Note: I published a version of this article originally in Bankless.

TLDR;

-

Contrary to criticisms, the forces that could centralize PoS tend to impact PoW in exactly the same way

-

Due to economies of scale, PoW becomes more centralized than PoS in the long run

Proof of Stake adoption

It seems like Proof of Stake (PoS) is the hottest Sybil resistance mechanism out there. New Layer 1 chains are mostly built with PoS instead of PoW (Proof of Work) while Ethereum is soon merging with its PoS Beacon Chain.

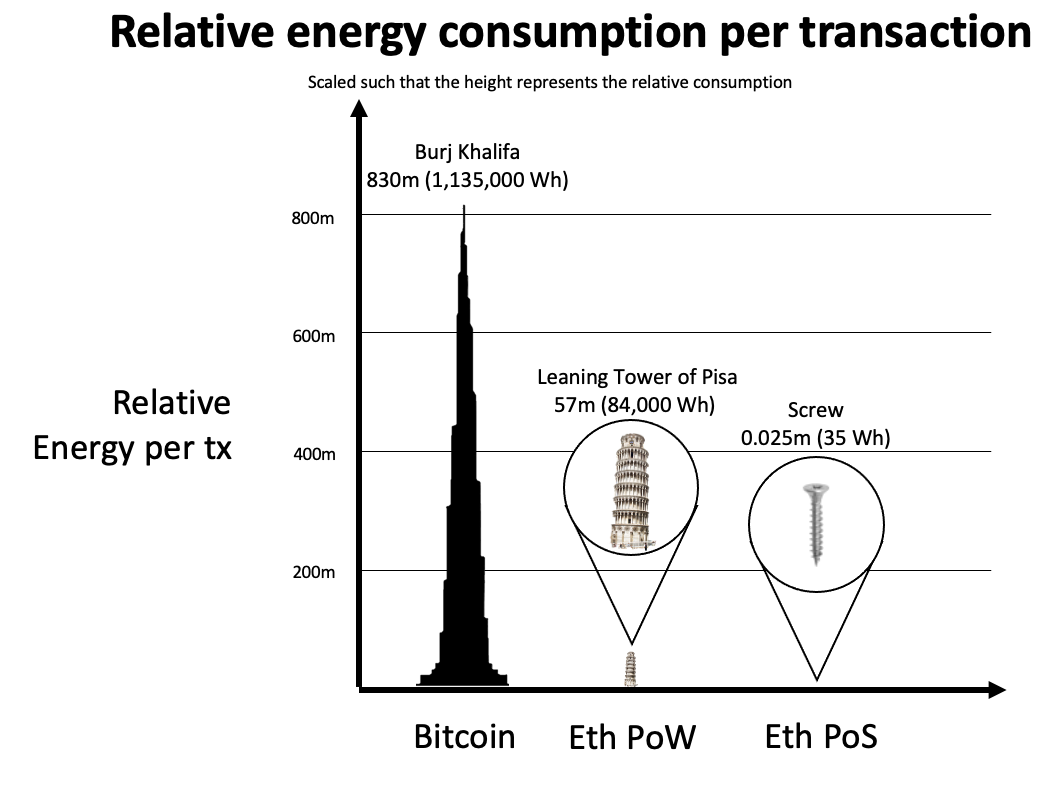

One of the main reasons for this trend is that PoS spends significantly less energy to secure a network than PoW. Whether crypto-supporters like it or not, the biggest public concern surrounding crypto has been about the amount of energy wasted by ASIC/GPU mining. PoS opens up a whole new door for more people to join this new world.

Of course, like everything in cryptos, there are camps. People are tribal. Critics say PoS is a “rich get richer” scheme: The rich will simply stake their wealth and get richer with stake rewards, which will result in the centralization of the network.

The same critics tend to praise PoW due to its off-chain properties: Everyone has access to mining equipment. Also, even if you are rich, you still have to buy/rent mining equipment. The mere fact that you have to spend money on mining equipment prevents rent-seeking behavior.

In this article, I will explain that “rich get richer” does not apply to PoS, at least not more than to PoW. In fact, I will further argue that PoW becomes more centralized than PoS in the long run.

Arguments from the Proof of Work Camp

Before we get deeper, let’s consider four categories of entities:

- Rich staker: A node operator who staked a significant amount in a PoS network

- Rich miner: A miner who invested a significant amount into mining rigs in a PoW network

- Poor staker: A node operator who staked a small amount in a PoS network

- Poor miner: A miner who invested a small amount into a mining rig in a PoW network

For convenience, I am using the word “poor” instead of “less rich”.

The “rich get richer” argument makes some core assumptions to arrive at this conclusion. These assumptions simply focus on rich stakers; however what they are missing is the fact that these assumptions apply directly to all participants in both mechanisms, including rich miners, poor stakers, and poor miners.

Let’s break these assumptions down:

1. “Stakers simply compound their wealth.”

The assumption here is that stakers never take profits. This is not true for everyone of course; but even if it were true, the very same assumption can be applied to the miners in a PoW network too. Even though there are higher costs associated with PoW, miners can (and do) reinvest their rewards into new ASIC equipment, increasing their share of hash rate within the network.

This is not just theory, this has happened in practice over the course of Bitcoin’s lifespan.

The similarity of stakers and miners is not even the main reason why this assumption falls short. Whatever we assume for rich stakers (or rich miners) should be applied to poor stakers or poor miners too.

Poor stakers will also compound their staking rewards and poor miners can also reinvest their mining rewards.

To the uneducated eye, both of these systems may seem centralizing: The rich increase their wealth from 100 to 110, and the poor increase their wealth from 10 to only 11. However, since there are 10 poor stakers/miners for every 1 single rich staker/miner, the percentage share in the network does not change.

Therefore, decentralization is not compromised.

2. “PoW is superior because anyone can buy mining equipment.”

There is a valid theoretical point that to be able to stake, you have to first buy the currency from the producers of the currency, i.e. stakers, resulting in a “closed ecosystem” where the power is consolidated in the hands of the early entrants. This is not the case with PoW, since mining equipment can be purchased externally and the currency can be mined.

However this argument remains theoretical at best, because in practice, there are always buyers and sellers in the open crypto market. Moreover, barrier to enter a PoW ecosystem requires the purchase of mining equipment which create an even higher barrier for retail participants to enter.

3. “Rich miners have to cover their operational costs (OPEX). Rich stakers won’t.”

Again, this applies to the poorer operators as well.

Poor miners will have to cover their OPEX. Poor stakers won’t.

4. “Mining equipment (unlike the stake) depreciates in the long term, so rich miners can't just compound their investment as they always have to buy new equipment.”

The market mechanics for PoW is such that there is some profitability, just like in PoS. Therefore money spent off-chain does not matter, as long as the delta profit can be reinvested into new mining equipment (see the assumption #1 above on reinvesting). In fact, because poorer miners have to do the same and they tend to have less capital, their reinvestment remains much lower, leading to a wider gap between rich miners and poor ones.

The real difference between PoW and PoS

Hopefully we proved above that whatever criticism made for “rich stakers" can apply to “poorer stakers” as well as “rich miners” and “poor miners”.

But there is something that makes PoW more centralized in the long term than PoS: Economies of scale.

Economies of scale are cost or investment advantages utilized by companies or individuals when they increase the scale of the purchase or investment.

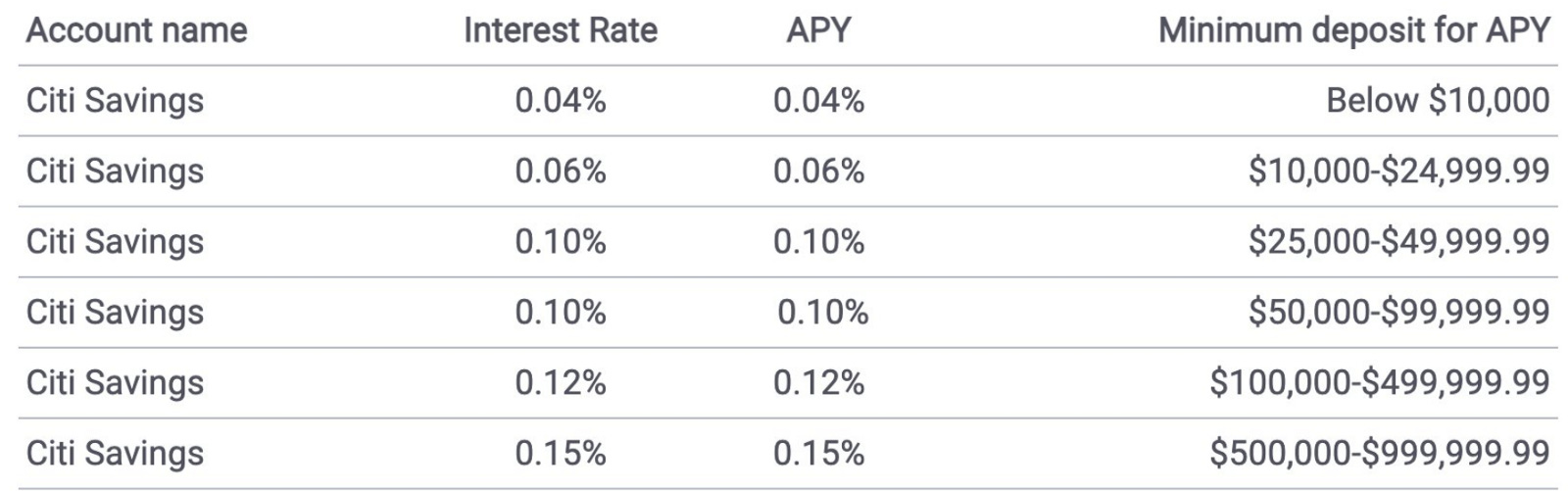

In a capitalist economy, economies of scale are prevalent. Simple example from Citibank saving rates:

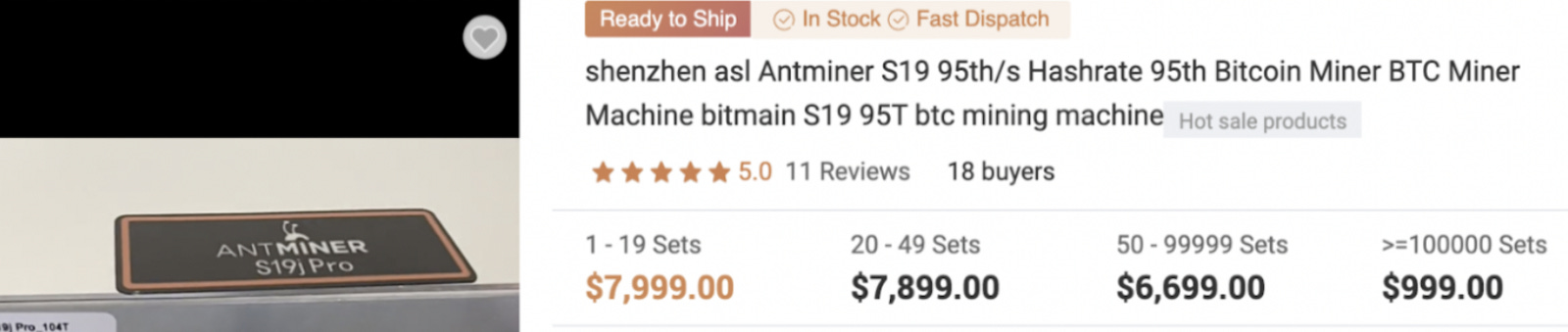

Economies of scale also help the rich PoW miners to buy mining equipment at a significantly lower cost compared to the poorer miners. Large scale deals are negotiated offline, but even an online example can prove this:

Economies of scale apply to operational costs too as rich miners have access to cheaper energy than poor miners. With Proof of Stake, the operational costs are the same—1 ETH costs the same amount for everyone while hardware and energy costs don’t scale with PoS.

Simulating the centralizing forces

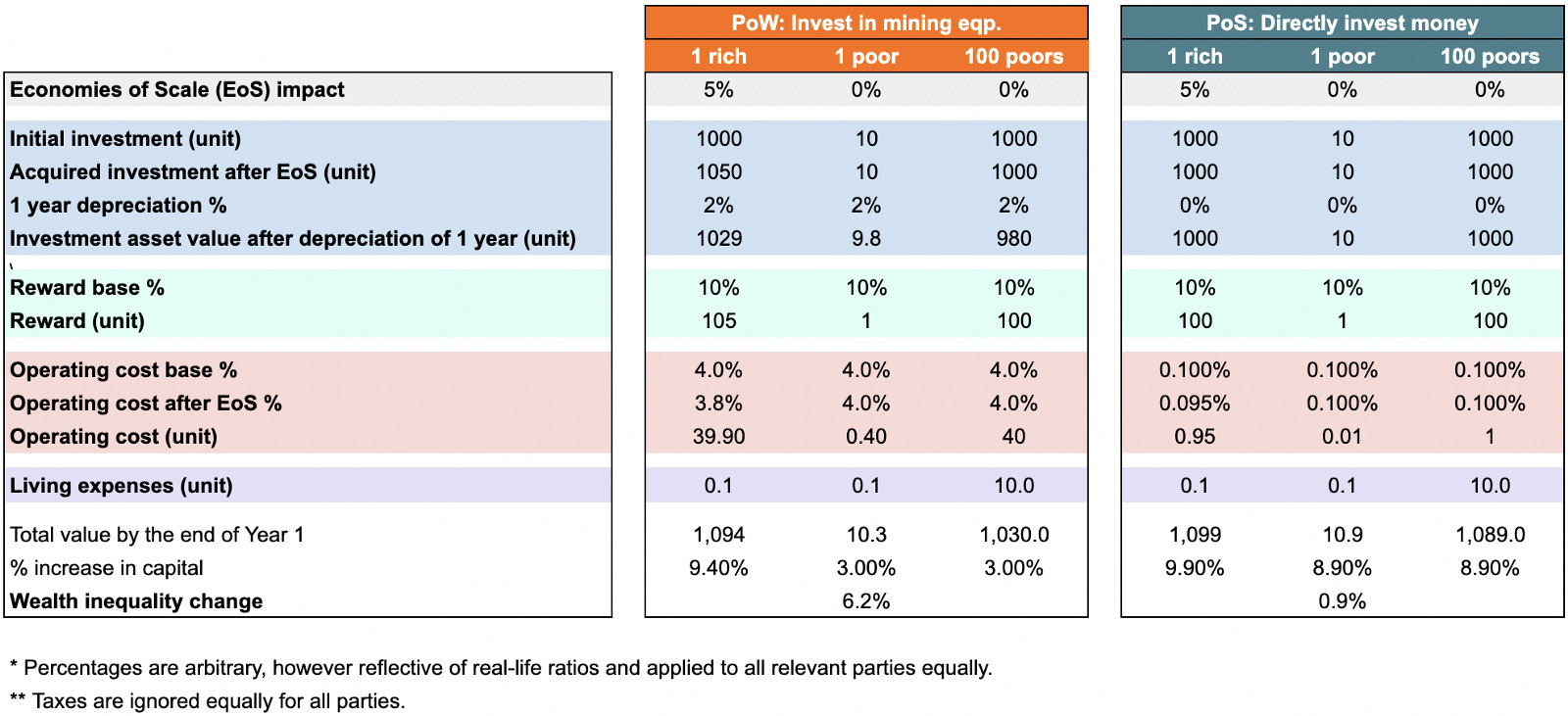

Building on the hypothesis above, what happens if we simulate the centralizing forces on equal footing?

- We assume 5% real-world economies of scale effect on operational costs and equipment purchase costs.

- We assume a 10% annual reward base on investment for both mining and staking rewards (in reality, the rewards vary from network to network and tend to be a little lower than this number).

- We assume 2% annual depreciation on mining equipment.

- We assume significantly higher operating costs for PoW than for PoS.

- We assume an absolute amount of living expenses for every individual.

Using the above model PoW increases wealth inequality by 6.2% whereas PoS increases it by .9%.

It turns out, the wealth gap between rich and poor operators in a PoW network increases much more than the wealth gap between rich and poor operators in a PoS network. Once we apply our assumptions to all sides accurately, the only distinction between PoW and PoS becomes the economies of scale.

Note that there is not a 1:1 correlation between the wealth inequality and decentralization; but if we assume that stakers and miners will stay in the crypto business, and will continue to reinvest their income towards their operation, decentralization becomes relevant.

At the end of the day, what PoW proponents praise the most about PoW —its off-chain properties— is the very thing that makes it more centralized than PoS.

Isn’t that ironic?

To see the formulas in the simulation above, click here.