Amazon has agreed to invest $4 billion into the artificial intelligence startup Anthropic to develop high-performing foundation models.

Another risk to the cryptocurrency recovery may come from the strength in the greenback, which has risen for ten straight weeks, its longest winning streak since 2014. The United States dollar index (DXY) has also formed a golden cross, indicating further potential upside in the near term.

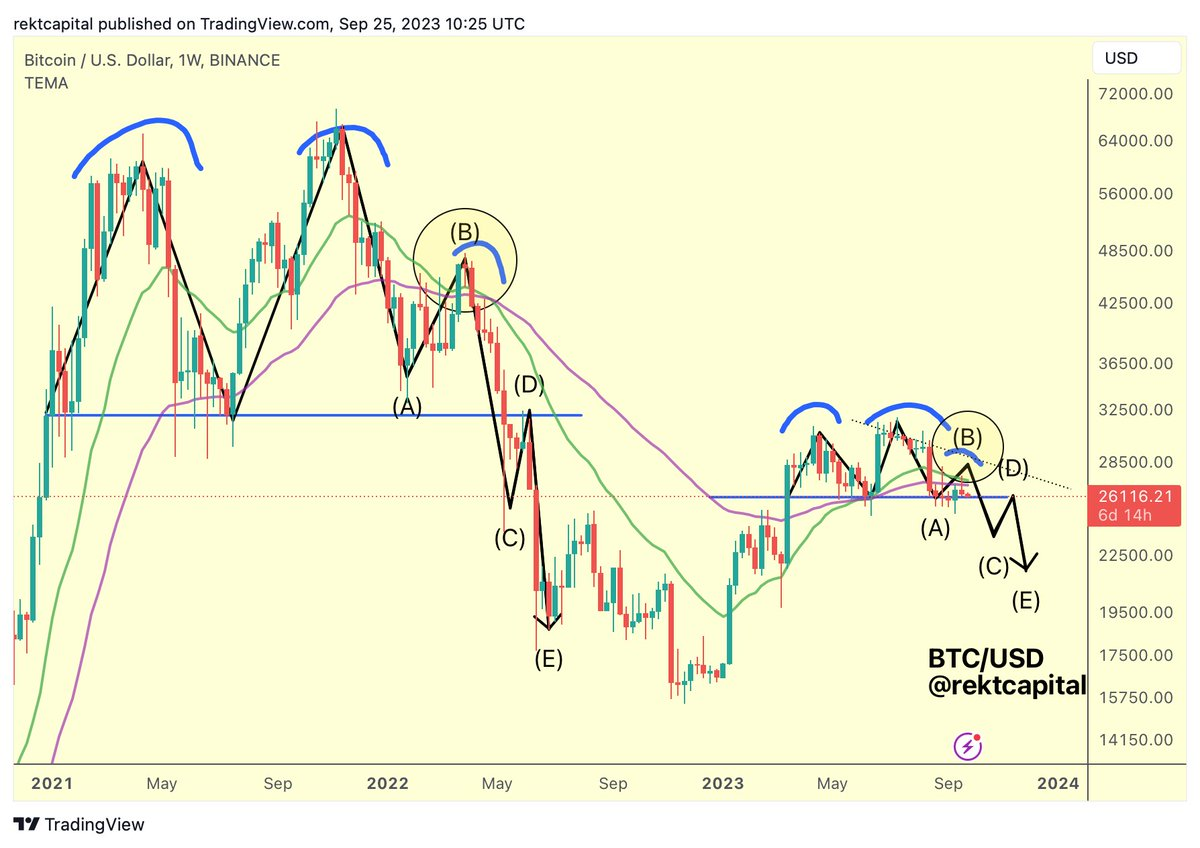

Will the U.S. dollar extend its gains or witness a short-term correction? Can Bitcoin bulls hold off the bear pressure in the last week of September? Let’s analyze the charts to find out.

The 20-day exponential moving average (4,422) has started to turn down and the relative strength index (RSI) is near the oversold territory, indicating that bears have the edge. If the price maintains below 4,325, the index will complete a bearish head and shoulders (H&S) pattern. This negative setup has a target objective of 4,043.

If bulls want to prevent the fall, they will have to quickly drive the price above the 20-day EMA. That could attract further buying and the bulls will then attempt to kick the price above the downtrend line. If they manage to do that, the index has a good chance of retesting the local high at 4,607.

U.S. dollar index price analysis

The U.S. dollar index bounced off the 20-day EMA (104.85) on Sep. 20, indicating that the sentiment remains positive and traders are buying on dips.

S&P 500 Index price analysis

The S&P 500 Index turned down sharply from the downtrend line and broke below the moving averages on Sep. 15. This started a downward move, which has reached the crucial support at 4,325.