WHO IS BUYING @nitrocartel ON @camelotdex?

Know who u r investing with or against!

📍In the post you will know

🔹How to read our dune board

🔹how & how much is invested in $trove

🔹My thoughts & Speculation

Twitter : 2lambro

Substack : 2lambroz.substack.com

lens : 2lambroz.lens

📍Welcome to our dune board

Here’s a quick recap n my thoughts on $trove before they were raising

📍Dashboard tutorial

Going into first page of the dash board you can see

🔹Total address deposited = Number of wallet that invested into camelot

As there are no investment cap per wallet i’d imagine its will be mostly 1 wallet 1 user

🔹Total ETH deposit = the amount raise, i will reference camelot’s site for its on-going circ. Marketcap & FDV

Moving on to the next sector you can see

🔹Total amount of ETH that are invested per wallet size

E.g. there are 1107.5eth raised for wallets that invested 1 - 5eth, being 27% of the total ETH invested

🔹Number of Wallets invested in the range

E.g. There are 4122 wallets that are invested 0-0.1 ETH, being 57.4% of the total number of wallet invested

This gives you a brief idea of what sizes of investors are what % of the total amount investors (who u are trading against)

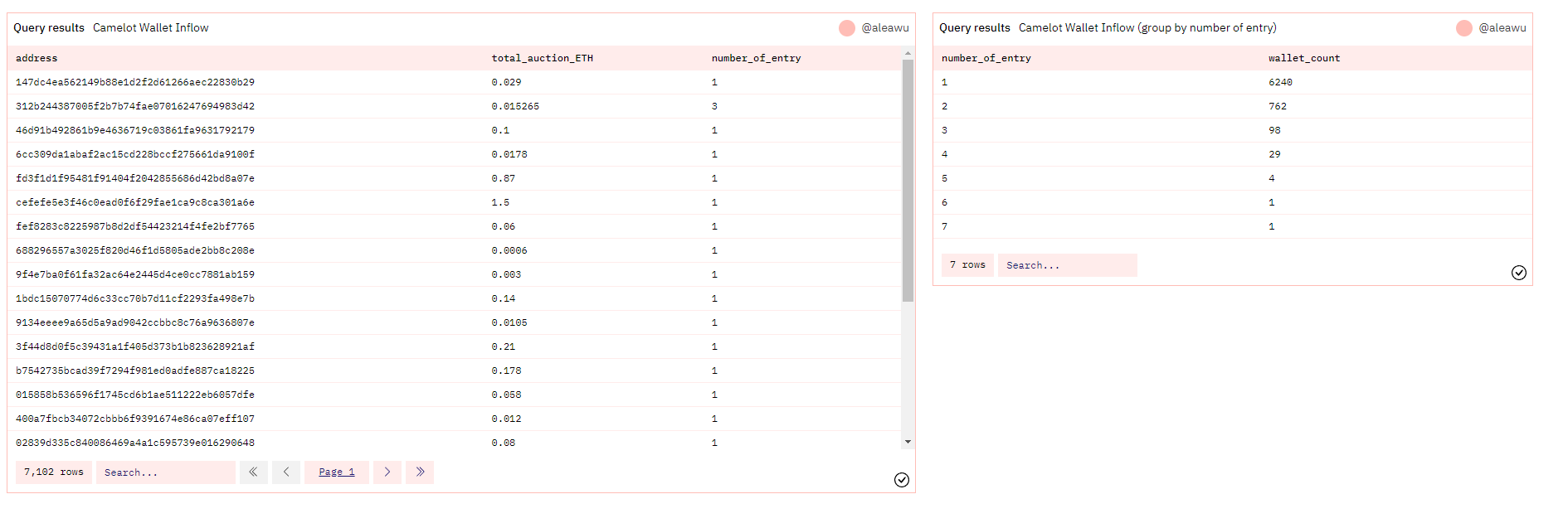

The last sector is mainly to make it easy for you to track different wallets who invested & number of times they deposit.

📍Summary, thoughts & Speculation

Congrats on @nitrocartel’s team on the big raise. I have to say i got dickslapped on my first tweet thinking they might be overpriced, arbitrum proved me wrong lol.

I dug a little deeper on a few wallets that invested a large amount, there are a mix of new wallets and a few arbitrum whale bulls.

The users that took part in this auction are well spread as u can see, a wide range of mini to micro investors with 0-5eth investors contributing over 50% of the eth invested & 83% number of wallets being 0-0.5eth investors.

With these type of auctions most secondary purchase power are exhausted (by design).

However its rare that 100% of these tokens are not vested, personally i think its a dangerous play where it doesnt give time for the team to deliver products/news to support it’s 30m+ valuation.

As mentioned before I have nothing against the team, they have done a good job in BD & marketing and I look forward to using ALP as collateral.

It is just that i worry with most crypto investor’s expectation of moon asap the team will be setup to handle lots of fud with retail users buying at a high valuation and rushing to sell before each other.

Key things i keep an eye on

🔹When and how will the team launch their 60million torve for protocol-own liquidity

🔹with such a larger amount than expected raise? How will they spend it?

🔹even tho the money raise is not for ALP, with that much money raised will they issue more incentive to push TVL of ALP to support $trove price? If so does that meant the might be a chance to buy ALP composition before they do? ( *cap size consider please, highly speculative)

Not gonna lie, I’m happy for the team & arbitrum but really worry if they price dump a lot it will hurt a lot of arbitrum bulls n hurt the momentum of the $grail and camelot.

Thanks for reading!