Lessons on the edge of generative art

(Updated 1/10/2022 to include info on verified artist status.)

Over the past few weeks, I’ve been watching, minting, buying, selling and otherwise taking notes on generative art as it relates to the fx(hash) platform on the Tezos Blockchain.

I wanted to share insights that I’ve learned, so that you can find art that you will love.

Let’s go!

Avoid Copyminters

These days, it’s so easy for nefarious individuals to take someone’s code and use it as their own. I actually found Takawo Shunsuke’s project, Generativemasks, being sold by someone else.

To protect against copyminting, there are a couple of actions one can take. First off, fx(hash) has implemented verified artist status as a way of providing some artist moderation. This can be identified with a check next to the artist’s name.

Not all artists will be able to verify their identity in time, nor does the status of a verified artist mean that their work is entirely their own. For this matter, take a look at the artist’s user profile. If the account doesn’t have any social media linked, you may want to skip minting or buying from the artist.

If there are social media links, then dig deeper. Most artists will at least publish a link to their fx(hash) drop. Oppositely, many artists will also have their collection linked in at least one of their social media posts.

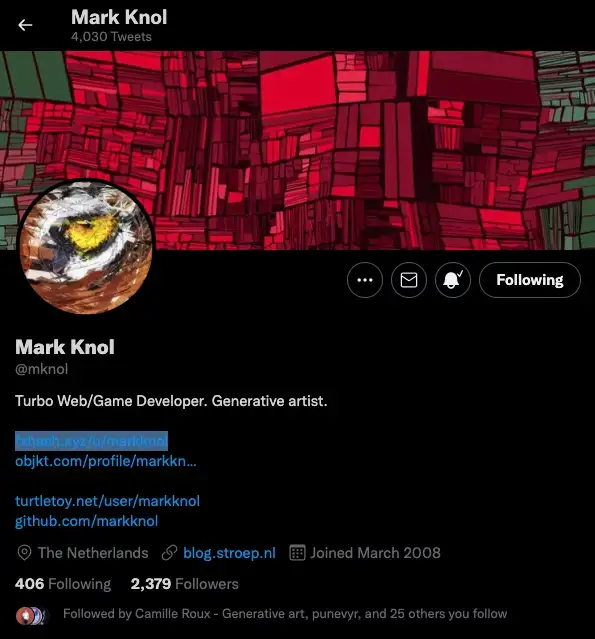

Reconcile these links, compare them and make sure that they are the same. Like other collections, take a look at the longevity of the account and their history. Twitter profiles show you when the account was created along with follower count.

Was the account just created this month?

The account might be from an artist looking to start something for themselves, but the account also may have recently been created to copymint.

In the case of the above example, everything checks out for this Mark Knol profile!

I try to triple check links, numbers, id’s and then to ultimately mint from a link given by the artist so as to make sure that I’m not funneling money into someone else’s wallet.

Operating Hours

fx(hash) has something known as operating hours. Basically, mints open for 12 hours a day and then close for 11 hours. This causes the time that the site is available for minting to move 1 hour each successive day, and allows people from around the world to eventually mint at a time that’s convenient for them.

Some artists choose to publish their collection towards the tail end of the open period so that it intentionally does not mint out. You can use the closed period to scout out and do research on pieces you like, as well as move fund around so that you’re ready to hit the mint button when fx(hash) opens once again.

The marketplace is open for 24 hours, so you can buy and sell as you like.

First Impressions

See something that looks like it may be of interest, but something seems off? Click into the piece, many of these generative works have animation to them. The rendered image is a static image that captures the piece at one moment in time.

For these pieces with animation, the render often doesn’t do the art justice. Just look at “Dancing Dots” by estienne or “Candy Eights 2D” by Numerus_Artifex which is a colorful 17 minute performance.

On Minting

1. Look for collections that will mint out sooner than later, so that a healthy secondary market can start. Minting out depends on the popularity of the art and artist. Some large collections, like those from p1xelfool, Sam Tsao, and Eko33 will sell out within seconds. Large collections with lesser known artists may takes weeks or more to mint out.

That said, there are many artists who are close to minting out. You may need to scroll a bit to find those diamonds in the rough though.

2. Some artists have a backlog of work that they are eager to publish. Coupled with low mints, this can lead to a situation where an artist has a bunch of collections that will take an increasingly long amount of time to finish minting.

3. Find artists in advance whose art you like and follow them for specific drop announcements. Many of these artists will share the time and date that their collection will drop, so that you can be ready to hit the mint button.

4. Don’t forget to take a look at their social media activity.

Are they getting a lot of likes, comments, and retweets on Twitter? Are people chomping at the bit to get a piece of the action or are there proverbial crickets chirping?

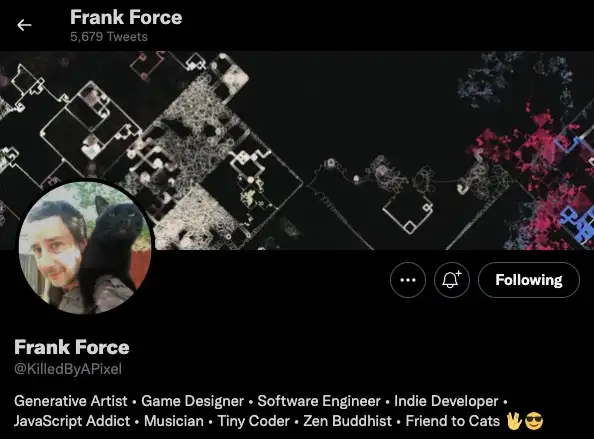

Here’s an example of a check I did on Frank Force:

-

I first came across Frank Force after seeing another artist I follow retweet one of his posts (signal!)

-

I saw that Frank was planning on releasing a collection on fx(hash). Curious to learn more, I looked through his bio.

-

I then went through some of the tweets and interactions. It’s hard to fake almost 6,000 tweets with over 3,500 followers (good signs)

-

I followed the website in Frank’s bio and went all the way back to to when his blog started in 2008. Along the way, I was able to see that he created a game (which I’m all too familiar with).

-

By reading Frank’s blog, a lot of the points on the Twitter bio check out including: generative artist, game designer, and software developer.

-

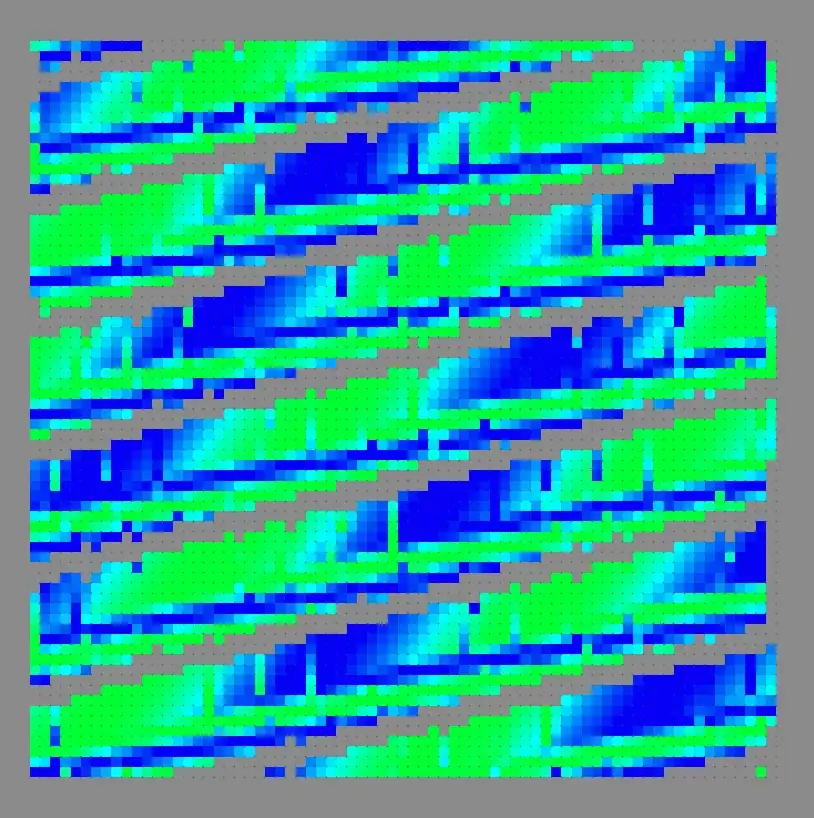

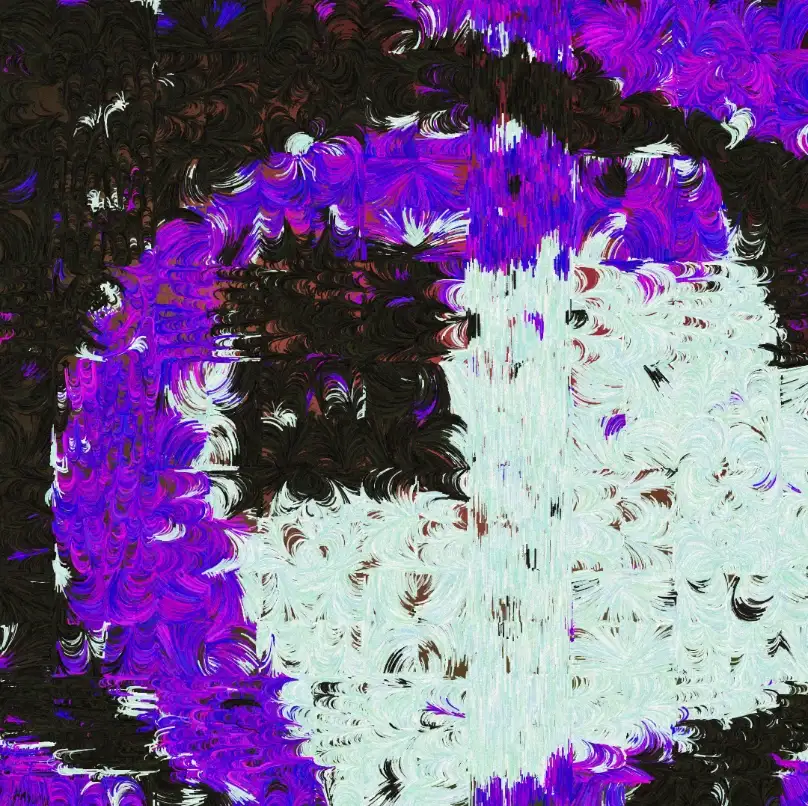

My last check was looking at the renders for his drop “Broken Flows.”

- I loved the way the renders looked and decided to mint.

5. Also consider the fact that fx(hash) does not have curation.

Though this allows for copyminters, it also allows for people to not worry about the approval process involved with platforms like art blocks. There are also artists who have on other platforms that may choose to release at a relatively affordable price.

One strategy to try is comparing fx(hash) artists work with work on other platforms like Objkt, art blocks, or Rarible. There may be some alpha when comparing the dollar amounts.

6. Last of all regarding minting, mint what you vibe with. Best case you turn a profit. Worst case, you have a piece you love.

On Buying

1. If you can’t mint, it may still be worth buying on secondary. I’ve seen many pieces sell for a few Tezos above mint, so it’s still good to click through and look at the marketplace if you find a collection you like. There may just be something you want for under $50 even.

2. You may find tokens listed as [“WAITING TO BE SIGNED].”

Essentially, the token metadata has not been generated for these pieces. If you really like an artist/collection, it may be okay to buy pre-reveal. Otherwise, you will want to wait for the token to be signed so that the visual representation is revealed.

3. Pieces that seem to sell are those look fairly distinct from one another. A good example of this is Matt Perkins collection “Meander River Plot v2”—this collection is so pleasant to watch, by the way.

Looks Rare

How rare something looks is subjective, of course.

Personal preference can make rainbows more desired than monochromatic color schemes or complexity more preferable to simplicity, for instance.

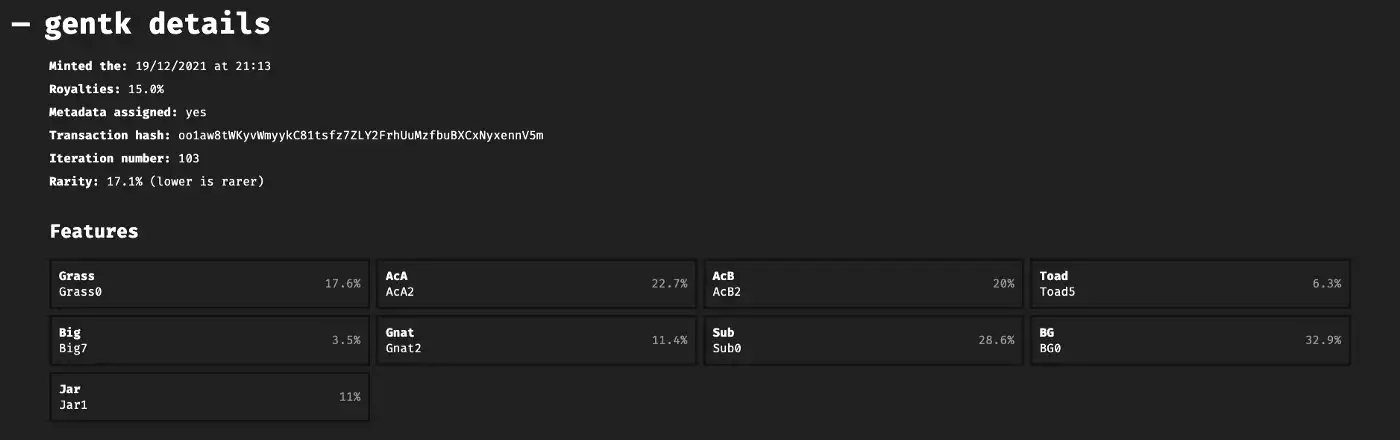

For those looking for more data points, some pieces will come with rarity data in the “gentk details” section of the individual token page. The rarity is a composite score of the various features in a piece.

The way this score works is, the lower the rarity score, the more rare the token in question is.

Obviously, metrics like this can help, but they should also be taken with a grain of salt. Some pieces can have very rare attributes but the composition itself may not be as appealing to the eye as a piece with less rare traits.

I think that’s about it for now. Hopefully this helps provide more insight into how to get more out of the platform and score pieces you will love. For additional information on floors, I would check out MattW.Tez on Twitter.

If you’ve enjoyed this, feel free to follow me @cryptomoogle. As always, let me know your thoughts!