** Originally published December 16, 2021.

Thread summary if you don’t have time to read the whole article:

Introduction

While DeFi and NFTs have captured the limelight in the past two years, decentralized autonomous organizations (DAOs) have more quietly become one of the most interesting use cases of blockchain technology that can now be found around the entire ecosystem. In essence, DAOs allow strangers from around the globe to trustlessly coordinate around digital assets through a shared set of rules enforced by smart contract code on a blockchain. In doing so, DAOs turn users and members of a protocol or organization into its owners and align them through financial incentives. This has led people to argue that DAOs are the next iteration of the firm, reimagining the corporate structure by automating the managerial and administrative aspects of an organization. Indeed, decentralized technology’s features such as “global digital assets, censorship resistance, and automated actions” will alter how organizations are formed and operated (source). However, the promise of DAOs is much larger than this – they are not just the future of work, but even more so of human coordination.

History

Conception

The concept of a DAO first arose in 2013 as a way to describe Bitcoin and other new cryptocurrencies. At the time referring to the idea as a decentralized autonomous corporation (DAC), leading figures in the Bitcoin space including Stan and Dan Larimer and Ethereum founder Vitalik Buterin explained how Bitcoin can be seen as a DAC since it is run by transparent code that is upgradeable through a democratic voting process among its distributed network of users and miners who are simultaneously shareholders of the protocol, paying for security, privacy, and transaction validation (sources here). They and others expanded this scope and began to envision how DACs could be used for other purposes. Vitalik published a series of articles titled, “Bootstrapping a Decentralized Autonomous Corporation,” where he hypothesized a DAC called “Identity Corp,” which would create an on-chain, cryptographically secure identity that is linked to an off-chain, physical identity (source). He suggested this could be used as a “decentralized ‘real name’ system,” which could enable a “world citizen’s dividend” or a grant-like system where every identity votes on real-life projects to spend their shared capital on. By 2014, Vitalik was assured of the future popularity of DAOs, stating “It is safe to say that ‘DAOism’ is well on its way to becoming a quasi-cyber-religion” (source). However, it was not until 2016 that DAOs turned from an idea into reality when a DAO finally formed - aptly named The DAO.

The DAO

The DAO was an Investment DAO on the Ethereum blockchain, in which people could pool together their funds and vote on what projects to invest in. Despite being the first of its kind, investors poured in around $150 million worth of Ether, at the time 14% of its total supply, making it the largest crowdfund ever (source). However, the experimental nature of The DAO soon became apparent. A paper co-authored by Emin Gün Sirer, now the founder of Avalanche, noted seven potential issues with the mechanisms of The DAO (source). For example, The DAO allowed dissatisfied members to burn their governance tokens and withdraw their funds from The DAO. This function would create a child DAO for that member, where they would then have to vote to fund themselves in order to fully withdraw their capital. However, if one chose to vote on a proposal, their governance tokens were locked until the voting period ended. Thus, The DAO incentivized members who were against a proposal to abstain from voting, rather than vote no, in order to have the option to remove their funds if the proposal looked likely to pass. This, along with other game theoretic and security concerns, caused the paper’s co-authors to call for a moratorium on funding proposals to allow for The DAO to upgrade its smart contract code. This in turn raised questions about how these changes could be enacted. If this were a normal organization, a CEO or team of senior employees could quickly act, pausing The DAO until these problems were resolved. But The DAO had to act according to its democratic processes. In fact, The DAO was not organized in a completely flat structure as it had “curators,” whose role it was to filter projects before they went to community votes. The authors of the paper called on these curators to impose the moratorium on new proposals, and if members disagreed, they could vote to change curators.

The DAO Hack

Less than a month later, an issue not raised in the paper quickly led to The DAO’s undoing. An exploit in the code allowed people to recursively call a contract to remove their funds from the pool without having to burn their governance tokens. This hack became public and some good actors drained The DAO and ended up salvaging around ~$100 million of its treasury. The hacker’s funds could not be withdrawn from their child DAO for 28 days, so over the next month there was a large community debate about potential responses. Vitalik proposed a soft-fork in which miners would not validate any transactions to or from the pool with the leaked funds, giving the community more time after the initial 28 day period to decide (source). Some believed that while the hack was immoral, it was not illegal and Ethereum functioned exactly as it should, so they argued a software update would go against the blockchain’s ethos of immutability and decentralization (source). Those in favor argued that if the effects of the hack lasted, the general media and public would view Ethereum as very risky and insecure, at a time when blockchains were already seen as a largely speculative technology full of scams and money laundering (source). In the end, the blockchain hard-forked, led by around 85% of its miners, moving the stolen funds into a contract that allowed The DAO members to restore their funds. 15% of the miners stayed on the original chain, which is now known as Ethereum Classic.

Aftermath

Even though its harm was effectively reversed on-chain, The DAO hack led to a general skepticism and distrust in DAOs and other blockchain applications. In the aftermath, Sirer wrote another post, this time asking the question, “Is Ethereum/Solidity suitable for secure smart contracts?” (source). While he still fully believed in the future of smart contracts, he admitted there would need to be a pivot from “‘let’s get DApps at all costs…’ towards ‘let’s build up the science of secure, smart contracts.”

2017-2019: Building foundation

In 2017, the crypto world turned into an ICO mania, with DAOs largely out of the picture. But in the next two years, the creation of some infrastructure, namely Aragon, DAOStack, Colony, and Moloch, laid the foundation for future DAOs to succeed. These projects each had their own innovative tools and provided slightly different solutions, but as a whole they provided users with the software to safely and efficiently create and operate their own DAO (source). The creation of open-source DAO frameworks allowed a couple notable DAOs to spring up, including Moloch DAO, a DAO that gives out grants to fund development on Ethereum; dOrg, a DAO that brings together builders who lend their services to other on-chain projects; and Nexus Mutual, a decentralized insurance protocol (source).

2020-present: Resurgence

Finally, in 2020, DeFi protocols emerged as the first widespread use case of DAOs. Protocols adopted a native token in order to decentralize and redistribute the burden of governance from the small founding team to its community (source). Over that summer, DeFi protocols collectively oversaw billions of dollars in their smart contracts, and spreading out decision making to millions of users was seen as an effort to avoid a single point of failure. The further creation of many DAO tools and the success cases of some early DAOs have caused DAOs to now become commonplace in the web3 world with a variety of use cases. But before looking into what DAOs can do, let’s revisit what a DAO fundamentally is.

Ideals

DAOs can take many shapes and forms and be viewed in many different ways. At its core, DAOs are what its acronym implies: decentralized, autonomous, and an organization. Today, the term DAO is used rather freely and its use is certainly not held to the precise definition that it might have once had. Not all DAOs are going to be equally decentralized, autonomous, or organized - so it's better to view these as ideals that can be bent rather than defining elements. DAOs aim to be decentralized through democratized governance processes where decisions are transparent and audited by the community (source). Against popular belief, DAOs do not need to employ a flat structure of its members in order to be sufficiently decentralized. Specialized committees within a DAO whose members, roles, and terms are regularly voted on by the community allow DAOs to be more efficient and productive while still not controlled by people through rigid and formalized power structures.

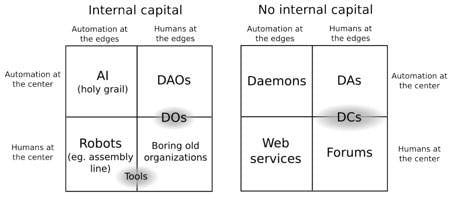

The autonomous property of a DAO can refer to two features. First, a DAO is autonomous much in the way that a computer virus is autonomous - it exists on its own through the smart contract code that enforces the rules of the DAO. Secondly, a DAO’s members are autonomous, as they choose their own labor and self-organize, rather than take orders from higher-ups (source). The organizational aspect of a DAO simply means that it contains a group of people with shared capital and culture. In his blog post on DAOs in 2014, Vitalik included the following graphic that sums up a DAO as having automation at the center, humans at the edges, and internal capital (source).

This graphic also helps illustrate what DAOs do not try to do. Importantly, a DAO is only a technological tool and it does not solve human problems. For example, while a DAO enables people to trustlessly pool together funds for investments, the code cannot propose a company to invest in. DAOs aim to eliminate the administrative work of an organization usually done by humans, allowing humans to focus their time on the creative aspect of an organization, which autonomous code cannot replace.

Properties

In order to achieve these ideals, DAOs almost always have the following three properties: a set of rules, governance, and internal capital (source). A DAO’s rules are written on and enforced by smart contract code. Rather than trusting other members of an organization to abide by the rules or a higher body to legislate if the rules are broken, members of a DAO only need to trust the code. Since smart contract code can be seen by anyone, this makes DAOs inherently more transparent and resistant to corruption and censorship than a traditional company (source). Decision making in DAOs occurs through a process of proposals and voting. DAOs usually create their own token for governance which also serves to kickstart its funding through a token sale. These tokens essentially function as shares in a company, financially aligning a user’s incentives with the DAO. To sum it up, DAOs coordinate through a shared set of rules, using governance to spend internal capital.

Off-chain discussion

Governance is the core mechanism of a DAO and is a multi-layered process. The first layer takes place mostly off-chain, on discussion and messaging platforms such as Discord and Telegram. Here, DAO members interact with each other more informally and generate ideas to improve and take the DAO forward. Tools like Collab.Land and Grape Protocol allow for token-gated Discord and Telegram channels.

Formal proposals

In the second layer, users can submit formal proposals which are voted on by everyone in the DAO. Some DAOs require members to have a certain amount of the DAO’s native token in order to submit a proposal, in efforts to reduce the potential of clutter. Token holders who do not meet this threshold can still easily help shape the direction of a DAO by brainstorming proposal ideas on Discord and Telegram or sharing their opinion on a proposal in its comment section.

Voting and execution

Ideally, voting takes place on-chain, often using a fork of Compound’s open-source governance protocol, which allows its results to be executed automatically by the DAO’s smart contracts. However, since many DAOs are built on top of Ethereum, on-chain voting incurs costly transaction fees. Instead, some DAOs opt to conduct voting off-chain, often using Snapshot’s product, a governance forum with an off-chain, but verifiable system. DAOs can also employ a hybrid approach, using off-chain voting to gauge interest and sentiment on a proposal prior to it going to an on-chain vote.

For DAOs that use exclusively off-chain voting, another step is needed in which the results of the vote are manually executed. This stage involves trusting people within the DAO, a feature that DAOs are theoretically supposed to eliminate. “Multisig” wallets, often through Gnosis Safe’s product, create more security around this step. Multisig wallets require two or more private keys in order to send a transaction, allowing a DAO’s treasury to be managed by a group of members, rather than a sole operator. Additionally, products like Llama help make treasury management transparent with dashboards and summaries.

Voting mechanisms

As far as the actual voting, DAOs tend to be innovative and experiment with various mechanisms. The most common voting mechanism for DAOs is quadratic voting, where one’s voting power equals the square root of their token balance (1 token = 1 vote, 4 tokens = 2 votes, etc.), which lessens the impact of large token holders. Other novel voting mechanisms include holographic consensus, which combines voting with a prediction market by having members stake their tokens for or against a proposal if they think it will pass or fail and be financially rewarded; conviction voting, wherein members stake their tokens on various proposals that over time can accrue enough votes to pass; and token based quorum voting, which works like a standard relative majority vote except the outcome only passes if a certain minimum percent of the voting power participates (source). As DAOs grow, they will not only continue to experiment with new voting mechanisms, but also likely employ several mechanisms depending on the proposal type. As a whole, however, DAOs should not be overly reliant on an extensive, formal governance system, which can hinder them from solving edge cases that occur (source).

Purposes

In the future as DAOs continue to innovate and become more widespread, it will be impossible to list all the various types of DAOs just as it would be for traditional organizations. But for now, DAOs can largely be grouped into the following categories: protocol, investment, collector, service, social, grant, and media.

Protocol

Protocol DAOs manage on-chain protocols through decentralized governance.

MakerDAO

One of the early leaders in this space was MakerDAO, which launched at the end of 2019 after four years of building. Maker is a decentralized lending protocol where users can deposit collateral to generate DAI, a stablecoin soft-pegged to the US dollar. Compared to other stablecoins like USDC and USDT that are controlled by a centralized entity, holders of Maker’s native token, $MKR, are responsible for maintaining DAI’s peg and the overall health of the Maker protocol through decentralized governance. In the case that the collateral provided for DAI is not enough to cover the existing DAI supply, $MKR tokens are created and sold on the open market in order to compensate for the un-collateralized DAI. Thus, $MKR holders are financially incentivized to set and regulate appropriate collateralization ratios for the various tokens accepted as collateral (source). Currently almost 9 billion DAI tokens are circulating across the DeFi ecosystem.

Compound and Uniswap (DeFi Summer)

In June 2020, decentralized lending protocol Compound, which launched at the end of 2018, introduced a native token in order to incentivize lending and borrowing on the platform. $COMP also functioned as a governance token, shifting decision making over the protocol from its small founding team to anyone who held the token. This kickstarted a wave of other DeFi protocols introducing a native token in order to attract liquidity to the protocol, a period that came to be known as “DeFi summer.” “DeFi summer” was capped off by another important event, when Uniswap, a decentralized exchange, created a token in order to reward people who added liquidity to trading pairs. However, unlike previous protocols which only distributed its tokens through rewards, Uniswap also airdropped its token to previous users and liquidity providers. Thus, Uniswap not only managed to reward and distribute ownership to its current and future users, but also to its earlier users. Nowadays, every major DeFi protocol uses a native token to support its ecosystem and airdrops have become a popular mechanism for protocols that launch without a token to retrospectively distribute ownership and reward its early users.

ENS and Other Protocol DAOs

Currently, many on-chain protocols revolve around finance, but there are many other types of protocols that have incorporated DAO elements. For example, Ethereum Name Service (ENS) is the Ethereum counterpart to Domain Name Service. ENS allows users to buy “.eth” and other domain names which can be linked to a wallet address. After existing for over four years without a native token, in November of this year ENS airdropped $ENS to its users based on how long they had held their domain name and how long it was registered for. ENS also used its airdrop to ensure maximum voting participation on several initial proposals, requiring users to vote on four articles of ENS’s constitution before claiming the airdrop. To account for the fact that not every ENS airdrop recipient would have the necessary time or interest to dedicate themselves to managing the ENS protocol, ENS created governance committees and encouraged passionate community members to run and $ENS holders to delegate their tokens to preferred candidates. Other notable Protocol DAOs include Aave, another decentralized lending protocol; Synthetix, a decentralized derivatives protocol; Instadapp, a DeFi management protocol; Curve, an automated market maker; Gitcoin, a public goods funding platform; and Olympus DAO, a decentralized reserve currency protocol.

Investment

Besides Protocol DAOs, the most popular type of DAO is an Investment DAO, with groups aiming to build on the concept first tested by The DAO.

The LAO and MetaCartel

Launched in April 2020, The LAO is a “legal” DAO, set up as a limited liability entity in Delaware. In order to fully comply with the law, The LAO has limited its size to 99 members, all of whom must be accredited investors. The LAO functions very similarly to The DAO, with some improvements to its flawed mechanics. For example, The LAO’s rage quit function allows members to withdraw their capital at any time, including during a 7 day grace period after any proposal is passed. Thus, members are able to vote against a proposal without the concern that the proposal passes and their capital is locked in the smart contract. MetaCartel Ventures, formed in 2019 as the first fork of Moloch DAO, is another important Investment DAO. Both of these DAOs, and other Investment DAOs, generally run similarly to a traditional fund or venture capital firm, except DAOs generally feature a more open and collaborative community and remove administrative overheads. In venture capital firms, the general partners or a committee make decisions on where to invest the funds provided by liquidity partners. In a DAO, everyone can vote on these decisions, combining the role of liquidity and general partners.

Constitution DAO

At first, these DAOs focused on buying digital assets, but recently their capital formation power has been brought to assets outside the typical crypto world. On November 11, a DAO formed and announced that they were trying to raise $20M to buy a copy of the Constitution being auctioned at Sotheby’s on November 18. The DAO, simply named ConstitutionDAO, ended up raising $47M in ETH. Unfortunately, ConstitutionDAO lost the bid, perhaps exemplifying the issues of transparently and publicly crowdfunding for an auction. Nevertheless, ConstitutionDAO brought a lot of media attention to DAOs, and illustrated the benefits of an Investment DAO.

Collector

Collector DAOs are similar to Investment DAOs, except their purpose of buying an asset is to collect it rather than to make a profit from it. Even more so than Investment DAOs, Collector DAOs are typically centered around a specific asset or type of asset.

PleasrDAO

The most notable Collector DAO, PleasrDAO, originally formed in order to pool funds to bid on an NFT by artist pplpleasr.

A day after the tweet, PleasrDAO placed the winning bid of 310 ETH, worth over $529,000 at the time, with the funds going to charitable causes. PleasrDAO went on to purchase more NFTs by pplpleasr, but also other NFTs, with the thesis of buying culturally significant works that they can in some way share back with the community. On October 20th, it was announced that PleasrDAO had purchased “Once Upon a Time in Shaolin,” the 1/1 Wu-Tang Clan album that was seized from Martin Shkreli. Although there are strict rules prohibiting the album from being shared digitally, PleasrDAO are working with some of Wu-Tang’s members to find ways to share the album with the community (source).

SquiggleDAO and Other Collector DAOs

Another prominent Collector DAO is SquiggleDAO, formed around Chromie Squiggles, an NFT project from Art Block’s Curated Series. Unlike PleasrDAO, SquiggleDAO has not raised any funds to buy NFTs. SquiggleDAO created a governance token, distributing it to anyone who owned a Squiggle. Members were then able to receive more tokens in exchange for donating their Squiggle NFT to the DAO. This also gave Squiggle owners who missed the original airdrop deadline an entry into the DAO. Since their drop, Squiggles have surged in price, and SquiggleDAOs collection of over 200 of them was recently estimated at $25 million (source). Other Collector DAOs include Flamingo DAO, a DAO formed by The LAO members who wanted to focus more on NFTs; Fingerprints DAO, which collects NFTs that use smart contracts in interesting and artistic ways; MeebitsDAO, formed around Larva Labs’ Meebits; and NounsDAO, which auctions one Noun NFT everyday, with 100% of the proceeds sent to the DAO treasury and the new owner joining the DAO.

