Please note this is an archived post from Jul 27, 2021 migrated from Medium.com

Dear APWine Community, we appreciate your patience and encouragement throughout the past several weeks as we enter the final sprint to launch V1.

We are pleased to announce that the grapes are almost ripe, and wine production will start very soon. We are aiming to launch V1 in late August. Part of the reason behind the delay is the expansion of our team!

The core winemaker family has grown, and since our last post, our team has increased to 9-people strong with all hands on deck putting the finishing touches on V1.

A substantial amount of work has been put into deploying V1 to create the go-to platform for tokenizing, trading, and hedging future yield. Ironically, the best time to release V1 is during a volatile market as DeFi users, humble yield farmers, and even large crypto asset management companies band together to fight a common enemy — volatile yield.

We initially planned to launch V1 just before EthCC Paris. Still, a slight delay will be necessary because of the ongoing audits, onboarding of new team members, and certain minor tweaks that will create the best user experience possible. V1 is dated to launch in late August, and we will be announcing with a fixed date closer to the launch.

To quote Shigeru Miyamoto, the godfather of video games, “A delayed game is eventually good, but a rushed game is forever bad.”

The GrapeVine

- The core team has attended and hosted networking events at ETHCC Paris

- After Peckshield, Quantstamp's first review outlined several possible improvements that we’re working on resolving. We are deliberately choosing to work with the best smart contract auditors to align with our approach of quality over quantity. Our top priority is security, as we expect V1 to manage and maintain a high volume of assets.

V1 at a Glance

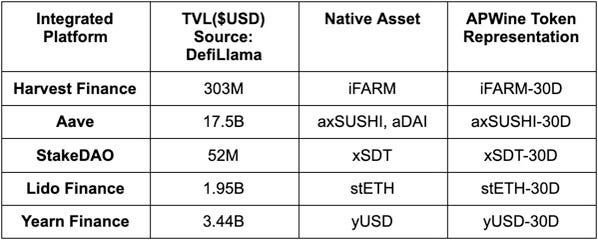

V1 of APWine will allow users to deposit native assets from Harvest Finance, StakeDAO, Aave, Synthetix, Maker, and Yearn Finance directly through the interface, even if they are not holding platform-specific interest-bearing tokens. Users can select their desired Future contract (based on the interest-bearing token and period) from a selection. Then, users can deposit their platform-specific native assets, and receive PT + FYT tokens. Lastly, users can trade their PT/FYT tokens on the APWine AMM (powered by Balancer) against their underlying asset.

For example, users will be able to deposit DAI directly through APWine and mint their PTs (Principal Tokens) and FYTs (Future Yield Tokens) without visiting Aave first. Users can then trade their PTs and FYTs in the APWine AMM pool against their underlying assets, in this case, DAI. By creating a decentralized “futures market” underwritten by stablecoins and IBTs, APWine enables retail users to utilize additional yield generation and hedging strategies.

There is a good chance that if you are reading this article, you are bullish on Ethereum and the DeFi industry. The team at APWine shares the same sentiments and that’s why we expect V1 to scale quickly in lockstep with the demand for yield in the crypto market. As TVL increases across the entire crypto space, the demand for yield farming, aka “liquidity mining” naturally increases. The arbitrageurs and speculators of tokenized yield on V1 will create a highly liquid protocol that will enable various asset management strategies. Increased marketing efforts towards education, how-to guides, and yield tokenization thought leadership are the core principles at APWine that drive DeFi innovation forward.

V1 will feature industry-leading UI/UX design and create a secure, simple environment for users to tokenize their Interest Bearing Tokens, and trade the yield on the in-house AMM. Interest Bearing Tokens will be deposited into a non-custodial audited smart contract that will accrue rewards that can be withdrawn by the owner of the subsequently minted PT tokens. Principal Tokens (PT) and Future Yield Tokens (FYT) are the assets that allow users to compound their yield and/or hedge against fluctuations in APY. V1 empowers traders to enter an entirely new market where they can speculate on FYT and PT prices. We expect the circular nature of the platform to bootstrap and sustain liquidity, creating a healthy environment primed for growth alongside the DeFi industry at large.

APW Token

Currently, the two most liquid avenues of acquiring APW are on SushiSwap and Comethswap (Polygon).

To recap, APW is an ERC-20 token that awards holders voting power within the APWine DAO. Locking APW through voting escrow (veAPW) will yield increased voting weight and share of protocol rewards. Additionally, APW token holders benefit from the performance fee (decided by the DAO) collected from all the yield deposited and futurized on the platform from day one. Fees collected via swaps performed on the APWine AMM will also be retributed to APW holders.

Next Up

Additional liquidity provisioning measures will be executed in collaboration with other DeFi platforms as we expect interest for APW to increase when V1 launches. We will be making announcements on this front in the coming weeks. We want to thank our community for the support and look forward to launching V1 as soon as possible.

About APWine

APWine is the pioneering protocol for tokenized yield in Web3. Users can leverage the protocol to fix interest rates, speculate on APR evolution or receive future yield in advance (even today).

Build the APWine City with us and connect with fellow Winemakers via: