So you want to do what all the hedge funds are doing and short Tether. You want to short a lot of it, but you don’t have a lot of $$. This article goes through the two ways people typically create short positions with leverage (off-chain and on-chain), the dangers of those methods, and how the method we use at Arana, TUDS, is significantly better.

FYI, just because institutional whales are shorting Tether doesn’t mean it’s worth shorting. DOYR, read their attestations, etc. Also, this is not financial advice, just a fun little shorting procedure I found that could pay dividends down the road.

How shorting works

Let’s begin by giving a quick overview of how shorting a position works.

You borrow 100 units of stock/commodity X at $1 per unit.

You then sell the 100 units of X for $100 in the open market.

You now have $100 and you owe your lender 100 units of X.

If X goes down in price, you can then repurchase 100 units of X for less than $100. For example, if X goes down 20% to $0.80, you can repurchase 100 units for $80.

You then pay back the 100 units of X to your lender and pocket the $20.

Just like that, you just made $20 by betting against an asset.

How does this work off-chain?

Shorting off-chain with leverage is incredibly simple as many CEXs offer margin trading or leveraged tokens that do the heavy lifting for you.

FTX, for example, allows you to buy a 3x short position by purchasing an ERC-20 token called USDTBEAR. With this, you can open a $1000 short position by buying $333.34 of the token. The token itself does all the borrowing and swapping mentioned earlier for you.

If USDT falls to $0.50, you earn $500, but if USDT rises to $1.33, you lose your position altogether. In the case of a large market cap stablecoin like USDT, hitting $1.33 is highly unlikely so, in my opinion, it looks like a solid position.

But this method carries a prominent risk: you’re using a centralized exchange. If the past couple of months have taught us anything, it’s that if “it’s not your keys, it’s not your coins.” FTX, for example, has a history of questionable behavior with inconsistent liquidations and market manipulation all on the retail investor’s dime.

What about on-chain?

Leveraged shorting on-chain gets a bit more complicated as everything needs to be done manually. In order to open and close positions, you need a lending protocol like Aave and a DEX like Uniswap. When shorting pegged assets like stablecoins, I’d recommend using Aave V3 as you can take advantage of their high efficiency mode (e-mode), allowing for a 97.5% liquidation threshold and 97% LTV.

*Note: High efficiency mode, or e-mode, is a feature on Aave V3 where pegged/backed assets like stablecoins can be loaned and borrowed at significantly higher thresholds.

To keep things simple, let’s look at how you can short $1000 of USDT without leverage:

- Collateralize 1100 USDC ($1100) on Aave V3

- Borrow 1000 USDT ($1000) against that using e-mode

- Go on Uniswap and swap the 1000 USDT for 1000 USDC

- Store the 1000 USDC in your wallet

If tether depegs to $0.50, you simply buy back the 1000 USDT using 500 of the 1000 USDC you received earlier, pay back the loan and withdraw the 1100 USDC. You now have 1600 USDC, which is a $500 profit!

Now, let’s short with leverage

Creating an on-chain short position with leverage takes the example we just went through and adds a layer of complexity.

You may have noticed that after swapping the 1000 USDT for 1000 USDC, the USDC was just sitting in your wallet. What a lot of people do to create a leveraged position is put that USDC back into Aave as collateral to borrow even more USDT.

Let’s take the previous USDT example, but this time you only collateralize 100 USDC. You can then borrow up to 97 USDT (97% LTV) and swap that to 97 USDC. You collateralize the 97 USDC, allowing you to borrow another 94 USDT. You swap the 94 USDT for USDC, collateralize that and so on. If you do this a total of 13 times, you can short $1057 of USDT with $1157 in collateral, all from your original collateral of $100.

Let’s take the previous USDT example, but this time you only collateralize 100 USDC:

- Collateralize 100 USDC ($100) on Aave V3

- Borrow 97 USDT ($97) against that using e-mode

- Go on Uniswap and swap the 97 USDT for 97 USDC

- Collateralize the 97 USDC on Aave V3

- Borrow 94 USDT against that using e-mode

- Go on Uniswap and swap the 94 USDT for 94 USDC

- Continue the loop…

If you follow the above loop another 11 times, for a total of 13 loops, you can short $1057 of USDT all from your original $100. You will have 1157 USDC as collateral and 1057 USDT as your debt obligation.

However, there are some serious problems with this method. For starters, opening this position requires 39 transactions. The gas fees, effort and time it would take to go through this is simply ridiculous. In addition, it would be vulnerable to MEV bots and price changes.

