Please note this is an archived post from May 14, 2021 migrated from Medium.com

The day has come for APWine to take on another great step.

On 19–21 May 2021, the $APW governance token will be distributed through liquidity bootstrapping event on Balancer. The event will start on May 19th, at around 12:00 CET, and will run for **48 hours to **end on May 21st, at 12:00 CET.

The liquidity bootstrapping will be accessible through the APWine LBP Page.

Why Balancer Liquidity Bootstrapping Pool?

On Uniswap, liquidity pools are created with the same amount of tokens on both sides: the value of both assets in proportion must be equal. For instance, if you want to provide liquidity to an ETH/DAI pool at a price of $4,000 / ETH, you will need to provide liquidity in proportion — e.g. both 10 ETH and 40,000 DAI. This means both assets have the same “weight”, or proportion, in all the liquidity provided in the pool — essentially a 50 / 50 ratio.

Balancer, on the other hand, allows the creation of pools with arbitrary weights. This makes it possible to create pools with custom weight ratios. In an 80% / 20% ETH/DAI pool, for example, you could provide liquidity with 10 ETH and only 10,000 DAI. Since 80/20 = 4, this means you can supply 4 times as much ETH as DAI.

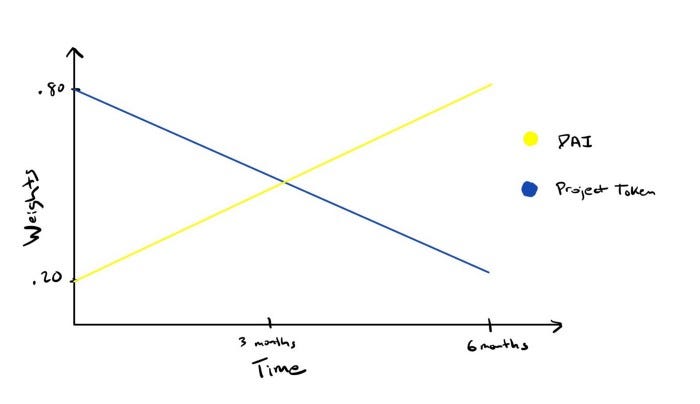

In practice, this mechanism comes in very handy to bootstrap liquidity for new tokens without an existing market. A Balancer Liquidity Bootstrapping Pool (LBP) is a pool whose weights gradually adjust from an initial ratio to a target ratio, during a pre-determined time period.

For example, you could set up a pool for an imaginary $TOKEN with USDC, at a starting ratio of 80 / 20 and end at 50 / 50. The linear interpolation of weights, if the reserves of the pool stay the same, also changes the $TOKEN/USDC price — if no one buys, the price of the token decreases as the weights adjust. This represents the fair competition between front-running bots and the community, along with minimized volatility and fair distribution during the entire price discovery period of the LBP. The final price meets what users are willing to pay. Bots are discouraged from buying a large chunk of the supply directly from the pool, since the price of the token will later decrease if no one else buys. This gives everyone a fair opportunity to join in.

LBPs have been battle-tested through many liquidity bootstrapping events and are a great choice for initial token distribution since liquidity can be built without needing to provide large amounts of initial capital. Recent successful token launches through LBPs led us to settle on this option, in a matter of distributing the initial $APW supply in the fairest way possible.

APWine LBP Details

The LBP aims to distribute 7% of the supply, as per $APW Tokenomics.

A pool will be created with an initial 3'500'000 $APW and 800'000 USDC, at a 90 / 10 weight ratio. The weights of the pool will gradually adjust to reach the target of 40 / 60 at the end of the event.

In practice, this means the price of $APW will start at $2.05 and has the theoretical capability to go as low as $0.16 — half the seed price (if there are no buyers).

Only the APWine team will be able to supply liquidity to the pool, and no $APW tokens will be in circulation before the LBP — this event is the first public opportunity to acquire $APW.

Since the aim of the LBP is to distribute $APW in a fair way, there will be trading fees to prevent bots from profiting by buying and selling the tokens during the event.

The funds raised during the event will be used to seed 50 / 50 liquidity pools on decentralized exchanges.

Next Steps

We’ll give more details on the pool address when we get closer to the beginning of the event.

In the meantime, we encourage all participants to read $APW Tokenomics and do their own research before engaging in anything. We have an existing presentation page and updated, in-depth documentation coming up. The new Telegram Announcements channel is the best place to stay updated on all token and protocol news.

We’d like to thank our community for the continued support and are very much looking forward to making the launch of $APW and the APWine Protocol a success, together.

Feel free to add the event to your calendar with this link.

About APWine

APWine is the pioneering protocol for tokenized yield in Web3. Users can leverage the protocol to fix interest rates, speculate on APR evolution or receive future yield in advance (even today).

Build the APWine City with us and connect with fellow Winemakers via: