An Analysis of MegaETH and the “Mega Tradeoff” written by Kaleb Rasmussen (@kaleb0x) with additional contributions from @RikaGoldberg, @0xTraub, and @404_cole. Additionally, special thanks to 0xBreadguy from the MegaETH team.

_____________________

Key Insights

-

MegaETH aims to achieve 1ms block times and 100,000 TPS. The architecture relies on high-performance sequencers, software optimizations, and other existing L2 features.

-

1ms block times enable new applications like real-time DeFi, on-chain high-frequency trading, fully onchain games, and real-time computing DePIN. This ultra-low latency will be MegaETH’s primary value add and unlocks use cases previously thought impossible on traditional blockchains.

-

MegaETH’s high-performance architecture relies on a single sequencer model, leading to tradeoffs like increased censorship risks, liveliness issues, and MEV concentration. Solutions such as ZK proofs and priority ordering could address these challenges but may impact performance.

-

If successful, MegaETH’s design could challenge the direction of existing L2s. Many L2s will likely find themselves in a middle ground, offering neither the decentralization of Ethereum nor the performance of MegaETH.

What is MegaETH?

Backed by $20 million in funding from Ethereum co-founders Vitatlik Buterin and Joseph Lubin, as well as Dragonfly Capital, along with an additional $10 million raised from the community, MegaETH is an in-development Layer-2 (L2) that aims to be the first “real-time blockchain”. Through software optimizations and high-performance hardware requirements, MegaETH claims to achieve a throughput of over 100,000 transactions per second (tps) and block times of less than 1 millisecond (ms).

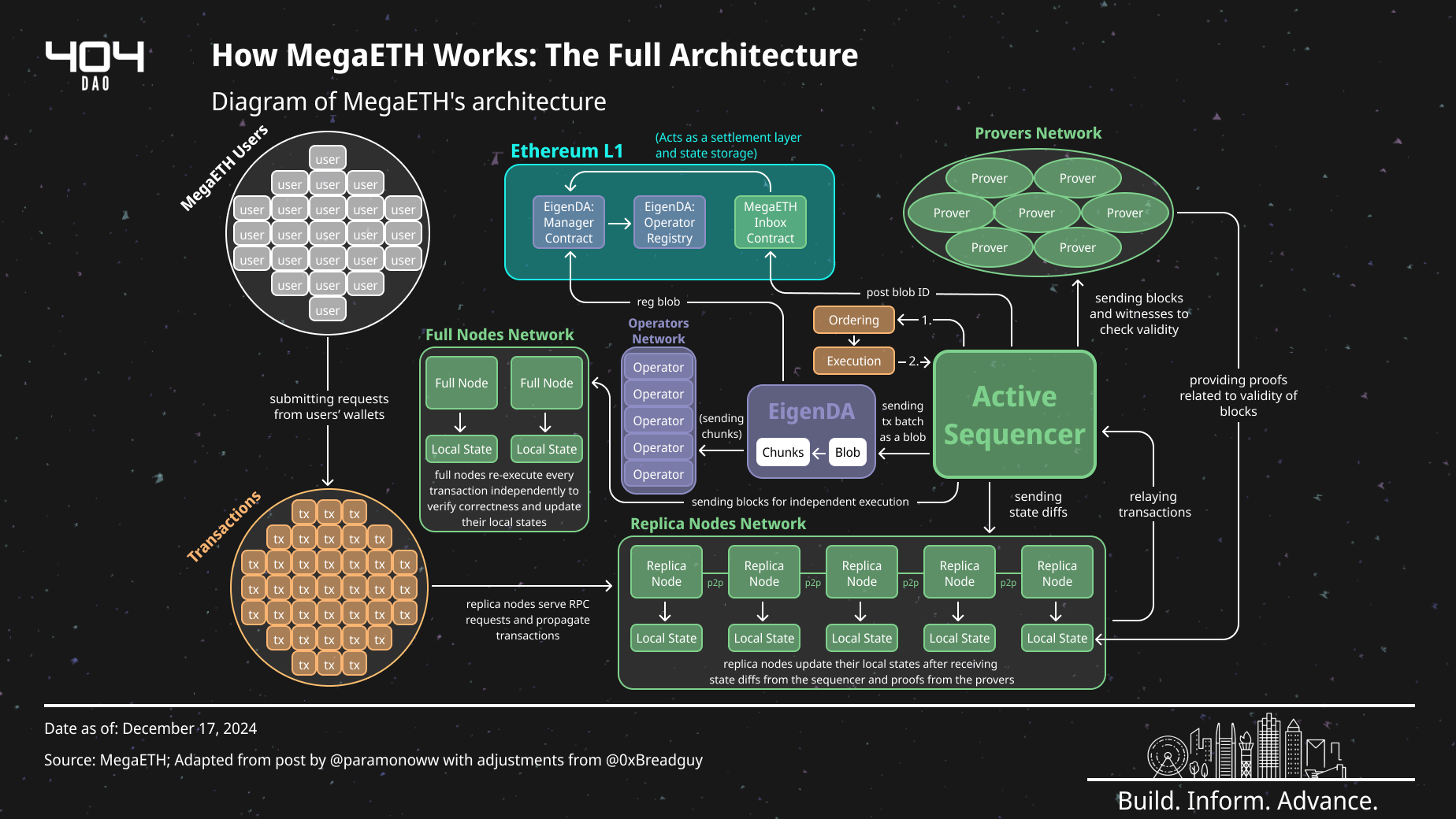

MegaETH plans to launch as an Optimium - an L2 that uses fraud proofs (optimistic) for settlement to Ethereum and EigenDA for offchain data availability. The public testnet, initially expected to go live in Q4, was delayed to Q1 to allow for further development and feedback, but a private testnet is currently running for MegaMafia builders.

Technology

To achieve high throughput and low latency, MegaETH aims to optimize the L2 architecture to deliver high performance without compromising security or decentralization - a challenge often faced by standalone Layer-1 (L1) networks. MegaETH relies on node specialization, software optimizations, and existing L2 features, such as escape hatches to accomplish this.

