Background

Polygon POS as constructed today and in the context of our current understanding of what an L2 is, is not an L2 or a Stage 0 rollup. While there have been hints at a future transition, there is no public roadmap or known endgame. As a result, here we will speculate about what a Polygon POS to rollup transition could look like.

Polygon is uniquely positioned because its core product, Polygon POS can eventually become a Stage 2 rollup while maintaining medium-term flexibility, a notoriously difficult feat.

Why bother?

Check-pointing to Ethereum gives Polygon POS chain a snapshot of Bor chain’s state for social consensus to recover from. However, without working fraud/validity proofs and a censorship resistance mechanism (eg. escape hatch/forced withdraws to Ethereum), this still leaves user funds vulnerable to an honest majority trust assumption.

This is not good enough.

For example, users funds can be stolen if validators decide to mint more tokens on Polygon POS which could prevent users from withdrawing to Ethereum. Also, Validators could submit a fraudulent checkpoint allowing them to drain the bridge contract. See L2 Beat for more details.

The POS bridge currently has ~ $2.49B locked according to L2 Beat. In fact this places Polygon POS bridge in the #1 position by TVL on L2 Beat’s leader board. There is clear demand to use the Ethereum aligned scaling solution.

Rollup Types

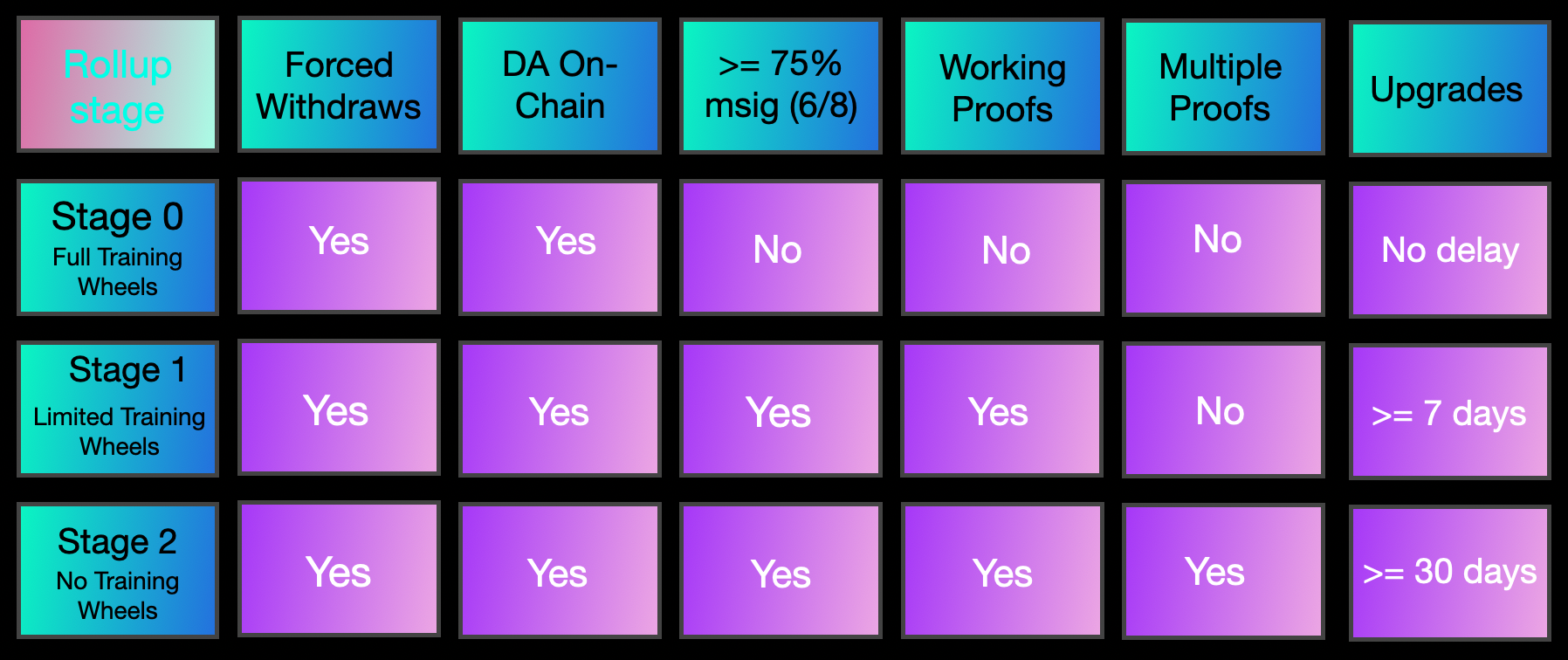

Recently, the discussion around rollup classification came into focus with Vitalik’s post on ethereum-magicians. Below is a summary. Please read the link for full analysis. See the video from Scroll’s rollup day in Bogota for richer context.

Stage 0: Full training wheels

Posts transactions on chain. Derive L2 state from L1. Needs a working escape hatch. Multi-Sig posts state roots on-chain no fraud/validity proofs live.

Stage 1: Limited training wheels

There must be working fraud/validity proof scheme & multi-sig based (6/8 or stricter, >= 75%) override mechanism. Upgrade mechanism can be lower than multi-sig but must wait 7 days or the length of the fraud proof dispute window, whichever is longer.

Stage 2: No training wheels

Two or more implementations of state transition function (2 fraud, 2 validity, or one of each), security council can adjudicate if proofs disagree. 2 valid proofs for two distinct state roots after processing the same data temporarily turns control to the security council, no valid proof for >= 7 days, Upgrades delay >= 30 days.

Endgame: Hybrid rollup construction relying on an honest minority trust assumption

Ideally, Polygon POS becomes a hybrid rollup operating primarily as a validium but with a fall back to a rollup. Polygon hybrid would also likely act as a liquidity layer for L3 validiums built on top; only for the sane use cases of course ( privacy, enterprise, app specific, etc.). This is certainly not a new idea as others have advocated for this kind of construction generally.

Here, Polygon POS transforms into hybrid rollup with fraud & validity proofs relying on a 1 of n honest minority trust assumption with a fallback to rollup. Ideally the user would have 3 choices of where to post their data, similar to a Volition, on a per transaction basis or as a persistent but flexible setting.

[1] Full rollup mode all data is posted to Ethereum with a SNARK and proof of equivalence to prove that the public data equals the versioned hash.

[2] DAC secured by Eigen DA (ETH re-stakers) would be ideal with a few of n honest minority assumption assuming a high enough erasure code rate. Avail or Celestia could be used for DA but both require an honest majority.

[3] Adamantium could also be attractive where users can effectively specify their own DAC by trusting a power user(s) of their choice or download all of the off-chain data themselves as a Power user. If the Power user goes off line all of their funds are automatically withdrawn to L1.

Enterprise Validiums

One of Polygon’s notable strengths is business development. In the future there will be institutional demand to use Ethereum as a settlement layer for financial transactions. I am not against enterprise activity on blockchains entirely. There are legitimate use cases for enterprise validiums. Again, a Polygon hybrid rollup could position itself as an L2 liquidity layer providing:

-

Native transaction privacy

-

Minimal trust assumptions outside the base layer of choice

-

Cheap and abundant DA at minimal expense - sound economics

-

Shared Liquidity

-

Escape Hatch L3 → L1

Alternative Path : Ethereum’s IBC Hub

The above idea of Polygon POS as a stage 1-2 rollup is 2-3 years away, if not longer. This also may not be the best idea to maximize user adoption.

Another path in the interim for Polygon POS chain could be to enable IBC, becoming a liquidity hub between Ethereum and Cosmos. According to Cosmos ecosystem developers this is possible.

This would unlock a litany of features and expose Ethereum brands to Cosmos natives while introducing asynchronous composability.

Uniswap could directly compete for market share with Osmosis and visa versa. Aave would not have to deploy an instance on EVMOS or another Ethermint fork but instead gain Cosmos users via Polygon’s IBC connection.

It’s important to note that Composable Finance is building on top of IBC to connect Polkadot to Kusama, Near, & Cosmos. Polygon POS would benefit tremendously by getting ahead of this opportunity and again acting as an IBC hub for Ethereum.

For example, users would benefit from having one hop access to privacy chains like Manta, Penumbra & Secret Netowrk via IBC.

Also, Polygon POS could opt into Mesh Security, Babylon or Trust Boost before transitioning to a rollup which would upgrade their current level of economic security.

Conclusion

The above set of classification standards and suggestions provide a solid starting point for the community to formally advocate for their position and help the Polygon team craft a roadmap for Polygon POS that everyone can hold each other accountable to.

The Best Path forward could be both approaches outlined above. Focus on transitioning Polygon POS into an Ethereum aligned IBC hub while the ZK teams (Hermez, Miden, Zero) deliver a fully functional zkEVM.