Service

Service (or guild) DAOs pool together talent to outsource to other blockchain based projects. Membership into Service DAOs typically depends upon passing proposals and proving one’s worth, rather than just buying in.

RaidGuild

For example, to join RaidGuild, one must first become an apprentice by displaying their talent (and reputation) in their discord. Then, in order to become a member, an existing member must stake some of their governance tokens. If the apprentice achieves a set of tasks within two months, they become a member and the existing member who “championed” them receives their stake back plus a reward. Thus, RaidGuild uses their governance token to incentivize its members to grow the DAO with high quality participants.

Other Service DAOs

Service DAOs often provide consultation, design, developer, and marketing services, typically using some form of on-chain escrow to ensure that the payment agreement is followed, or in the case of a dispute goes to arbitration. Service DAOs themselves can provide these arbitration services, with LexDAO leading this niche. Other notable Service DAOs include DAOhaus, which provides user-friendly tools to launch and operate a DAO; dOrg, which has built many features for various companies and communities, such as Compound, since its launch; PartyDAO, which was formed in order to ship products such as PartyBid, a protocol allowing people to easily pool together their funds to bid on NFT auctions; Fire Eyes, a Service DAO incubated by Raid Guild which focuses on tokenomics and governance; and NeptuneDAO, which was incubated by The LAO and pools together members funds and provides liquidity to bolster early DeFi protocols.

Social

Social DAOs are the most flexible type of DAO and already take many different forms. In general, Social DAOs aim to create a strong community that uses DAO tools to shape and execute a vision for the community based on their shared values. Social DAOs use a native token to incentivize and reward member participation and value-add.

Friends with Benefits (FWB)

The leading DAO in this space is Friends with Benefits, which originally formed as a private discord between artists, creators, and builders in the space before turning into a DAO. FWB has a tiered membership system: access to its in-person events costs 5 $FWB and full membership granting access to its private discord on top of the in-person events costs 75 $FWB, which has been increased through governance several times from the original level of 50. FWB members can be financially rewarded not only through token price appreciation, but also by receiving additional $FWB from the DAO’s treasury in reward for contributing value. Within FWB, several sub-groups have organically formed and been developed through governance in order to support the community. Its product team builds products that benefit FWB and other DAOs. So far, it has built a DAO dashboard and a ticketing service for in-person events that creates a QR code backed by on-chain verification of access. FWB’s membership team onboards new members and oversees the member application process. FWB also has a treasury team that creates budget proposals and provides financial recaps and its editorial team writes a newsletter. A recent vote approved the creation of a partnership team, which will work with third-party communities and brands to grow the DAO along with its marketing team. These groups all have a team lead and other core members, whose compensation is decided by votes on a budget proposed each month. In efforts to market itself, diversify its treasury and build partnerships with significant players in the space, FWB has sold significant portions of its native token for USDC to venture capital funds including a16z and Investment DAOs, like The LAO. FWB also participated in a swap of native tokens with another leading Social DAO, Whale DAO.

Other Social DAOs

Other notable Social DAOs include Seed Club, a social token incubator, and CabinDAO, which funds collaborative residencies for creators.

Grants

Grant DAOs are structured similarly to Investment DAOs, except pooled funds are used for grants, rather than investments.

Moloch

Moloch DAO, briefly mentioned earlier, was the first use-case of the DAO framework developed by Moloch. The open-source framework has been forked many times, and is notable for its “ragequit” feature, allowing a permissionless exit for members. Moloch DAO formed because they view blockchains, specifically Ethereum, as a public good, where the total benefit created by the technology outweighs any individualized benefit to a user (source). Thus, individual users are not necessarily incentivized to undergo high individual costs when the benefit is shared across the ecosystem. In creating Moloch DAO, its members hoped to share costs and make public goods funding more efficient. Moloch DAO was originally solely focused on Ethereum 2.0 development. It has broadened that scope, but still only deploys funds toward the Ethereum ecosystem.

Other Grant DAOs

Other Grant DAOs include YangDAO, a now defunct DAO that funded projects in the interest of the Yang Gang (supporters of politician Andrew Yang), Mint Fund and Sevens Foundation, which both aim to help creators make the transition to web3. Also, many protocols have a grants arm, including Uniswap, Compound, and Aave.

Media

Media DAOs use DAO tools to collaboratively create and publish public content and products.

Forefront

One of the main Media DAOs is Forefront, whose content focuses on social tokens, DAOs, and other tokenized communities. Forefront built a dashboard summarizing the social token market and profiling other Social DAOs and tokens. It publishes articles, written both by members or by outsiders in return for $FF through its writing program and curates resources and produces learning material to help onboard people into web3. Forefront features several internal guilds that focus on culture, growth, and writing. Like FWB, Forefront has exchanged $FF from its treasury for USDC with several strategic partners, including the MetaCartel. Forefront also voted to deploy some of its funds towards grants. Recently, an investment club grew out of Forefront, allowing Forefront members to pool together capital under an Investment DAO structure. Although this operates outside the Forefront treasury, by restricting it to Forefront members they hope to grow demand for the $FF token. In these ways, Forefront incorporates aspects of Investment, Grant, and Social DAOs.

Mirror

Another notable Media DAO is Mirror, a decentralized alternative of web2 sites like Medium and Substack. Mirror gives writers ownership of their data and features a suite of products that allow its users to easily monetize their articles and kickstart initiatives with fundraising tools. In this sense Mirror could also be considered a Protocol DAO. In an experiment to grow its platform, Mirror created a native token, $WRITE, and airdropped one token to each of its existing users. It then cost new users 1 $WRITE to receive a Mirror subdomain and publish on it. This entry cost could be purchased on an exchange or won during Mirror’s $WRITE race. Every week, existing Mirror users could use their $WRITE to vote on participants in the competition. The top ten vote-getters would be granted 1 $WRITE, effectively letting them join the platform. This allowed current users to shape Mirror’s community and future users. This past fall, after community discussions, Mirror put the $WRITE race on hold and eventually ended it. Mirror opened up its publication and suite of tools to anyone who wanted to use it. While no longer having direct input into who can use Mirror, $WRITE holders can still shape Mirror’s future through governance. Additionally, its earliest users are still distinguished since new users do not receive their own subdomain to publish on.

Other Media DAOs

Other media DAOs include BanklessDAO, which furthers Bankless media’s mission of providing education on bankless money systems; and DarkStar DAO, a research and publishing collective.

Limitations and Future Outlook

DAOs are a powerful technological tool that have seen some initial successful use cases; however, they do not come without their drawbacks. The following is a noninclusive collection of various limitations that DAOs have or will experience and innovations within the space that will be needed in order for DAOs to truly alter how people coordinate.

Oversaturation

Like with DeFi and NFTs, “DAOs” have become a popular buzzword and will be viewed by some simply as an easy means for profit. Especially with how quick it can be to set up a simple DAO, the DAO ecosystem will become oversaturated with purposeless DAOs. Many teams will create a DAO around their project to garner hype and create “utility” for the project. This has already occurred in the NFT ecosystem. Due to the success of several NFT communities forming a DAO around their NFT project after its drop, notably MonkeDAO (for Solana Monkey Business holders) and Bored Ape Yacht Club DAO (which has become somewhat of a Social DAO), almost every new profile-picture NFT project promises the creation of a DAO on its roadmap. However, any DAO on an NFT roadmap will likely fail. Communities driven by shared values are a prerequisite for DAOs to form. DAOs can help enable these types of communities to succeed, but they cannot create them. Additionally, DAOs are not needed for every circumstance: not every discord group chat will actually benefit from turning into a DAO and some organizations are better off with a CEO who can make quick decisions rather than depending on a more lengthy decentralized governance process.

Lack of flexibility

DAOs have and will fail due to a resistance of being flexible, specifically in efforts to adhere to DAO ideals. The term DAO is already becoming somewhat of a misnomer since many DAOs are not fully decentralized or autonomous. But these DAOs should not be looked down upon or admonished for not being a true DAO. In fact, DAOs should be flexible and mold their DAO based on what best fits their organizational needs (source). The pitfalls of DAO maximalism was seen early on in DAO’s history, in the case of Genesis DAO, a DAO formed by DAOstack in 2018. The DAO ultimately failed for several factors, one of which was a lack of discussion around voting proposals. The first version of their governance technology did not feature a section for comments on proposals. Although off-chain discussion was offered as a solution, some “DAO maximalists” in the group argued that off-chain discussion should be limited to keep everything on-chain (source). Proposals were rejected without the proposer having any sort of idea why it was rejected or how it could be improved. Lack of community discussion ultimately led to disengagement and an absence of value alignment. DAOs today largely do not face this hurdle and are more than willing to engage in off-chain discussion.