But the real issue is closing the position. In the scenario where USDT doesn’t depeg, closing the position would require undoing the circular collateralization. And at a 97.5% liquidation threshold, you can only withdraw a small portion of collateral at a time.

In the above scenario, the health factor is 1.067. Let’s say as you undo your position, you only withdraw as much at a time without reducing the health factor below 1.02 (already a dangerously low number). This would take a minimum of 15 loops, or 45 transactions. The risk of being liquidated by price fluctuations during this unwind is very high.

Fortunately for you, this short position is between two stablecoins. Imagine doing this with non-stable tokens where e-mode is unavailable and a measly 1.02 HF can liquidate you in a moment’s notice. Sure, you can set your HFs higher, maybe having them start at a 1.3 with a floor of 1.1. But you’re still undertaking massive risk just to close a position, not to mention your leverage capabilities would be limited to 2.1x.

Long story short, don’t do this. It’s one of the most common ways people get liquidated. It’s stupidly risky, a pain in the ass to deal with, expensive and time consuming.

Now that we’ve gotten all of this out of the way, let’s get to the good stuff.

TUDS - the way shorting should be done

TUDS, or Trustless Undercollateralized Decentralized Shorting, is an on-chain shorting method our investment firm, Arana Ventures, came up with. It’s a simple method that uses a flashloan to provide upfront collateral. It takes 5 transactions to open and close any position, and with the use of a batching protocol, it feels like 1.

Let’s once again use the example of shorting $1000 of Tether using $100 of USDC. How it works is the following:

- Borrow a flashloan of 1000 USDC ($1000) from Aave

- Deposit the 1000 USDC + 100 USDC of your own as collateral on Aave (1100 USDC total)

- Use e-mode to borrow 1000 USDT ($1000) against the collateral

- Go on Uniswap and swap the 1000 USDT for 1000 USDC

- Return the 1000 USDC to the flashloan

In the end, you effectively have a debt obligation of 1000 USDT collateralized by 1100 USDC, of which only 100 USDC came from your wallet. That’s another way of saying you’ve shorted $1000 of USDT from only $100 of USDC.

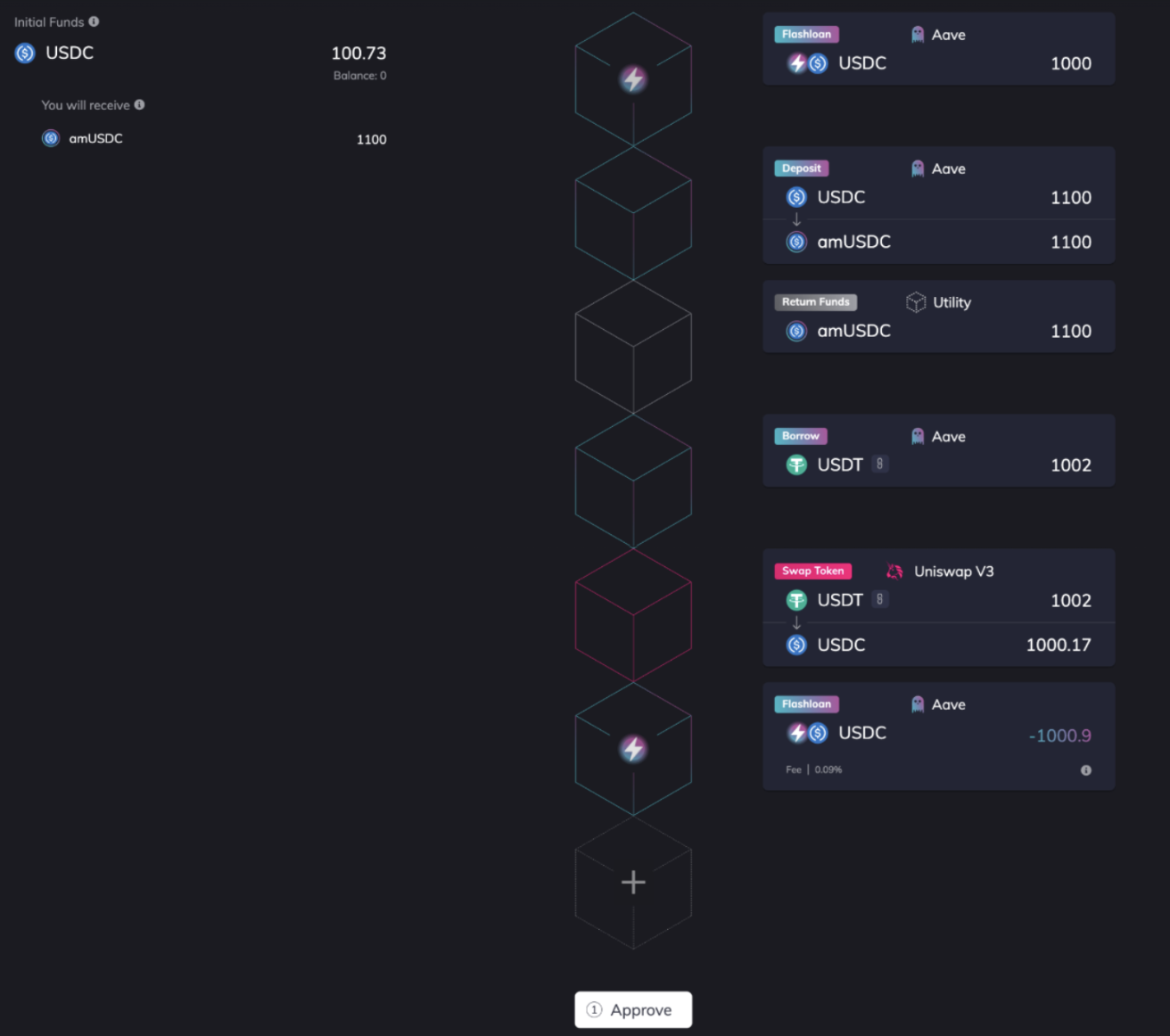

Because you’re using a flashloan, you need to use a batching protocol to complete the entire process within the same block. To do this, we use Furucombo, a drag and drop batching protocol. The picture below illustrates how this works.

As you can see on the top left, I’ve provided $100.73 of collateral and will receive 1100 aUSDC, which indicates that I have 1100 USDC locked up on Aave. On the right side, the boxes outline the process I described earlier and show a 1002 USDT short position. The reason for the additional 2 USDT is due to a slight price discrepancy between the two stablecoins.

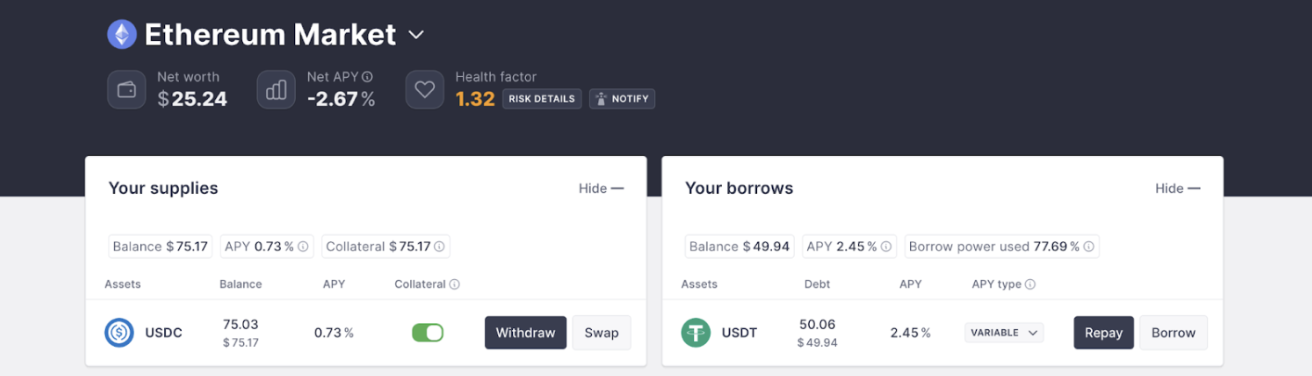

A few weeks ago, we tried our first test case, opening a $50 USDT short position with $25 USDC on Aave V2 using ethereum. After I submitted the batched transaction, it showed up on our Aave account within a few seconds.

Had I used V3, I would’ve been able to spend as little as $5 to open this same position.

In total, opening a short position using TUDS takes 5 transactions, 6 if you include the return funds, and the process all happens in one block. This allows for CEX level speed and simplicity while preventing the risk of price fluctuations or MEV. The position was also opened completely on-chain with self-custodied funds.

Now that we’ve covered how to open a short position, let’s go over how to close one.

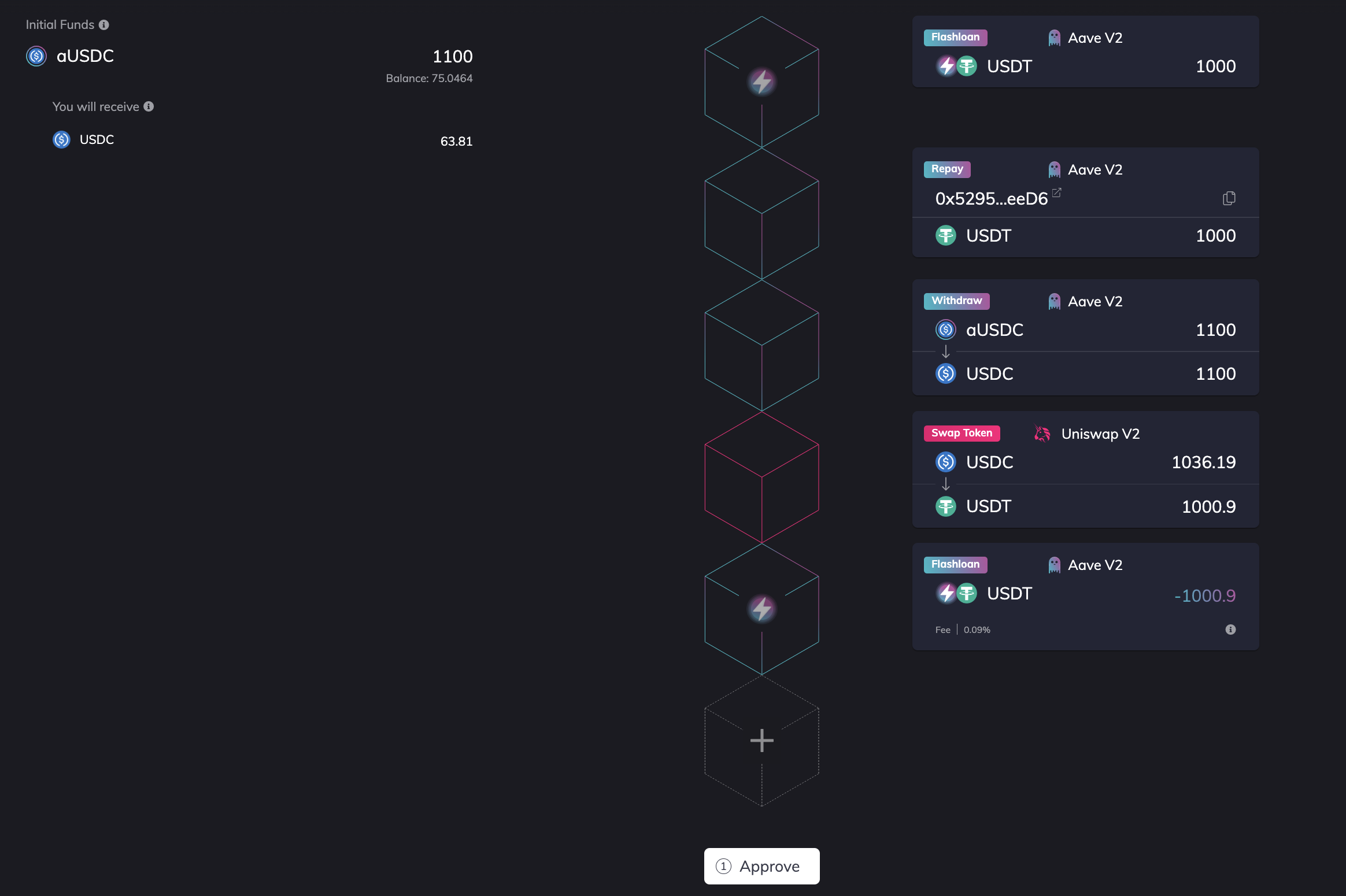

Essentially, all you do is the same 5 step process but backwards. Using the 1000 USDT example, in the event it does not depeg, closing a position would look like this:

- Borrow a flashloan of 1000 USDT ($1000) from Aave

- Repay the 1000 USDT loan from the short position

- Withdraw your 1100 USDC ($1100) in collateral

- Go on Uniswap and swap 1000 of the 1100 USDC for 1000 USDT

- Return the 1000 USDT to the flashloan and walk away with 100 USDC (p/l of $0)

Because USDT didn’t change in price, you walk away with the original 100 USDC you invested when opening the position, giving you a p/l of 0. The below picture illustrates how this works.

In the event USDT depegs to $0.50, closing a position would entail the following:

- Borrow a flashloan of 1000 USDT ($500) from Aave

- Repay the 1000 USDT loan from the short position

- Withdraw your 1100 USDC ($1100) in collateral

- Go on Uniswap and swap 500 of the 1100 USDC for 1000 USDT

- Return the 1000 USDT to the flashloan and walk away with 600 USDC (p/l +600%)

Because USDT went down by 50%, you now exit your position with 600 USDC instead of 100 USDC. That’s a $500 profit from a $100 investment!

Do you see how much simpler this is than the circular method of leverage? It’s 5 transactions that happen within 1 block while leaving the health factor completely untouched. And you can customize this to whatever level of leverage you’d like. 2x, 5x, 8x, 15x, and so on.

Plus, the TUDS method operates on a level of simplicity that rivals centralized exchanges but with increased flexibility and self-sovereignty. There’s no all-knowing, all-seeing SBF 👁👁 randomly liquidating you because he wants to buy the dip during his mid-morning shit.

TUDS Limitations

Despite being the best way to short cryptos on leverage, TUDS has its limitations.

For starters, it’s simpler than the circulating method, but it’s still a bit tricky to understand and requires a level of comfort with DeFi protocols. If I had to guess, a good portion of you are still trying to wrap your heads around it. However, once you get the hang of it, this method becomes fairly straightforward.

Secondly, there are limitations to the amount of leverage you can provide. If you use e-mode, which requires lending and borrowing between assets that are pegged to one another, you can achieve up to 32x leverage. However, this gives a health factor of 1.005, which is laughably low. Without e-mode, the max leverage depends on your collateral. But with relatively “safe” and liquid assets like ETH and USDC, you can expect a 5-6x max leverage with a ~1.03 HF, which is also dangerously low.

At Arana, we have a 1.1 HF minimum when shorting stablecoins w e-mode and a 1.3 HF minimum when shorting non-stablecoins without e-mode. This gives us a max leverage of 7.8x and ~2.1x respectively, which is still competitive to FTX’s 3x leveraged tokens.

Probably the biggest limitation has to do with the chains you can use and the assets you can short. Because Aave V3 mostly only uses the L2 chains, and Furucombo uses only Polygon and Ethereum, the only way to create short positions with e-mode is through the Polygon chain. Without e-mode, you can use Aave V2 with the Ethereum chain. But you’re still limited to two chains and can only collateralize and short the assets Aave recognizes.

Lastly, the variable interest rates on Aave, or for any DeFi lending protocol, can get pretty extreme. For the most part, rates are actually pretty low, usually between 0.5-5%. This is miles better than FTX’s 10.95%. However, if supply goes down and/or borrows go up drastically due to some anomaly (see solend whale), that 0.85% interest can quickly turn into 85%. In the short term, this really isn’t a problem. But if you’re not paying attention, you could end up accumulating insane interest payments over the matter of a few months.

The potential impact of TUDS

Even with its limitations, the long-term viability of TUDS is close to limitless.

Finance is incomplete without a way to create leveraged short positions, and DeFi is incomplete if those positions can’t be safely created on chain. Without shorting, we wouldn’t be able to curb overvalued assets, provide hedging opportunities or shield commodity providers from market volatility.

This is especially true in the crypto world, as during bull markets, valuations are unjustifiably high, whales are overleveraged and commodity providers, such as miners, hold treasuries with only the commodity they’re providing. This leads to a massive bull run followed by a nightmarish crash into a bear market. Sound familiar?

With a strong crypto shorting market, the bull runs will stay within the bounds of reason, leading to smoother transitions into the bear markets. Overvalued assets are shorted, gradually bringing them back to justifiable prices. Retail investors can be hedged from whale shenanigans. And miners, instead of dumping their treasuries at the least profitable price, further hurting the market, can exit their profitable short positions.

TUDS is the first way to create short positions efficiently, trustlessly and safely. The infrastructure to simplify the process and expand its usability is not there yet, but my hope is that a better developer than myself sees the potential in this and finds a way to make TUDS accessible to everyone. If you think that person could be you, feel free to email me at parth@arana.ventures, and I’d be happy to hop on a call.

Have a great day,

Parth