Abstract

Nova DAO is a Web 3.0 E-Commerce ecosystem that consists of a communally governed marketplace and a DAO. The DAO shall be funded with the proceeds of the marketplace, and shall function as a decentralized fundraising and incubation platform. We believe new forms of aesthetic creation such as generative design are the future, and that they will not remain constrained to the virtual world. We desire to help increase exposure and accessibility for the same.

Overview

Our goal is to create a vibrant and self- sustaining commercial ecosystem.The DAO will be directly funded by a portion of the sales on the marketplace. We believe that decentralization and cross pollination have pragmatic benefits in addition to philosophical ones, and so, the DAO shall be a vehicle through which we find new artists and new avenues to explore. Members of the DAO will be part owners in profit as well, making them stakeholders in the truest sense. Therefore, we hope to create a thriving social ecosystem in addition to the financial one. Our answer to why we must build on-chain is tethered to the value proposition made possible by using a DAO based model, which we consider to be the inevitable next step in how we organize ourselves and allocate capital. Defined as a Decentralized Autonomous Organization, DAOs represent a new form of socio-economic cooperation made possible by consensus networks such as Ethereum. Essentially, a DAOs primary benefits are summarized by substantial increases in efficiency in an organization’s functioning. Furthermore, Nova DAO will utilize the benefits provided by the current NFT space in two significant ways. Firstly, we will utilize what we believe is a significant unlock of NFTs — the trustless and automated tokenization of assets and revenue streams — digital or otherwise. Secondly, the NFT space provides two crucial advantages when it comes to attaining user adoption. It is, for most people, the first experience of real ‘buying and selling’ on the blockchain. Furthermore, the NFT/ Web 3.0 space has already demonstrated a great acceptance and adoption of DAOs. In this paper, we shall first explore the benefits of DAOs as they pertain to general economic cooperation, and how their philosophical advantages translate into economic ones. Furthermore, we shall delineate why and how we plan to use NFTs in our marketplace, and finally, the benefits the simultaneous utilization of both will provide over traditional E-Commerce marketplaces. By doing so, we shall demonstrate how our model leads to significant improvements in efficiency and transparency of current systems.

The WHYs

WHY USE A DAO?

-

Mimetics are increasingly supplanting economics as the persuasive mechanism behind human cooperation. This is to say that concepts that cannot be conventionally financially operationalized are now having financial impacts. It is inarguable that a large part of what attracted people to Bitcoin and blockchain in general was the fact that it is decentralized. Decentralization is not something we can conventionally quantify in terms of economic value. Indeed, those paying exorbitant gas on Ethereum as opposed to Solana largely do so on philosophical grounds. Sacrificing ‘decentralization’ for ‘scalability’ on the trilemma is something most blockchain enthusiasts frequently balk at (https://www.gemini.com/cryptopedia/blockchain-trilemma-decentralization-scalability-definition) . This is unequivocal evidence that the philosophical underpinnings behind ventures are now greatly impacting their success, especially in Web 3.0. Therefore, something which is effectively a moral truism — that the concentration of power is bad, and the inverse is good — is now something that if harnessed, can be a powerful tool with regards to creating user growth. In other words, things that actually benefit the many, as opposed to the few, are now being commercially rewarded through adoption. The emergence of DAOs is a phenomenon that perfectly encapsulates this notion. A trend that is causing this is the decentralization of capital investment itself. Indeed, seeing as it originated in the financial fringes, the cryptocurrency market has always had a higher share of ‘retail’ investors. It is not an unreasonable leap of faith to surmise that ‘traditional’ financial institutions would not be too amenable to the idea of decentralization. This is noteworthy because it represents a significant societal shift with respect to how economic (and thus inevitably, social) capital is allocated. We believe that it is a trend that is unlikely to slow down.

Therefore, our goal is motivated by the inherent value of the philosophical tenets of DAOs, and by the pragmatic virtue of the emergent value that such notions are adding because of people’s belief in them. DAOs have tangible commercial and economic value as they spur consumer participation and community growth. We shall now elaborate on a few of the philosophical motivations for their emergence. -

Decentralization

The most apparent benefit of DAO’s is that of decentralization. Firstly, the decentralized nature of a network allows for immutability. This is because of the diffusion of deliberation. To varying degrees, most of today’s corporations are highly hierarchical. Therefore, any deliberative missteps higher up the chain can have catastrophic consequences for the organization. On the other hand, whilst DAOs would of course have de facto leaders or founders, they would be far more fungible and accountable to the rest of the stakeholders in the network.

-

Automation/Trustlessness

DAOs allow for a socio-economic operationalization of the notion that ‘code is law’ in a very literal sense. In other words, they bring trustlessness, enabled by smart contracts, into use cases that traditionally allow for human error and bad faith actions. The bylaws of organizations, for example, can be automated using smart contracts. Furthermore, working on the blockchain means that obfuscation and bad faith actions are much harder to execute, thanks to the transparency provided by the chain.

-

Organic cross-pollination

Because everyone is an owner in DAOs in the literal sense, there is a palpable sense of responsibility and camaraderie prevalent in them. Indeed, the collaborative atmosphere and sentiment is a pivotal element of any of today’s DAOs. As such, we believe the DAO model is perfectly apt for a platform such as ours, as the organic cross-pollination amongst members would result in a global community of creators and enthusiasts. Moreover, the community itself would not be bifurcated-members of the community would have a much easier time becoming creators themselves, with the ideational and executional help provided by the DAO’s members.

WHY USE NFT’S?

It is apparent that the two primary use cases for the blockchain are currently primarily in the form of decentralized finance and NFTs. The blockchain allows for specific use cases that have rendered the most fundamental aspects of both these fields possible. Furthermore, NFTs are the first goods that have actually been bought and sold on the blockchain, and projects in the space have been heavily utilizing DAOs, fractionalized ownership and staking. For a project like ours, we believe targeting the consumer segment most acquainted with the space is imperative.

The WHATs

-

Marketplace

The center of our venture will be our marketplace. We are confident that the innovation we are seeing, entering the ‘metaverse’ right now will not be one way. The communities and technologies that are developed and gain pre-eminence in this space (such as generative art) will make their way back to the ‘real world’. Therefore, we intend on this marketplace to be the hub for such commerce. The second fundamental aspect of the marketplace is that it will be self governing and self sustaining. This shall be accomplished by leveraging smart contracts, DAO protocols, and most importantly, innovative economic protocols.

-

NFT Collection

Our genesis NFT collection will be called Nova Deus (‘new gods’). A generative collection that draws inspiration from the Hindu, Greek, and Egyptian pantheons. Early minters will be able to mint for free. Furthermore, this collection will provide the proof of concept for our revenue sharing model that provides passive income based off of real commerce, and not self-fulfilling valuations the way today’s prominent passive income NFT’s operate. Another example of future utility for the NFT’s is that they could function as ‘membership’ passes for exclusive drops on our platform. These are both examples to illustrate the utility that NFT’s can unlock on an E-Commerce platform.

-

DAO

The DAO will consist of two things — the community and communal funds. This group will:

-

Be the deliberative authority when it comes to choosing new artists, designs, or the implementation of any new features on the platform. For example, if we were to propose the introduction of a ‘stake for early drop access’ feature, this would first have to be voted on by the community.

-

The DAO would give us new ideas to expand, scale, and introduce features. This is because the members would in every sense — emotionally, operationally, and financially, be owners and have a feeling of agency over the platform. Indeed, we expect this aspect of our venture to make scaling easier, as it grants the venture a globally dispersed set of social capital. The recent ENS airdrop — which has freely given tens of thousands of dollars of governance tokens to domain holders, is a testament to this fact, as the utility of these governance tokens is to form a DAO.

-

Finally, the crucial part of the DAO would be the contract that holds the funds. These funds would, in a very literal sense, be everyone’s. A ‘real world’ analog to this would be a traditional Venture Capital fund. Although fund managers are limited by the law and frameworks put in place to dissuade malfeasance, social trust still plays a massive role in this dynamic, as the legal and regulatory systems are by no means trustless. This dynamic is especially stark when compared to the trustlessness enabled by mathematically backed and immutable smart contracts.

While other fund-raising DAOs such as the Nouns do exist (nouns.wtf), there are a few crucial factors that differentiate our venture:

- Nouns (and others of its kind) are simply funds. They do not have an integrated commercial marketplace of any kind-whether physical or digital. Even at launch, we will be selling real goods on the blockchain, to demonstrate a proof of concept for our economic processes. Further down the line, using the DAO, we hope to fund projects, both digital and physical, to be sold on our marketplace.

- Secondly, our aim with introducing both a communal fund and a marketplace is to induce a recursive feedback loop with regards to user growth. In simple terms, the network effect of each component will fuel that of the other. Indeed, a large part of the exponential growth in value seen in the space like the now legendary Genesis Cyberkongz( https://www.cyberkongz.com/) is caused by such feedback loops.

-

The HOWs

Since our vision is one that fundamentally rests upon the social and economic means of cooperation, the ‘tokenomics’ or economic operation of our platform are crucial to how we plan to execute.

-

MARKETPLACE

The manner in which we plan to execute our vision of a decentralized, self-fulfilling commercial ecosystem will begin with us building a simple marketplace on which customers can purchase goods directly through their Web 3.0 wallet. As a proof of concept, we will be allowing users to utilize the IP rights they get on their NFTs and will create 1/1 pieces such as hoodies, shoes and other garments. Initially, we aim to simply establish a proof of concept-over the medium to long term, we intend on growing organically and in complete tandem with our community.

Furthermore, we want to give consumers the experience of seamlessly purchasing a ‘real’ good with their Metamask — the same way our target demographic (at launch) has been doing with NFTs for the last few months.This aspect of our product is absolutely imperative, as for us to achieve our vision of a DAO enabled platform, the marketplace must be interacted with directly on chain. This would also enable the kind of economic or ‘tokenomic’ models that would allow for our vision to exist.

-

GENERATIVE NFT COLLECTION

Firstly, we shall release 7500 ‘Nova Deus’ NFTs. We intend for these to be exclusive membership tokens for various kinds of utility on the platform. These will function as the primary ownership distribution model for our platform. We have chosen a large collection size deliberately, as we feel that a more inclusive community is more in tandem with the ethos behind DAOs, as opposed to the more exclusionary form prevalent in the market today.

-

DAO/COMMUNITY FUND

The marketplace shall generate revenue on the basis of commissions. A part of these commissions will be funneled towards us for development costs, with another share going to a locked smart contract with the DAO funds. The ETH in this locked contract will then be fractionalized for $NOVA, which would also be a representational governance token. It is these tokens that will be distributed to both the stakers and the buyers on the platform. This is to say that a portion of ETH will be sent to a contract, and this ETH will then be represented by our native token. Furthermore, from each transaction on the platform, 90% of the $NOVA tokens created will be distributed amongst the staked genesis NFT’s, with the remaining 10% going to the parties involved in the marketplace transactions. Therefore, participating in commerce on the platform gives people governance over this DAO.

Besides funding, the DAO community will be crucial in providing guidance, networking and pilot testing to the creators.

-

Total Supply: 1,000,000,000,000

-

Decimals : 18

-

NovaDAO’s native token ($NOVA) will be used for funding new creators as well as distributing rewards. The funding will work on a cohort system with minimum the specs:

-

Minimum total fund size: 150E

-

Number of ventures: 5–15

-

Revenue from a third of the Nova Deus NFT sales (2500 x 0.07E = 175E) will form the first “fund”. This money will be sent to a smart contract containing the entire supply of $NOVA. Against this deposit, the contract will release a number of $NOVA at the predetermined price (TBD) which will then be rewarded to stakers.

-

Beyond this, a certain % of marketplace revenue will be sent to a contract, every time said contracts reaches a pre fixed value (determined by the size of cohort and kind of ventures the DAO wishes to fund), said contract will deposit the eth in the original contract and give out $NOVA at current market value which will then be distributed to stakers.

-

This can be thought of as a decentralized version of early stage Venture Capital funds where capital is raised, deployed as per the discretion of managers (DAO) and investors ($NOVA holders) and rewards are distributed among the investors after fee deduction by the fund.

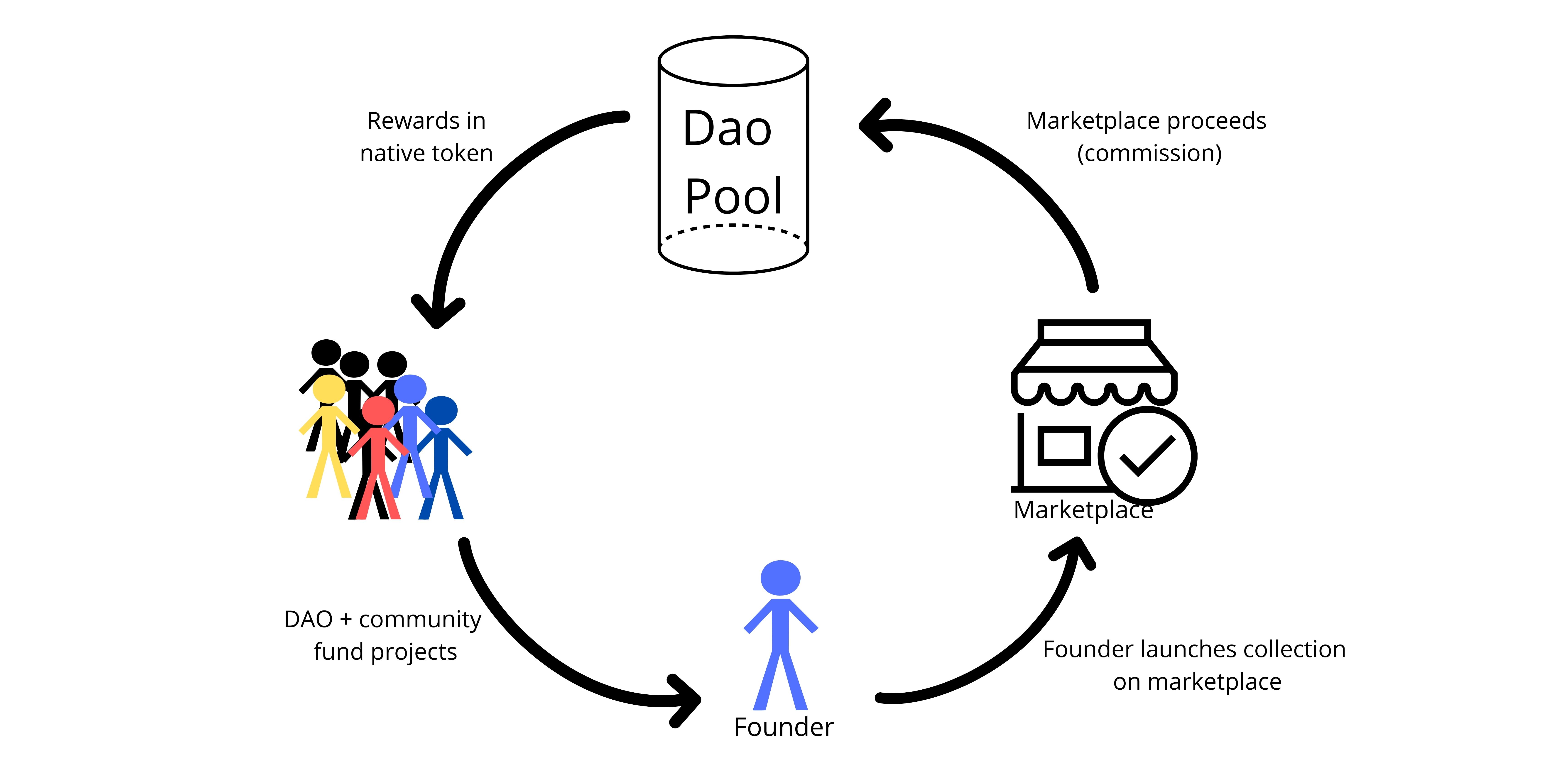

Here’s the TL;DR as an infographic:

-

-

Staking

The Nova Deus NFTs will signify membership to the DAO as well as be the tokens that will be staked to earn $NOVA. Every time a fund is raised (starting with revenue from the mint), staking will be opened to all NFT holders.

- The first round of staking will have the following particulars:

- Total time: 1 month

- Total coins: TBD

- Lock-in: 2 weeks

- Period of distribution: hourly

- The first round of staking will have the following particulars:

Then proposals will be evaluated and voting will occur to determine which ventures are to be funded.

Once the projects have been funded, the DAO will deliberate upon the size of the next fund. Once said fund is raised (via marketplace commission); staking will open once again.

Note: If the DAO agrees (and founders see a requirement) other NFTs may be issued to raise capital for a particular cohort. These NFTs may be one time tickets or elongated access, as agreed upon by the DAO.

Note: A fixed % of every staking round will be reserved for the founding team. This equates to the standard model of reserving a fixed number of tokens for the core team and vesting them as the venture progresses.

- Voting

Besides the general governance voting, Nova DAO will also be the key stakeholder in determining the allocation of funds:

- DAO votes to determine size and target of cohort/fund as well as particular ventures.

- The DAO will be the key decided in how much money gets raised (with some minimums and maximums set by the founders) and what kind of ventures will be targeted with this money.

- Beyond this, the DAO will analyze the proposals of ventures (while proposals will be open for any $NOVA holder to see, only the DAO will get to deliberate upon these). The DAO will vote on which ventures will be funded — this will also include deliberation on timelines, requirements and general business plans.

- While the founders (and other core team members) will be the first layer of filtration; we will always encourage founders to engage with the DAO to help them create a proposal and business plan that ensures max success.

- Once the ventures (and funding terms) are specified, the cohort will be opened up to all $NOVA holders to invest in! This is where the fun starts.

- If the vote fails, the DAO will make an offer to the founder which they have the choice to accept or decline.

Note: Even beyond funding, DAO members will play a crucial role in assisting and guiding new founders to ensure their projects are successful. This will include networking, pilot testing, general advice etc.

Note: The proposals will also include milestones upon which new rounds of funding will be released.

Funding

Once the voting by the DAO goes through, the funding round will begin as follows:

- Each and every $NOVA holder will have the capacity to fund a venture.

- In order to fund a venture, a holder will have to burn their $NOVA. Based on market exchange rate, the smart contract will release ETH to an escrow account where it will be held until the funding requirements are complete.

- Eg. if a venture needs 20E in funding and market rate is 1E = 100 $NOVA, then someone can burn 200 $NOVA and the contract will release 2E to an escrow account to hold until the entire 20E can be fulfilled.

- In order to ensure max participation, every wallet will have a cap on the amount of $NOVA they can burn (for example, no single wallet can fund more than 0.5% of a venture, exact number tbd ). Similarly, wallets will also have a cap on the number of ventures they can fund in a particular cohort.

- This system prevents whale wallets from gaining an unfair amount of the rewards.

- We understand the problem can be circumvented by whales distributing their $NOVA into multiple wallets and are actively looking for solutions to this. Perhaps something like a POAP to mark “qualified investor wallets”. If you have a potential solution then please feel free to reach out to us.

- When a burn event takes place, the wallet will receive a POAP and a record of their % investment in the venture will be kept. The POAP will be used to claim rewards.

- Once the funding requirements are complete, the first installment of funds will be sent to the founders to begin their projects. As the founders complete milestones (which will be voted upon by the DAO), the next installments will keep getting released.

- Of course we understand that sometimes a vote on whether a milestone is complete may fail due to differences in opinions. Hence we plan to implement a system where the founders of a funded venture have a fixed number of chances to call votes. This will allow them to get community feedback and try to better their product. If the vote fails each time, the stop loss on said investment will be executed and the remaining ETH will be returned back to the DAO pool. This helps the DAO hedge their bets and ensure we aren’t left holding the bag in case things go wrong.

Note: Each venture will have a fixed amount of time in which the funding needs to be raised. If the venture is unable to attract interest, the escrow-ed ETH will be sent back to the smart contract and the POAP holders will be: either given their coins back (this would mean the smart contract holds the tokens for specified period before burning them) or be given newly released nova tokens at market rate. (TBD).

Note: the burning of $NOVA tokens is important not only to create deflationary economics, but also to remove the double spend problem of money! To whoever said 9th grade Economics won’t help you in life…

Rewards Distribution

Finally, the rewards distribution mechanism will be pretty straightforward. Upon launch of a project, the predetermined amount of funds will be sent to a contract. From this:

- The DAO & core team will get a small incentive fee based on the return generated by the investment. These terms will be different for each cohort.

- The remaining rewards will be distributed among the investors in the ratio of investment. The POAP received upon investment will need to be burnt in order to claim reward.

- We are currently working on the specifics of the currency in which rewards will be given out in order to ensure efficient tokenomics. However, in cases of projects in which funding is given in exchange for a specific amount of native tokens of the project, we may simply distribute said token among the investors.

In summary, we aim to create a positive feedback loop where earnings from one project go into funding the next one and so on. Let the age of Web 3.0 creation begin! We’d love to hear your opinions on what we’re building. Feel free to reach out to either of us! While we’ve tried our best to maintain accuracy, the specifics in our tokenomics and voting mechanisms are subject to iteration and change.

Anav:

https://twitter.com/SawhneyAnav

sawhney50@gmail.com

Raghav:

https://twitter.com/cryptanosaurus

https://www.instagram.com/raghav.gupta.28/?hl=en

raghavgupta2898@gmail.com