Where DAOs can struggle today in their accordance with DAO ideals is with decentralization. As discussed before and seen in the examples above, many successful DAOs are not necessarily flat. These DAOs benefit from leaders, whether formal or informal, who help grow the DAO based on its shared values and vision and employ hierarchical structures for improved organization and efficiency. However, unlike traditional organizations, these leadership positions arise organically and are fluid. The terms, responsibilities, and structure of leadership within a DAO is decided by the community through voting, and always subject to change if the current structure is not working. In September, Maki, the cofounder and most important leader of Sushiswap, a DEX protocol that originated as a fork of Uniswap, stepped down from his position and moved to an advisor role. In his absence the Sushi core team shifted to a flat structure and has very publicly struggled with organizational decay. On December 6th, Arca, an investment firm, published a governance proposal to help address Sushiswap’s recent struggles (source). The proposal looks to implement a hierarchical structure, with various teams featuring a team lead, similar to some of the DAOs highlighted above. In general, crypto can often be a copy-cat world for better or worse. But, successful DAOs will be the ones that are not afraid to break these molds and will constantly adjust to match their desires and needs.

Token gated

At the moment, many DAOs are token-gated. While this creates financial incentives and leads to an exclusivity that perhaps enables a higher quality DAO, it also prevents most people from joining. Some of the bigger DAOs cost thousands or tens of thousands of dollars to join or are closed to new entrants. Some DAOs provide ways around this by allowing entries through proposals. But still in these cases, accepted members usually have to work or provide value for the DAO and then use their compensation to buy their way into the DAO for full membership. Some DAOs have gone further by establishing scholarship or fellowship programs. FWB in September voted to allocate 18,000 $FWB to a fellowship program, specifically targeted toward underrepresented peoples (source). While this is a step in the right direction, these types of programs are a feature from the traditional financial and organizational world, and ideally DAOs should be built in a way where these programs are not even needed. In the future, interesting DAOs will be ones that are not token-gated, but rather ones that reward users for participating and adding value within a community. This would effectively be a sort of retroactive public good funding for individuals. There have already been some DAOs that form in a similar fashion. As mentioned earlier, it is not uncommon for DeFi protocols to first launch without a token, and then airdrop tokens to users who brought value to a protocol. Because of some of the higher profile airdrops, namely Uniswap and ENS, people have begun “farming airdrops,” where they spam engagement, often with multiple wallets, on a protocol that does not yet have a token hoping they will be included in a lucrative airdrop. In the future, protocols and other types of DAOs will need to find ways to reward its early users without incentivizing this disingenuous behavior.

Treasury management

Successful DAOs have huge amounts of capital in their treasury. Uniswap has over $6 billion and ENS over $3 billion (source). For many DAOs, a large portion, if not all, of their treasury consists of their native governance token. This makes their treasuries volatile and susceptible to significant price depreciation. As seen above, some DAOs have diversified part of their treasury and swapped their tokens for USDC, in order to stabilize their treasury and ensure safety for when we enter another bear market. The conundrum many DAOs face is that outright selling their token on the open market is equivalent to dumping their token, and will itself lead to price depreciation. Conducting token sales with private entities and venture capital firms or DAOs can allow DAOs to sell their token with a vesting period to avoid this market dump. However, only the top DAOs can attract this capital and thus lesser known or smaller DAOs largely do not have this option.

A DAO with a large treasury does not mean that it will succeed if it does not know how to spend its treasury. As a whole, DAOs tend to be on the more conservative side when it comes to deploying their treasury, perhaps due to the reluctance to sell their own token and drive down its price. However, some argue that DAOs should Blitzscale, a strategy that has seen success for traditional businesses and start-ups in industries of high network effects (source). At the least, every DAO should have a treasury team dedicated to finding interesting and beneficial ways to spend or invest their capital.

Interchain operability

Right now, most DAOs exist on Ethereum’s blockchain, since that is where most of the DAO tooling has been built. In the past year, high gas fees have made Ethereum expensive to interact with, causing some users to migrate to other layer-one blockchains. These alternatives will continue to see DAO tooling built on their network for DAOs that want to interact on-chain with low costs. However, even more important will be interchain operability for DAOs. Right now, if a DAO is deployed on Ethereum with a multisig wallet, they are unable to use that same wallet to buy a Solana NFT, for example, and hold it all in the same treasury. As Ethereum layer-two scaling solutions become more popular, DAOs might opt to hold on-chain voting on an L2 for cheaper gas fees, but to keep their capital on L1 for higher security. There will have to be significant tooling built, but solutions will come that enable DAOs to operate cross-chain along with the rest of web3.

Self-referential

Most DAOs are currently self-referential – that is, they use crypto to do stuff within the crypto world (source). The few examples of DAOs using their tools to interact with the real world, notably PleasrDAO’s purchase of the Wu-Tang album and ConstitutionDAO’s attempt to buy a copy of the Constitution, have garnered a lot of mainstream media attention, but these are largely exceptions. Indeed, in the near future we will see many more DAOs fundraise for off-chain assets. Recently, Kickstarter announced that they will be building a crowdfunding platform on the Celo blockchain. However, we will also see DAOs interact with real world assets in ways far more interesting than fundraising.

Two of the DAOs that are leading this expansion in scope are CityDAO and KrausHouse. CityDAO is an experiment in bringing decentralized governance to land ownership. They started by purchasing a 40 acre plot of land in Wyoming, which was divided into parcels and represented on-chain by NFTs. CityDAO’s land is managed and governed by its citizens, holders of its “citizen” NFTs. As its name implies, CityDAO aims to continue adding land and eventually build a city that is governed by the DAO. CityDAO embraces more radical economic values and ideas such as Harbeger taxes, where land-owners self-value their land and pay taxes at that value, but at any time someone else can buy the land for that value. KrausHouse is another example of applying DAOs to real world ownership, in this case to a basketball team rather than a city. KrausHouse calls themselves a group of basketball fans who are “just crazy enough” to buy an NBA team and collectively own and manage it through fractionalized shares. These types of DAOs are very much in their infancy but could provide huge restructures to how everything in the world is owned, managed, and governed.

Structured compensation

In the future, we will likely see many people shift from working for one company to working for several DAOs, in essence creating a portfolio of jobs for themselves (source). However, for this to happen there will need to be more structure around how people are recognized and compensated for the value they contribute to a DAO. Tools like Coordinape and SourceCred are beginning to solve this problem, building systems for communities to highlight, reward, and incentivize member participation.

Scattered tools

Between web2 tools such as Discord, Google Docs, and Notion and web3 DAO tools such as Gnosis Safe, Snapshot, Coordinape, and Mirror, participating in and operating a DAO can be very complex. In the future, products that combine these tools and create a one-stop shop for DAOs will help simplify DAOs and make it easier for newcomers to participate in a DAO.

Meta-governance

When DAOs form, they will often be singular, contained entities. In order to unleash the full potential of DAOs, we will see DAOs coordinate and organize with other DAOs. Past examples of this include MetaCartel and The LAO investing in other DAOs, FWB and Whale DAO exchanging native tokens, and Service DAOs bringing their expertise to other DAOs. In order to build a powerful DAO ecosystem, DAOs will need to continue to connect with other DAOs. Beyond the cases we have seen thus far, there will also likely be DAOs that form as a collective of many existing DAOs.

Preference to high profile members

While DAOs can be anonymous, many people do not join DAOs anonymously, or if they do, they use the same anonymous profile they use in other mediums, such as on Twitter. This has the potential to lead a DAO astray if preference is given to its high profile members. Leaders in a DAO should be those who dedicate a significant portion of their time bringing value to a DAO, not people who have developed a following or status for their work outside of the DAO. Future DAOs might experiment with enforcing members to keep their identities anonymous (and unique from other anonymous identities they might have). Protocols like Proof of Humanity, an on-chain identity verification system for humans, could help enable this.

Legal

In the United States, regulation around crypto is currently one of the industry’s biggest question marks and limiting factors, and DAOs are no exception. Policy makers are tasked with creating legislation that properly regulates crypto without limiting its innovation. David Kerr and Miles Jennings recently examined in depth the legal framework for DAO (source). They found that most DAO structures in the US either have no legal entity associated with the DAO or are established offshore. Lack of a legal entity can trouble a DAO when it comes to limiting liability for its members, properly filing taxes, and signing third-party contracts. However, none of the existing US legal entities such as LLCs, partnerships, corporations, and trusts perfectly fit a DAO.

Even the Wyoming DAO Law, legally recognizing DAOs and giving them the same power as LLCs, does not really suit a DAO’s characteristics and legal needs, although it is a positive step of regulators recognizing the need for such legislation on DAOs. As a potential short-term solution, Kerr and Jennings argue that Unincorporated Nonprofit Associations (UNA), which is defined as “consisting of [two] or more members joined under an agreement that is oral, in a record, or implied from conduct, for one or more common, nonprofit purposes,” are well suited for non-profit DAOs. This structure is still not perfect for a DAO and is more of a short-term solution. Further legislative work will need to occur to allow DAOs to be protected and compliant with the law without restricting their flexibility.

If you enjoyed this article, feel free to follow the author and BC Blockchain club on Twitter and reach out! Additionally, donations are greatly appreciated to help support our student members and their work. If you would like to donate, see below for the corresponding Ethereum addresses. If you wish to donate using a non-EVM chain or in some other manner, please dm us on Twitter.

- Author’s address: peterhorton.eth

- BC Blockchain Club’s multi-sig: bcblockchain.eth

Disclaimer: This report is for educational purposes and should not be construed as investment advice. Additionally, the author may hold any of the assets mentioned.