Sophie had always struggled to access financial services. Growing up in a remote area, she never had access to a bank, and as a result, she had to rely on cash for all her transactions. This made it difficult for her to save money or invest in her future. But then, one day, Sophie heard about a new type of currency called Central Bank Digital Currency (CBDC). Intrigued, she did some research and discovered that CBDCs were digital currencies issued and backed by the central bank of a country. Unlike cash, CBDCs could be accessed and used through a smartphone or the internet, regardless of where you lived.

CBDC Advantages

Banking the Unbaked and Underbanked

Central Bank Digital Currency (CBDC) has the potential to revolutionize financial inclusion by providing access to financial services to populations who have been excluded from the traditional banking systems. For many years, traditional banks have been criticized for failing to cater to the needs of unbanked and underbanked populations. These populations may be located in remote areas, lack the necessary identification documents, or have insufficient financial history to qualify for a bank account.

The unbanked percentage in the United States in 2021 was 4.5% of households. This means that no one in that household had access to a checking or savings account at a bank or credit union (FDIC). In another estimation by FDIC, 14.1% of U.S. households were underbanked, meaning that the household was banked and in the past 12 months used at least one of the following nonbank transaction or credit products or services that are disproportionately used by unbanked households to meet their transaction and credit needs:

-

Money orders, check cashing, or international remittances (i.e., nonbank transactions); or

-

Rent-to-own services or payday, pawn shop, tax refund anticipation, or auto title loans (i.e., nonbank credit).

The unbaked percentage in some countries is a disaster for the financial systems of those countries. As can be seen in the image below provided by statista.com, the unbanked rate in some countries is more than 50% of the population. This means that more than half of the population does not have any access to any bank: No saving, no investing, no future thinking, nothing. This can lead to a lifeless economy. A big amount of money in circulation is in the form of cash, and a great percentage of this cash money will never go into investments, the stock market, the heart of companies’ fundraising, will not have enough funds; hence, most of the companies will die and never grow to their full potential.

However, with CBDCs, anyone with a smartphone or access to the internet can participate in the financial system, regardless of their location or socioeconomic status.

Financial Power

CBDCs can help promote greater financial literacy and empower individuals to better manage their finances. Access to financial services is crucial for individuals to save money, invest in their futures, and protect themselves against financial shocks. Unfortunately, traditional banking systems have often excluded those who need these services the most. With CBDCs, individuals can access a range of financial services such as savings accounts, loans, and insurance. This can help improve their financial stability and create opportunities for economic growth.

Cash Independence

CBDCs can help to reduce the reliance on cash in many parts of the world. Cash is often seen as a barrier to financial inclusion since it requires individuals to physically visit banks or financial institutions to deposit or withdraw funds. This can be difficult for those living in remote areas, who may have to travel long distances to access banking services. CBDCs, on the other hand, can be accessed through a smartphone or the internet, making it easier for individuals to participate in the financial system. This can lead to reduced cash usage, which can improve financial security and reduce the likelihood of fraud or theft.

Transparency and Security

Central Bank Digital Currency (CBDC) can provide increased security and transparency compared to traditional banking systems. Traditional banking systems rely on intermediaries such as banks and financial institutions to process transactions and manage accounts. This reliance on intermediaries can create potential security risks and increase the likelihood of fraud or theft. “In 2021, banks reported nearly 250,000 cases of check fraud nationwide, according to the Financial Crimes Enforcement Network, a unit of the U.S. Treasury Department. By last year, that number exploded: nearly 460,000 check fraud cases were reported – an increase of 84%” (CNBC). And, as a citizen of a third-world country with a lot of banking fraud, Iran, accept this from me: many banking frauds are never reported since those who make them are in the government or the dignitaries. In these countries, all media works for the pleasure of the government, and most of these banking frauds will never leak.

In contrast, CBDCs rely on blockchain technology to record transactions on a public ledger. This enhances transparency and reduces the risk of fraud. The use of blockchain technology can also help ensure that transactions are secure and private, providing increased security compared to traditional banking systems.

