Introduction

One of the main narrative headwinds against digital assets since their inception has been the claim that they have no intrinsic value. The notion that blockchains do not have revenues like conventional businesses has presented a roadblock to some investors, while others simply consider blockchains as a type of commodity or a social network that doesn’t have or need any intrinsic value.

The main problem with this impasse is that without a fundamental understanding of what digital assets are, it is hard to understand what economic good they produce, how they can be a net benefit for the economy & society, and why they are a better alternative to the existing financial system or internet economy.

Lacking an answer to these questions, many people, including Congresspeople, are convinced that digital assets are actually worse than the existing financial system.

While I don’t entirely agree with these criticisms of the detractors, the proponents have yet to deliver a serious refutation. Perhaps this is because a refutation is not deserved or forthcoming. Or perhaps it is because the next wave of “innovation” must be conceptual rather than technological.

This small treatise is my attempt to offer an answer to what economic good digital assets produce, how they can be a net benefit for the economy & society, and why they are a better alternative to the existing financial system or internet economy.

I will attempt to answer the criticisms by summarizing what I regard as the two primary discoveries about intrinsic value in digital assets- John Pfeffer’s equation of exchange model and Raoul Pal’s network effects model- and showing how these two perspectives are integrated.

Digital assets are best thought of neither as currencies, businesses, social networks, nor commodities, but represent distributions of intrinsic coordination (rather than extrinsic or price coordination).

Equation of Exchange Model

In 2017, John Pffefer built upon Chris Burniske’s model of applying the equation of exchange (M=PQ/V) to digital assets. I will spare the details of M=PQ/V, and attempt to capture the main point of Pfeffer’s argument. Pfeffer argues that for blockchains, the corollary of conventional business revenues is mining fees. Mining fees verify transactions on the network. And they require computational resources. If we were to classify blockchains as businesses, then computational resources are the main revenue source of the network.

Tokens represent computational resources. If there is no way to tie token price directly to computational resources, then there is no real incentive to hold the tokens. Or even if tokens are tied to directly to computational resources, then why would investors hold a deflationary, commodity-like asset like computational resources? Investors do not hold barrels of oil or raw electricity. Since velocity (V) of tokens is likely to remain high, there will be little value (PQ) accrual to blockchain networks.

Although they have different conclusions, Pfeffer’s thesis bears a family resemblance to Ryan Sean Adams’ thesis that blockchains are businesses. The economic good that blockchains produce, is blocks. Blocks are computationally verified transactions on the distributed ledger.

But for Adams, blocks don’t look overvalued, because of all their benefits. To Pfeffer blocks look very overvalued.

Pfeffer is not against digital assets, as he clarifies in a recent podcast. He just doesn’t think they are good businesses. He is skeptical of the value capture of layer 1s & decentralized applications. He argues against network effects models like Metcalfe’s law to value blockchain networks because of the many examples of open source software, that capture little or no value, such as ITP, Linux, and Wikipedia. Even if they are useful products, they aren’t good investments, he argues.

Thus, Pfeffer says that the only thing that can justify the high premium on computational resources is the store of value use case, best exemplified in Bitcoin. Pfeffer’s thesis has been key for the Bitcoin maximalist argument and advantages of proof-of-work over proof-of-stake.

Pfeffer’s thesis may be wrong, but it brings out a few important insights:

- Like Ryan Sean Adams, “blockchains sell blocks.” Pfeffer’s paper examines the fundamental revenue model for blockchains-as-businesses.

- Selling blocks secures the network against a 51% attack, which is Kyle Samani’s adaptation of Pfeffer’s thesis combined with the fat protocol thesis. Thus, selling blocks ensures network security, reliable value storage, and risk management.

- The revenue from owning the network or selling blocks may not have not comparable margins to other profitable businesses. The price / earnings for many layer 1 blockchains can be exorbitant.

Raoul Pal’s Network Effects Model

Raoul Pal published his initial network effects valuation model in January 2021. Pal’s paper explicitly argues against Pfeffer’s equation of exchange model. Pal argues that the MV=PQ of monetary theory has failed to describe reality. The problem is monetary theory’s core assumption- that supply is the key driver of value.

Pal makes the case that demand-side network effects like Metcalfe’s law actually describe value accrual of blockchains in a much more accurate way. Network growth or demand is based on simple liquidity preference, time preference, and risk preference. There is nothing irrational about blockchain network adoption effects.

He sees no real issue that they are purely speculative investments, because in the end everything is. Different networks are just different flavors of value store with different use cases. Pal’s view is not exactly that blockchains are commodities, though it is a comparison he makes with Bitcoin. But L1 blockchains are social networks, like Facebook or Twitter. He doesn’t go into the questions of earnings, revenue, intrinsic value, or value accrual, or the business models for social networks. For Pal, value accrual in blockchains is network effects, plain and simple.

Let’s fast forward from Pal’s January 2021 paper to Pal’s new valuation model, which he published on LinkedIn in March 2022. It goes beyond Metcalfe’s law. Pal gives an incredibly concise & beautiful formulation:

network value = daily transaction volume X daily active users.

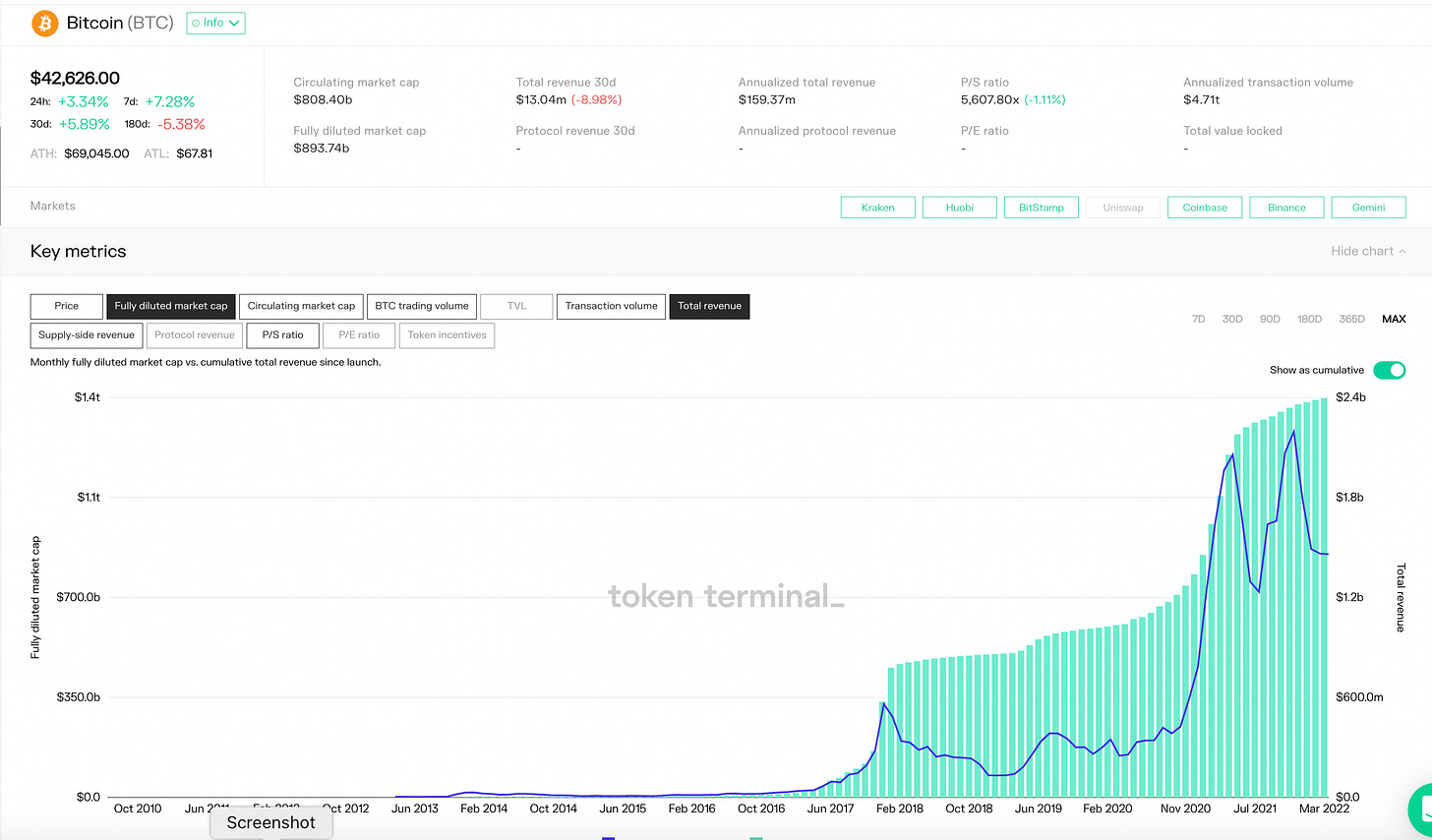

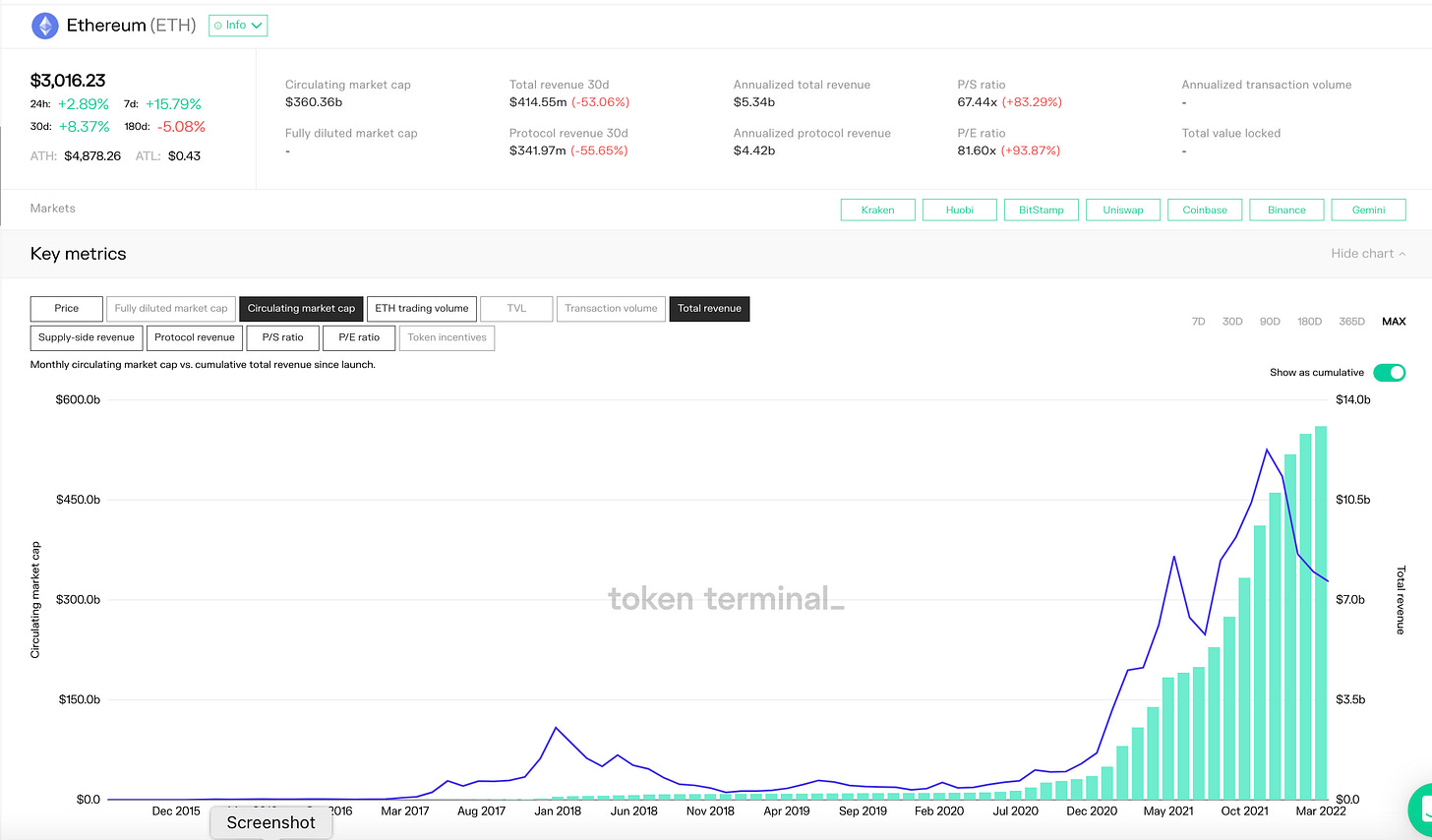

Check out how accurately this fits the price movements of $BTC and $ETH:

This formula is astounding in its simplicity, elegance, and descriptiveness.

So what is the problem with it? While it may be a more-than-adequate counter-example to Pfeffer, it doesn’t seem to answer Pfeffer’s basic problem of the intrinsic value or the revenue model, why it should make a profitable business. It doesn’t tell us what economic good blockchains produce, how they are a net benefit, and why they are superior to the existing financial and web2 systems.

Intrinsic Coordination Model

We know that blockchain networks are valuable, but we don’t know why they are valuable. Pfeffer’s perspective is one we are familiar with from trad-fi investors, (especially value investors): “*where are the earnings?” *Pal’s perspective is one we are familiar with from social media: “it’s all about narratives, marketing, & memes.”

I want to suggest a way to go beyond these two perspectives. It is through consideration of the *content monetization models *of web2 vs. web3. I will argue that the content monetization of web2 social media is the advertising revenue model, while the content monetization model of web3 is learning.

What is the economic good that is produced by blockchain network revenues?

Blockchains sell blocks- and blocks are an algorithmic verification of a trustworthy transaction. Verification generates revenues by mutual validation, peer review, & coordinated error-correction. Advertising generates revenues by coercing people into believing an idea. At a conceptual level, advertising revenue and verification revenue could not be more opposed to one another.

To think that verification occurs only at the computational level is wrong.

The intrinsic coordination thesis is that distributed verification applies at the human level as well as at the computational level. People engage in mutual learning and verify one other’s investment hypotheses through peer-review and error-correction. This drives greater network effects to investment and thus, more protocol revenues. This is reflexive, because more mutual learning leads to more reliable confirmation or disconfirmation of the investment hypotheses, which makes the invested networks more secure, which leads to more mutual learning that grows the network.

It is the opposite of a hype-driven, narrative-driven, meme market. It is primarily distributed peer-to-peer learning that drives investment interest. The more meme marketing and propaganda, the more people call crypto a ponzinomics scam. But the more deep content threads and thought pieces, the more outsiders & fence-sitters are convinced of the value.

This is very different form the advertising revenue model, because the system is not based on coercion, but on mutual learning.

Intrinsic coordination describes how digital media as a whole reflects a system of intrinsic & organic content verification. People mutually peer-review and verify the objective truth of each other’s content against their highest criterion, to evaluate validity. Their highest criterion adjusts over time, to get closer to or further away from the objective truth. This is not just for investments, but for any type of content. That is, learning content is its own coordination equilibrium, independent of price.

They do this evaluation not as algorithms, but as organic human beings, using logic, intuitive discernment, & moral standards. Over many years time, the world gradually works out the vast puzzle of objective truth through extended reflection, feedback, conversation, and prayer. The internet is a vast distributed, organic, peer-to-peer learning system. Learning is the human level corollary of transaction verification that happens at the computational level.

This requires such a shift in our perspective and our orientation that I suspect many wolves of blockchain Wall St. will continue along the path of marketing propaganda. But the thing is, they will be unable to compete with objective truth. It’s not possible. In the same way that Bitcoin is unstoppable because of its mathematical / economic truth, objective truth is unstoppable because it reveals the logical, aesthetic, and moral source of existence.

To the extent that web3 groups continue with the web2 advertising model, they cannot make the argument that they offer a meaningful improvement to the financial system or the web2 tech stack.

If web3 is based on learning rather than advertising, then the criticisms of industry corruption & ponzinomics become less valid. The network effects of truth are justified simply because it is the truth. It is not primarily financially motivated. People come to the truth for its own sake, not because they are coerced by marketing or propaganda.

Digital Assets Prove That Content Is More Valuable Than Money(And How Much More Valuable)

My basic thesis is that the premium paid for digital assets above cumulative revenue reflects precisely how much more valuable content is than money. People would literally rather hold part of an open source digital network than the money they use to pay for it. This means that the open source content is more valuable than the money.

It has always been common knowledge that content is more valuable than money. If one can learn effectively, then earning money is trivial. Consider the story about Thales told by Aristotle in his Politics:

He was reproached for his poverty, which was supposed to show that philosophy was of no use. According to the story, he knew by his skill in the stars while it was yet winter that there would be a great harvest of olives in the coming year; so, having a little money, he gave deposits for the use of all the olive-presses in Chios and Miletus, which he hired at a low price because no one bid against him. When the harvest-time came, and many were wanted all at once and of a sudden, he let them out at any rate which he pleased, and made a quantity of money. Thus he showed the world that philosophers can easily be rich if they like, but that their ambition is of another sort.

Similarly, level of education correlates with higher lifetime earnings. Also consider the value of asymmetric information.

Here we can distinguish two complementary equilibria: *intrinsic coordination *or interpersonal coordination by common sense social norms, and extrinsic coordination or coordination by an impersonal price mechanism. These are complementary.

In economics, Ronald Coase’s *The Nature of the Firm *(1937) is the precedent for this distinction. He shows that coordination within the firm is opposed to coordination by the price mechanism.

These are complementary equilibria because one or the other is more appropriate depending on social proximity.

And this is the primary difference between web2 and web3:

In web2, prices coordinate distribution of content or interpersonal norms, because of the advertising revenue model. In web3, content or interpersonal norms coordinate the distribution of prices, through the learning revenue model.

In intrinsic coordination, content is evaluated organically by a highest criterion, which in turn determines distribution of prices & allocation of resources. This is the opposite of the big data approach to content in the advertising revenue model, where prices & statistics algorithmically determine analysis & distribution of content.

This is a conceptual shift rather than a technological one. All we are doing is drawing out the conceptual implications of the technology, and showing its telos. Blockchain technology implies that content is the primary coordinating element that determines prices & allocations of resources. Because one would literally rather hold a piece of an open source software network than hold the money. The generation of content is still completely distributed, but is its own equilibrium.

This is completely different conceptually, from advertising revenue model. If one of the primary questions of digital assets is revenues, then the answer is in how content is monetized. In advertising revenue model, content is monetized in one way, in web3 it is monetized in a different way. Advertising involves imposing a subjective reality onto someone else. Learning involves mutual convergence to objective truth. That is not to say that there is no hierarchy in learning.

NFTs already demonstrate this conceptual difference between learning and advertising- between content determining distribution of prices and price determining distribution of content. NFTs have outperformed other classes of digital assets & are inversely correlated in price to other digital asset classes. This simply reflects that they began to have content that was more valuable than money.

This is a Cryptopunk holder turning down a $9.5 million offer for his jpeg:

“My identity along with the identity of other iconic Punks and apes have value beyond the NFT itself. We have our own brands similar to any other brand and that has value. Because I value my personal brand and identity, this was an easy rejection for me.”

NFTs reveal an economic system where valuable content is the primary coordinating element, not price. And this means that NFT content is not just about art, fine art, memes, games, clubs or metaverses, it is about learning. With learning, the content is the end goal, not making money. In advertising, making money is the end goal, not learning the content.

As means to an end, price and interpersonal norms are complementary equilibria, as end goals, there can be no compromise between the two. Either content is more important or money is more important.

Education is the primary resource in any economy, and prices follow from that.

Thus, intrinsic coordination is not a political viewpoint, because its essential claim converges to objective truth; it is theological and not political. And for this reason intrinsic coordination has the same immutable quality as the original distributed ledger.

The political economy that corresponds to blockchain networks is not libertarian or socialist, but distributist. It maintains private property through ownership of digital networks, and at the same time it facilitates more and more direct ownership of capital by labor. It enhances localism rather than anonymous, impersonal, machine-like efficiency. Distributism offers a non-political way to mutually enrich society, without the excesses of market fundamentalism or communism / socialism.

The only content that is both general enough and specific enough to intrinsically coordinate all fields of knowledge more effectively than money is theological. Every humanly designed institution crumbles after some pitiful amount of years. Yet the institution designed by Christ has lived for more than 2,000 years and lives into eternity. According to the witness of St. Thomas Aquinas, God is Simple, Perfect, Good, Infinite, Existent, Immutable, Eternal, and One. He is known by us, He knows in us, He is Just, Merciful, Providential, full of Power. He conquers all evil. The Holy Trinity comes to dwell inside of us to the extent that we will receive it. He alone coordinates all human affairs most justly & fairly by pure Love for us. And we are called by Charity to share this Love amongst one another.

Intrinsic Coordination as Fundamental Valuation Model

This presents an interesting way to combine Pfeffer’s and Pal’s models, in order to get the real fundamental valuation model of digital assets.

A protocol reflects a certain mathematical & economic truth, which drives its reliability of use & how much value is stored in its smart contracts, which reflects how secure the network is, which reflects how trustworthy the network is, which reflects what kind of trustworthy NFT content is associated with that network. And that trustworthy content drives a greater understanding of the network’s reliability at the fundamental mathematical & economic layer.

The mathematical & distributed immutability (driven by computational resources) at the infrastructure layer thus corresponds to a metaphysical & theological immutability at the content layer (driven by human cognitive resources). These reflexively reinforce one another.

Since Pal’s model relies on network effects & transaction volume as one of its key components, we can consider *cumulative revenue (integrated with transaction volume & daily active users). *Cumulative revenue is the total amount of resources that have secured the network against a 51% attack. It is the historical track record & proof of the network’s reliability.

Network security can be analyzed at the protocol layer, as cumulative PoW or PoS revenues, or at the application layer, as TVL or as cumulative liquidity mining fees, or at the NFT content layer, as cumulative royalty fees.

The advantage of incorporating cumulative revenue is that we get a more fundamental model. The cumulative resources that have secured the network against a 51% attack is a metric that demonstrates the historical track record of the networks’ security, validity, and its ability to generate revenue, ultimately its trustworthiness. And cumulative revenue fits proportionally with price data, at least over longer time frames. The cumulative revenue ought to reflexively establish price at a certain multiple, unless network security drops and becomes vulnerable to a 51% attack.

If the P/E or P/S of blockchains is a huge multiple, it is because the economic good that is produced by blocks is so valuable and so lacking in our economy- trustworthiness. We are a world utterly lacking trustworthiness.

The premium or the P/E multiple of network price over its revenue, is precisely how much more valuable content is than money. It reflects the fact that content governs money, and not vice versa. The protocol itself is a kind of open-source content. What we thought would destroy governments instead enables an economy of distributed self-governance through the virtues.