Elwood is a trading platform for institutional investors and financial service providers seeking to access the exciting world of digital assets.

What they do

This platform can be used by asset managers, banks, hedge funds, NeoBanks and WealthTechs, FinTechs, and exchanges.

Asset managers can use Elwood to expand into digital asset trading and manage the risk across your crypto portfolio.

Banks can gain access to the evolving digital asset ecosystem. Supporting both your wealth management and e-trading businesses.

Elwood provides the infrastructure to access crypto markets, leaving hedge funds to focus on alpha generation.

NeoBanks and WealthTechs can maintain their customer experience while Elwood powers the underlying crypto market connectivity.

Technology innovators can integrate the Elwood Trading Platform into their systems, enabling their clients with crypto market access and trading capability. This can be a leverage for FinTechs.

And last but not least, exchanges can add depth to their order book by leveraging Elwood’s liquidity. Access multiple venues and instruments through a single API.

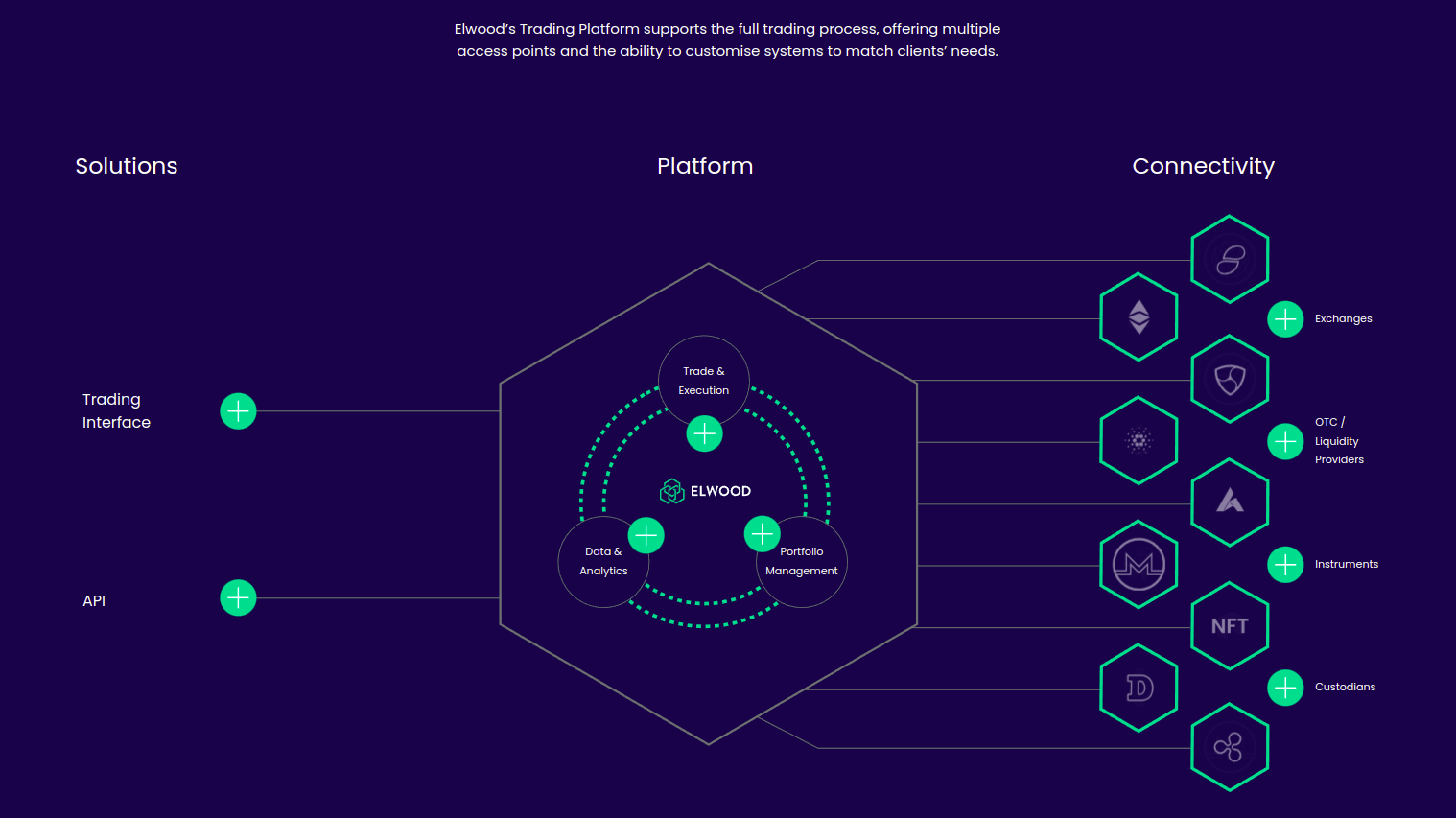

Their mission is to deliver access to digital asset markets with sophisticated data analysis, seamless best execution and portfolio management capability that institutions and other investment professionals expect across their operations.

Elwood Technologies combines the latest technology solutions, designed by digital natives, with the expertise of seasoned investment professionals. Our institutional heritage gives Elwood a deep understanding of trading. They have built our systems to create seamless digital asset trading workflow, reporting, and analysis.

Their platform delivers direct access to leading digital assets markets and liquidity venues, allowing institutions and asset managers to integrate digital asset trading and management within existing systems.

They believe it’s time for digital assets to take their rightful place in the world of professional investment.

The vision for Elwood Technologies was created by Alan Howard, co-founder of hedge fund Brevan Howard and one of the world’s most successful investors. Frustrated by the difficulty of trading digital assets, he set about creating an enterprise-level platform that would integrate digital markets with traditional asset trading systems.

The leading team of developers and digital natives built a system capable of delivering access via a scalable end-to-end system. A system that would meet the highest standards in pre-trade, execution and post-trade capability, as well as the most exacting standards of compliance and reporting.

Their platform’s modular structure and ease of integration makes it the ideal digital asset infrastructure for all investment operations, from global investment banks and crypto asset funds to fintechs and neobanks who wish to offer digital asset trading to their clients.

The Team Behind the Project

James Stickland, CEO: James has 25 years’ corporate and financial service companies experience; previously responsible for Global Corporate Investments at HSBC and a former Executive Director for Global CIO at J.P. Morgan Chase.

Chao Yan, CTO: Chao spent 15 years at several global asset management firms, responsible for their multi-asset trading platform, delivering numerous innovative and practical front office solutions and risk systems. A technology innovator and platform design expert.

Daniel Ciment, COO: Daniel has spent over 20 years in various leadership positions in the Equities electronic trading space. Before joining Elwood, Daniel was the Chief Operating Officer of the IEX Exchange. Prior to that he was Global Head of Equities Electronic Trading at J.P. Morgan.

Leigh-Anne Jansen, Global Head of People: Leigh-Anne is a Global People & Development Leader with over ten years of experience building up teams from scratch in scaling businesses. Her history of working in the internet and technology industry is showcased across past roles at Deutsche Bank, Oracle and Flywire.

And many other people who can be graded as A and A+ in my opinion.

Investors

Elwood Technologies, the cryptocurrency company backed by billionaire fund manager Alan Howard, raised $70 million in a funding round co-led by Goldman Sachs and Dawn Capital.

The Series A round also included UK bank Barclays and Commerzbank’s CommerzVentures, as well as Galaxy Digital Ventures, BlockFi Ventures, Flow Traders, Chimera Ventures and Digital Currency Group.

It is needless to say what a great list of investors there is. Also notable to say that this list includes big banks and financial institutions who may come to the crypto area as well.

“The rich mix of investors participating in this raise reaffirms the movement of financial institutions working closely with their native digital asset technology providers,” said Elwood CEO James Stickland in a statement.

My Opinion?

This is a good project and the investment happened a big step for the world of crypto. Also there may be a probability that they release a token in the future and this may help them to develop a better platform. If you are a institution you can use this platform and may have a chance to get a probable airdrop in future.