Fund Security

CBDCs can provide increased security for users' funds. Traditional banking systems often require users to entrust their funds to a third-party intermediary such as a bank or financial institution. This can create a risk that the intermediary could become insolvent or engage in fraudulent activity, leading to the loss of users' funds. With CBDCs, users can hold their funds directly, eliminating the need for intermediaries. This can help reduce the risk of loss due to intermediaries' failure and provide users with greater control over their funds.

Cross-border Transactions

CBDCs can enable more efficient and secure cross-border transactions. Traditional cross-border transactions can be slow and expensive, requiring multiple intermediaries to process the transaction. This can create potential security risks and increase the likelihood of errors or delays. As mentioned in a guide provided by Integrated Research, cross-border transactions can vary from bank transfers to eWallets.

Bank Transfers

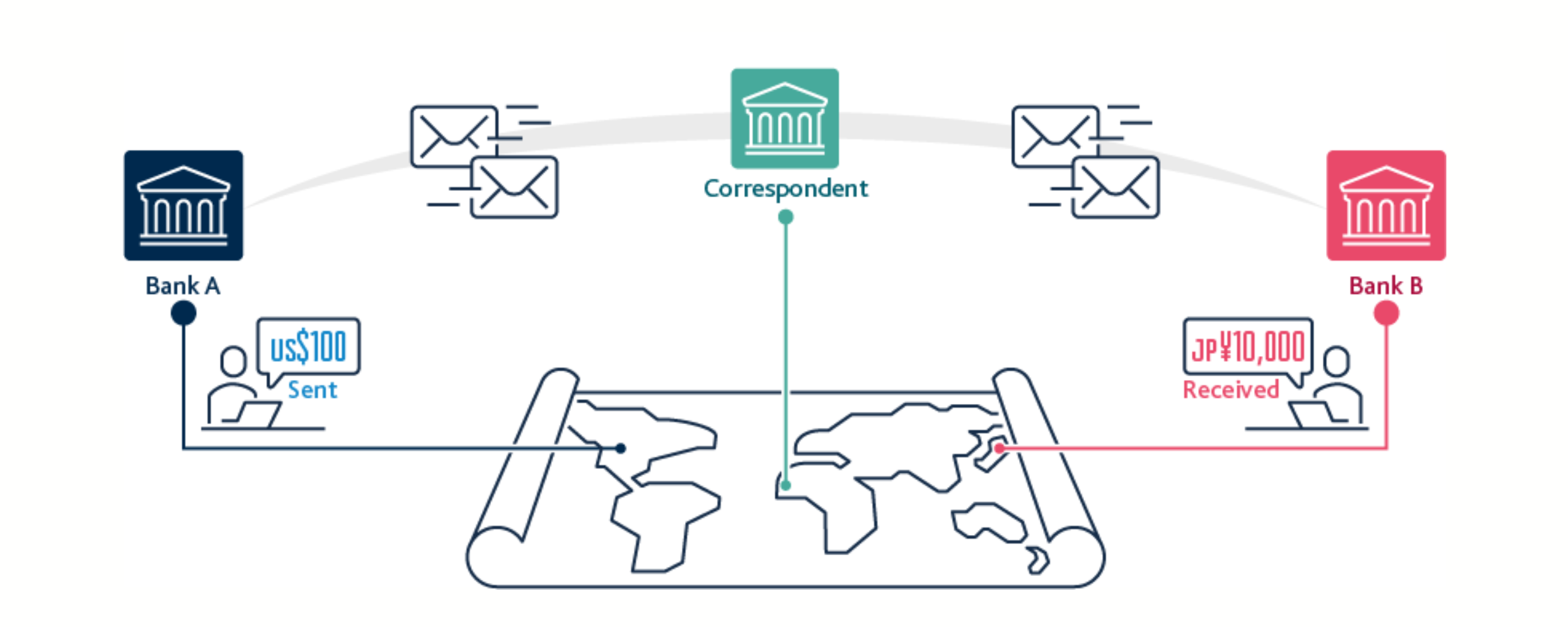

Also referred to as wire transfers, a simple cross-border transaction using accounts held at each bank would involve a payment message sending an instruction to debit an account in Bank A and credit an account in Bank B.

However, not all banks have a direct relationship with each other, so sometimes they need to transact via an intermediary, or a correspondent banking network. A correspondent bank provides accounts for Bank A and Bank B, enabling the transaction. The correspondent bank is an essential component of the global payment system for cross-border transactions.

Credit Card Payments

Credit cards play a significant role in cross-border payments, and are a preferred option for many consumers. From the consumer’s perspective, they simply enter their card details and wait for the transaction to be verified. Behind the scenes, as with any payment process in the global financial landscape, there is more going on. Cross-border payments require more work from the involved credit card networks and acquiring banks as they need to convert between two different currencies. This additional workload results in extra fees that are passed down through the payment chain.

eWallets

Commonly available through apps for smart devices, eWallets like PayPal, Neteller, Alipay, Apple Pay and Google Pay allow users to safely store their payment cards of choice so they can pay for goods and services. Some eWallets support multiple currencies and the ability to place orders across borders. Although wallet-to-wallet transactions do not technically count as cross-border transactions, they do help facilitate the transaction.

For all of these transaction types, the typical time to settle is 2-5 business days, depending on the banks and countries involved and the fees can be as high as 6% (Stellar Learn). These high numbers can get even higher depending on the countries and banks involved. If the countries and banks are not in a close relationship the settling time can take up to 14 business days. These numbers can be frustrating for customers who need fast and cheap transactions, for example, to purchase something in another country.

CBDCs, on the other hand, can be used to facilitate cross-border transactions directly, eliminating the need for intermediaries. This can help reduce the time and cost associated with cross-border transactions, while also providing increased security and transparency.

CBDC Disadvantages

Elimination of Commercial Banks

While Central Bank Digital Currencies (CBDCs) offer several advantages over traditional banking systems, they also come with some concerns. One of these concerns is that CBDCs could potentially undermine the role of commercial banks in the financial system. Commercial banks provide credit and loans to individuals and businesses, which can help spur economic growth. However, if CBDCs become widely adopted, it could reduce the need for traditional banking services. This could potentially lead to unintended consequences for the broader economy, such as a reduction in credit availability or an increase in financial instability.

Privacy Threat

Sophie had always been a private person, even when it came to her finances. So when she heard about the implementation of Central Bank Digital Currencies (CBDCs), she couldn't help but feel a little uneasy. She knew that CBDCs were recorded on a public ledger, which meant that anyone could potentially monitor her financial activity. It was one thing for her bank to have access to her financial information, but it was another thing entirely for it to be available for anyone to see.

Sophie decided to do some research on the topic and found that while the increased transparency of CBDCs could reduce the risk of fraud and illicit activity, it could also undermine individuals' privacy rights. She read about how governments and other entities could potentially use this information to discriminate against certain individuals or groups, and the thought made her even more uneasy.

One day, while Sophie was at work, she received a call from an unknown number. She answered, and a stern voice on the other end informed her that she was under investigation for potential tax evasion. Sophie was taken aback--she had always been meticulous about paying her taxes on time and had never done anything that could be considered illegal. The voice on the other end informed her that they had access to her financial information and had noticed some suspicious activity.

Sophie was stunned. She had no idea what they were talking about. She tried to explain, but the voice on the other end was dismissive and unyielding. Sophie felt violated--not only had her privacy been invaded, but now she was being accused of a crime she didn't commit.

As it turned out, the whole thing was a mistake. Sophie's financial information had been mixed up with someone else's, and the investigation was dropped. But the experience left her feeling shaken and vulnerable. She knew that if her financial information was available on a public ledger, there was always the potential for it to be used against her, even if she had done nothing wrong.

Sophie realized that while the idea of CBDCs was intriguing, the potential loss of privacy was simply too great a risk for her. She decided to stick with her traditional bank and hope that her information would remain safe and secure.

In the story above, we can see that even though Sophie wants her financial information private, CBDCs can make them publicly available. In some sense, she has lost her privacy of financial information, and now, she is feeling insecure. And, as Gary Kovacs, former CEO of AVG Technologies, says:

Privacy is not an option, and it shouldn't be the price we accept for just getting on the internet.

Of course, what he emphasizes here, applies to any digital money exchanged on the internet, which applies to CBDCs, as well.

In a quote from Barack Obama, the former president of the United States, we can see:

The government works for the people, not the other way around.

Combining this with another quote of him, which says:

The government should be transparent.

We can understand the importance of transparency of the government, not the citizens. In other words, since the government works for people and gets paid by taxes, it is the government that should be transparent. The government should show what exactly it is doing, how and what amount it is spending, and how it is investing. This information should be transparent about the government, but not about the citizens. The citizens must have privacy in their investments and spending. No one, not even the government should be able to have access to the financial information of a citizen. But, unfortunately, it is the other way in our world. Governments know all about their citizens, and citizens almost know nothing about governments. This matter can be even worse with CBDCs.

The increasing adoption of CBDCs has raised concerns over the potential loss of privacy and the role of governments in monitoring individuals' financial activities. While traditional cash transactions are anonymous and untraceable, CBDCs are recorded on a public ledger, which could potentially allow governments to monitor and track individuals' financial activities. This has led to the same questions about the privacy implications of CBDCs and the potential for government surveillance.

The use of CBDCs could undermine individuals' privacy rights by allowing for increased monitoring and tracking of their financial activities. This could have serious implications for civil liberties, as it could allow governments to track individuals' spending habits and potentially use this information to discriminate against certain groups or individuals. Additionally, the use of a public ledger raises concerns about the security of individuals' financial information, as it could potentially be accessed by unauthorized third parties.

The potential for government surveillance through the use of CBDCs has led to calls for increased transparency and regulation. Some advocates have argued that CBDC transactions should be subject to the same privacy protections as traditional cash transactions, while others have called for increased oversight and regulation to ensure that individuals' privacy rights are protected. Ultimately, the use of CBDCs raises important questions about the balance between privacy and security, and the role of governments in monitoring and regulating individuals' financial activities.

Complex Implementation

Additionally, the implementation of CBDCs could be complex and costly. Developing and implementing a CBDC would require significant resources and expertise from central banks and other stakeholders. It could also involve significant changes to existing financial infrastructure and systems. Moreover, the costs associated with developing and implementing a CBDC could potentially be passed on to consumers in the form of fees or other charges. This could potentially limit the adoption and accessibility of CBDCs, particularly for low-income or marginalized populations.

Programmable CBDCs

One of the main concerns is that programmable CBDCs could enable government surveillance and control over individuals' financial activities. Since transactions can be programmed to include certain conditions or requirements, the government could potentially use this feature to restrict or monitor certain transactions. For example, they could require that CBDCs can only be used for certain types of purchases or that they can only be transferred between certain parties. This could limit individual freedom and privacy.

Another concern is that programmable CBDCs could be vulnerable to hacking or other types of cyber attacks. Smart contracts and other automated processes are complex and require careful coding and testing to ensure their security. However, if there are vulnerabilities in the code or if the system is not properly secured, it could be exploited by malicious actors. This could result in the loss of funds or other negative consequences.

Finally, there are concerns that programmable CBDCs could be used to facilitate money laundering or other illegal activities. Since transactions can be programmed to include certain conditions, it could be easier for criminals to disguise their activities or move funds through the system undetected. This could undermine the effectiveness of anti-money laundering and counter-terrorist financing measures.

Conclusion

In conclusion, while the adoption of CBDCs holds great potential for financial inclusion, improved security, and greater efficiency, there are also valid concerns that must be addressed. As with any major financial innovation, it is important to weigh the benefits against the risks and prioritize the protection of individuals' privacy rights. While CBDCs can promote transparency and reduce the risk of fraud, they could also lead to government surveillance and undermine the role of commercial banks. To address these concerns, increased transparency and regulation may be necessary, and privacy protections for CBDC transactions must be carefully considered.

Furthermore, the implementation of CBDCs is complex and costly, requiring significant resources and expertise from central banks. However, the potential benefits of financial inclusion, economic growth, and global trade cannot be ignored. It is crucial that appropriate measures are taken to ensure that the benefits of CBDCs are maximized while minimizing any potential negative consequences. Overall, the future of finance and the role of governments in monitoring and regulating individuals' financial activities will be shaped by how these issues are addressed, and it is essential to proceed with caution to ensure a balanced approach.