Part 1: What the FTX Happened

Introduction

2022, in the world of crypto, can be characterized by the unraveling of debt and fraud from centralized institutions. Between Terra/Luna, Three Arrows Capital, the collapse of CeFi lenders and the bankruptcy of FTX/Alameda, NAVs of close to $100 Billion were found to be gambled away and commingled.

With FTX/Alameda, the executives were allegedly manipulating the book value of their balance sheets, misappropriating funds and insider trading. Ultimately, a leaked balance sheet by CoinDesk and a sell order from a competitor exposed a $10B hole in FTX and collapsed the house of cards.

Context

Alameda was founded in 2017 as a quantitative crypto trading firm focused on arbitrage opportunities. FTX was started shortly after, in 2019, as a centralized crypto exchange. Both entities were founded by Sam Bankman-Fried (SBF). They became instant success stories as Alameda grew to over $10B in AUM and FTX grew to $30B in user deposits.

SBF quickly became the “golden boy” of crypto, amassing a wealth of over $20B. As a self-proclaimed “effective altruist”, he donated to numerous media publications and politicians. He became the front-man for the SEC’s efforts to regulate crypto and was a main contributor to the DCCPA, a controversial crypto-regulation bill currently proposed in congress.

The Collapse

On November 2nd, 2022, CoinDesk leaked a balance sheet of Alameda’s holdings. The results were alarming. The hedge fund held $14.6B in assets, mostly in illiquid tokens, to $8B in liabilities. Of those assets, $5.82B was in FTT, the made-up, no utility token of FTX. At the time of the leak, the circulating market cap of FTT was $3.4B, significantly less than Alameda’s position. Had Alameda been forced to sell the FTT, it would have caused the price to plummet well below its listed price of $26, meaning its book value did not reflect fair value. Shortly thereafter, it was uncovered that Alameda held or collateralized $802M of Serum (market cap of $280M), $508M of Maps (market cap of $10M) and $76M of Oxygen (market cap of $9M), among others. Put together, these assets had a book value of $7.2B but if they were sold on the open market, they would’ve likely sold for $1-2B. At fair value, it seemed likely that Alameda was insolvent and vulnerable to a margin call. Furthermore, these assets were all invested in by FTX Ventures.

What became abundantly clear was Alameda’s rise to prominence was predicated on an engineering hack that created an illusion of assets out of thin air. The formula was simple: FTX Ventures buys a majority stake (90%+) of a cryptocurrency or creates one in-house, releases a small percentage of it to the public (<10%) and promotes it to cause a buying frenzy. With all the demand concentrated on the small amount of public tokens available, the price of the tokens skyrocket, causing FTXs oversized position to list at a massive book value. FTX would then list this position to Alameda’s balance sheet, who would collateralize it to borrow funds, with FTX as its primary lender. To put it simply, Alameda was heavily leveraged, using illiquid cryptocurrencies FTX made out of thin air as collateral, with user funds on FTX as the primary source of leverage.

Shortly after the leak, Changpeng Zhao (CZ), the CEO of prominent FTX competitor Binance, announced on Twitter that his exchange was looking to sell its stake of FTT (est. $680M) “due to recent revelations that have come to light.” The announcement led to panic selling from FTT holders as they feared the sell pressure would lead to an Alameda liquidation, death spiraling FTT to $0. It also led to a bank run from FTX users as an Alameda liquidation meant the loss of billions of dollars in user funds. On November 8th, user withdrawals on FTX were frozen and FTT fell 80% to $5.20. By November 11th, FTX and Alameda filed for bankruptcy, posting a $10B hole in user deposits.

The $10B Hole

Although it is unclear exactly where the $10B of user deposits went, a general idea is beginning to emerge as more information leaks to the public.

The majority of funds seem to be lost through Alameda’s leveraged exposure throughout the 2022 bear market. As the market continued to go down, Alameda continued to “borrow” more user deposits to post margin on their loans, amounting to a hole of at least $4B.

The remainder seems to be lost, not through investing, but through commingling deposits for personal and business expenses. The expenses include but are not limited to $121M in personal real estate, $70M in political donations, a $1.4B acquisition of Voyager and an unsecured $1B loan to SBF himself.

Further Details and Evidence

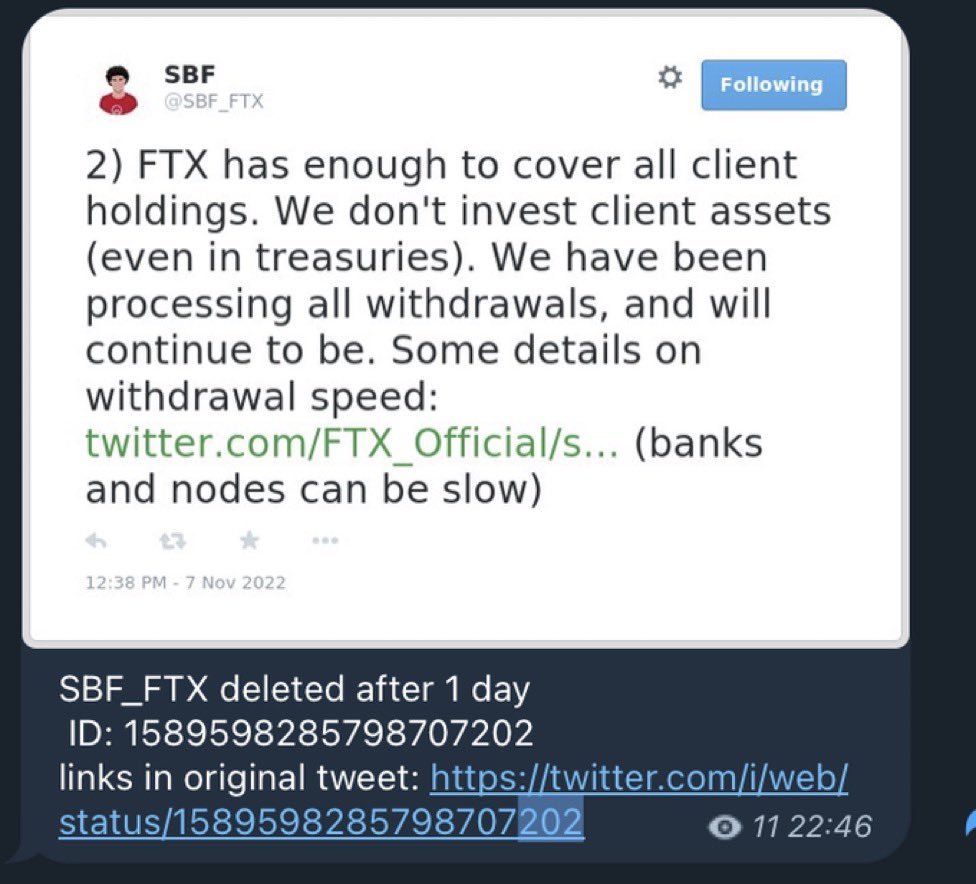

As journalists investigate the situation, the alleged evidence to fraudulent activity accumulates. For example, it was found that FTX’s terms of service forbids the investing of user deposits. Section 8.2.6 states, “Title to your Digital Assets shall at all times remain with you… FTX Trading does not represent or treat Digital Assets in User’s Accounts as belonging to FTX Trading”. On November 7th, during the bank-run, SBF supported these terms in a tweet, stating “We don’t invest client assets”. We now know this wasn’t true.

It was always expressed by SBF that FTX and Alameda were separate entities and Alameda did not have special rights to using the FTX platform. It’s now known that Alameda had access to all real-time trading data and received liquidation exceptions. This is similar to playing poker while knowing your opponent’s hand. Furthermore, Alameda processed a significant portion of user deposits on behalf of FTX and often never sent them to the exchange, but instead kept them to be traded. They also joint-filed for bankruptcy.

Executives of FTX/Alameda led the public and investors to believe that the two companies were highly profitable. Renowned investment firms such as Sequoia Capital and Tiger Global invested hundreds of millions into the company noting its profitability. Evidence now shows that in 2021, when the crypto market hit all time highs, FTX had actually lost $3B.

The intent of SBF’s altruistic efforts may have been equally deceptive. It is now theorized that his donations to the media and politicians were attempts to control the public narrative and receive regulatory exemptions. His claims of “effective altruism” may have been attempts to obscure his commingling of deposits for personal use. Lastly, a draft of the DCCPA leaked in early November and seemed to call for stringent regulation on decentralized exchanges while seeking regulatory exemptions for FTX, further highlighting potential nefarious behavior.

**

**

Part 2: The Implications and Moving Forward

Contagion

Because of FTX’s influence on the industry, its collapse is causing a ripple effect across centralized institutions. FTX was a popular custodian for institutions, who are now having to post losses on their funds. One of the largest hedge funds in the space, Multicoin, posted a 55% loss during these events. Furthermore, many of the largest lenders in the space provided loans to Alameda and are now risking insolvency. BlockFi, a retail-oriented crypto lender, had lent $671M to Alameda and deposited $355M on FTX. After already reporting solvency issues in Q2, they filed for bankruptcy on November 28th. Most notably, Genesis, crypto’s predominant prime brokerage firm, had $175M locked on FTX and supplied loans to Alameda, although the amount in loans is unknown. Genesis has frozen withdrawals and is expected to be illiquid. Its parent company, Digital Currency Group (DCG), is also the parent company of Grayscale, the suppliers of GBTC. DCG is expected to undergo a restructure to fulfill liquidity needs.

With decentralized applications, the contagion is fortunately less drastic. The crypto market cap fell 23% from $1.03T on November 5th to $790B on November 9th. It’s since stabilized to $850B. The Solana ecosystem saw the largest drawdowns as FTX was a prominent contributor. Solana’s coin, Sol, fell almost 60% and its total value locked decreased from $1B to $280M. Many of Solana’s wrapped assets, such as Sollet Wrapped Bitcoin, were in the custody of FTX and are now trading at cents on the dollar. Many smaller applications, such as Ren Protocol, used FTX to custody their treasuries and are unlikely to retrieve them. However, outside of Solana and some smaller applications, the decentralized sector was fairly immune with limited capitulation or bad debt.

The importance of blockchain and decentralization

The numerous black swans, FTX being the most prominent, within the digital asset space have damaged the industry’s reputation and have hurt many investors, retail and institutional alike. However, digital assets and decentralized protocols as technologies once again proved their resiliency. The second largest crypto exchange and one of the largest crypto hedge funds collapsed, leaving a hole larger than 1% the industry’s market cap. The contagion spread to the other institutions in the space, leading to further insolvencies. Yet, decentralized ecosystems remained intact.

Regarding regulation, the FTX debacle was not a product of bad regulation, but a product of poor transparency. It didn’t take the SEC or an auditor to strongarm FTX into releasing their financials. All it took was their balance sheet to be leaked on Twitter. From there, crypto influencers conducted investigative journalism to uncover the truth, leading to its demise. Had the balance sheets of both companies been publicly available and updated real-time, the entire scheme would have been uncovered well before it became an empire.

One of the primary value propositions of blockchain technology is its transparency. It has the ability to, in real-time, prove a company’s solvency and use of funds. Had FTX been required to custody user deposits on-chain, on publicly known wallets, any commingling of funds would’ve been posted on a blockchain explorer for users to immediately catch. Due to the events in November, exchanges, such as Binance, are beginning to post more of their finances on chain to verify their proper use of funds. Blockchain technology offers regulatory oversight that far exceeds current regulations, and should be considered as a regulator’s friend, not enemy.

As blockchain technology continues to develop, the expectation is that more of the financial world moves on-chain for operational and compliance purposes. Regulating institutions will be more feasible. Transferring and verifying assets will be instantaneous and immutable. And custodying assets will be unmediated and trustless. The recent events only emphasize the importance of blockchains, and with proper regulation, can accelerate its adoption.

Passing proper regulation that uses the regulatory benefits of blockchains and encourages onshore innovation will require an in-depth understanding of the technology. If regulators work with developers and allow them to experiment, uncovering its long-term potential, regulation that best protects consumers and investors while encouraging innovation will emerge. The DCCPA, in its current state, written by SBF, fails in that regard.

Arana Ventures

Arana Ventures was founded with the belief that decentralized systems have the potential to provide immutability and security at an unprecedented level, and after these events, our premise remains stronger than ever. We are continuing to roll out our fund of funds and look forward to releasing a direct investment fund in late 2023.

For our fund of funds, we will be doing additional due diligence to understand how portfolio funds custody their assets and protect themselves from vulnerable points of centralization. Most of the funds we’re looking to work with either use decentralized services or have diversified exposure to centralized entities.

For our direct fund, we currently have internal capital we’re testing with. Because we conduct all of our investments directly on-chain, our exposure to the collapse was limited and we outperformed beta. Prior to the crash, we had 50% of our assets in cash or cash equivalents. We are now 100% long as the market’s resiliency has impressed us.

Note to Potential LPs

Overall, of all the funds we’re in contact with, the ones with the most exposure seem to be the net-neutral arbitrageurs and market makers. These funds depend on centralized exchanges and lenders to maximize their opportunities and drive “safe”, consistent returns. The highly volatile, net long funds tend to utilize decentralization the most and, therefore, had the least exposure.

Throughout the bear market, we have seen increased interest from investors to work with the “safer” net-neutral funds and capitalize on the inefficiencies of the digital asset space without the risk. The current situation is a reminder that this industry, in its adolescence, does not favor risk aversion. Investors of this space, including prospective LPs of Arana, may not want to invest with the intent of earning consistent returns. Instead, they may want to invest a moderate amount of capital with the goal of generational upside but the risk of losing their investment altogether. **Not Financial Advice**

Conclusion

The FTX/Alameda collapse, as alleged, is one of the greatest examples of fraud in the modern day. It has financially affected millions of people and damaged the reputation of crypto technology. However, the digital asset space has once again proven its resiliency and should be viewed as the future of financial regulation. With the right leadership, blockchain technology and crypto can shape a more transparent, self-sovereign future. The recent events have not undermined that vision, but strengthened it.