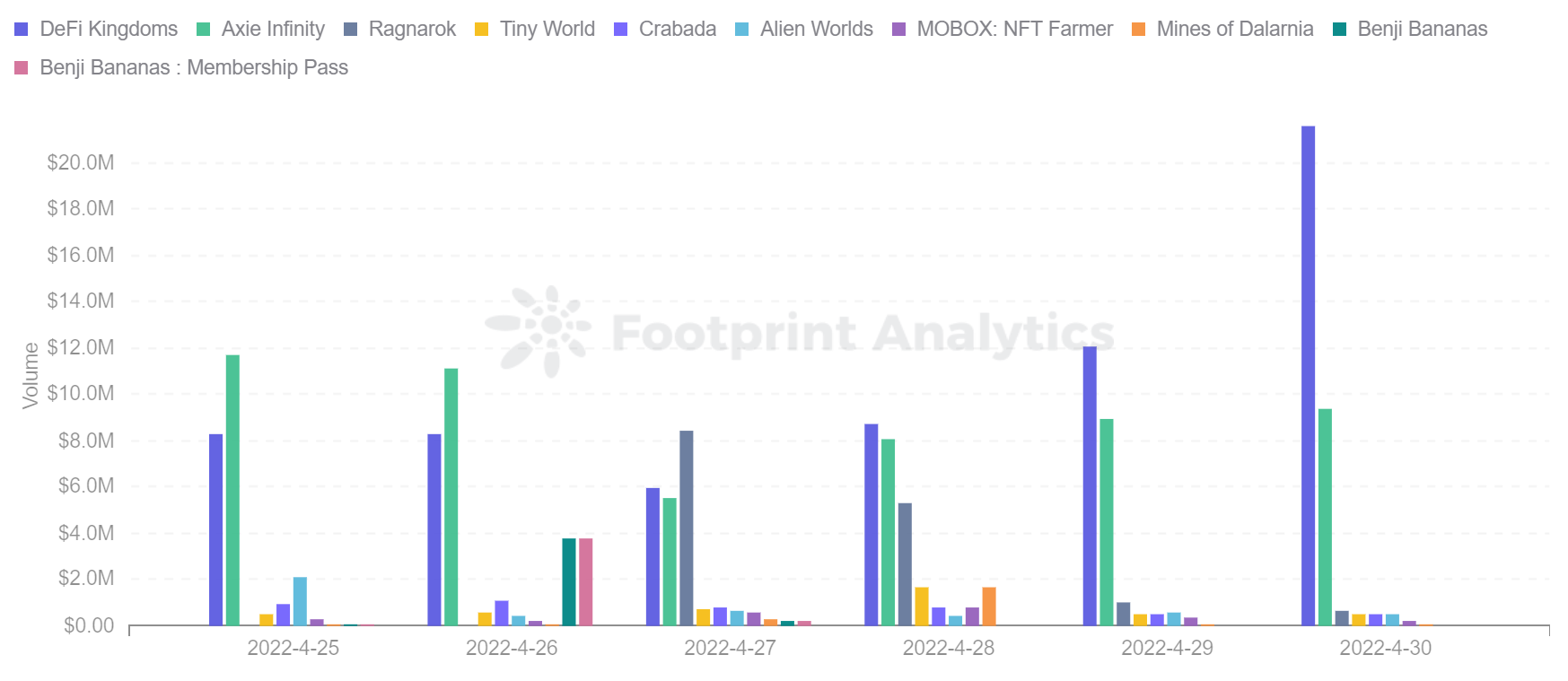

DeFi Kingdoms surpasses Axie Infinity as the most traded project

As of March 29, DFK has overtaken Axie Infinity as the most traded program. News of the attack on Axie Infinity, which was considered safe, shook users' confidence and trading volumes fell off. As a result, April will be a tough month for Axie Infinity, which will hopefully be able to restore user confidence in the game by recovering $5.8 million in funding and launching Axie Infinity Origin's new arena game mode on April 7.

Although DeFi Kingdoms has no VC funding, they maintain a monthly user retention rate and a solid daily user base through their own Tokenomics and the team's planning and advancement of the program.

STEPN becomes the most popular DApp

STEPN is the first successful Move-to-Earn game and has the real potential to become the long-awaited game that will bring GameFi into the mainstream.

Players buy NFT sneakers and earn through in-game tokens. It further gamifies sports by creating a system of sneaker upgrades, such as walking, jogging or running.

STEPN has been online for less than 6 months and as of April 30, its market cap has surpassed $2 billion. Now that Axie Infinity has fallen short of new users, STEPN may even surpass Axie Infinity's $2.2 billion market cap.

Footprint Analytics data shows that the price of token GMT rose from $0.16 to $3.52, an increase of 2100% in a short period of time.

There is no doubt that STEPN is currently one of the hot trends in the market.

Summary

While GameFi was closely tied to macro trends, with overall transaction and user numbers declining overall, there was no stopping individual game projects from making a splash in April. STEPN grew rapidly, with DFK overtaking Axie Infinity as the most traded project and Splinterlands stabilizing its daily active user base.

Welcome to join #NowhereDAO, a free information and token information sharing platform: