Introduction

NFT has taken over the world. Extremely expensive pixelated cartoon characters, anime themed art and cartoon animals are increasingly becoming the avatars of choice for crypto investors. However, the Bored Ape (BAYC) is the most iconic of this zoo.

Bored Ape - Bored Ape Yacht Club (BAYC) - has become the most expensive and influential collection of NFT collectibles. In addition to having a total market value of over 1.69 million ETH, the collection has managed to gain recognition from the likes of NBA stars Stephen Curry, Steve Aoiki and Jimmy Fallon, just to name a few.

How did this cartoon ape JPEG collection turn into a multi-billion dollar brand in just over a year, and is BAYC really powerful, or is it just the latest buzzword thrown around by the "community" to gain traction?

In our first installment of Not Just JPEG, we delve into the world of BAYC to see what they're all about and look at the in-chain data to see if the hype is real.

Backstory

How BAYC started

"Ape" and "Apeing" have a strong cultural meaning in cryptocurrencies. These words are often used to describe blind investments in something, usually stocks, cryptocurrencies, and NFTs, and the use of the term increased as retail investors became more interested in investing during the New Coronavirus pandemic. Spend some time on subsections like WallStreetBets or Crypto Twitter and you will see the term appear in all other posts.

According to an interview with CoinDesk, BAYC founders Gordan Goner and Gargamel imagined a bar that only members of the exclusive club would have access to. Apes (apes) were the preferred members of this club, and the concept of the Bored Ape Yacht Club (BAYC) was born.

April 23, 2021 was the date of the BAYC launch. Priced at 0.08 ETH or about $200 at the time, casting was almost free by today's standards, but it took about a week for this collection of 10,000 NFTs to finally sell out. There was no hype and no appeal. It wasn't until a week later that Pranksy, one of the most profitable and prolific NFT collectors (currently outside the top 10 of Nansen's NFT profitability rankings), began to speak out for the collection.

Going from strength to strength

The BAYC collection is the foundation of the ecosystem Yuga Labs has built over the past year, but it does not represent the entire ecosystem. After feeling that BYAC alone seemed too one-dimensional, the Yuga team decided to create a companion collection: about 2 months after the launch of BAYC, the Yuga team distributed 10,000 Bored Ape Kennel Club NFTs to BAYC owners for free.

This was followed by a third series, Mutant Ape Yacht Club (MAYC), which was launched in August 2021. This time, the total size of the series is 20,000 units, twice the size of the first two series. 10,000 mutant sera were provided to 10,000 BAYC holders, which allowed them to create mutant versions of BAYC. The other 10,000 were sold to the public at a casting price of 3 ETH. This time, the series sold out within an hour and the team raised a total of $96 million.

Recently, the team launched its fourth series: Otherside, a virtual land series created for the upcoming BAYC metaverse. The total size of the collection is 200,000 NFTs, 100,000 of which will be available on April 30, 2022, with the rest to be distributed to NFT holders who contribute to the development of Otherside. Similar to previous collections, existing holders of BAYC and MAYC will be able to collect their Otherside NFTs at no additional charge, while the public will be able to purchase the NFTs for 305 ApeCoins.

The launch has generated a lot of interest in the cryptocurrency space, with 112 smart currency addresses interacting with the sales contract. The price of ethereum network gas flew from 40-70 Gwei the day before to a peak of 8100 Gwei during the mint. this spike caused an uproar on Twitter, with many users disappointed by the mismanagement of the release and the quality of the smart contracts deployed. However, Vitalik himself has responded and concluded that optimizing the contract had little impact on Gas fees.

Land sale sparks world attention

In September 2021, the world-renowned auction house Sotheby's sold a set of 101 Bored Apes (BAYC) and 101 Kennels (BAKC) for a total of $26.2 million, more than 30% above the upper estimate. In the same month, Christie's, another leading auction house, conducted its own BAYC NFT sale. A total of four Bored Apes were sold for a total of approximately $2.8 million.

Both auction houses are leaders in the art and luxury auction world. Looking for works by the likes of Vincent van Gogh, Raphael and Leonardo da Vinci? Sotheby's and Christie's may be where you can buy. The presence of BAYC at auction house events adds a stamp of legitimacy to such collections and NFT in the eyes of the traditional art world.

Sitting at the top

The rivalry between BAYC and CryptoPunks has been brewing since it began its rise to prominence. Over the years, Punks has been known as the preeminent "blue chip" NFT asset due to its long history and dedicated community. While BAYC's floor price repeatedly surpassed CryptoPunks' floor price and eventually passed 100 ETH, CryptoPunks' OG status allowed the series to arguably hold its crown in the NFT space.

However, when Yuga Labs acquired the intellectual property of CryptoPunks and Meebits from Larva Labs, the debate over which was more influential finally died down. cryptoPunks still maintains its OG status and historical relevance, but as of today, the king of NFT is undoubtedly BAYC.

On-chain in-depth analysis

To understand the success of BAYC and its world, let's dive into the on-chain data provided by Nansen to assess if the series is really as successful as it seems.

Overview

This is a high-level overview of the series.

Secondary sales of over 528,000 ETH (after filtering through clean transactions) (as of April 27th)

Highest single-day volume of 15,415 ETH

30-day average daily trading volume of ~1,800 ETH

~6200 holders

257 Boring Apes have been held since minting

Yuga Labs received a 2.5% royalty on secondary sales and has received approximately 14,100 ETH (~$33.8M) in royalties.

Seniority Distribution

As mentioned earlier, holders exceeded 6.2 K. The series took about a week to reach 200 unique addresses, but parabolically trended from May to July to reach over 4,400 unique addresses. About 80% of NFTs have been held for at least 60 days and about 63% have been held for at least 90 days. This indicates that an average of 63% of NFTs were purchased for 93 ETH or less. The floor price peaked at 150 ETH at the end of April and has since dropped to a floor price of about 100 ETH. The average buyer joined the club relatively early, but is still breaking even or making a modest profit during most of the market's downward trend.

How sticky are the floor prices?

In addition to examining the percentage of wallets with substantial profits, let's look at the percentage of wallets holding only 1 BAYC NFT and the balance of diamond lots to assess the sustainability of the current floor price.

The percentage of wallets with only 1 BAYC in their wallet is high. At 81%, it is higher than similar collections in the Nansen Blue Chip - 10 Index, such as CloneX (71%), Azuki (76%) and CryptoPunks (72%). This makes holders less likely to sell their boring apes, as this is the only BAYC they hold, thus creating a more resilient floor price. In addition, there are not as many "whale" holders who can drive down prices by liquidating their collections.

On top of that, there are currently 5,200 BAYCs that hold these NFT wallets that have not been sold. While this number is down slightly from the all-time high of nearly 6,000 NFTs, it is one of the few series that is gradually increasing.

We can also look at shelf activity to get an idea of holder psychology.

Only about 6.5% of BAYCs are on the shelf, with 0.10% within 15% of the floor price, and most are in the 180 - 360 ETH price range. This indicates that most holders are not considering selling, while a small percentage of holders are looking for prices well above the current floor price.

The prices are so high that only degens seem to buy collectibles at all-time high prices. It's hard to imagine smart money not profiting at these prices, let alone ape in.

Looking at the trends in smart money holders, two things stand out.

The number of smart NFT early adopters and smart NFT traders is trending downward.

There is a gradual upward trend in the number of smart NFT holders and smart NFT sweepers.

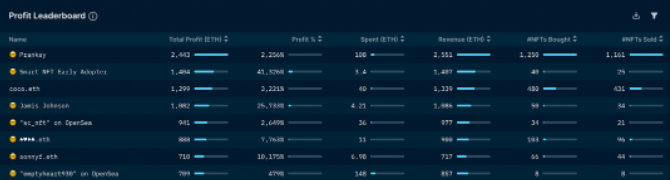

Overall, early adopters have begun to gradually reduce their holdings, and traders are taking profits and exiting as prices rise. Early adopters may see "financial freedom" level profits. one of the top wallets on the BAYC profit chart is the smart NFT early adopter, which earned a total of 1,404 ETH in profits, a margin of 41,326%.

Traders typically scale up as prices rise, and they have a hard time staying in their positions as BAYC continues to push to new highs. However, smart money addresses, which tend to have a long-term horizon, have been increasing. This suggests that they are optimistic about the long-term outlook for the series.

According to the individual trading dashboard, we have seen smart money indeed still making purchases over the past 30 days. Some of them are even buying at prices well above the 12-hour simple moving average.

The Future of BAYC

BAYC is poised to become a highly influential brand with a cultural impact similar to Supreme, but with social signals comparable to high fashion brands such as Gucci and Louis Vuitton (LV). As their ecosystem grows and evolves, so does their influence and significance. the launch of ApeCoin, ApeCoin DAO and the Virtual Land Collection further solidifies their position in the Web3 world. More mainstream partnerships similar to the Adidas partnership and a trilogy of BAYC films in the pipeline will help spread BAYC's share of ideas among the general public.

With holders being given full commercial rights and control over their NFT, we could see a future where individual BAYCs become celebrities by virtue of having rights themselves. Brands and films may use compelling BAYC images or BAYC with specific characteristics may appear in their commercials or films.

Between these mass media touchstones and the upcoming "Otherside" virtual world, the Bored Ape Yacht Club (BAYC) is now pioneering the meaning of culturally significant NFT collectibles.

Conclusion

BAYC has evolved from a simple JPEG NFT to a broader ecosystem that is becoming as culturally influential as brands like Supreme. Their rapid rise is practically unheard of and unparalleled by mainstream fashion brands and crypto-based projects alike.

While everything they've achieved so far is impressive, to say the least, this may just be the beginning of the larger universe they're about to create. The activity of the holders suggests that both degens and smart money share a similar optimism about the future of BAYC. The team dreams of a world ruled by BAYC, a dream that may not be far-fetched, and where BAYC may become the ruler of the metaverse.

Welcome to join #NowhereDAO, a free information and token information sharing platform