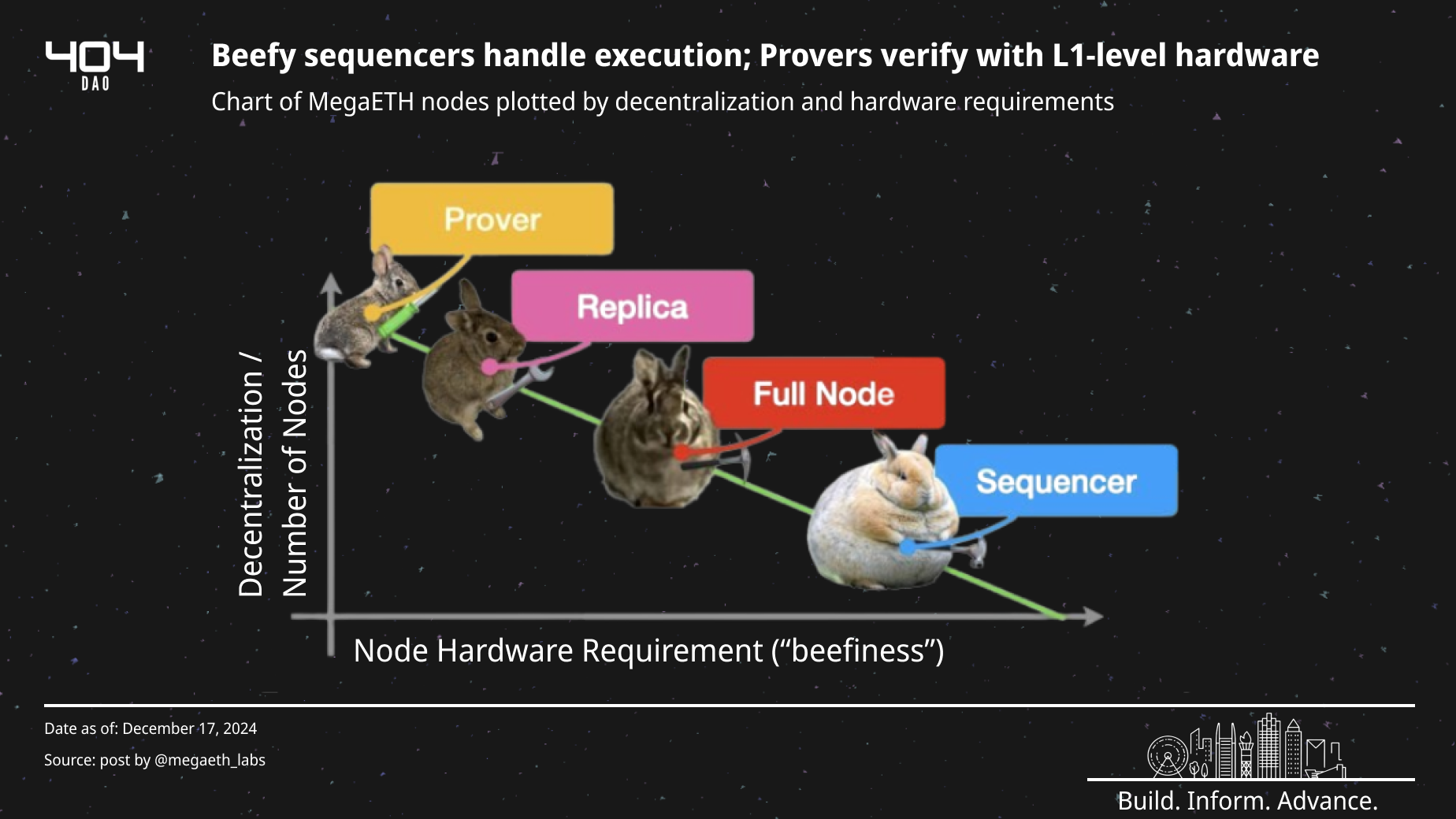

Node Specialization

MegaETH employs node specialization, unlike traditional L1s, where all nodes perform identical tasks. This approach distributes responsibilities across various node types, enabling Web2-level performance with decentralized validation.

Sequencer Nodes

MegaETH’s sequencer nodes are responsible for:

-

rapid ordering and executing of transactions

-

dissemination of state diffs(1) to replica nodes and full blocks to provers and full nodes every 1-10ms

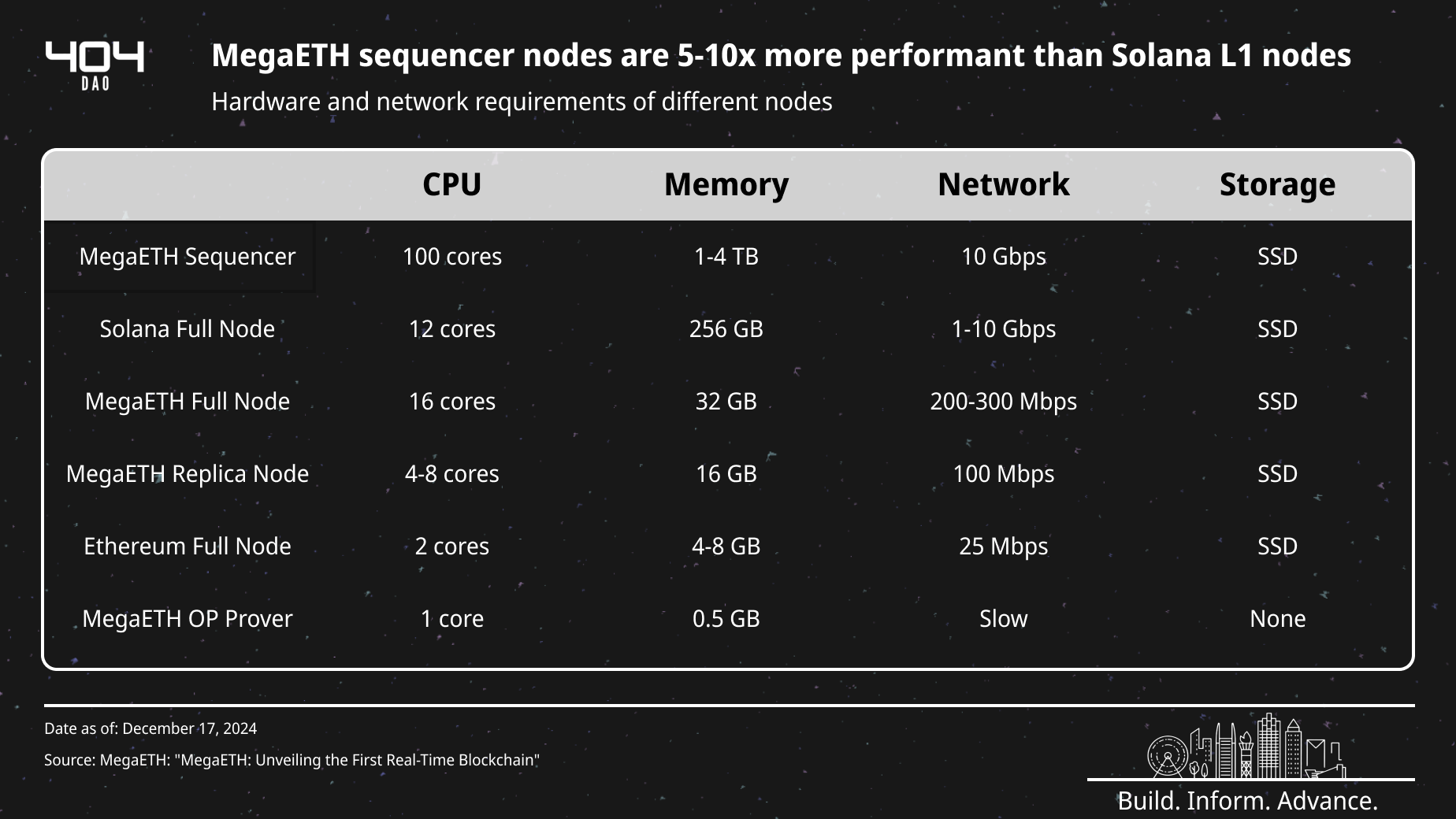

To achieve its level of throughput and latency, MegaETH sequencer nodes are 5-10 times more performant than Solana L1 nodes.

1: The state diff represents the specific change to a blockchain's state. For example, if Alice initially has a balance of 10 ETH (pre-state), sends 5 ETH to Bob (transaction), and her new balance becomes 5 ETH (post-state), the state diff reflects this change: Alice's balance decreases by 5 ETH.

Prover Nodes

Provers validate blocks executed by the sequencer through an optimistic proof system.

Proof System:

-

State updates are presumed valid unless challenged within a dispute window (typically seven days)

-

Using stateless verification, provers require lower hardware resources than Ethereum L1 nodes and do not need to store the entire blockchain state

Prover Function:

-

Receive blocks, state data, and cryptographic witnesses(2) from the sequencer to validate the correctness of state updates

-

Detect discrepancies (e.g., double spending occurred) and submit fraud proofs to challenge invalid updates

2: Witnesses consist of the necessary state data (e.g., pre-state balance, transaction, post-state balance) and cryptographic proofs to verify the data is part of the state.

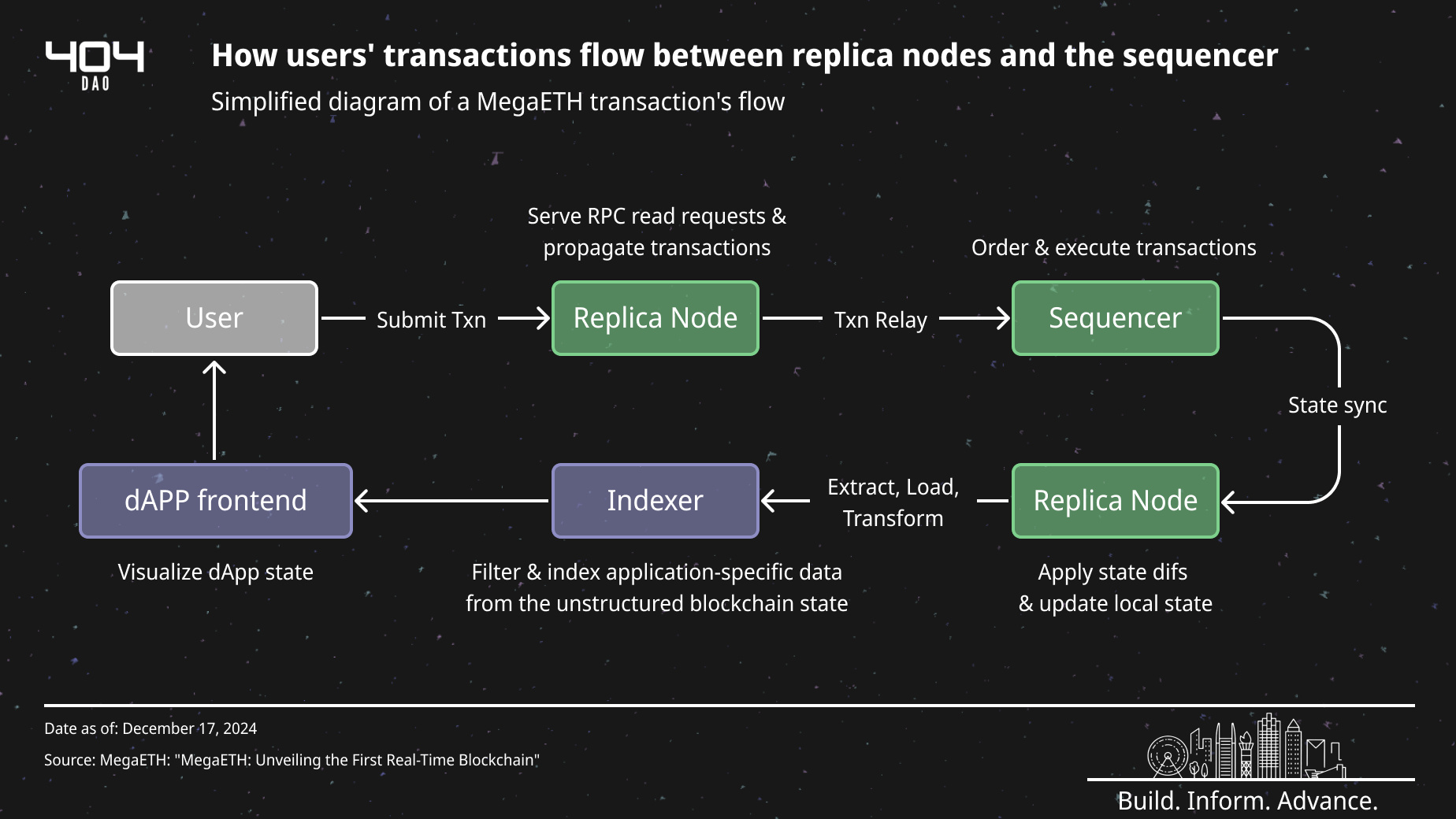

Replica Nodes

Replica nodes make up the majority of nodes in the MegaETH network and are designed to help relay information to and from frontend applications efficiently:

-

Receive and relay state diffs (e.g., Alice’s balance changing from 10 ETH to 5 ETH) from the sequencer and apply them to their local states

-

Use prover-generated proofs for verification of state diffs, instead of re-executing transactions, allowing for lighter hardware requirements

Full Nodes

Full nodes re-execute every transaction, unlike replica nodes, and are designed for power users, like centralized exchanges:

-

Offer quicker assurances of correctness through independent re-execution (i.e. don’t want to wait the full seven-day challenge period)

-

Slightly higher hardware demands than replica nodes but more affordable than sequencers

Together, these nodes and EigenDA for data availability compromise the architecture shown below.

Software Optimizations

MegaETH also intends to implement various software optimizations to achieve its goals:

-

Real-Time EVM Execution Engine: Combining a “low-latency, streaming-based block building algorithm” that continuously processes transactions as they arrive with a “concurrency control protocol” for parallel transaction processing. These features will allow MegaETH to handle large volumes of transactions efficiently and publish state diffs at intervals as short as 10ms.

-

In-Memory Computation: Sequencer nodes store the entire EVM state in memory, boosting state access speeds up to 1,000x compared to solid-state drives (SSD) systems. This enables high-performance, data-intensive, Web2-like applications to operate onchain with minimal latency.

-

JIT Compilation: Sequencer nodes will leverage Just-In-Time (JIT) compilation to convert smart contracts (EVM bytecode) into native machine code at runtime, achieving significant performance improvements. This client-level optimization could enable up to 100x speedups for compute-intensive applications by bypassing the overhead of interpreting EVM bytecode line-by-line and emulating a stack machine, the approach used by most Ethereum L1 execution clients.

-

Optimized State Trie: Replacing Ethereum’s Merkle Patricia Trie (MPT), a data structure used for storing the state, with a custom state trie that minimizes disk I/O operations and efficiently scales to terabytes of state data.

-

State Sync Protocol: To propagate state diffs from the sequencer to replica nodes with high throughput and low latency, MegaETH will use an efficient peer-to-peer protocol. This ensures that nodes with a “modest internet connection” can remain synchronized with the latest state.

Specific technical documentation for these features is not yet available.

The Mega Vision

Overall, MegaETH aims to scale to Web2 standards with over 100,000 tps and 1ms block times. It seeks to realize Vitalik’s Endgame vision where “Block production is centralized, block validation is trustless and highly decentralized, and censorship is still prevented”.

While many projects are building on MegaETH, specific technical documentation on how MegaETH will achieve its ambitious performance goals has not yet been publicly released, and the high expectations bring a certain degree of execution risk that should be carefully considered.

Evaluating the Mega Ecosystem

What Matters More? TPS, Block Times, Something Else?

MegaETH is being built for applications that produce a high volume of [compute-intensive] transactions as well as highly interactive applications that require extremely low latency. To optimize for these applications, MegaETH has focused on:

-

increasing throughput (high tps),

-

reducing the cost for compute and data-intensive transactions, and

-

decreasing latency (low block times).

Analyzing how MegaETH compares to other L2 and L1s will provide valuable insight into if it has an advantage in these key metrics.

Analyzing Throughput

In today’s blockchain ecosystem, high throughput (high tps) blockchains are a dime a dozen:

-

Solana (Launched): a Parallel non-EVM L1 claiming to scale to 65,000 tps

-

Sei (Launched): a Parallel EVM L1 claiming to scale to 12,500 tps

-

Monad (In-Dev.): a Parallel EVM L1 claiming to scale to 10,000 tps

Compared to these existing and planned high-throughput EVM chains, MegaETH will likely be on par or slightly better in theoretical throughput.

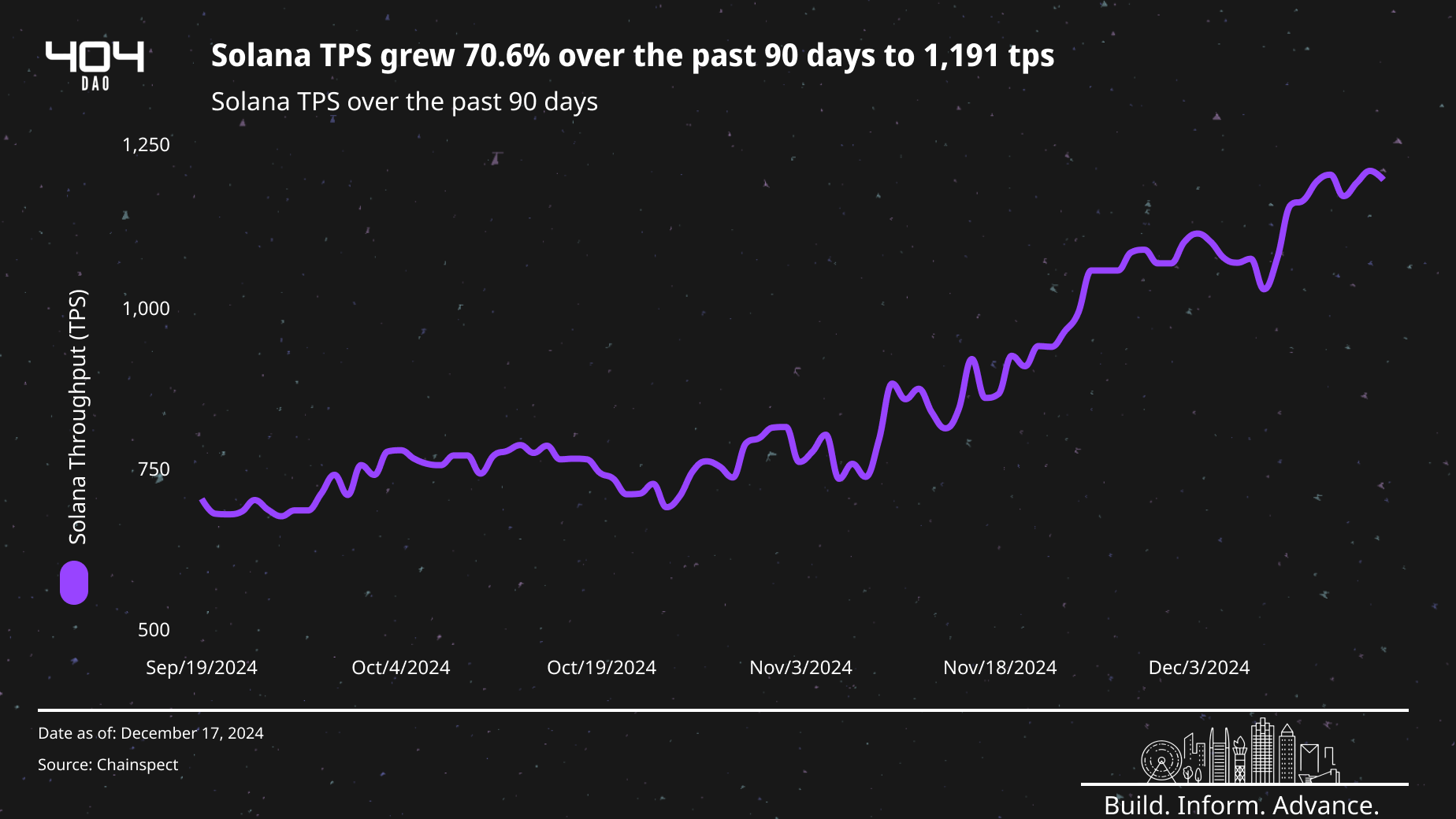

However, there is currently an abundance of blockspace: no application is in need of this throughput, and no chain is close to reaching its theoretical capacity. Solana, as an example, currently averages ~1,100 tps (voting transactions excluded) and has only recorded a max tps of 7,229, according to Chainspect. As such, other metrics are likely more important to determining if MegaETH will be successful.

Analyzing Compute Efficiency

Through JIT Compilation, In-Memory Computation, and an Optimized State Trie, MegaETH has the potential to significantly increase throughput and reduce the costs for compute-intensive and data-intensive transactions. However, other L2 teams are also working to do this.

Offchain Labs launched Arbitrum Stylus on Arbitrum One and Nova on September 3, 2024, enabling developers to write smart contracts in Rust, C, and C++ (compiling to WebAssembly, WASM) alongside Solidity. Stylus introduces a WASM VM alongside the EVM, ensuring full interoperability between Solidity and Stylus contracts. It significantly reduces compute costs (10–100x) and memory costs (100–500x) compared to the Ethereum EVM, unlocking compute-intensive applications like Renegade. Renegade leverages Stylus for multi-party computation (MPC) and zero-knowledge proofs to build an on-chain dark pool (a privacy-preserving DEX) with no MEV or slippage.

Analyzing Latency

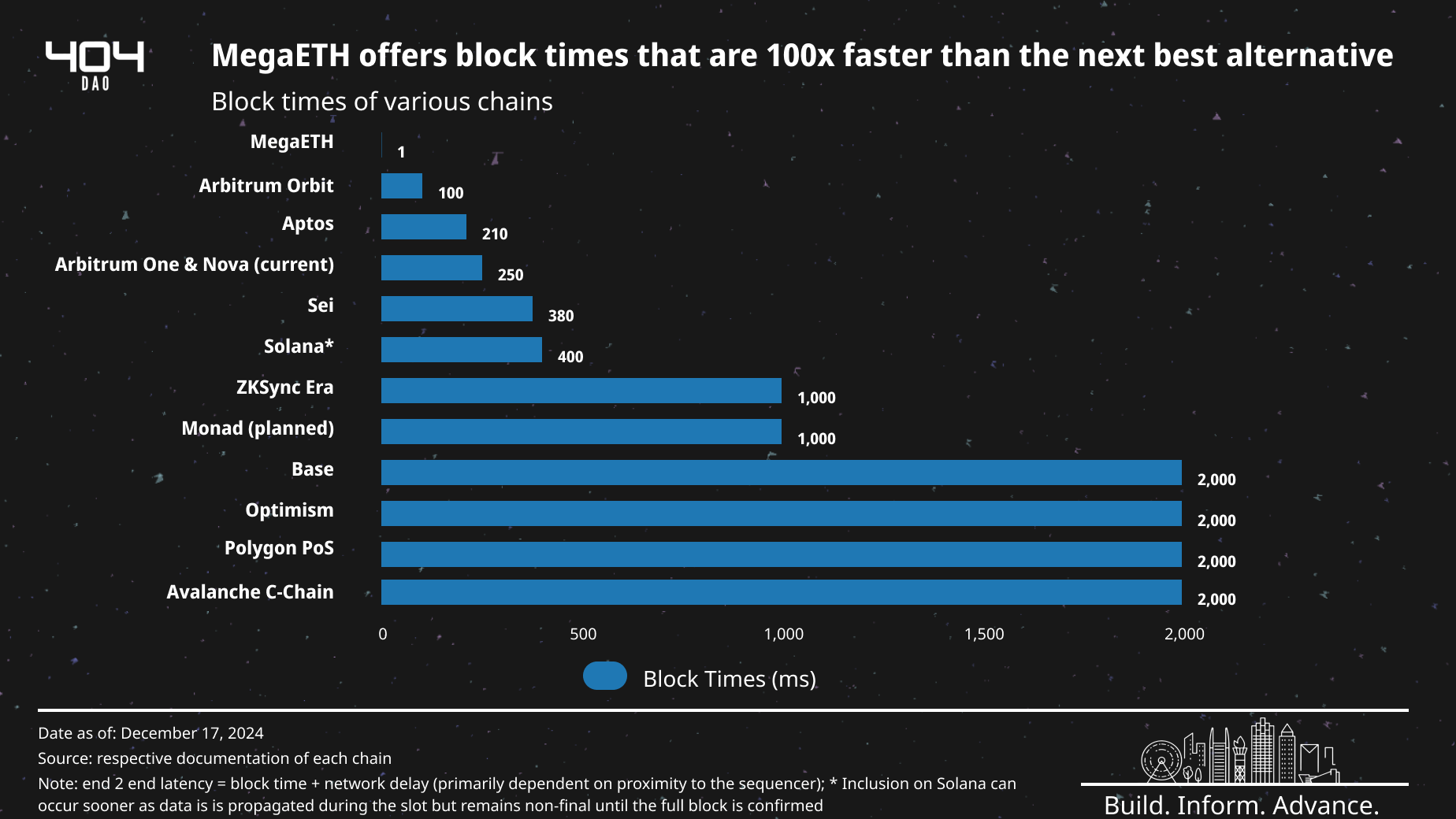

Because MegaETH relies on a centralized sequencer model and does not require consensus, it could theoretically enable ultra-low 1ms block times—over 100x faster than nearly all other live or planned chains. This brings latency on par with Web2 levels, where delays depend mainly on a user’s proximity to the sequencer rather than a chain’s block times. This is primarily what sets MegaETH apart.

1ms block times will be MegaETH’s primary driver of new applications and better user experiences, previously thought impossible on traditional blockchains.

Onchain Gaming

MegaETH’s low latency and support for compute-intensive applications enable real-time, fully on-chain virtual games and worlds. Without latency below 100ms, player interactions would lag significantly, making it impossible to create an immersive and smooth real-time experience that players would enjoy.

Biomes, a sandbox game like Minecraft, is leveraging MegaETH to build a fully on-chain virtual world where everything—dirt, ores, and physics—is tokenized, ensuring true scarcity and tamper-proof rules. Items like chests and doors will also have smart contract programmability, enabling mechanics such as an NFT-gated door for a virtual club. The team believes these features will allow them to create a virtual world with the largest GDP.

Real-Time DeFi

Research by Uniswap Labs shows that(3) lower latency reduces arbitrage losses, thereby increasing profitability for liquidity providers (LPs). Shorter block times minimize price discrepancies between CEXs and DeFi, making arbitrage trades less profitable. On MegaETH, higher profitability from lower block times could incentivize LPs to migrate, attracting DeFi projects and creating a liquidity flywheel.

3: “In the LVR with fees framework, arbitrage losses increase with the square root of block time.”

MegaETH could lower the barriers for high-frequency trading (HFT) to happen onchain, as market makers and HFT firms could colocate next to the sequencer for the lowest possible latency. Onchain HFT could not otherwise happen where latency exceeds 10ms. Onchain HFT has the potential to:

-

improve the overall DeFi experience for the average user

However, chains designed for MEV to be captured and distributed back to users, such as Unichain, might offset the advantages of ultra-low latency and onchain HFT. Moreover, the potential enablement of onchain HFT has sparked concerns, drawing comparisons to the negative effects electronic trading firms have had on traditional financial markets.

Some DeFi projects building on MegaETH are listed below. Of note, some are still in stealth and limited information has been disclosed.

-

CAP Labs: stablecoin engine for maximum yield

-

GTE: launchpads, spot, and leverage trading DEX

-

Valhalla: perpetuals DEX

-

Noise: the platform for trading trends

-

MegaBot: native high-frequency trading bot & sniper

-

Teko Finance: real-time money markets

Real-Time Computing DePIN

Low latency can also be useful for some DePIN applications, such as decentralized VPNs (dVPN), which encrypt and route traffic between p2p individual nodes instead of servers. To plan the routes for data packets, dVPNs use a “Control Layer” on a blockchain. MegaETH's ultra-low block times enable these calculations to be published in just milliseconds, ensuring minimal delays. Hop Network is leveraging MegaETH to build a dVPN Control Layer that matches the speed of traditional VPNs while offering superior anonymity and censorship resistance.

The Mega Tradeoff

The use cases for MegaETH appear compelling. So what’s the catch?

MegaETH employs a single sequencer model, where one active sequencer is responsible for ordering and executing transactions at a time. The team has expressed plans for the active sequencer role to be rotated across different sequencers, with a long-term vision of having an extensive list of permissioned, non-MegaETH-owned sequencers included in the rotation. However, the specifics of the model, including the timeline for implementation and the rotation interval, are still being finalized. Rotation could be based on factors such as geography to reduce latency for active users, behavior, or other considerations.

While most L2s have centralized sequencers today, many L2s have committed to decentralizing their sequencers, including Arbitrum, Eclipse, Movement, and others. Offchain Labs has already established a partnership with Espresso Systems, the protocol focused on decentralizing sequencing for rollups, to decentralize their sequencer sometime in 2025.

Arbitrum wants to avoid a “rotating centralized” approach and instead use a consensus of sequencers to publish a block. Like Ethereum, a sequencer, chosen at random for each new block, will propose a block and a consensus of a committee of sequencers will validate this block through a voting process.

Since a decentralized sequencer committee must first reach consensus to publish a block, block times are bottlenecked by the speed of global back-and-forth communication (speed of light) between sequencers in the committee. As the size of the committee grows, communication becomes more complex, requiring multiple rounds to reach consensus. This leads to delays of a few hundred milliseconds, making ultra-low latency nearly impossible.

The Mega Tradeoff, therefore, for MegaETH, is increased performance mainly in the form of exceptionally low latency at the expense of:

Real-Time Censorship Resistance

All chains also face the issue of censorship, albeit to differing degrees. On Ethereum, around 10.6% of validators (responsible for proposing and verifying new blocks) censor OFAC-sanctioned transactions. In these cases, users may experience delays, waiting for a non-censoring validator to include their transaction. On average, censorship would cause the average OFAC-sanctioned transaction to have to wait 13.4 seconds as opposed to the normal 12-second block times.

For MegaETH, if a user is censored by the single active sequencer, the user would either:

-

need to force include the transaction on the L1, or

-

wait for the active sequencer role to rotate (once implemented) to a different node, which could take a couple hours

While this may result in real-time censorship, it prevents indefinite censorship as the transaction would likely eventually be processed by one of the sequencers.

To further address this, on a podcast with Logan Jastremski, MegaETH CTO Lei Yang brainstorms a solution involving a decentralized committee of sequencers that could force the single active sequencer node to include a transaction in a timely manner or face slashing. If implemented, this could further reduce the duration a user is censored without increasing latency.

Liveliness / Increased Risk of a Reorg

MegaETH could face liveness risks with a single sequencer model, as any immediate downtime or failure by the sequencer could disrupt transaction processing and hinder network reliability. To mitigate this risk, the team plans to maintain a standby sequencer as a fallback once the rotation model is implemented.

Additionally, in the event a sequencer acts maliciously and publishes an invalid block, the invalid block would be detected by provers and the network would need to reorganize (reorg). This would entail rolling back the chain to remove the invalid block and replacing it with a correct one. Depending on how many new blocks have been published after the invalid block, this could be highly disruptive as all blocks after the invalid block would also need to be discarded and replaced.

This risk can be mitigated by requiring the active sequencer node to post a bond, which would be slashed if an invalid block is published, disincentivizing malicious behavior. However, to date, the MegaETH team has not publicly indicated that this will be required by their sequencers at launch or at an unspecified time in the future.

Adopting a Zero-Knowledge proof system could fully eliminate this risk by ensuring only valid blocks are published through cryptographic validation. However, as ZK proofs improve, uncertainties remain about latency penalties and the need for hardware specialization, which may differ from MegaETH's proposed setup.

MEV Centralization

MegaETH's high-performance single-sequencer architecture will likely concentrate MEV profits among a limited number of entities. The platform currently plans to implement a First-In-First-Out (FIFO) transaction ordering scheme, which may be enforced through a trusted execution environment (TEE) like SGX. Under FIFO, transactions are processed strictly in the order they are received, effectively mitigating sandwich attacks and other MEV strategies reliant on transaction reordering.

In this model, the chain may experience more spam and frequent reverts from searchers trying to get their transactions included. Additionally, searchers that colocate next to the sequencer will be the first to capture MEV generated from DEX arbitrage and liquidations. Without explicit mechanisms, MEV profits will remain with colocated searchers rather than accruing to the sequencer or the broader MegaETH ecosystem.

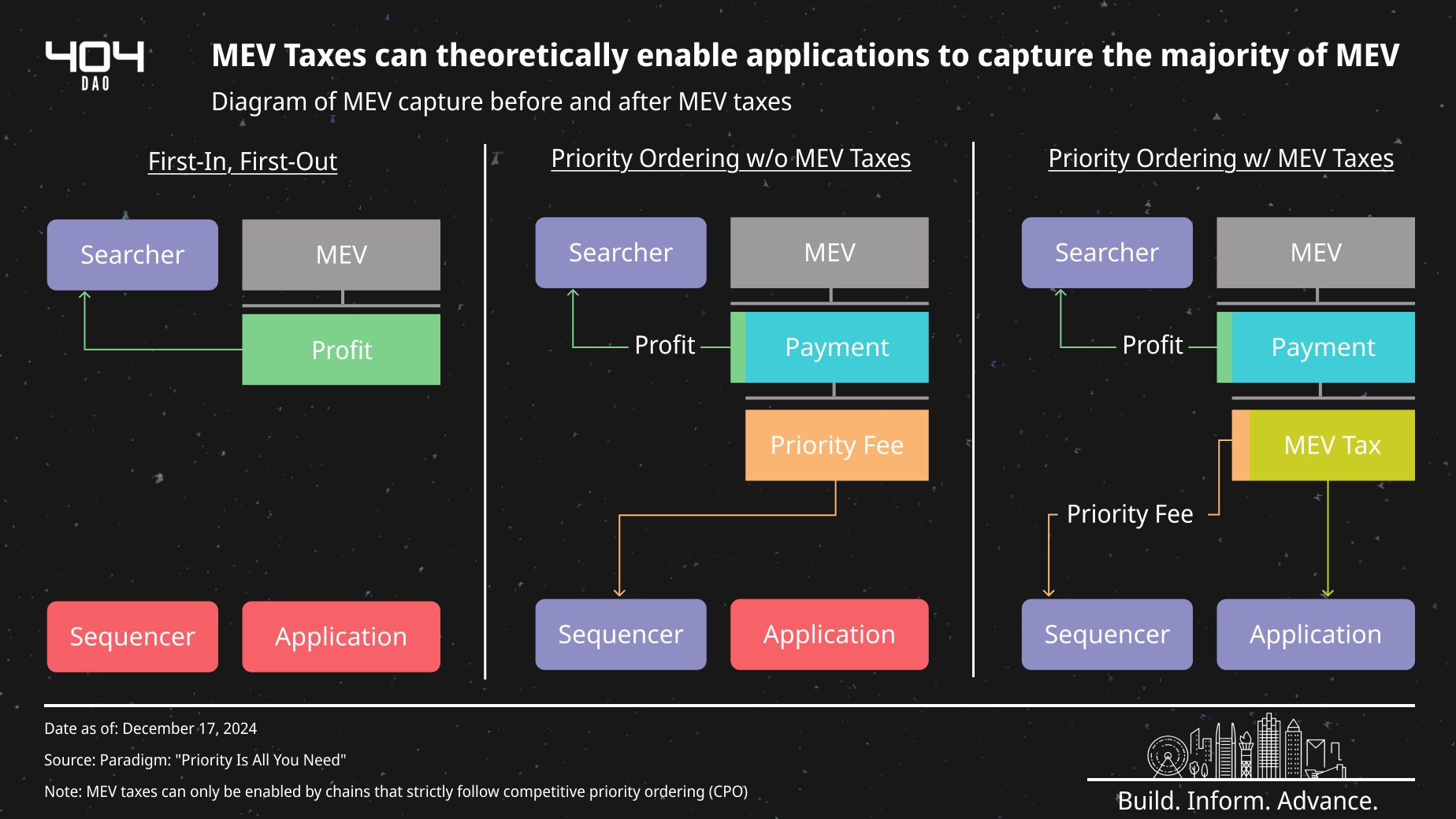

One alternative is to adopt priority ordering, like that used by OP Mainnet, where the sequencer orders transactions by priority fees. If there was competition among colocated searchers, most MEV could shift from searchers to sequencers while also allowing applications to capture some of the MEV they generate. A TEE could ensure compliance with priority ordering, while an encrypted mempool could safeguard against sandwich attacks—both integral to the endgame architecture envisioned for UniChain.

In the priority ordering model, applications and users could capture MEV through MEV Taxes. Applications would charge transactions a percentage of their priority fee (e.g., $99 charged by the application per every $1 of priority fee charged). Searchers competing for arbitrage opportunities would set high priority fees to get their transaction included, while regular transactions would remain unaffected. Of note, for MEV Taxes to work, priority ordering must be strictly followed without censoring, viewing or delaying any transactions.

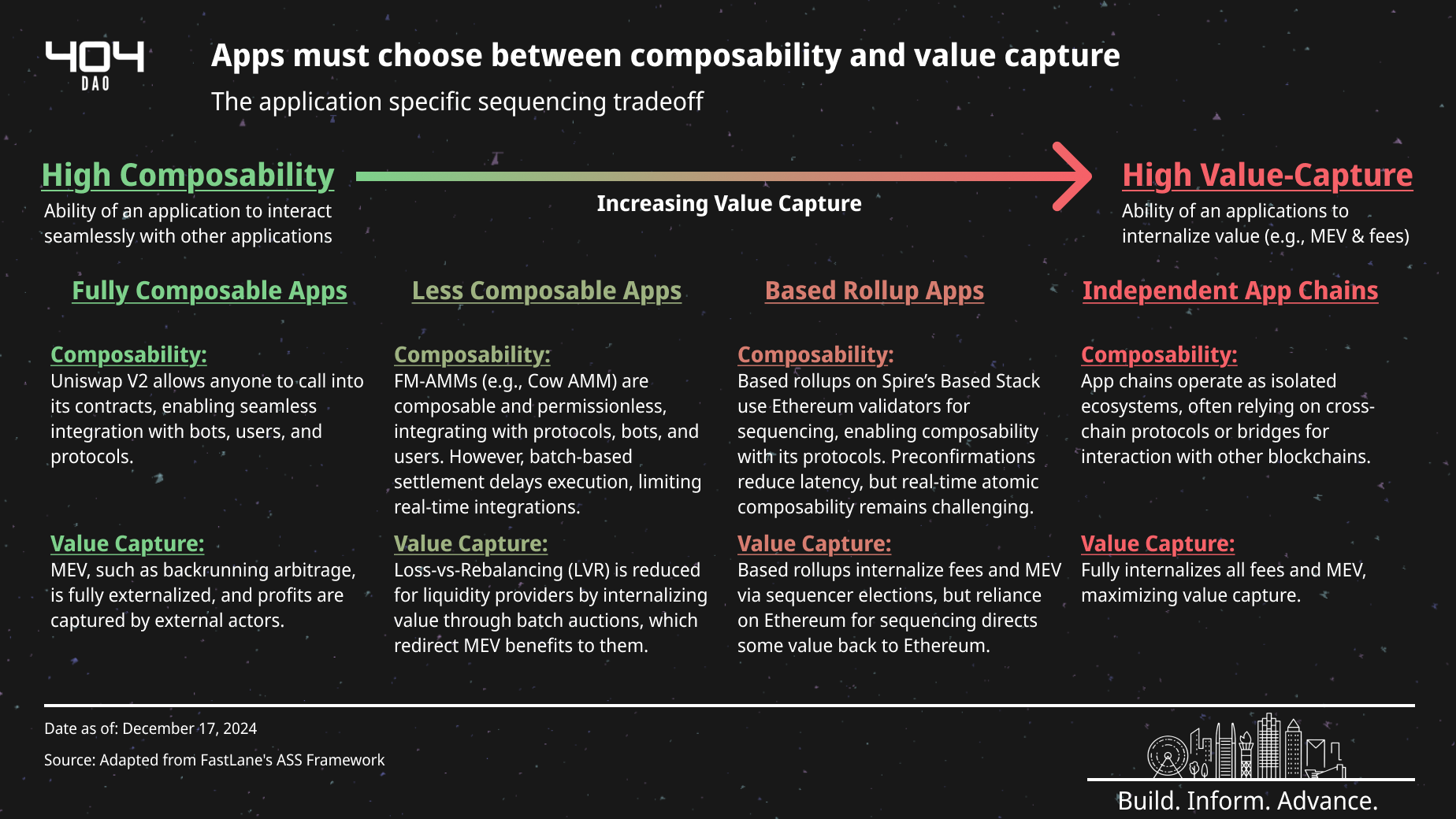

Incorporating encrypted mempools and TEE enforcement could add latency, conflicting with MegaETH's performance goals. Application Specific Sequencing (ASS) includes a wide variety of other methods where applications capture more of the MEV they generate:

-

Rollup-Based Solutions.

However, applications that attempt to capture more value could reduce their composability within MegaETH or introduce additional latency to their application.

A trend of applications increasingly building appchains to capture value and deliver custom experiences has emerged however. Sei’s Parallel Chain Stack is among the first to enable high-throughput L2s through parallel processing. As such, successful high-performance applications on MegaETH may seek their own L2 or L3 appchains for MEV capture or custom features like private transactions, though MegaETH has no plans to develop such a chain stack.

MegaETH believes the new use cases unlocked by ultra-low latency are worth these tradeoffs.

What’s the Case for Decentralized Blockspace?

The decision to prioritize censorship-resistance and security through a decentralized sequencer comes at the cost of higher latency. For latency sensitive applications such as gaming, real-time DeFi, and real-time DePIN, low latency is highly important. That said, some sectors value uninterrupted operation, robust decentralization, and strong censorship resistance over low latency and throughput.

Potential Sectors

Restaking

Restaking protocols, such as EigenLayer, allow users to lock their tokens to secure the main network (e.g., stake ETH, securing the Ethereum network) and additionally reuse those tokens to secure other networks/protocols (e.g., restake ETH to secure a data availability service such as EigenDA). These protocols are likely to remain on Mainnet as downtime or security issues could compromise their operations and the systems relying on them.

Ultra-High Net Worth DeFi

DeFi platforms that manage large reserves of capital require maximum security and uptime. AAVE, with over $19.1 billion in TVL on Ethereum Mainnet, must remain operational even during high market volatility. Any extended downtime could disrupt the protocol’s liquidation process, leaving under-collateralized loans unresolved and potentially causing cascading insolvencies. As such, institutions and individuals highly concerned about the security and preservation of their wealth will likely keep their funds in resilient Mainnet DeFi protocols.

Censorship-resistant Cross Border Payments

In countries with unstable financial systems, censorship-resistant cross-border payments are critical for ensuring that transactions can occur without interference from governments or intermediaries. While Ethereum Mainnet offers the highest degree of censorship resistance, and the best choice for moving billions of dollars, high fees could be less ideal for smaller remittances. Censorship-resistance and cheap fees on decentralized sequencer L2s could offer a solution here.

Based Rollups, however, could provide greater liveliness and censorship-resistance guarantees than decentralized sequencer L2s that would be beneficial in cross border payments. This is because based rollups are sequenced by Ethereum Mainnet validators and therefore inherit Ethereum’s liveliness. Decentralized sequencers will likely have smaller sequencer sets and transactions could therefore be more prone to delays from censorship.

L2s that don’t immediately follow MegaETH’s path will likely end up in a middle-ground state between not being the most decentralized (Mainnet & Based Rollups) or the most performant (MegaETH). Given that most users will likely either prefer high performance and usability or high decentralization and security, the market for applications in this decentralized sequencer L2 middle ground (that don’t fully deliver on either high security or high performance) appears limited.

Measuring Success

MegaETH's success will hinge on its ability to enable new and compelling zero-to-one applications that leverage its high throughput and unique 1ms block times - unlocking possibilities previously thought impossible on traditional blockchains.

To build these applications, MegaETH has been collaborating with founders through its Mega Mafia program, which includes global gatherings, isolated offsites, and co-building sessions with core team advisors. While many teams are actively building (and likely many more in stealth), only time will reveal whether the revolutionary potential of these applications can meet expectations.

The community's early enthusiasm is evident, as MegaLabs raised $10 million in under three minutes on Echo – the community investor platform founded by Cobie – from over 3,400 investors across 90 countries.

Moreover, the future launch of other high-performance L2s like RISE Chain, Atlas, and Heiko will further validate this report’s thesis. Comparing MegaETH's activity against existing L2s like Optimism and Arbitrum, which offer low fees and fast execution (though not on MegaETH’s scale), will be crucial. Ultimately, the market's demand for significantly lower block times and fees, beyond what most L2s already provide, will determine the future direction of the L2 space.

Closing Thoughts

MegaETH’s endgame blockchain architecture will allow it to theoretically produce the most performant, lowest latency chain on the market, making it the best infrastructure for many applications to develop on. Because MegaETH could provide the best platform for applications in gaming, DeFi, DePIN, and more to satisfy their users' wants in the quickest way possible, it has the potential to capture a significant amount of market share. Before a clear winner emerges on the performance side of the spectrum, the plethora of over 100+ L2s will need to make a choice: aim to compete with MegaETH now or find a new niche in the middle ground.