Learning something new is always intimidating. The fear of messing up. The inevitability of feeling dumb or uneducated. The stress of “not getting it”.

Whether it’s learning a language or to cook. Whether it’s starting a new job or moving to a new city. The new, the unknown, can be a lot.

If you add financial or technical elements, this just gets exponentially more intimidating and inaccessible for beginners.

Web3, cryptocurrencies, blockchain - they’re all of the above. Technical, financial, with a whole language around it. Even with a ton of great primers out there, I’ve found it’s hard to get to a “so what” or a “ok, but where do I start?”.

For me personally, I learn best by doing and got a better sense of bitcoin and ethereum, wallets and NFTs, just by playing around.

I’ve been doing little sessions for friends over the past couple of months and figured I’d share here what I’ve shared 1:1, in case it might provide others a roadmap for exploration.

- 💰 How do I buy crypto?

Ok. So first, feel free to learn more about cryptocurrencies and why they’re compelling (eg. decentralized, math-based, on blockchain). Also why there are different ones (eg. bitcoin vs ethereum) built on different “protocols” (that just means they’re coded to value and optimize for different things - think of Bitcoin as a good “store of value” like OG gold, while Ethereum is more of a “supercomputer” and oriented to writing apps and added functionality).

But for our purposes, assume you want to buy Ethereum, so you can go on to get some NFTs or a vanity .eth domain (kinda like a personal domain name but it maps to your wallet - more on that shortly).

So, you need to convert your fiat (eg. your USD or CAD or Euro) into crypto (eg ETH), just like you would if you were traveling to another country. Right now, the exchange is something like $100 USD = ~0.0003 ETH or 1 ETH = ~ $3300 USD (word to the wise, cryptocurrencies are crazy volatile so this changes a lot and quickly, and don’t do this with any money you’re counting on needing to be there).

You’ll do the converting on a cryptocurrency exchange like Coinbase, MoonPay or Gemini. If you’re in Canada, try Bitbuy. You’ll need to set up an account and go through classic KYC (Know Your Customer compliance) things like uploading your driver’s license etc. No need for multiple accounts - like you probably have a main personal bank, just pick one.

Once you have an account, you’ll be able to connect your bank account or in some cases, buy via your credit card. Start with something small (eg $100) and work your way through all the steps. See your USD get converted into ETH.

You can stop here, if you want to simply diversify some of your dollars into crypto, like investing in a stock and holding. This is what I did back in 2017, just as a learning exercise and really didn’t do anything more until 2021 when NFTs started exploding, and I was “airdropped” my first NFT. Which leads me to …

-

💳 What’s a wallet and why do I need one?

If you’d like to use this ETH to explore and transact with web3 products, you’ll want to move this ETH to a “wallet”. Think of a wallet as a digital safe that holds your assets - yes, currency, but also eventually, NFTs and other tokens. It’s been one of my favorite parts of the web3 experience - this idea that I own all my assets and I carry them to all the different sites, like a secure digital backpack and to interact with the site, I just “connect wallet”, instead of remembering a kazillion passwords and logins, which can also more easily be compromised.There are mainly two kinds of wallets: a hot wallet that’s basically an app like Metamask or Rainbow or a cold wallet that’s essentially like a USB stick (Ledger, Trezor). A hot wallet is crazy convenient but easier to hack (as it’s connected to the internet) while a cold wallet is way more secure but can be a pain to use often. A lot of times people will split their assets across a number of hot and cold wallets but for our purposes, we’ll talk about setting up a hot wallet like Metamask.

The simplest is to download it as Chrome extension - the instructions are fairly straightforward - be sure to be super careful about the Seed Phrase step. This is your Private key. Think of this like your password or your banking pin. You don’t want to ever tell anyone this. You don’t even want to write it down digitally. I found this annoying (but I did it) - write it down on a piece of paper and store it in your safe.

Once you’re done, you’ll be given your Wallet address - a long string of letters and numbers starting with OxB…

Counterintuitively, this is your Public key and feel free to share this when people ask for your wallet address - it’s like an email address to direct anything to your wallet.

