We’re excited to announce a partnership between Aelin and Gelato to enable liquidity mining on Uniswap v3 on Optimistic Ethereum. Our partnership allows for $AELIN/$ETH liquidity mining to begin through an easy-to-use UI built directly into the Aelin website.

44 AELIN will be distributed per month to liquidity providers in rewards. At current prices, that’s approximately $3,000,000 per month.

First, we’ll explore how to join the $AELIN/$ETH staking pool. Then we’ll discuss some backstory on this solution and how we’ve gotten here.

How to stake your AELIN/ETH and receive POOL 2 Rewards

STEP 1: First make sure you’re connected to Optimistic Ethereum. Go to chainlist.org and add Optimistic Ethereum (Chain ID = 10) to your wallet if you are not.

If you need to bridge tokens to purchase AELIN or ETH, do so at the Optimism Gateway or a Fast Bridge

If you are on Brave, make sure to DISABLE your shield on the sorbet.finance website for a better viewing experience.

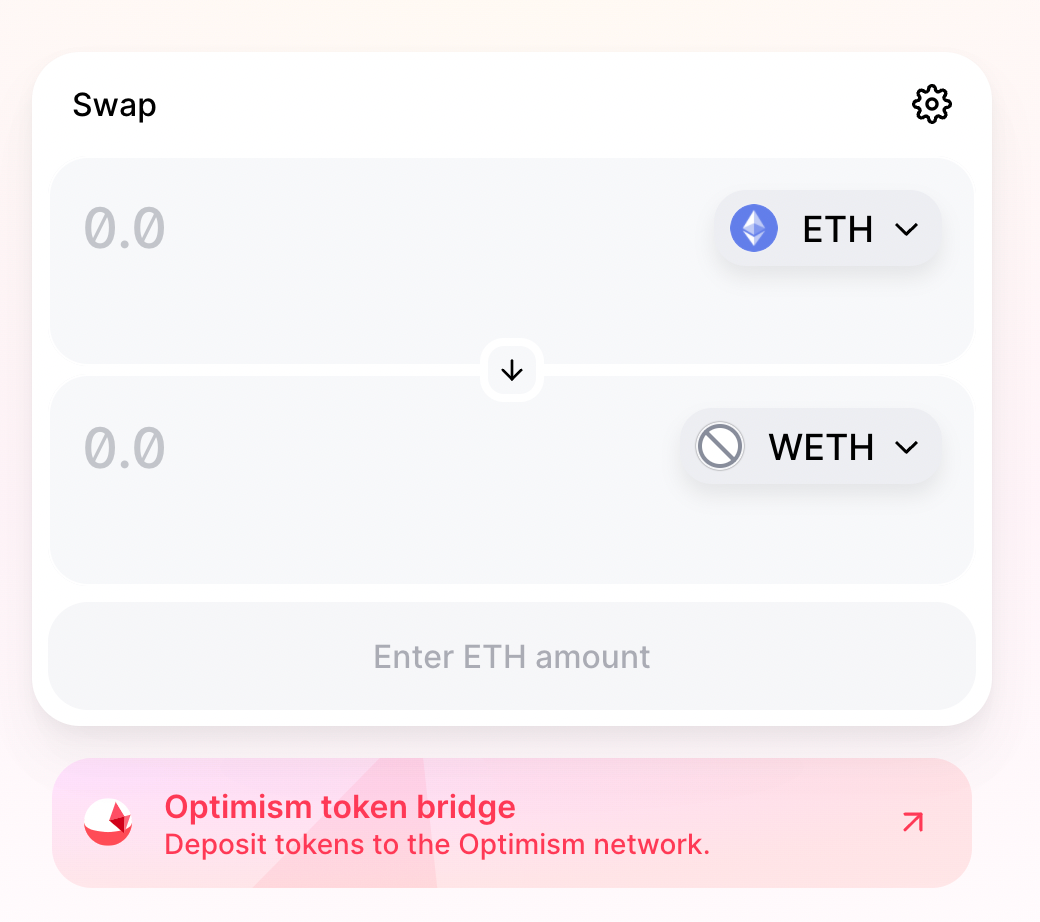

STEP 2: Wrap your ETH on Uniswap v3 to receive WETH 1:1.

You need WETH to participate in the Pool 2 Staking.

STEP 3: Add Liquidity via Sorbet.finance WETH/AELIN

Click Add Liquidity then deposit WETH/AELIN to proceed

STEP 4: Approve the Aelin staking contract to stake your G-UNI tokens. Click the approve button shown in the picture below.

First approve the contract above, then wait a few minutes, then deposit your tokens!

STEP 5: Wait a few minutes for STEP 4 transaction to confirm, then deposit your tokens into the staking contract. Refer to the picture above!

STEP 6: That’s it! You’ll begin receiving your AELIN immediately.

Uniswap V3 NFT Problem

Kain Warwick being Kain Warwick

We’ll start with a bit of backstory here.

Uniswap V2 (and V1) allowed users to provide liquidity to a 50/50 pool and then receive fungible ERC-20 pool tokens in return. You could then stake these pool tokens in a staking contract to be rewarded for providing liquidity. You’d then receive rewards based on the number of pool tokens that you staked in the pool comparative to the number of tokens in the staking contract as a whole.

Uniswap V3 introduced significant changes, one notably being that liquidity provider (LP) positions are represented as NFTs (ERC-721 tokens) as opposed to the fungible ERC-20 tokens on Uniswap V1 and V2. With Uniswap V3 protocols can’t simply reward liquidity based on a calculation of ERC-20 pool tokens; they now must find a way to convert non-fungible liquidity positions into a manageable calculation.

That’s where Gelato comes in.

Gelato G-UNI Solution

Gelato’s G-UNI pools are a solution for automated liquidity management on Uniswap v3. They convert your non-fungible liquidity positions in a given Uniswap pool into fungible ERC20 tokens and automate the rebalancing and fee compounding processes.

Overall, this makes Uniswap v3 liquidity provisioning much more accessible, composable, and profitable for the average user. G-UNI is powered by the Gelato Network, which provides decentralized smart contract automation, specifically rebalancing and auto compounding functionalities.

These G-UNI fungible tokens can then be deposited into a staking contract and will generate rewards.

You can learn more about G-UNI here: