Please note this is an archived post from Dec 21, 2021 migrated from Medium.com

Winemakers, the very first Winelisting has concluded!

It was exciting to see so much engagement from the community. The entire process was smooth! We look forward to the next Winelistings that will fuel the growth of APWine.

We aim to turn APWine into the go-to platform for tokenizing and trading unrealized yield across multiple blockchains.

We want to thank all projects, their associated community members, and the APWine Community for a competitive voting marathon.

Let’s raise our glasses and toast to the new wines that will be maturing in the APWine vineyards (🍇,🍷)

#1 xSDT Staked SDT

#2 PalPoolStkAave Paladin Staked Aave

#3 stETH Lido Staked ETH

#4 sPSP-4 Staked ParaSwap Pool 4

#5 tfUSDC TrueFi USDC

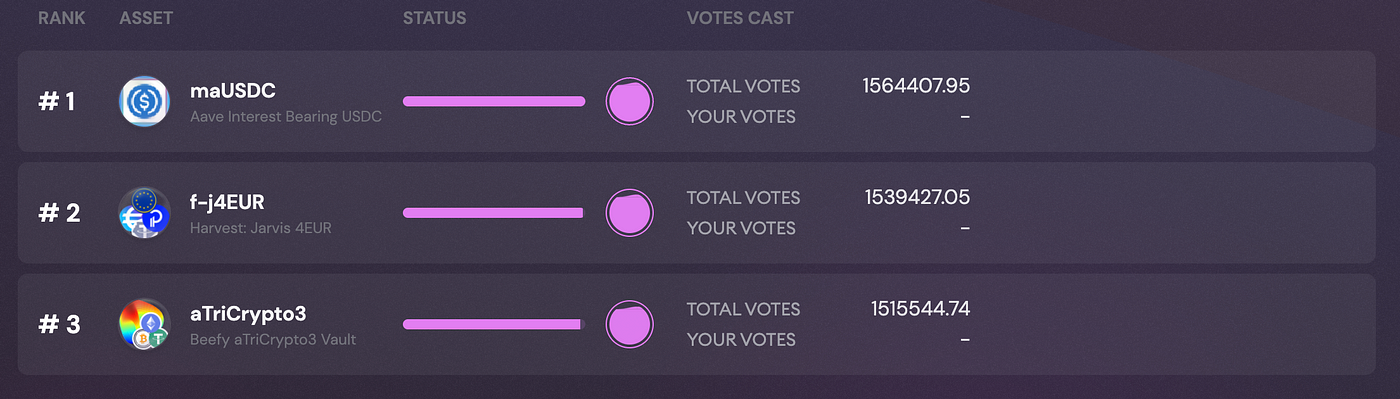

Polygon Winners

#1 maUSDC Aave Interest Bearing USDC

#2 f-j4EUR Harvest: Jarvis 4EUR

#3** aTriCrypto3 **Beefy aTriCrypto3 Vault

What Happens Next — Incoming new Future Pools

Now, we will be setting up each new pool. Follow our Twitter to be notified as soon as new pools go live. The next Winelisting will start in approximately three weeks, so have your veAPW ready!

The pools will be set up on the Ethereum Mainnet and Polygon. Users will be able to speculate on the volatility of yields generated by these native protocols through these 90-day futures pools. Defi users can hedge risk on their passive revenue or expand exposure without buying the underlying assets. We want to thank everyone who voted for these pools to appear, and we hope you enjoy the flavors!

Keep the Proposals Coming!

Every new asset that enters the vineyard starts its journey in the governance forums here. We encourage teams, community members, traders, DAOs, etc, that would like to see an asset integrated into the platform to make a simple proposal following the general guidelines.

Official V1 Launch — December 23rd

It’s finally here, the moment we’ve all been waiting for. V1 will launch on December 23rd. There will be a public testnet available 24 hours before the launch of the live interface. APWine will provide documentation on utilizing the protocol and its AMM through the live interface.

Incentives for liquidity provision — Attention Wine Makers!

There will be incentives available to bootstrap liquidity provision on all AMM pools (for FYT/PT/Underlying assets, see AMM documentation here.

There will be 1,875,000 APW allocated for the** Mainnet** pools during this first 90-day period and 125,000 APW allocated for Polygon pools.

For more details, check out the tokenomics here.

The emission rate will stay the same for the next Winelisting event (but split among the current and existing ones). The liquidity mining program will also evolve, focusing on increasing the capital efficiency of the allocated rewards.

APW Protocol Revenue — With great wine comes great responsibility

Currently, the fees charged within the AMM are collected and sent to the APW treasury. It is now set up as follows: 0.25% for liquidity providers and 0.05% for the DAO.

The DAO will vote on treasury allocations and revenue sharing with veAPW holders in the coming days. The community is henceforth always responsible for how the funds are utilized. Other performance fees will be proposed and subject to improvement proposals for future Winelisting events. Bookmark https://app.apwine.fi/governance and check the forum often! The future of APWine is now in your hands.

About APWine

APWine is the pioneering protocol for tokenized yield in Web3. Users can leverage the protocol to fix interest rates, speculate on APR evolution or receive future yield in advance (even today).

Build the APWine City with us and connect with fellow Winemakers via: