Twitter : 2lambro

Substack : 2lambroz.substack.com

lens : 2lambroz.lens

How to improve your crypto yield farming skill 100x

how i farm & the tools i use

In this thread

-

Types of yield & farms

-

⭐Thinking framework

-

Apply 🐑farmer framework to an example

-

Understanding yield farm is a form trading

-

Reply 🐑 for extend farming thread

Core types of yield

🔹Trading Liquidity Providing (uniswap v2v3, curve, balancer, GLP)

🔹Lending yield (aave, compound)

🔹Volatility yield (options & lots of upcoming protocols)

🔹Protocol fee (GMX, marketplace token, gamefi)

These yields are typically mix with elements of

🔹Protocol incentives

🔹PvP ponzi

🔹Speculation

Thinking framework with lambro example

Protocols like to mix & match with a lot of elements together to confuse you. This is my simple thinking framework

⭐ Yield > cost = profitable (yield farm) trade

Yield

-

Where does the yield come from?

-

Can I boost my yield?

-

How long does it last?

-

Is there enough capacity to exit?

-

What are my risks?

Cost

-

What does my farming position mean? (m i longing a token or Volatility? Betting it stay within a range?)

-

What is the cost of my farming position?

⭐ Yield > cost = profitable (yield farm) trade

Apply lambro farmer framework to an example

Scrolling tweets i found a new protocol shill by twitter kols

“lambswap $lamb is the next generation swap with veTokenomics enabling DeFi 5.0”

After reading the docs, i will start to apply my 🐑farmer framework

🔹Where does the yield come from?

Uniswap V2 style trading fee+ token incentives

🔹Can I boost my yield?

There is some “ve” element to boost my yield

🔹How long does it last?

Looking at the token “utility” & gut feel on “hype”. Not sure yet.

🔹Is there enough capacity to exit?

Checking the LP pair of $lamb/usd there is around 1m should be enough to exit

🔹What are my risks?

- rug

- potential implement loss on the pair.

🔹So assuming the farm is safe and I want to proceed, which pair should i farm?

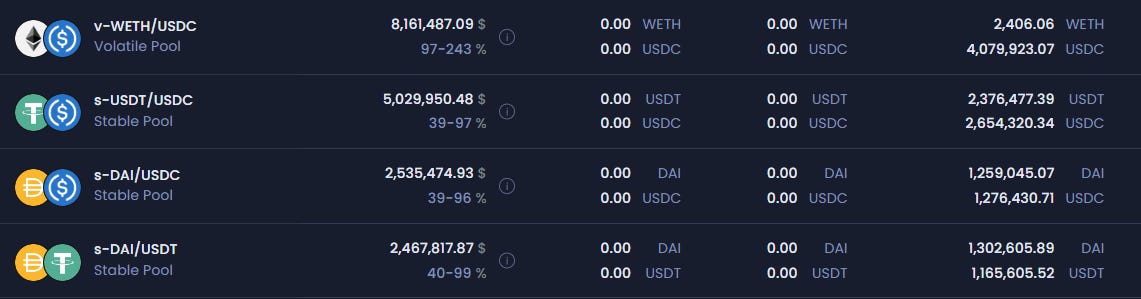

- WETH/USDC 90-243% apy

- USDT/USDC 39-97% apy

*this is from a random dapp example

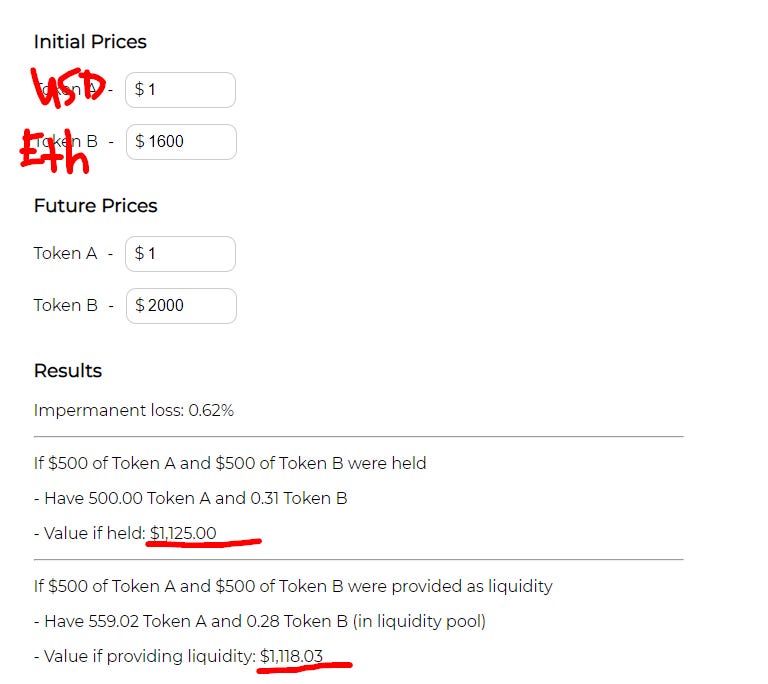

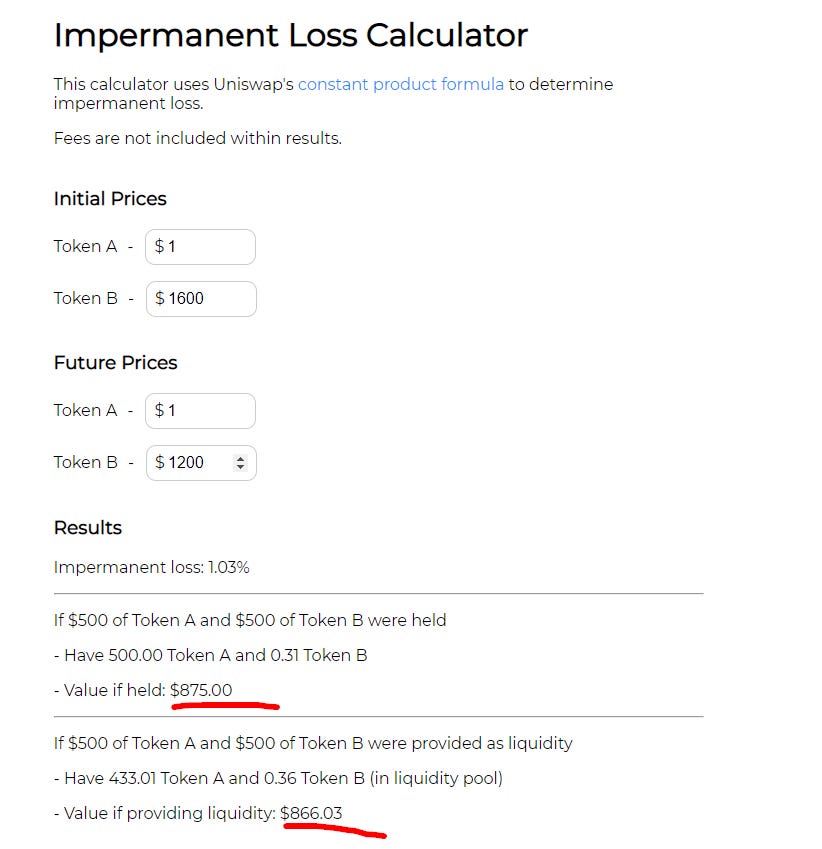

Since its uniswap v2, i will have a look at my potential IL in relation to eth movement with impermanent loss calculator by @dailydefiorg.

Remember to consider, are u holding eth anyways? Or buying eth to farm.

🔹Thinking framework conclusion

I have eth & i don’t think the price of eth will swing up or down aggressively within 2 weeks hence why 97% compared to 39% apy from usdt/usdc pair is worth the risk.

🔹After selecting the pair I look at how i can boost my apy?

-Lock stake x amount of time? (if is ETH/USDC m i will to bet on the price not moving? *essentially shorting volatility*

-Buy $lamb token for more boost apy? (will the emission cover potential cost of lamb dumping?)

Lastly u need to have a strategy on how and when do you want to exit ur farmed token,

Does the LP pool have enough liquidity for you to exit?

Understand yield farming is a form of trading

As example from lambswap u can see that the core part is “cost” and understanding what outcome u are expecting from ur “farming” position (LP) is very important.

Here’s a brief overview of some farming in trading point of view

🔹Uniswap v2 position =ideally price doesnt move =short volatility

🔹Uniswap v3 position =ideally price doesnt move =short volatility or potentially you want to DCA in or out at a token from ur ideal price range

🔹Balance LP, GLP = ideally price doesn’t move but short volatility and basically a index token(depending on pair) with yield

🔹Single stake = long token 1x and expect at yield to cover the potential drop in price

There are tons more detail in the art of farming.

If you guys like this post and want me to expand more on

-

tools i use to find farms, monitor ur position

-

different type of yield strategy (leverage, delta neutral, long/short vol)

reply 🐑 & like my substack

Thanks for reading!

u suck if u don't like & comment if u read till here.

reply 🐑 & like my substack