Please note this is an archived post from Mar 17, 2022 migrated from Medium.com

Following a successful proposal created in late February, we are excited to announce that the long-awaited liquidity gauges are now live.

On APWine, the $APW inflation is going to users who provide liquidity. Until now, there was a fixed number of $APW pointed at pools across Mainnet & Polygon.

Starting today, it’s now up to our community to vote where the $APW inflation should go. A core function of APWine’s protocol is now in the hands of the people, and we couldn’t be more excited to see it happen!

Winemakers can also reduce the $APW emissions directly, allowing them to balance dilution against additional incentives for liquidity providers.

👉 Explore: app.apwine.fi/gauges

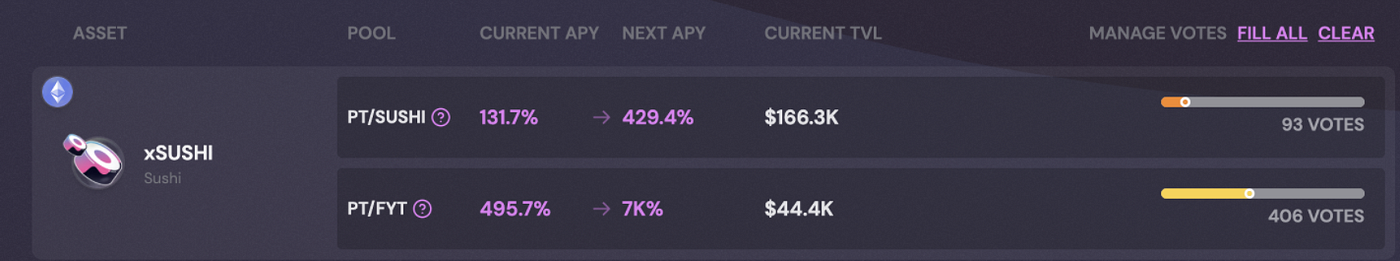

On this page, you’ll be presented with a liquidity gauge for each individual pool (PT/underlying & PT/FYT).

The logic & outcome of the votes are pretty straightforward:

More votes 👉 higher $APW emissions 👉 higher APY projection in the next cycle.

Gauges operate on a 7-day cycle basis, giving voters more flexibility with experimenting whether higher $APW emissions incentivize liquidity providers or not for a particular pool.

Community votes will be reflected on-chain once the ‘’taking effect in’’ countdown hits zero.

A word on incentives 🍇

Liquidity gauges give the $APW token yet another superpower and a reason for users & DAOs to purchase it on the open market.

If a protocol would like to increase the amount of $APW emissions for their interest-bearing pool on APWine, they first need to acquire $APW and lock it to gain voting power.

How to gain voting power

To vote on liquidity gauges, users first need to lock $APW in the governance dashboard — from here, your voting power will be reflected on the gauges page.

Note: The APWine protocol takes only veAPW into account for gauges, not LP or tAPW tokens.

The gauges page displays pools across all chains. You can vote while being on any chain since the voting system only needs your signature.

APWine core community members will continue to work on various improvements, further optimizing the efficiency of those allocations.

About APWine

APWine is the pioneering protocol for tokenized yield in Web3. Users can leverage the protocol to fix interest rates, speculate on APR evolution or receive future yield in advance (even today).

Build the APWine City with us and connect with fellow Winemakers via: