This is not my original. It is an attempt to create a short and simplified version of a key article I read in Bankless recently.

How do we evaluate Blockchains based on Profits?

Basic definition: Profits = Income - Expense

For Blockchains:

- Income can be modeled as fees brought in per day / month / quarter

- Expense can be modeled as issuance per day / month / quarter

Blockchains earn revenue from transaction fees while their costs are what they pay for security via issuance. On the other hand they issue tokens to incentivize validators to keep the blocks secure.

Definition for Blockchain : Net Profit = Transaction fees (in $) - Issuance (in $)

How many Blocks are produced?

Bitcoin produces blocks every 10 minutes with 1 MB of transactions. Ethereum produces blocks every 15 seconds with 80 KB of transactions which is 4 MB every 10 mins.

How do we measure value?

Money movers provides this excellent tracker showing that Ethereum settles $20B per day and Bitcoin settles $13B per day.

How do we track fees?

Cryptofees.info can come to the rescue. Check out their site below. 7-Day average for Ethereum is $24B while Bitcoin is only $623M

How do we track Issuance?

MoneyPrinter.info tracks this. Ethereum is paying $46M per day and Bitcoin at $40M

Summary

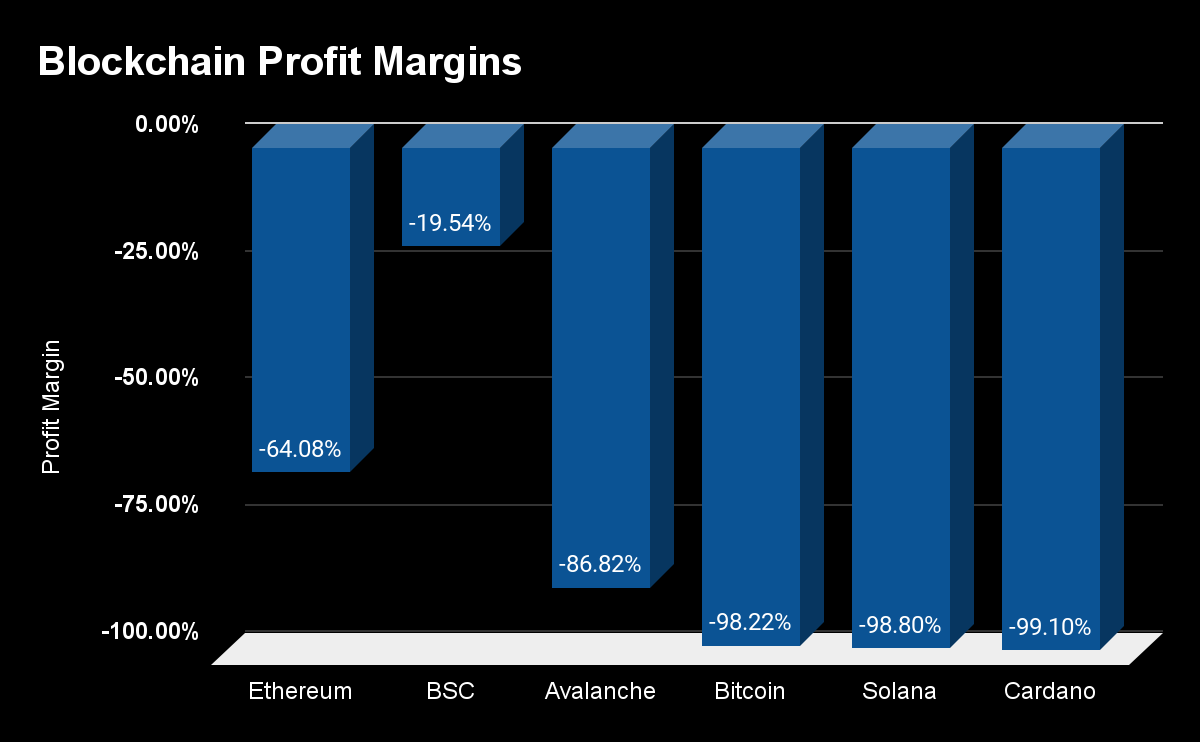

Ethereum is raking in nearly $13M in transaction fees every day. However it is distributing $36M in ETH per day in issuance to miners. As such, Ethereum is currently operating at a -64% loss.

Bitcoin is still operating at a -98% loss. The network is far from operating at breakeven. Building a profitable blockchain business is not easy!

Profit margins for each blockchain is captured below:

Conclusion

As a smart contract platform, Ethereum has created a set of ecosystems - from DeFi to NFTs, there are whole set of applications developed which will enable revenue to scale. Bitcoin on the other hand has only one use case - moving money. Ethereum can transmit money, exchange tokens, help take out a loan, collecting digital items and many other use cases.

So in the longer run Ethereum will emerge as one of the most profitable blockchain.

Attribution:

This is a much smaller and hopefully simpler version of the original article from Bankless linked below: