Key takeaways

💠Velodrome collab with Base to introduce Aerodrome

💠Aerodrome aim to be Liquidity center and Landing hub for project built on Base

💠Aerodrome distribution encourage user to lock AERO to get veAERO

💠40% of the supply with be airdrop for veVELO lockers as veAERO

Background

Layer 2 solutions on Ethereum, like Optimism and Arbitrum, have been growing rapidly due to their lower gas fees, faster transactions, and shared security. L2s have even begun surpassing Ethereum Mainnet in daily transactions.

Velodrome, a major L2 decentralized exchange (DEX), has thrived by focusing solely on the Optimism ecosystem. It boasts a significant $250M in Total Value Locked (TVL) and $5.9B in cumulative volume.

To address fragmentation and user experience challenges across different L2 ecosystems, Optimism is developing the Superchain, aiming for seamless interconnectivity between L2 solutions.

As part of this, Velodrome is collaborating with the Base team to launch Aerodrome, which will serve as Base's primary Automated Market Maker (AMM) and liquidity provider.

Introduction of Aerodrome

Aerodrome utilizes the innovative ve(3,3) technology and introduces features like the Night Ride UI, concentrated liquidity, and a dynamic AERO FED.

Its primary role will be to support business development within the Base ecosystem. This involves helping new projects as they launch, onboarding new protocols, and ensuring liquidity for the ecosystem.

Key Features

Public Goods Integration

25% of Aerodrome’s initial votepower is reserved for Ecosystem Goods. This will help power liquidity on assets crucial to ecosystem success, whilst fees earned from these pairs will be used for public goods funding (PGF) and public goods votepower; making $AERO the engine of the ecosystem.

Protocol’s Landing Hub

Aerodrome will also serve as a landing hub for protocols looking to deploy on Base, allowing them to build deep liquidity quickly and in a capital-efficient way. Protocols can lock veAERO and deposit incentives for veAERO voters to direct AERO emissions to their pools. In return for their votes, veAERO holders receive 100% of trading fees and incentives from the pools they choose, creating a self-balancing flywheel that rewards the most productive players in the system.

Aerodrome Distribution

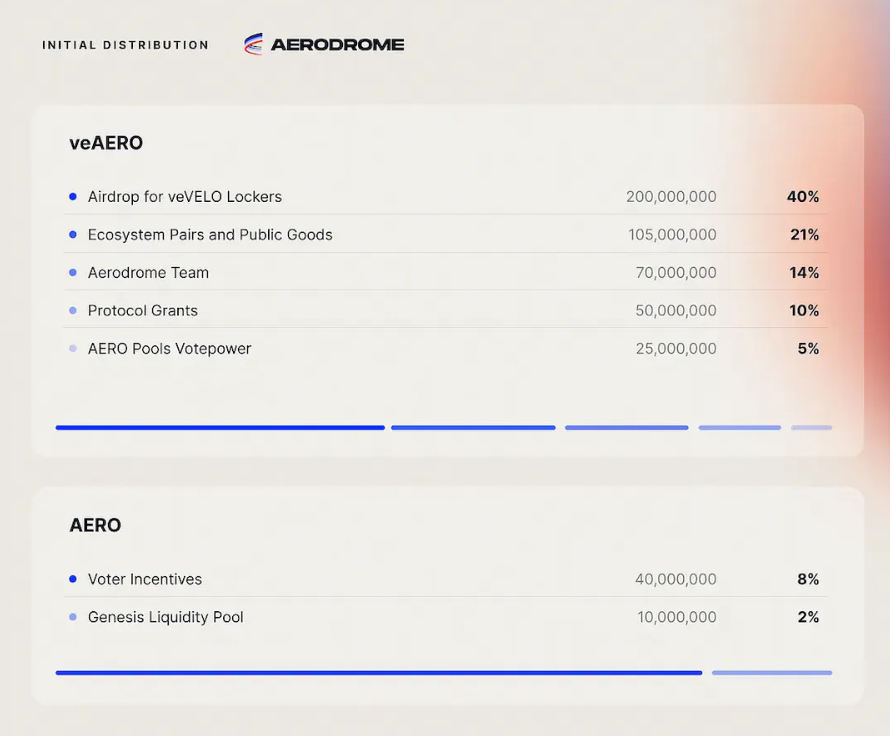

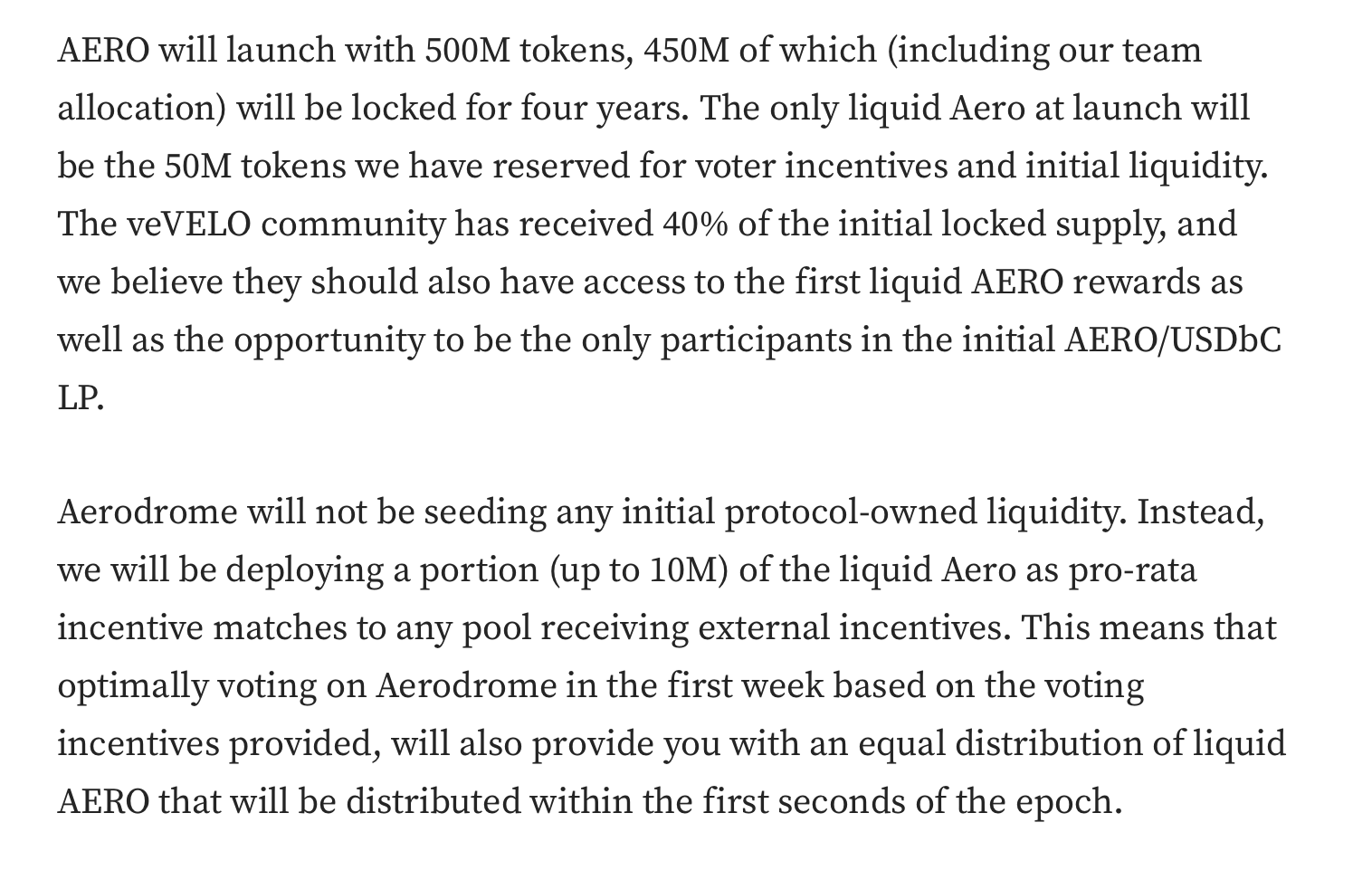

The initial AERO supply is 500M, with 90% (450M) locked as veAERO.

veAERO Distribution:

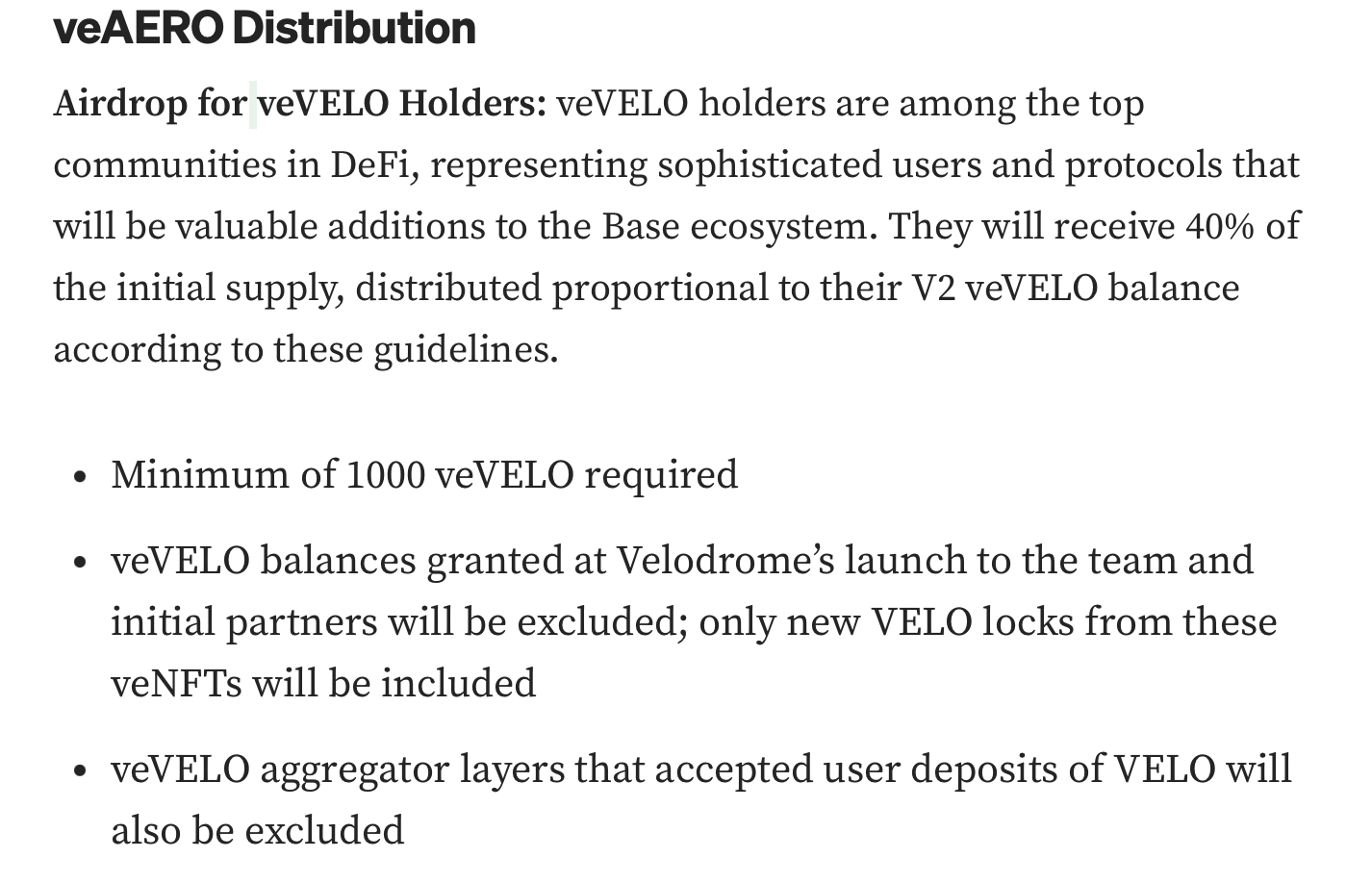

veVELO holders, representing top DeFi communities, will receive 40% of the initial supply based on specific guidelines. Other allocations are set for ecosystem pairs, public goods funding, the Aerodrome team, protocol grants, and AERO token pools.

AERO Distribution:

AERO tokens will be used to match ecosystem partner incentives and support essential liquidity pools. A genesis liquidity pool will contain 2% of the initial AERO supply paired with USDC to facilitate AERO swaps at the launch.

AERO Emissions: Emissions start at 10M AERO weekly, undergoing three phases:

-

Take-off: Emissions will increase by 3% weekly for the initial 14 weeks.

-

Cruise: Post the 14th week, emissions will reduce by 1% each week.

-

Aero FED: Around the 67th week, veAERO voters will dictate emission rates within predefined maximum and minimum bounds

- To lessen dilution impact, a rebase formula will adjust benefits for veAERO holders based on locking rates.

Integration and Future Vision

Aerodrome aims to be the primary platform for liquidity and public goods on Base, kickstarting what could become the leading on-chain user onboarding engine.

Both Aerodrome and Velodrome will partner closely to serve as the main hubs of their respective ecosystems, playing critical roles in the Superchain's development.

Velodrome's stakeholders, specifically the veVELO lockers, will be given an allocation of the initial veAERO distribution to help initiate the Aerodrome ecosystem.

What make Aerodrome TVL so high?

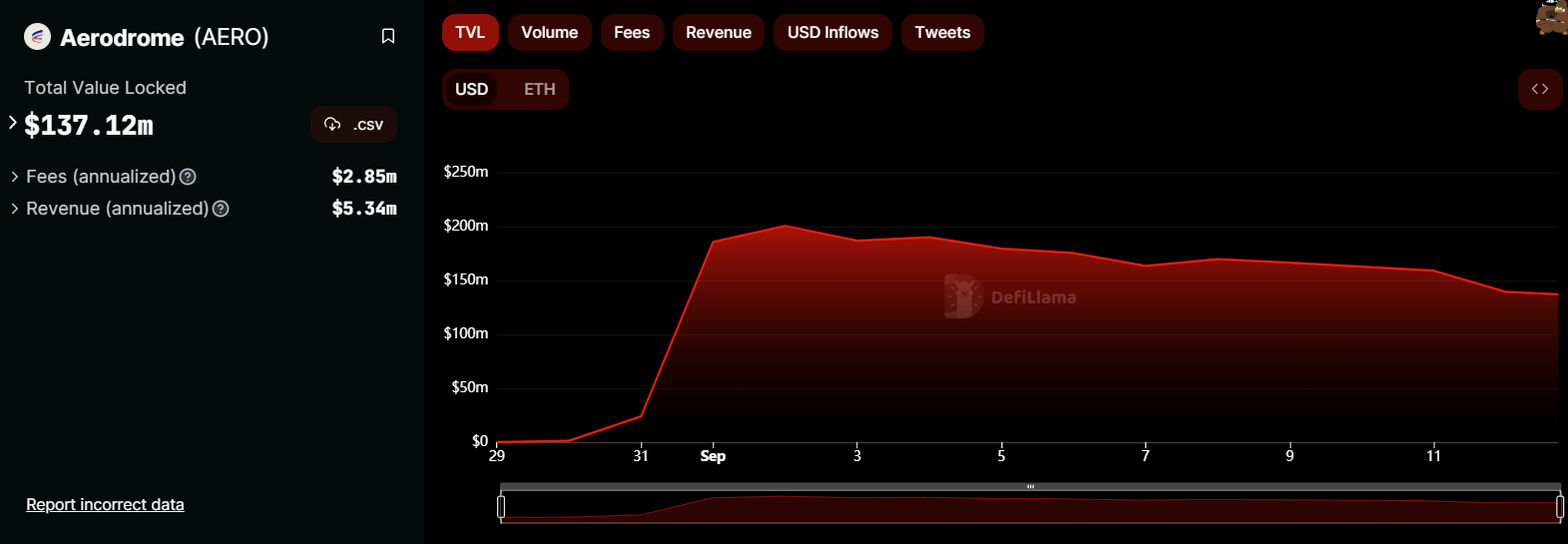

Aerodrome TVL

As of September 12, Aerodrome's TVL (Total Value Locked) is $137.12M, accounting for more than a third of the TVL on BASE. It's 5 times larger than the second project. Surprisingly, they surged from $2M to $200M in just 3 days.

The reasons behind this rapid growth

-

Large partner: 22 projects have integrated with Aerodrome (Update Sept 12th), and this number continues to rise consistently.

This will ensure that users of projects collaborating with Aerodrome know them as a liquidity center=> Large amount of potential users

-

Token strategy: 90% locked as veAERO showcases dedication to scarcity and value gain. =>This rarity might fuel demand and nurture a robust token ecosystem.

-

Attracting user from Velodrome:

Excluding initial grants to the Velodrome Team and launch partners increases the amount of $veAERO available to each locker.

=> This makes it more attractive for potential participants, as they can potentially receive a larger share of the tokens.

Potential

The potential of Aerodrome will come from the development of Base Ecosystem. As Base attracts more users, the demand for token conversion will increase, and Aerodrome will be the first option to consider. Furthermore, for projects looking to join, Aerodrome will enable them to develop depth quickly and efficiently.