It’s not very user friendly, so a lot of people will go buy a “vanity eth address” - the thing like apatelthompson.eth and map it to the hexadecimal address.

-

💃🏽What can I buy and do??

Now the fun part. Go exploring. Not everything requires buying things and here are a range of things you can do to start exploring in web3.🙋🏽♀️ Buy a vanity eth name. Go to ENS Domains and find an .eth address you’d like to buy. Many people will get one tied to their name. Find one that’s available and go through the steps to register it. Beware of paying “gas fees” with each transaction - these are essentially transaction costs paid to the people that process the computations related to your transaction. If they seem high, try waiting for another time of the day that might be less congested. In any case, you want to keep track of how much gas fees are because sometimes they can outweigh the cost of the thing you’re buying (incidentally, if you’re interested, there are a lot of efforts ongoing to solve for this part of the Ethereum network, while it’s also driving people to build on other protocols like Solana, with tradesoffs).

Anyway, once you buy it, you should see it in your wallet or when you connect to an NFT marketplace like OpenSea or Rarible.

🖼 Find an NFT to “mint”: Either find a project you’re interested in (on IG or Twitter) and keep track of when they’ll be releasing their collection of NFTs, or use a calendar like this or this to find a collection you’d like to get at release. The pros are you can get them for likely the lowest prices, especially if it’s a popular project. The cons are it’s completely random which one you might get - a super rare one or not so much. Plus you can buy one before it’s really clear if the community is really committed to investing in the roadmap and project. Best bet is to follow a project for a while leading up to the mint, check out their discord (which I find often too chaotic to hang out in for long) and get a sense of what they’re building and how.

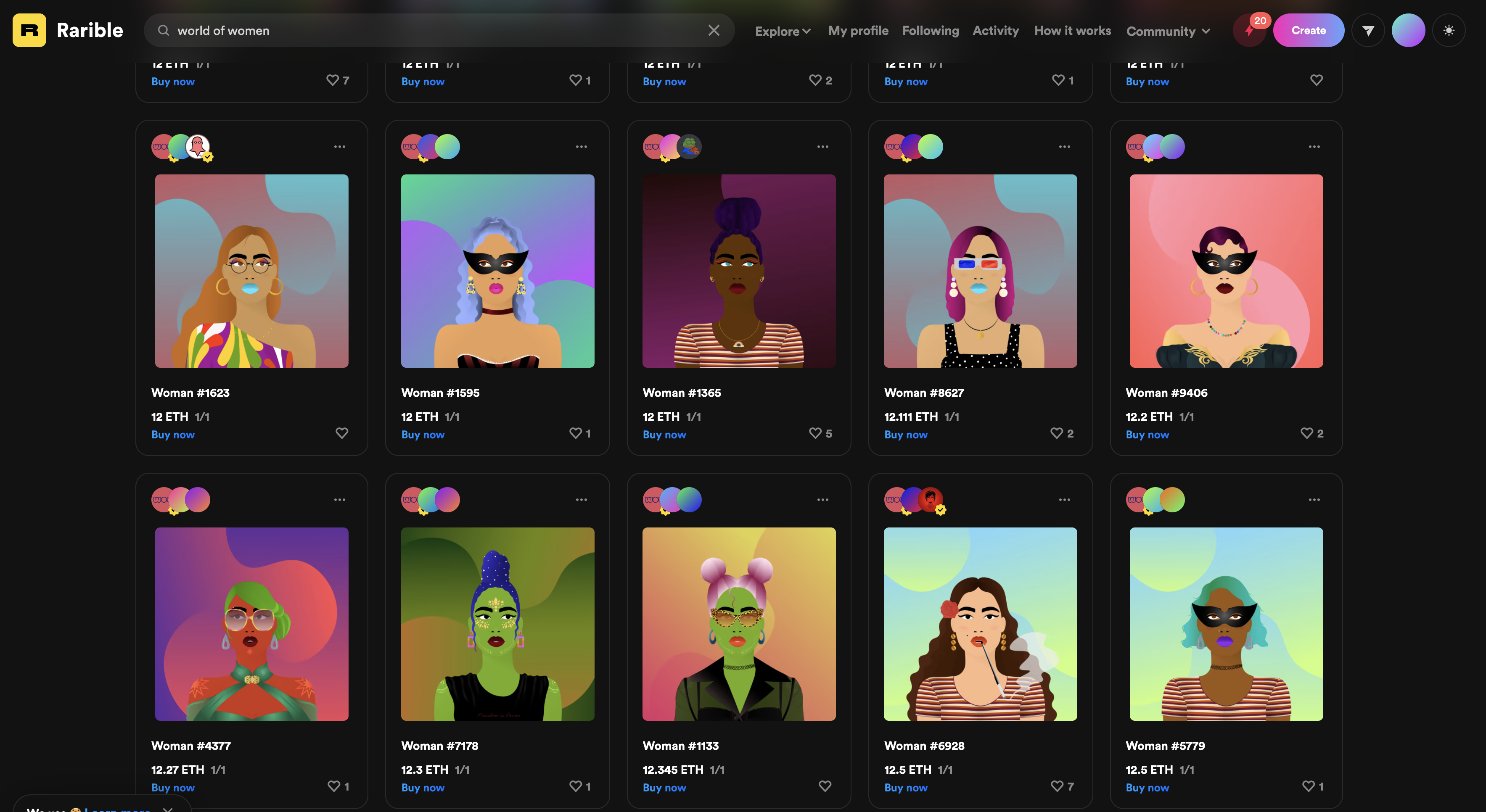

🛍 Find an NFT to buy on “secondary”: This just means you go to a marketplace (like OpenSea or Rarible) to buy an NFT that others already own. You can search different collections like World of Women or Boss Beauties or mfer.

IMPORTANT: Be really sure you’re on the official page (eg with the verified badge) - there are a ton of fake pages that will get you to connect your wallet and try to sell you fakes. We haven’t innovated our way out of scammers.

The pros here are you can find exactly the one you want and you can get a sense of collections that have a lot of value and investment from the people behind them. The cons are they’re likely pricey.

Fwiw, I know a lot of people buy NFTs because they expect them to appreciate in value - I think that’s a wonderful side effect, but for my part, I’ve only ever bought NFTs of communities that I think are doing something really worth backing.

Through that lens, an NFT is like a membership card, or a ticket to a community doing some set of things. Here is a collection I came across that would be great for someone really into movies and screenplays. You can see the “benefits” you get access to buy holding one of their NFTs.

🗺 Read (or write!) a post on Mirror, “learn to earn” on sites like Rabbithole or Layer3. Check out snippets of the metaverse by visiting Sandbox or virtual NFT museums on Spatial.

🧐 A couple last notes. The thing that makes this all scary and intimidating (I think), is that we’re talking money and we’re talking deeply technical things. And there’s the fear of doing something that either loses you the money (eg. via the volatility or via a scam or just “picking the wrong thing”). So:

- Only put money in that you could afford to lose all of. And for the first while, think of any money you put in as a payment for a “course”. If you think about it as money you’re spending/investing to learn then you won’t stress the ups and downs. And really, that’s what the first money in is: the opportunity to explore and learn.

- Keep security top of mind until it becomes second nature: only go to the official sites (via links from official social pages and verified badges); read any transaction you sign and make sure the website is the one you want. Don’t let FOMO have you clicking or going for all the things. If it feels too good to be true, it likely is.

- Lead with the projects that you love not that you think will make you money. If you love music - go find music projects. If you love art, ditto. If you love golf, check out Links DAO etc. Forget about striking it rich and enjoy the curiosity and exploration.

It’s still so early in the space (you’ll hear people say this a lot), that for many people, buying some crypto and some NFTs will be enough. But my hope is that people are able to enter the space through a sense of curiosity and wonder and excitement, not fear (or missing out or messing up) or intimidation.

And that starts with baby steps.

🔭 Happy exploring.