TLDR

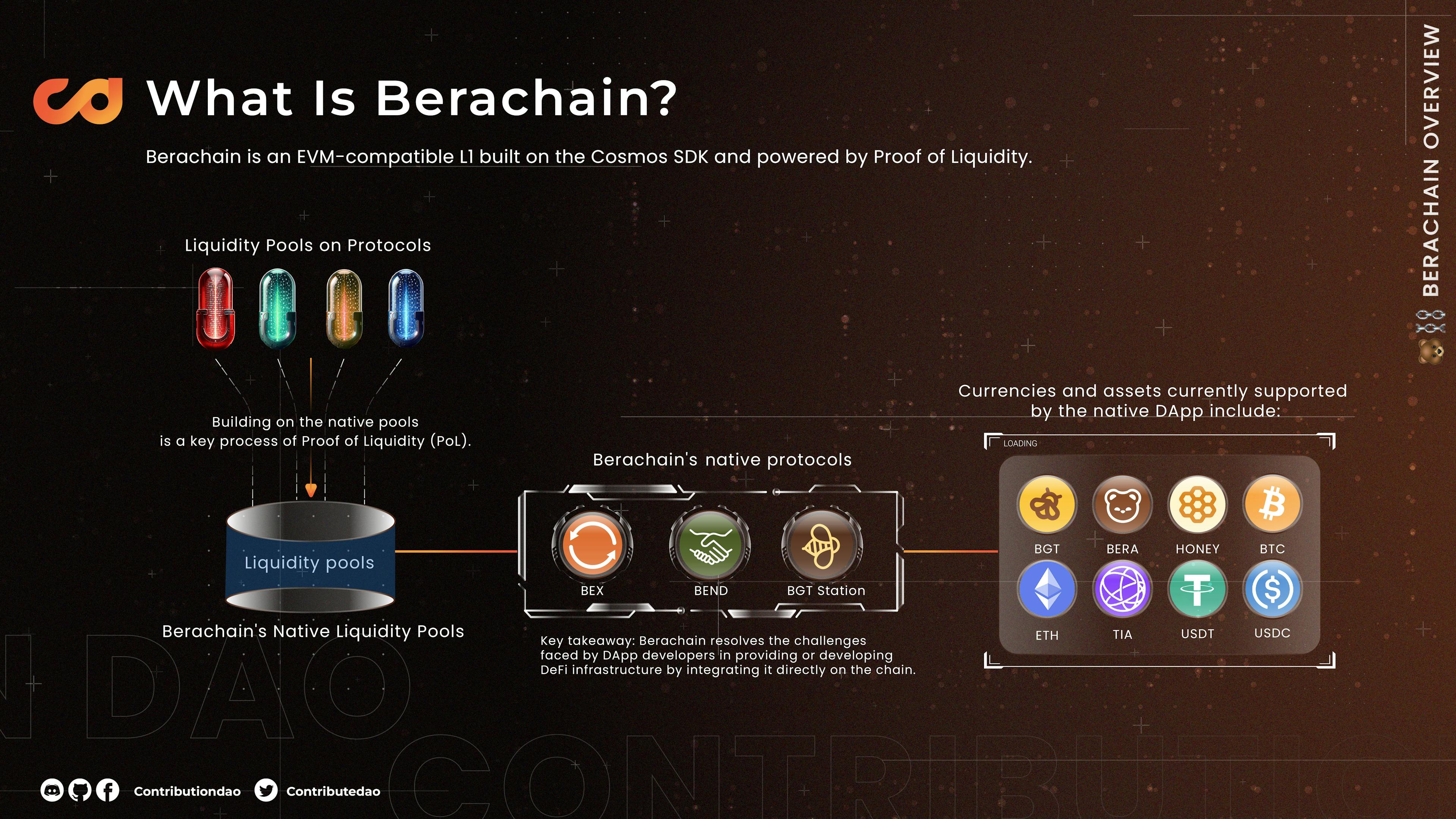

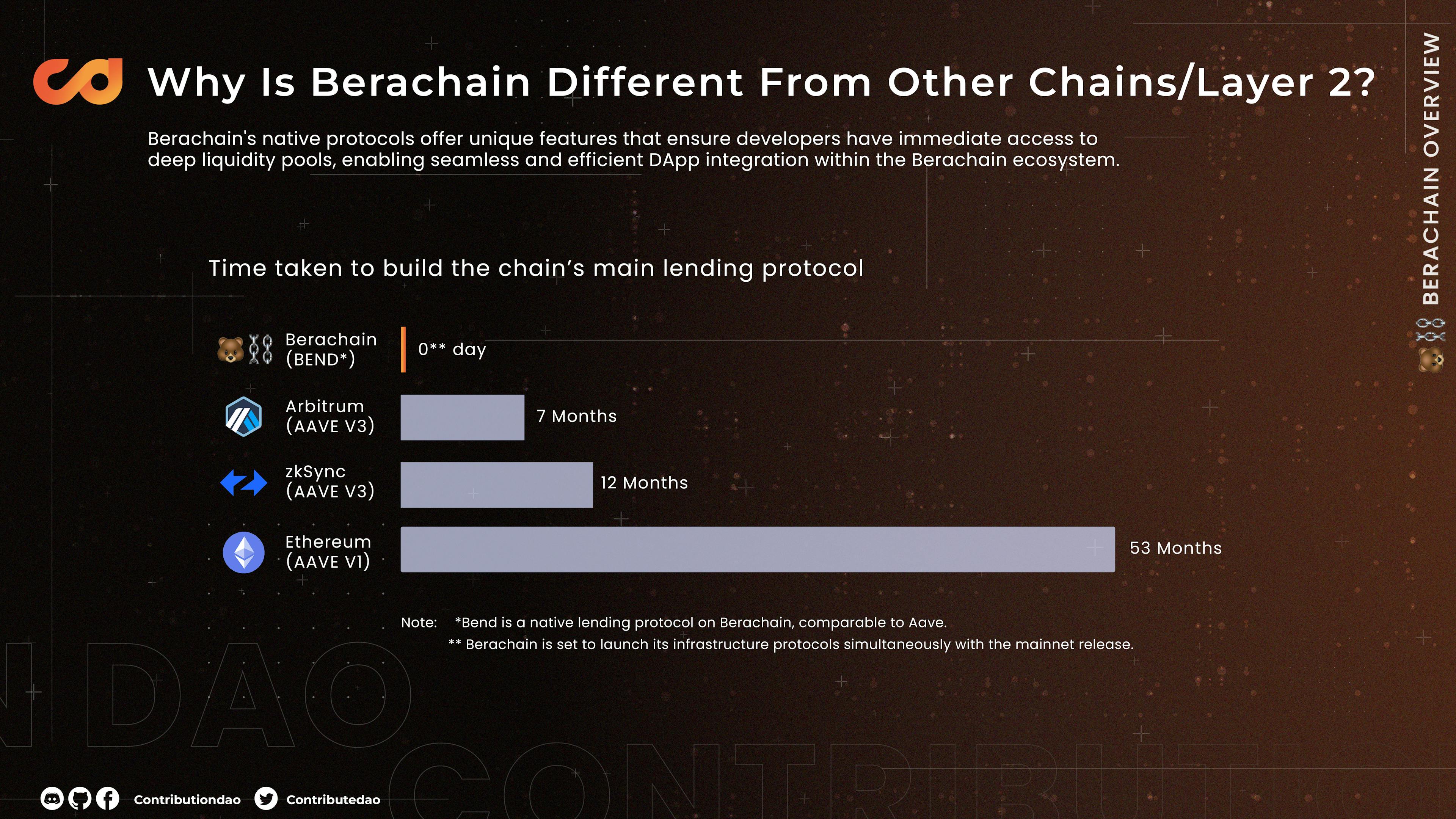

Berachain's a new EVM-compatible blockchain, built on the Cosmos SDK. It introduces Proof of Liquidity (PoL) as a new economic model, tackling the challenges PoS faces. PoL separates governance and gas fee tokens into BGT and BERA. Users provide liquidity, not just delegate, to earn BGT on top of trading fee rewards from LPs. With its bribe mechanism and unique reward system, Berachain aims for deeper liquidity, fairer validator competition, and reduced stake centralization.

Introduction

Proof of Work (PoW) involves miners competing to mine blocks and earn rewards, thereby securing the network under the assumption that the longest chain is the most trusted. Despite its effectiveness, PoW faces criticism for its high energy consumption and environmental impact. As an alternative, Proof of Stake (PoS) emerged, where validators stake native tokens to secure the network, significantly reducing energy usage. However, PoS introduces challenges such as high entry barriers for average users, leading to variations like Delegated PoS (dPoS), where users delegate tokens to validators.

PoS, however, creates its own set of issues: liquidity problems for the native token, stake centralization, limited benefits for validators in managing network infrastructure, and difficulties for protocols in enhancing network security.

Berachain offers a solution with its EVM-compatible blockchain based on Proof of Liquidity (PoL). Built using their developed framework, called Polaris EVM, on top of the Cosmos SDK, Berachain represents a modular stack blockchain that is also EVM compatible. It introduces a new economic model, PoL, which aims to address the limitations and pain points currently faced by PoS. In this article, we will delve into how Berachain's PoL approach addresses these challenges.

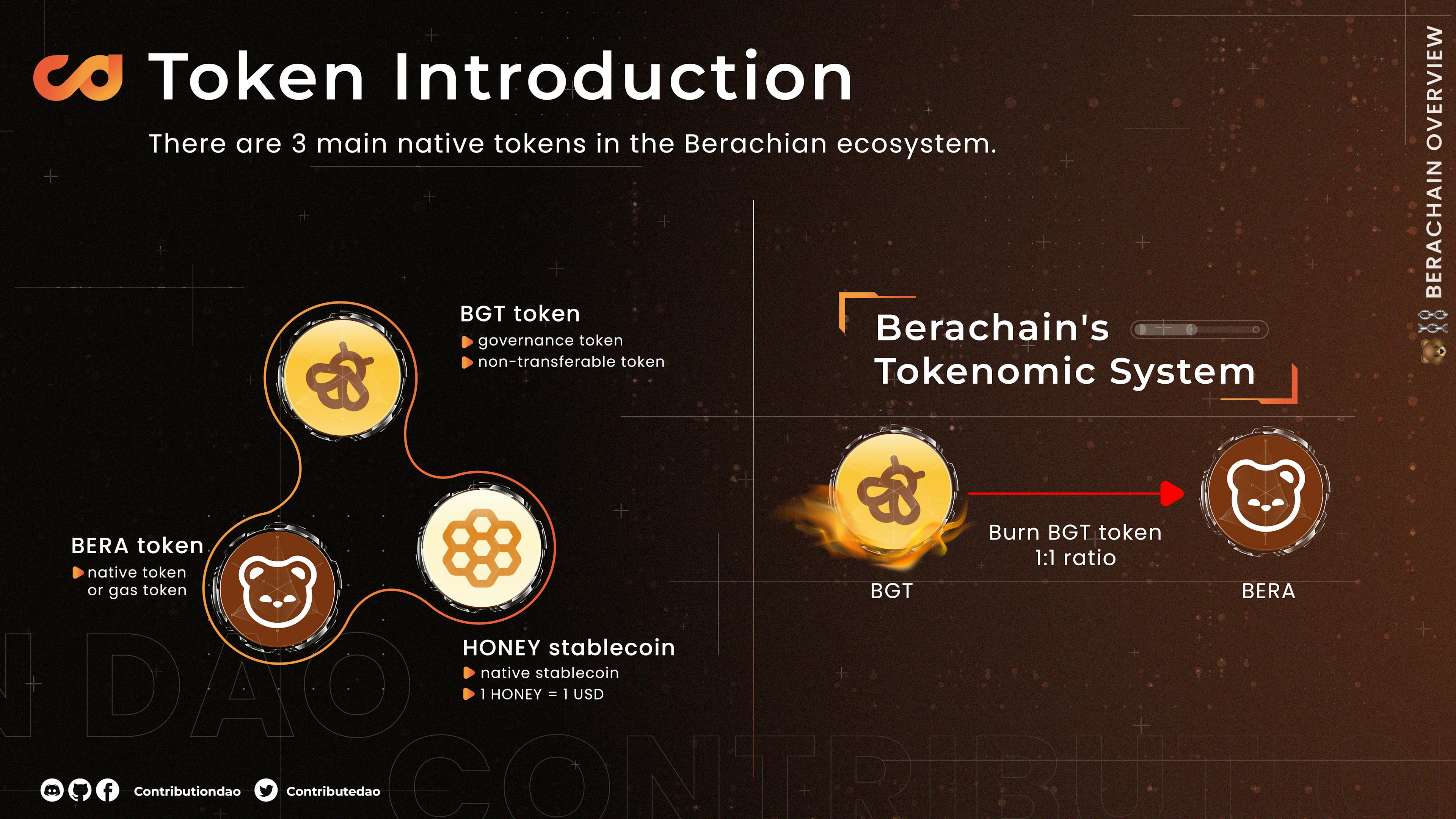

The Three Native Berachain Tokens

To understand Proof of Liquidity (PoL), it's crucial to first become familiar with the native tokens that play a pivotal role in the Berachain ecosystem. There are three main tokens:

-

Honey: This is the native stablecoin of Berachain, collateralized one-to-one with USDC.

-

BERA: Serving as Berachain's “gas token,” BERA is used for paying transaction fees, similar to the function of native tokens in other blockchains.

-

BGT: This is Berachain’s staking and governance token. As a soulbound token, BGT cannot be purchased and is only earned by providing liquidity into Berachain’s core primitive protocols or other protocols/smart contracts approved by governance over time. Upon launch, BGT can be earned through activities like depositing liquidity in the native BEX, borrowing Honey on BEND, or providing Honey in the bHoney vault on perps. As governance approves more smart contracts for emissions, users can earn BGT rewards by participating in LP in those protocols. BGT can be delegated to validators for creating and voting on governance proposals, such as determining which LP pools or protocols receive BGT emissions and their respective reward rates. Finally, BGT may be 1-way burned into BERA. BERA cannot be burned into BGT.

As you can see, unlike dPoS and PoS, governance token and gas token are not the same. BERA can be transferred and purchased, but BGT cannot. Its only purpose is to be used only for governance.

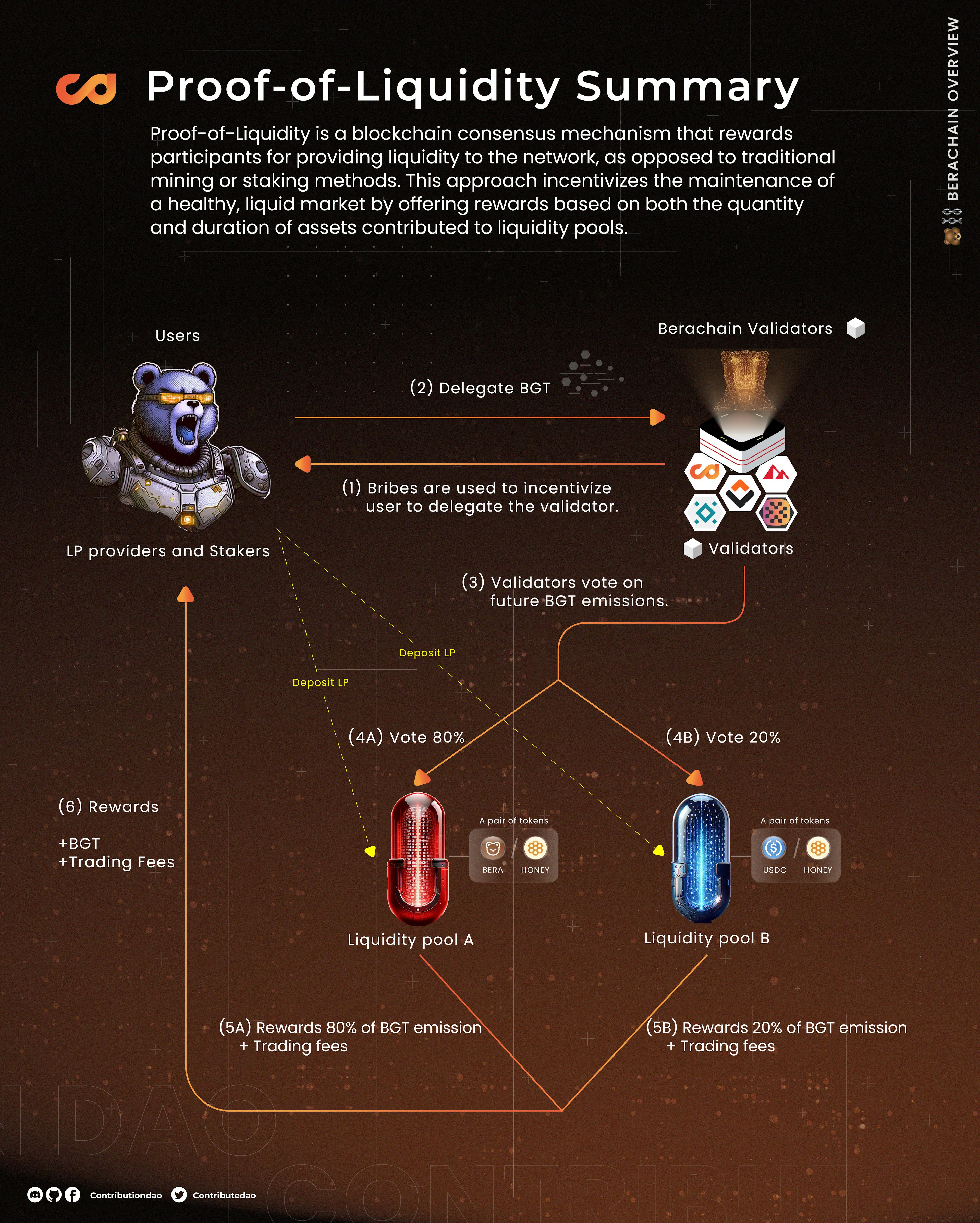

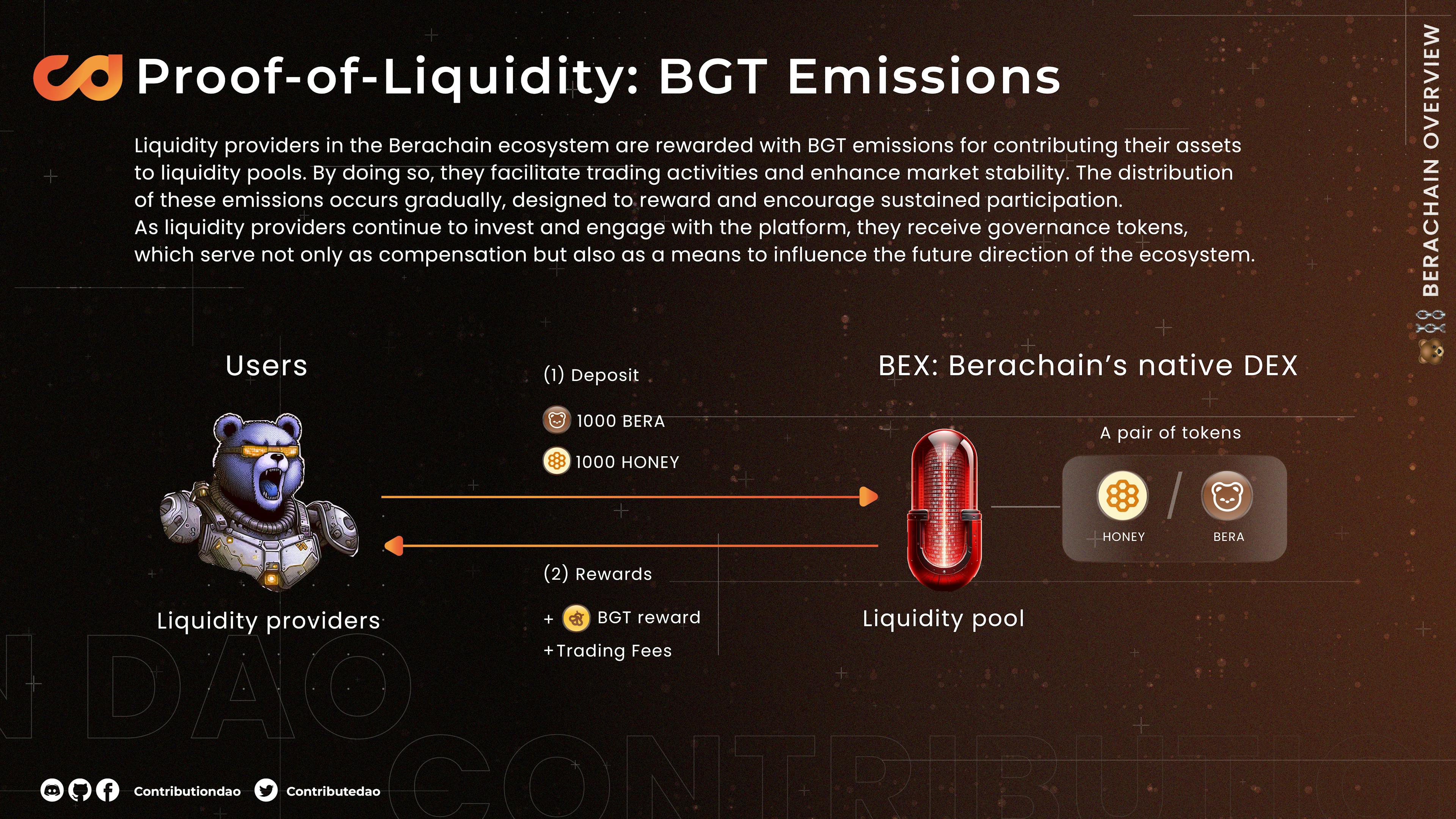

Overview of PoL

In summary, PoL replaces native token delegation with liquidity provision to the native core protocols built into Berachain, namely BEX, BEND, and BERPS. Users providing liquidity to pools receive BGT as an additional reward. This reward is calculated based on the BGT emission rate specified for each pool, in addition to trading fees. As users earn more BGT, they delegate it to validators. The total delegated BGT of each validator influences their power to determine future BGT emissions and their likelihood of being chosen to propose a new block.

Here's how PoL works:

-

Similar to dPoS, at launch, initial validators must stake BGT tokens. Since BGT can't be purchased, an initial setup is needed for receiving delegations from the foundation.

-

Users provide liquidity to Berachain's core primitive protocols, which include native BEX, borrowing Honey on BEND, or providing Honey in the bHoney Vault on BERPS. In return, they receive BGT (based on each pool's emission rate) and trading fees paid in Berachain's stablecoin, Honey.

-

Users delegate their BGT to validators, aligning with their vision for the future of the chain.

-

Validators may use bribes to incentivize BGT delegation. In Berachain, a bribe is an additional reward distributed to delegators whenever the validator proposes a new block.

-

Validators vote to determine the BGT emission rate for each liquidity pool, which is influenced by the overall inflation of BGT, validator power, and the distribution weight chosen by the validator.

In summary, users earn BGT (in addition to LP rewards) from providing liquidity to Berachain's core primitive dApps, rather than by delegating BGT. They can then convert BGT to BERA (a one-way conversion) or delegate BGT to validators. More BGT tokens for validators mean more voting power, allowing them to influence the BGT emission rate for each pool.

How Governance Influences BGT Emission Rate

As validators receive more delegations, their voting power increases. The total BGT delegated to each validator determines two key factors:

-

Their chance of being chosen to propose a new block.

-

Control over a portion of the BGT emission rate. Validators can distribute the BGT inflation they control (equivalent to the percentage of BGT delegated to them) across various BEX liquidity pools.

For example, if 100 million BGT tokens are delegated among validators, and 25 million BGT are delegated to validator V, with the current BGT inflation rate at 8%, then validator V controls 25% of the BGT inflation (2%). They can distribute this 2% to their preferred liquidity pools on BEX, such as 1% to BERA/HONEY, 0.6% to BTC/HONEY, and 0.4% to BERA/HONEY. This mechanism enhances liquidity in Berachain's native pools.

Validators proposing a new block earn three types of rewards:

-

BGT Inflation: The BGT emissions discussed earlier.

-

Trading Fee: A percentage of the fee is taken by the validator, with the rest distributed to their delegators.

-

Gas Fees: Users pay gas fees for chain usage, which are awarded to the validator who proposes the new block.

To increase their income, validators compete to attract more delegators. The “bribe” mechanism in Berachain helps with this by offering additional rewards to delegators, on top of the standard pool rewards (BGT emission and trading fee). This competition for bribes attracts more users to delegate to validators, enhancing network security and decentralization.

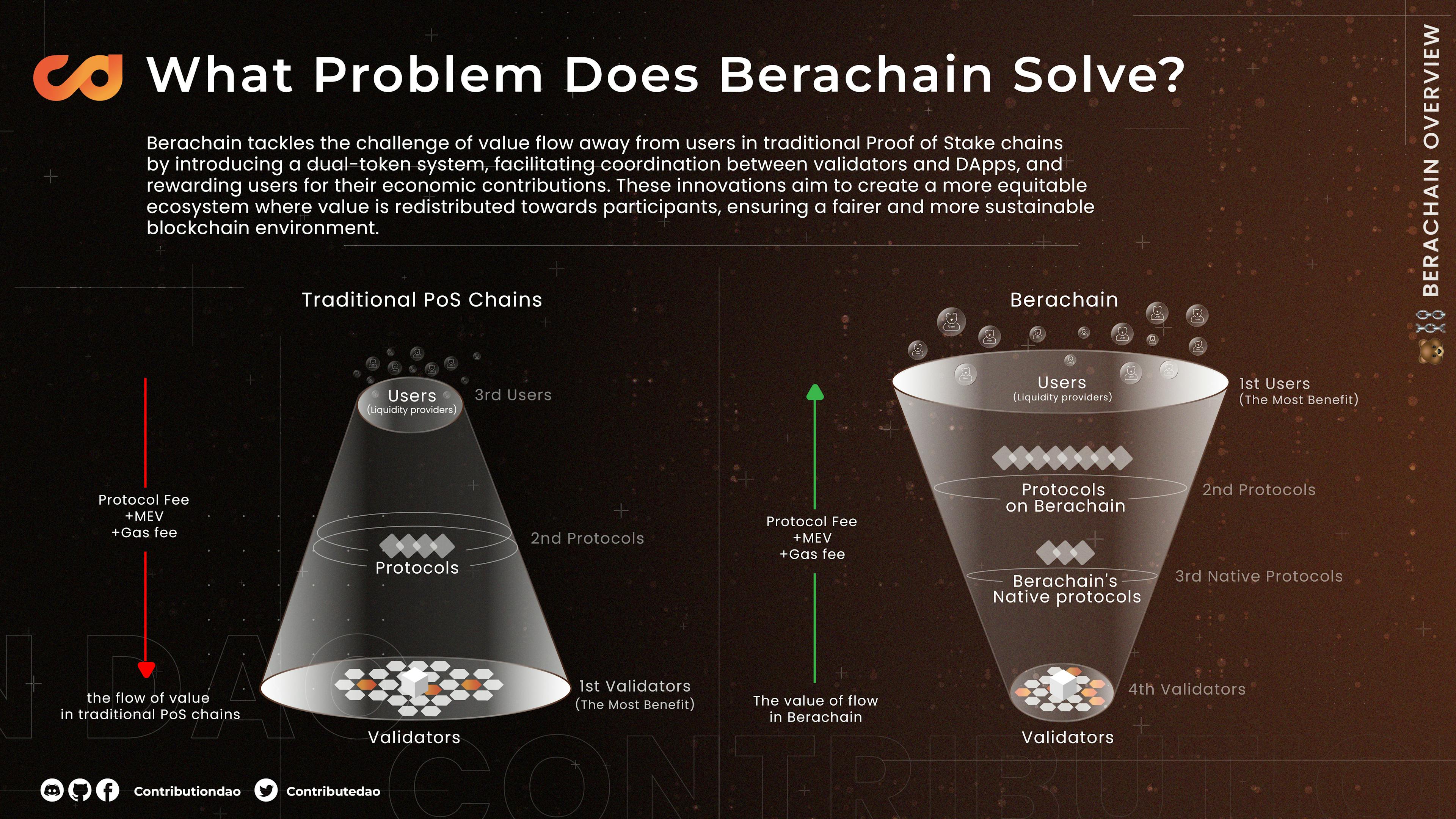

What Does the Berachain Solves ?

Berachain addresses several problems commonly encountered in PoS systems, such as liquidity issues for the native token, decentralized reward distribution, and limited benefits for validators in managing network infrastructure.

Native Token Liquidity

In traditional PoS and Delegated PoS (dPoS) systems, there is typically one native token serving dual roles: as both the gas fee and governance token. This can lead to liquidity issues, as a significant portion of the token is locked up for staking. While this staking disincentivizes malicious actions, it also reduces liquidity. Berachain solves this by introducing two distinct tokens: BERA for gas fees and BGT for governance. This separation helps improve the liquidity of the native tokens.

Stake Centralization

In many systems, governance tokens generated from chain inflation are distributed solely to stakers. Berachain takes a different approach, allowing users to provide liquidity to any pool with non-zero BGT emission, thereby receiving both trading fees and BGT. This model diversifies participation in network security and ensures a fairer distribution of BGT.

More Benefits for Validators

Berachain's bribe mechanism leads to more cooperation between validators and protocols (dApps built on Berachain). Protocols may incentivize validators, who in turn use these incentives to attract more delegators through bribes. An increase in delegation enhances the likelihood of validators being chosen to propose blocks, which in turn boosts their income. Protocols benefit from the validators' increased voting power and control over BGT inflation, which drives more liquidity to their pools. This increased liquidity attracts more end-users, leading to more transactional activity and consequently, more fees being collected.

Summary

The launch of the Berachain testnet significantly captured the crypto market's attention, demonstrating strong interest in this new platform. Our goal is to explain how Berachain works in detail, providing easy understanding without the need to go through extensive documentation. We've covered several aspects of Berachain, particularly its innovative economic model, Proof of Liquidity (PoL). PoL is designed to address the challenges faced by Proof of Stake (PoS) systems. It differentiates between governance and gas fee functions with two separate tokens, BGT and BERA. Users earn BGT by providing liquidity rather than through delegation, in addition to the usual trading fee rewards from LPs. With its bribe mechanism and unique reward system, Berachain is poised to achieve deeper liquidity, promote fair competition among validators, and tackle stake centralization.