In this article, we are thrilled to present the use case of Aspis Vault for private pool participation in community sales. Let's delve into the details of one of the first use cases of Aspis Protocol for collective investments.

MRY VC, an investors club comprised of special NFT holders, leverages the power of pooling capital to support various initiatives and fund different trading strategies. Recently, some members of MRY VC decided to create a private pool on Aspis to participate in the pre-sale of MooW. With 9 wallets collectively contributing 20k, they easily deployed a Vault, with each investor receiving LP_MRY_MOOW tokens proportional to their deposit size.

Each Vault deployed using Aspis Protocol functions as a separate contract, securely holding all the funds and enforcing the predefined rules that can be easily verified directly from the chain. Aspis Protocol operates without a backend, relying on Subgraph to retrieve real-time contract state from the chain.

The safety of the Vault is ensured by the voting mechanism, preventing the pool creator from executing transactions without approval from investors. To proceed, the manager's proposal requires at least 51% of voting power (corresponding to the investor's deposit). As a private pool, it is safeguarded against unauthorized access or third-party interference, akin to a multi-signature wallet with 9 signatures, requiring at least 5 confirmations to execute transactions. Here you can see the proposal that needed to be voted on for the transaction to be approved to transfer funds to participate in the MooW community sale:

Anyone can create a similar Vault by contacting us if interested.

Investors who participate in this Vault will receive their MooW tokens based on a vesting schedule. The MooW team will transfer tokens directly to the Vault, where they will be held during the vesting period. In order to obtain their tokens in their personal wallets, investors will need to burn their LP tokens, which represent their share in the Vault. It's important to note that tokens held in the Vault balance are not removed from the market. The Vault manager has the ability to trade these tokens on any decentralized exchanges (DEXes), allowing them to trade the received tokens in accordance with the vesting schedule as soon as they are received.

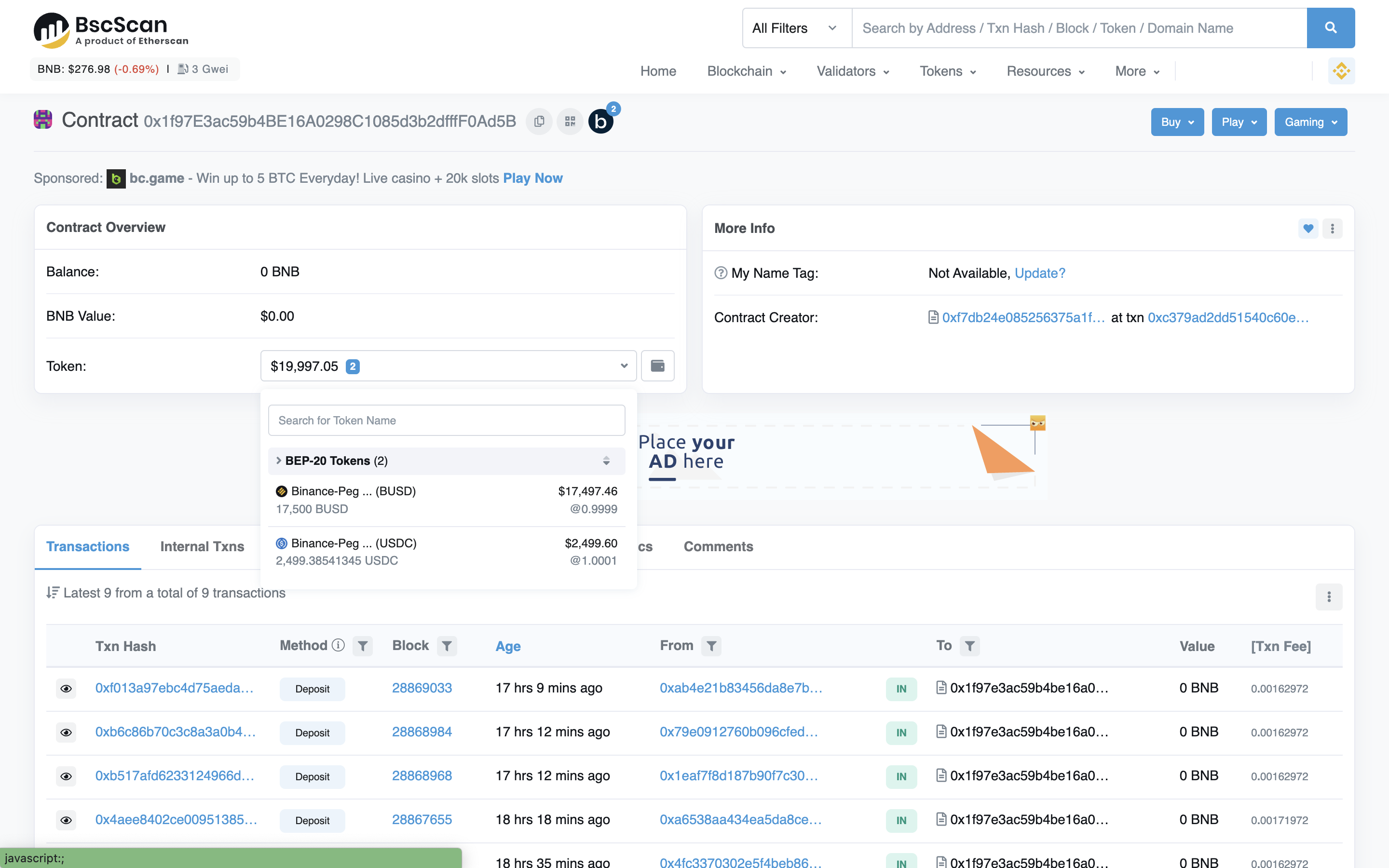

Another notable feature for Vault investors is the flexible withdrawal and distribution mechanism. Only depositors receive LP_MRY_MOOW tokens representing their share of assets already present in the Vault, or that will be vested by the project. We are also implementing a vesting mechanism to ensure that if an investor decides to exit the Vault, their unvested portion remains on the Vault's balance, requiring the burning of LP tokens. Unlike a multisig, this approach eliminates the need for complex accounting or signatures from all participants, as investors can manage their own transactions. Here you can see all holders of LP_MRY_MOOW tokens on BSC scan:

Additionally, withdrawal windows can be defined to allow early capital redemption. Participants can initiate withdrawals during specific periods, configurable through voting. For instance, withdrawals may be permitted during the first 3 days of each quarter or the first week of every month. This enables the manager to anticipate the distribution of capital during the "Active" period while imposing a Rage Quit Fine as an early redemption fee. Notably, there is no centralized entity collecting this fine, as it is automatically distributed proportionally among all investors based on their current share. This measure prevents potential abuse of rules by the manager and discourages investors from hastily exiting the pool.

We are thrilled to explore further use cases with our infrastructure, enabling the deployment of contracts with various complexities while prioritizing security. Previous blog posts on our mirror have already explored potential use cases. If you're interested in a specific use case that better aligns with your needs, please fill out this form and indicate your preference. Embrace the freedom of self-custody. With recent events, such as the FTX case and ongoing regulatory lawsuits against major CEXes, this message is gaining prominence. Stay tuned for more exciting developments as we continue our journey.